The universe is a monstrous thing populated by demons, where nothing perishes but everything is perpetually diminished … virtues are deceptions … honesty is a paradox … nothing is what it seems: the human enterprise labors tirelessly at its own extinction in an ironic attempt to ‘improve’ itself. (All of) this is the manifestation of the universe’s malevolent design. Our endeavors are a part of the greater whole, most of which we cannot see or hope to understand. Individuals are blind and dumb … our wit would save us but it vanishes when we need it the most …

America is clinically depressed … the holidays make people crazy. The world is crazy and sad: it is afraid, the way for humans to manage fear has always been to lie to themselves … this is what courage is, a peculiar kind of lie.

The human race is confronted with gigantic resource imbalances and excess consumption: the public ignores the problem or denies it, preferring to watch television. We don’t know how to discuss it so we don’t try:

‘Fairytale of New York’ by Jeremy Finer and Shane MacGowan

It was Christmas eve babe …

In the drunk tank.

An old man said to me: won’t see another one,

And then he sang a song,

The rare Old Mountain Dew

Honesty is found in a song imagining two pieces of human detritus wheezing through Christmas in jail …

I turned my face away and dreamed about you.

Got on a lucky one,

Came in eighteen to one …

Nobody earns a living, everyone gambles, just like on Wall Street …

I´ve got a feeling,

This year´s for me and you.

So happy Christmas,

I love you baby!

I can see a better time,

Where all our dreams come true.

Enter the ad men …

They got cars big as bars,

They got rivers of gold …

Don’t they always? Here comes the truth …

But the wind goes right through you,

It´s no place for the old …

… they end up in the drunk tank!

When you first took my hand on a cold Christmas eve,

You promised me Broadway was waiting for me.

You were handsome — you were pretty —

Queen of New York City, when the band finished playing they yelled out for more,

Sinatra was swinging, all the drunks they were singing;

We kissed on a corner,

Then danced through the night.And the boys from the NYPD choir were singing Galway Bay,

And the bells were ringing out for Christmas day.

So it goes, the improbable chemical-fueled combination of ecstasy and infatuation that lasts for an instant then vanishes forever … as rare in iron-bound Mordor as a diamond necklace in the sewer. Humans turn their entire lives for a chance at these instants, these unforeseen moments … gambling everything in the chase or in fruitless attempts to buy ecstasy in a store. By this process the world is destroyed.

You´re a bum you´re a punk,

— You´re an old slut on junk,

Lying there almost dead on a drip in that bed …

— You scumbag you maggot,

You cheap lousy faggot,

Happy Christmas your arse I pray god it´s our last.

We can’t discuss our self-inflicted misery but we can write songs about it. How the message is delivered matters more than what it is. Shane MacGowan should write about the unraveling of the world, about climate change and Peak Oil, about financial collapse … the rest of us would sing along in bars on St. Patrick’s Day …

John Hussman discusses interest rates, debts and the insanity of it all:

Since 2009, both the stock market and the broad U.S. economy have been dependent on perpetual support from massive federal deficits and unprecedented money creation. Meanwhile, Wall Street is content to ignore the extent of this support, and looks on every movement of the economy as a sign of intrinsic health – which is a lot like admiring the graceful flight of a dead parrot swinging by a string from the ceiling fan.

Our economy is fundamentally string!

A quick look at how the deleveraging of the U.S. economy is going – total credit market debt has now reached $55 trillion, including government, corporate and household sectors, representing 3.5 times GDP (down only slightly from the 3.8 multiple observed at the recession trough of early 2009). To put this in perspective, every 100 basis point change in interest rates on maturing and refinanced debt now implies a redistribution of income between borrowers and lenders on the order of $500 billion annually. The Fed has worked tirelessly to ensure that borrowing is as cheap as possible – the risk being that any departure from that would give every interest rate change of one percent an annual economic effect the same size as the “fiscal cliff.”

