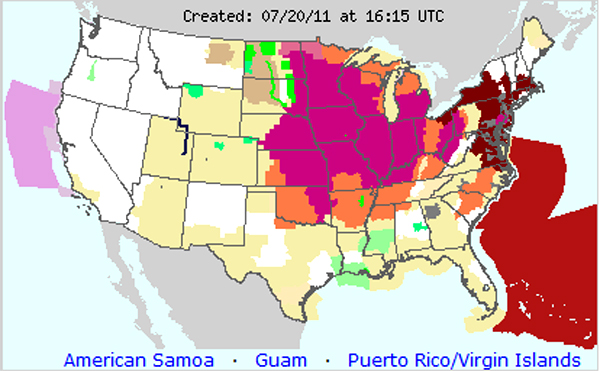

It’s hot outside, has anyone noticed?

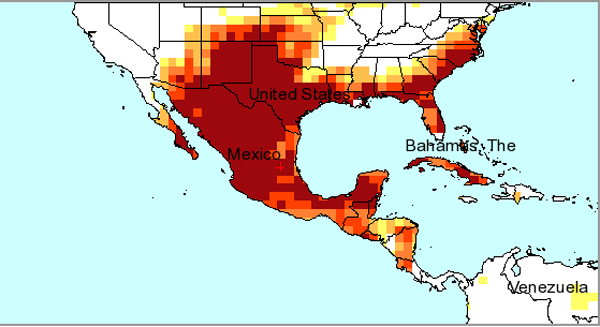

Got drought?

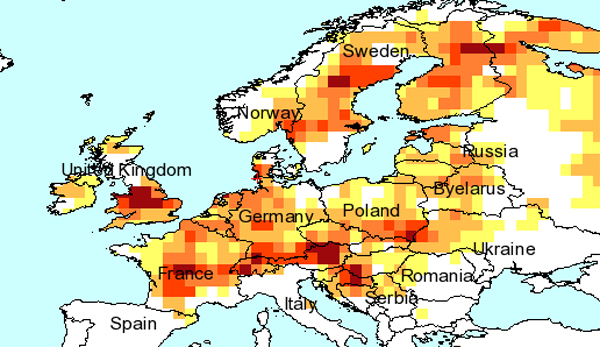

Severe droughts are found in non-drought-ey places like Sweden and central England. What’s up with this nonsense?

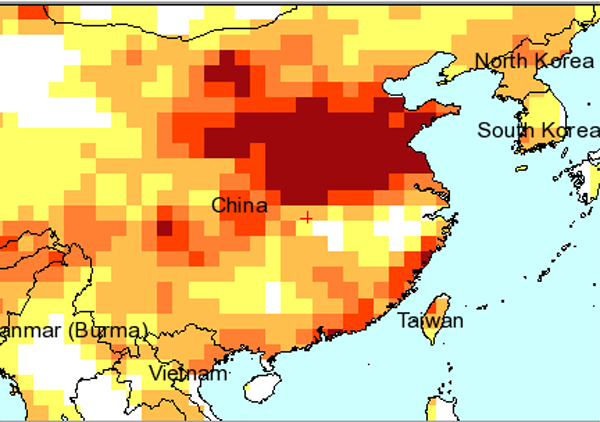

Here is one more map. China’s severe drought has been underway for several years. Droughts are self-reinforcing as soils dry out (and aquifers are pumped dry). The diminution of soil moisture contributes to reduced rainfall. Droughts indicate the power of solar energy. Of all the climate phenomena, droughts are the most damaging to human enterprises. The debris of lost civilization found all over the globe are testimony to the force of no rain for extended periods of time:

An interactive drought map can be found at the University College London website. It’s worth checking out. There are severe droughts in many of the world’s breadbaskets in Africa, Europe and central Africa. Severe drought grips parts of central Canada which needs water for its grains as well as tar sands energy production.

France needs plenty of water to cool its nuclear reactors.

China is struggling to maintain domestic grain stocks by purchasing grains. This pushes commodity prices which in turn pushes hard on credit.

America has as much of a weather problem as it has a drought. Too much rain has left the grain belt soils saturated with planting behind schedule. The extreme heat stresses young plants: there is no drought today but tomorrow? Heat also is a trigger for extreme events such as the Spring’s tornadoes.

