The votes are in on the Tea Party’s success in holding the weak Obama adminstration hostage last week: a sharp decline in markets worldwide.

The debacle illustrated the slight flaw of government by, for and about finance tycoons. The tycoon’s lackeys ‘lack’ sense or the ability to act in the national interest … this is not confidence building.

In 2008, the establishment abandoned free markets as these would have delevered — as they should have. The issues driving ‘pseudo-markets’ became whims of government decision makers. Markets could tolerate Bernanke as he gave them the means to ‘cash out’ of losing positions. What sort of market confidence does the Tea Party extremism represent?

How much confidence does the market have in the craven Obama administration? How much does it have in Geithner, Bernanke or Dudley @ the New York Fed? How much confidence does the market have anymore in the gutless Democrats or the spendthrift state- municipal governments? Where is the confidence in the ‘system’ which is now run by the most compromised and the least capable?

Washington’s gridlock/ineptitude is not confidence building. Also not confidence building is that management of America’s economic system is a restricted club. Anyone with independent ideas, common sense or courage of convictions is automatically excluded from administrative control. Anyone not co-opted by finance and big- business interests is also automatically excluded. The system consequently lacks the means to adjust, even to save itself.

These are not confident times:

– Bernanke the Money Launderer is in monetary control in the US. This imbecile does not inspire confidence anywhere except with regard to Mrs. Bernanke who clearly loves her husband is not divorcing her husband.

– Trichet the moron is in control of EU monetary policy along with a cast of monetary midgets within individual European states. Where is the confidence?

– Japan’s mendacious, sadistic pseudo-government does not inspire confidence but rather an urge to prosecute ministers for crimes against humanity.

– China’s lying establishment does not inspire confidence, even as it proclaims more and more (imaginary) growth. China does have a lot of new, incredibly ugly buildings/cities/industrial areas/highways/port facilities/mines/etc. China’s crappy products do not inspire confidence.

– EU finance’s old-school rapaciousness along with that of its Quisling IMF does nothing but renew fears of the re-emergence of the one thing Europeans are very good at … massacring each other in pointless, bloody wars. The tremors of European wars-to-come are starting to be felt even here on USA topsoil. Wars and revolutions are not confidence building, neither is untrammeled greed leading to it.

– How the Eurozone was marketed to upturned hearts of ordinary Europeans against the current reality does not inspire confidence in anything, not even in Santa Claus. The euro was to be a hard-currency alternative to the US dollar. This would allow members to enjoy the same seigniorage advantage as do Americans. Now what? Europeans see themselves unable to afford food priced in euros, much less the new German and French cars promised by the German and French bankers. Meanwhile, the Europeans are trapped. Without the euro, the lesser Euro-states will not be able to afford fuel! Where is the confidence? It has been replaced by the desperation!

– The US guzzles 18 million barrels per day of petroleum and all we have to show for it is zero- percent GDP growth, 9-16% unemployment and huge increase in finance debt! Where is the confidence?

From the ‘Why Doesn’t’ department:

– Why doesn’t the US start the process of examination … of what must be done to restructure its ridiculous debt?

Yes, Virginia, if the US restructures banks will indeed go out of business, just not all of them.

– Why don’t the individual EU member countries start issuing their own currencies and use the euro as a means to manage external accounts within the EU? This was the way countries used gold before the 1930’s currency crisis. In fact, the EU could start with limited gold backing for the euro and really tempt fate.

The Greek government could issue drachmas on its own account — without borrowing them from finance or a central bank — and put people back to work. The ‘new drachmas’ would be demurrage currency which would prevent hoarding, drachmas good only in Greece would eliminate capital flight. The Greek citizens and businesses would earn in drachmas … and in euros. Some of these euros could be used to service/repay some of the euro-denominated debts. Taking this zero-cost step would be a real confidence builder. Repeating the same ol’ bailout routine is a proven loser: repeating the failed policy leaves the markets to understand there is no hope anywhere and that finance managers are complete morons.

– Why doesn’t the Chinese start selling their hoard of foreign currencies? Giving them away for free or burning in bonfires would cost the Chinese less than hanging onto them until their county is completely bankrupt … which is where they are heading.

– Why doesn’t the courage- free US government call the Japanese government on the carpet over its leaky reactors? Beating up the ‘even more cowardly than the US’ Japanese government would be good practice: the administration could make use of lessons- learned versus the cowardly Tea Party radicals.

The ‘deal’ would be simple: fix the goddamned reactors or there will be no more Japanese cars imported into the USA! How about giving the crappy-Japanese government 30 days to start working on the cleanup? I guess we all have to wait until there are miscarriages and big-headed kids in Seattle.

– When is the American public going to start boycotting Japanese products? I refuse to buy anything Japanese until the reactors are entombed and the rest of Japan’s reactors shut down. (I don’t buy anything anyway, so I don’t really count.)

– Why doesn’t the US start the Justice Department investigating the Wall Street- and big business tycoons? This would be the easiest and cheapest way to purchase some confidence for the markets: by putting finance crooks in jail!

– Why doesn’t the US start breaking up the business cartels? There is no advantage to anyone by having these organizations whose costs are greater than their sum of parts. Doing so would gain instant confidence in the US being able to run its own ship.

– When is the US going to get serious about energy conservation?

– When is the US going to nationalize its election process and remove the counterproductive influence of money relative to anything resembling public interest?

People are going to talk about the dollar but they will be wrong, here is the dollar:

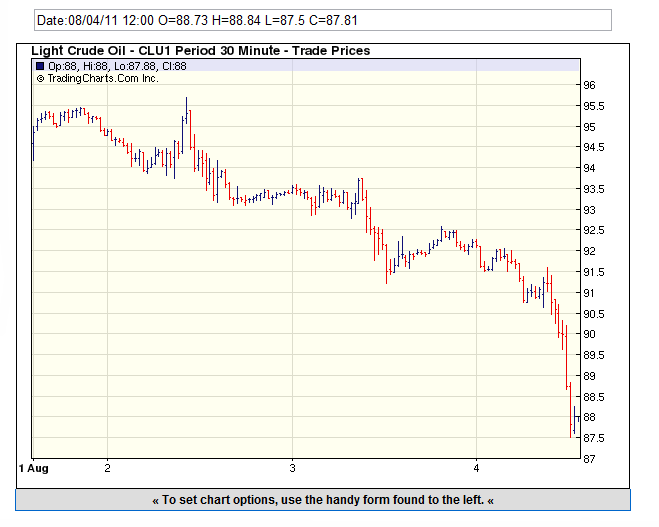

Figure 1: WTI September futures contract by estimable TFC Charts (click on chart for big):

The dollar has gained 11% of its lost value in three days relative to all- important USA crude. So much for ‘QE.whatever’. The central banks are fighting the last war/losing battle against crude price driven deflation. Easing was demonstrated to be counterproductive back in April. With central banks panicking themselves and promising more easing, the likelihood is even more leakage of confidence on the part of markets.

What part of ‘energy conservation’ do you people not understand?