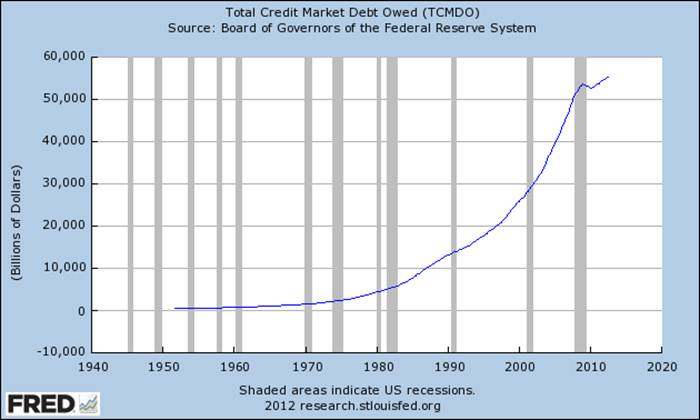

Figure 1: total government and private sector debt in credit market @ $55 trillion — this amount does not include off-balance sheet credit, shadow banking or forex/currency claims which are an order of magnitude greater. The Fed offers a willingness to push down credit costs … to do so it must be prepared to lend indefinitely.

The private sector offers unsecured loans to firms as a matter of faith. The expectation is for general increase in the amount of credit/economic growth and serviceable cash flow. Growth’s ‘utility’ is the ability of the firms to borrow over time and to use these loans to refinance prior loans as they become due. Unsecured loans exceed the worth of collateral by ten-times or (much) more. The central bank does little but manage the flows of currency and foreign exchange.

Currently: the private sector has lent stupendous amounts to firms, this represents most of the blue line in the chart. Collateral is non-existent or worth very little. Leverage is now 30x or more. The borrowers are unable repay because they do not earn anything and never have. The lenders are over-leveraged/insolvent and borrowers are unable to borrow any longer. There is no more growth, it was all fake anyway.

The offered remedy: the central bank lends to private sector banks, taking their impaired collateral onto its own balance sheet at ‘face price’ which provides the banks a temporary reprieve from insolvency. The bank bailout is done with a straight face ‘to end unemployment’! There is no economic growth because there is no credit expansion … central banks cannot expand the credit base by offering unsecured loans. This remedy has been applied in Japan since 1990 and has failed. The more central bank credit is offered, the less private sector credit … the central banks’ actions are self-defeating. The Fed lends to push down rates: the lowering of rates reduces private sector profits as well as incentives to lend! As with the petroleum biz … rates that are profitable to the bankers are unaffordable to borrowers.

The ‘More Stupid’ remedy: the central bank targets nominal GDP (NGDP), lending in excess of collateral or accepting fraudulent collateral as security for loans in an attempt to create credit expansion by itself.

Outcome of the ‘More Stupid’ remedy: the offending central bank becomes instantly insolvent just like all the private sector lenders and for the same reason. There is a ‘run on the banks’ as depositors remove deposits: currency is the only real collateral for the Mount Everest of claims laid against it.

Insanity is contagious: watch all the central banks attempt nominal GDP targeting at the same time! No central banker wants to be blamed for a recession: all the bankers are easing as much as possible.

Hussman:

The Federal Reserve under Bernanke is like a bad doctor facing a patient with a broken femur. Being both unable and unwilling to restructure the broken bone, he announces that he will keep shoving aspirin down the patient’s throat until the bone heals. Despite virtually no relationship between the injury and the treatment, that femur might eventually heal enough on its own to allow the patient to hobble out of bed. But by then, the patient will need to be treated for liver failure. What’s even more bizarre is that everybody quietly knows this, but as he shoves another handful of aspirin down the patient’s throat, nobody proposes restructuring the broken bone, and they instead stand around helplessly saying “well, ya gotta do somethin’ don’t ya?”I continue to believe that most of the economic impact of policy changes in the past few years can be traced to a) the abandonment of accounting transparency by changing FASB rules, which allowed banks to suspend mark-to-market accounting and effectively relieved them of capital requirements, and; b) the U.S. guarantee of bad mortgage debt extended by Fannie and Freddie. Both of those policy changes will impose enormous costs over the long-term, but they did allow the financial system to abandon the immediate need to actually restructure bad debts.

Hussman leaves out energy costs, but no matter. The central banks have to cease lending at some point … it’s pointless … the patient is dead … the only workable remedy is for the private sector to take losses and write off bad loans.