The world’s stock of grains has been under pressure since 2008. This looks like an opportunity to profit by the misery of others but the ‘sketchy’ quality of credit worldwide means the markets might be turned in unpredictable ways.

The reason for this is because finance markets have become credit or ‘margin’ markets. What is bought and sold is margin. Grain might be had but credit might not be, or vice-versa. Either is a hazard. The volatility of credit is a symptom of its declining ‘energy value’.

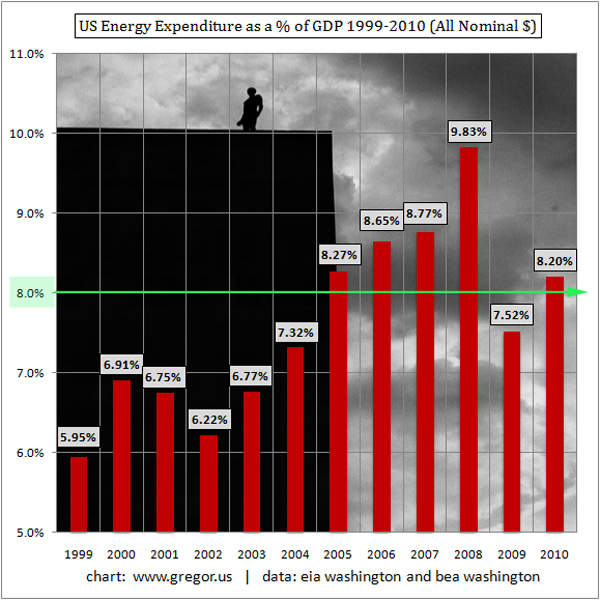

Here is Net Energy Value in action: Gregor Macdonald drills down energy costs- relative to GDP. Here’s his chart:

The green line indicates the proximate point where the energy tab relative to GDP causes the economy to vomit. Sez Gregor:

The energy limit model to economic growth is working beautifully, having come into play prior to the 2008 crisis and now once again forcing another global slowdown. Above is the most recently updated chart showing energy expenditures as a percentage of US GDP. As usual, I have not merely taken EIA.Gov’s calculations here, but cross checked various data from EIA.gov on total energy spending with BEA.gov data on historical GDP. In addition, I am working on a chained (real) dollar version of the above chart but here I have presented the nominal version of both expenditure and GDP. | see: US Energy Expenditure as a Percentage of GDP 1999-2010 (All Nominal Dollars).As we can see, the relief from the 2007-2008 energy spike was short-lived. Whatever economic “recovery” the US was able to cobble together was built on the base of lower energy price levels in 2009. But by 2010, the energy expenditure percentage was right back up above 8.00%. More urgently, preliminary data shows that 2011′s level is back above 9.00%.

Adding more credit to the economies is counterproductive. What happens is the value of each unit of credit becomes worth less than the equivalent unit of fuel. More credit/diminishing energy: you do the math. At some point credit value evaporates. Then what, Mr. Creditor? Energy is needed to collect on the (energy) debt … which has become intrinsically worthless. New debt cannot be used to obtain energy! Devalued credit is a cost that has to be collected from ‘somebody’.

Meanwhile, fuel is a finance asset during the tiny period between when it is lifted to the surface then pumped into Some Dude’s tank. Asset managers’ profits are costs to users, obviously! The cost of devalued credit is added to the cost of asset speculation. The result is credit-driven: ‘Conservation by Other Means’.

Here’s another take on energy cost:

The New Austerity and the EROI SqueezeEric Zencey

The government of Minnesota has shut down thanks to a $5 billion budget gap. Wisconsin public employees have been de-unionized so their salaries and benefits can be cut to close a budget gap. New Jersey just missed shutting down as a Democratic legislature and a Republican governor agreed that austerity cuts are needed (though there’s still going to be some wrangling over how the pain will be distributed). Last week the Italian cabinet signed off on $68 billion in austerity cuts. Demonstrations in Britain and riots in Athens, prompted by government cuts in pensions and social security, suggest what may lie in Italy’s future. In the U.S., we’ve got gridlock-and-extortion in Congress over raising the federal debt limit, even as both sides are generally agreed that the era of ever-rising deficits is over.