At the same time, perhaps the establishment can begin allow those at the bottom of the economic food chain to earn. This requires less credit not more. Credit allows those with access to it to pretend to outperform those without … who are consequently exposed to ruinous competition. By borrowing, the government competes with its own citizens: by doing so it gives cause to those who would purposefully become dependent upon the government and thereby destroy it …

Speaking of energy, from the New York Times, Alan Riley counts his natural gas chickens right now!

The shale energy revolution is likely to shift the tectonic plates of global power in ways that are largely beneficial to the West and reinforce U.S. power and influence during the first half of this century. Yet most public discussion of shale’s potential either focuses on the alleged environmental dangers of frakking or on how shale will affect the market price of natural gas. Both discussions blind policy makers to the true scale of the shale revolution.The real impact stems from its effect on the oil market. Shale gas offers the means to vastly increase the supply of fossil fuels for transportation, which will cut into the rising demand for oil — fueled in part by China’s economic growth — that has dominated energy policy making over the last decade.

There are two major factors in play here. First, the same shale extraction technology of horizontal drilling and hydraulic fracturing can be employed whether the rocks are oil-bearing or gas-bearing. We have already seen over half a million barrels of oil a day flowing from the Bakken field in North Dakota. The recent Harvard-based Belfer Center report — “Oil: The Next Revolution” — suggests that shale oil could be providing America with as much as 6 million barrels a day by 2020. The United States imported only 11 million barrels of crude oil a day in 2011. Given the potential for offshore and conventional domestic oil production, this would suggest that by 2020 America could be near energy independence in oil.

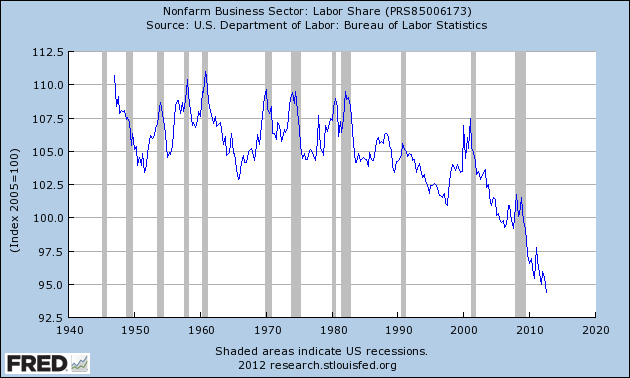

Then again, perhaps not … Maugeri’s report and others- similar have been holed below the waterline in the NY Times and elsewhere. What isn’t discussed is how broke Americans are to pay for the extra billions of barrels of frakked crude. It sez here — declining real wages — they can’t.

Figure 2: Wages have fallen in real terms for over fifty years! More costly fuel against declining wages = unaffordable. Credit flows toward the fuel extraction- and finance industries away from workers, who cannot buy products … houses, automobiles, service ‘goods’ … or the fuel needed to run them. As business operating margins shrink and the bosses take more for themselves worker pay falls further, impacting sales in a vicious cycle.

As an expedient, the government borrows in the workers’ place. Because the workers are unproductive in the sense they cannot- and will not earn, the government must borrow exponentially greater amounts, and do so indefinitely … None of the energy promoters are able to explain how energy ‘production’ is supposed to work without paying customers.

Riley:

The second factor is the potential to use natural gas for transportation. Some analysts suggest that this will only be a realistic prospect for fleet and long-haul road transportation. But they are overlooking the immense advantage that natural gas has as a transportation fuel in America and Europe, which have both developed a natural gas infrastructure in urban areas that takes piped natural gas into homes, offices and supermarkets. Once gas is cheap and widely available, it is possible to consider dealing with the “last mile” problem of providing home refueling kits so consumers can fill up natural-gas powered cars in their own garages.

Riley is a professor of energy law at The City Law School at City University London. Riley sees methane fueling the cars in the immediate future … despite uncertainties about supply. Meanwhile, there is no sign of a generalized shift by the auto industry toward producing natural gas powered vehicles or the means to adapt the current fleet to natural gas use. With more than 270 million vehicles in US service alone, such a switch-over would be very costly and time consuming.

Meanwhile, there are questions about how much gas will be available over time. If fuel is affordable, there are insufficient returns for drillers. A recent New York Times article calls the natural gas frakking enterprise a “Ponzi Scheme”. Drillers cannot earn by selling fuel, they must borrow from Wall Street.