Though not a single politician or mainstream economic analyst has ever made the connection, the new worldwide austerity in public spending traces to a physical cause, as measured by change in EROI — energy return on energy invested. This is the ratio between the energy that comes into the global economy and the energy it takes to produce that energy. Worldwide, the average EROI of oil is down to 20:1 from its original value of 100:1 eighty years ago. This means that our oil-fueled economy simply has less capacity to generate wealth than it did back then, because an increasing share of the energy that used to be dedicated to producing goods and services is being plowed back into securing energy.

Gregor, Zencey, Gail Tverberg, Charlie Hall, Nicole Foss, James Howard Kunstler and others make similar arguments. Somehow, economists can’t make the connections except for Paul Krugman once a year. All they can see is money and credit.

Here is the estimable Michael Pettis — by way of Yves Smith — making the ‘Europe trapped by mercantile Germany’ argument. This is nothing new to those who loiter in the back alleys of Economic Undertow smoking dope and spray painting ‘comments’ on the wall:

Whichever argument you think is the more just – that the imbalances are mainly the fault of the US or the fault of China – since the Chinese accumulation of US Treasury bonds was the automatic consequence of Chinese policies that the US opposed, it seems a little strange that the US should feel any strong obligation to maintain the value of the PBoC’s portfolio…Likewise with Germany…. for Germany to run a large current account surplus – the consequence I would argue of domestic policies aimed at suppressing consumption and subsidizing production – Spain and the other peripheral countries of Europe had to run large current account deficits. If they didn’t, the euro would have undoubtedly surged, and with it Germany’s export performance would have collapsed. Very low interest rates in the euro area (set largely by Germany) ensured that the peripheral countries would, indeed, run large trade deficits.

The funding by German banks of peripheral European borrowing, in other words, was a necessary part of deal, arrived at willingly or unwillingly, leading both to Germany’s export success and to the debt problems of the deficit countries…

In that case it is strange for Germans to insist that the peripheral countries have any kind of moral obligation to prevent erosion in the value of that loan portfolio. It is like saying that they have a moral obligation to accept higher unemployment in order that Germany can reduce its own unemployment. Whether or not these countries default of devalue should be wholly a function of their national interest, and not a function of external obligation.

Etc.

Pettis gets the picture half-right. The mercantilists bankrupt their customers, that is the part he gets.

The mercantilists’ products rather than policies are the instruments of bankruptcy. The capital flow problem is that from PIIGS to Saudi Arabia — not in Pettis’ argument — for the fuel needed to run the German products sold to the PIIGS on credit.

Saudia is the bankrupting angel, Germany exports some of its consumption to Spain in the form of luxury automobiles and energy consumption- enabling ‘engineering’ along with credit. PIIGS get the bill: once ‘invested’ in the consuming goods at the current high level they must buy the supporting energy at whatever cost or the investments are stranded.

$120 crude is simply annihilating the PIIGS. Currently Insolvent, they will all be bankrupt in months. Bailouts will simply prolong the agony.

The prob with the economists as they consistently ignore energy. What is an economy? It’s the means to manage energy flows. Period.

The PIIGS made the mistake of believing the hype about modernity and its ‘blessings’ … of mobility on demand and store-bought status. Now, they are trapped along with the rest of the industrialized world. None of the Europeans dare to exit the euro b/c individual currencies would be highly discounted in F/X markets except for French/Swiss francs and D-marks. Without F/X none of the PIIGS could buy fuel. They don’t have the export goods to swap for fuel any more than they have goods to swap for euros now.

Right now the euros are needed to swap for the fuel. For PIGGIES no euro means ‘welcome to the 19th century!’ No wonder the PIIGS are selling their souls and everything else they can get their hands on. They have their (stupid) priorities: cars first everything else last.

Also missing from Pettis’ analysis is that without captive customers for bank ‘services’ and autos, PIIG- like Germany and France will also rapidly fall bankrupt.

Without a vital and productive industrial economy as a prop, France’s fifty eight nuclear power reactors and its massive nuclear weapons programs will become unaffordable expenses. I can see the stupid French boarding up abandoned reactors with plywood and running away as fast as they can like the Japanese are doing at Fukushima.

Hitching our futures to the automobile appears to be a fatal — as in death — error. Pettis should look out his back door, China is caught in the same ‘Modernity Trap’. Its Mercantile Meltdown is preordained, simply a matter of time.

More on the endless debt ceiling farce: Michael Hudson goes parabolic on the establishment:

Hudson suggests the debt controversy is cheap theater. It’s more likely the collective suspension of energy disbelief. Mister Reality sez something has to go: ‘growth’, 24 hour electricity, cars, jet planes, suburban sprawl, centralized manufacture, monopolies/cartels, debt-centric finance … politics insists that all of these are sacrosanct. Reality looks at its watch and taps its foot.

When reality pulls the plug all of the above will go.

Finally, more currency/debt ceiling imagination appears outside the electronic fence of the Undertow: (Firedoglake)

“But here is the point: If our nation can issue a dollar bond, it can issue a dollar bill. The element that makes the bond good makes the bill good… If the Government issues bonds, the brokers will sell them. The bonds will be negotiable; they will be considered as gilt edged paper. Why? Because the government is behind them, but who is behind the Government? The people. Therefore it is the people who constitute the basis of Government credit. Why then cannot the people have the benefit of their own gilt-edged credit by receiving non-interest bearing currency… instead of the bankers receiving the benefit of the people’s credit in interest-bearing bonds?”

Thomas Edison, quoted in NY Times, Dec. 6, 1921http://prosperityuk.com/2000/09/thomas-edison-on-government-created-debt-free-money/

If you think about it, it does seem odd that the US Government is the monopoly supplier of US dollars and yet our politicians go through life thinking the government will run out of money unless it can borrow more …

Beowulf promotes a platinum currency that is simply issued by the Treasury on its own account. Sound familiar? Why not gold? Treasury has gold! There is more dangerous imagination lurking in the far corners of the Internet from Warren Mosler and Randall Wray and others.

Thomas Edison got his ideas about money issued on a government’s own account from the brilliant German industrialist Walter Rathenau who in 1914 used monetization as the means to enable Imperial Germany’s war effort. A few weeks of war in Belgium, France and Russia and the Germans were out of ammunition. Factories were simply unable to keep up with army demand.

Cordoned off from the rest of the world by British blockade and lacking gold in its Treasury, Germany was also broke. What to do?

Rathenau made the basis of German finance the industrial output of German citizens rather than metal. At the same time, industrial productivity was dramatically increased by Rathenau’s forced reorganization of German manufacturing. Instead of the quaint hand-craftery taking place in German workshops making complex goods from the ground up, Rathenau standardized goods into components. He then distributed component manufacture to hundreds of different factories, redundantly dispersed across the German Empire. The shutdown of one factory for any reason would not effect any others nor gross output. Skilled manpower was augmented by millions of women pressed onto assembly lines. With no overall increase in manpower (which was at the battlefront), German output tripled as Rathenau insisted it would.

The relationship between output and credit issued was measured by statistics kept by Rathenau’s ministry. Rathenau used his ministry to create the finance that Germany’s wartime industries needed. Germany by way of Rathenau made itself into a hedge fund able to leverage as much credit as it needed. Within a year, the English adopted the same approach, as did the Americans during the run-up to World War Two. In both cases production increased dramatically without any increase in factory manpower … or additional treasury gold.

Ironically, the Germans refused to use Jewish Rathenau’s methods until Albert Speer became Armaments Minister in 1943 by which time the Hitler war was lost.

America’s Rathenau approach during the war made the US the ‘Arsenal of Democracy’, the most productive industrial country on Earth, outproducing all the other countries put together. Except for heavy armored vehicles — and leaving out qualitative differences such as between airplane types — Rathenau’s Germany outproduced the 1939-1945 version. America’s postwar boom was a product of Rathenau’s economic template.

China uses Rathenau method of production. China has entire cities making socks and underwear.

Rathenau invented practical debt finance as an expedient to keep German military production from crashing, it has been adapted to all the modern economies as a way to wage war against nature and claim resources. The point is the need to move past the current ideologically driven ‘My way or high way’ dogma. Economic systems are infinitely malleable: they are only limited by their ‘owner’s flexibility and imagination!

An American Rathenau would take the opportunity of today’s default(s) and simply allow the entire rotten system to crash, then restructure from the ground up. All the ‘dead money’ debts would be simply written off. Creditors would belly-up, their debts would then evaporate in turn. With debt distilled out of the country, Americans would be left with what is useful. Values would attach to these rather than value-added debts.

The president could simply go on TV and mention systemic default as an opportunity to restructure and the political charade would be over in a heartbeat …

…