China has even greater incentives to develop its shale gas resources. According to the U.S. Energy Department’s Energy Information Administration, the country’s recoverable resources are larger than those of the United States at 36 trillion cubic meters. The main geostrategic reason for Beijing to develop shale gas for transportation is that the U.S. Navy controls the Pacific and most Chinese oil arrives by tanker. Large scale use of natural gas for transportation would protect China from much of the effect of a U.S. blockade.

It is good to learn from the Times the US is planning to blockade China … The only remedy that will actually work is to get cars off the road. They cost too much. One way or the other the cars are gone, so are the roads. Once gone we will discover we really didn’t need them, that they ruined our lives, instead.

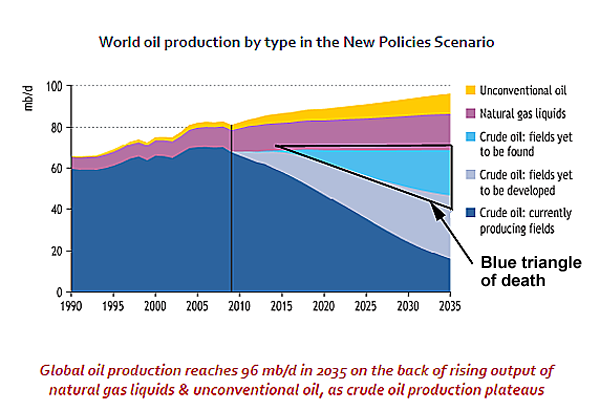

Figure 3, from BP’s 2010 World Energy Outlook with data from the International Energy Agency: the ‘Blue Triangle of Death’, oil fields — presumably large, conventional deposits — that have not been discovered that are needed to make up for declines elsewhere. The shortfall indicated here is about 30 million barrels per day by 2035.

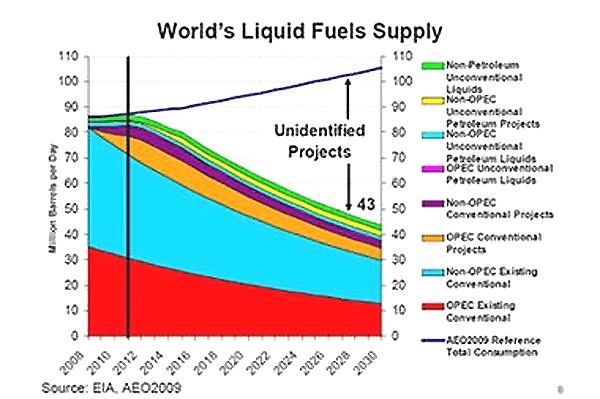

Figure 4, here is an even larger shortfall, graphs by EIA’s Glen Sweetnam (2009) by way of Kurt Cobb. He points out that any gains from tight oil formations will be overtaken by ongoing declines in conventional fields. Sweetnam calls for 40+ million barrel shortfall by 2030.

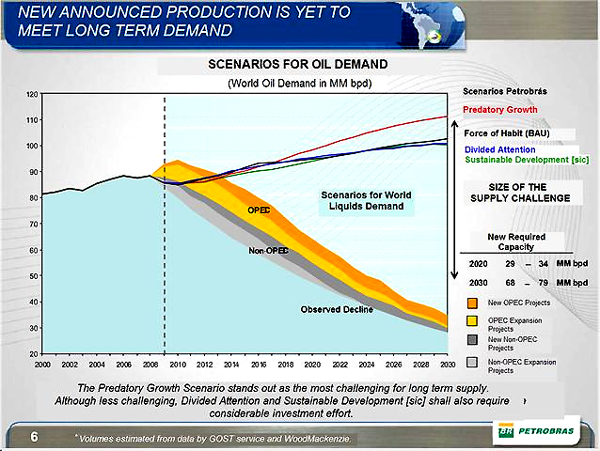

Figure 5: The Mother of All Oil Shortfalls: Petrobras in 2010 reckons a deficit of sixty to seventy million barrels per day — or more — by 2030! The marginal increases from frakking and even Iraq will not change the outcome significantly. Says Cobb:

… many people will say that we already have a large new resource of tight oil (often mistakenly referred to as shale oil) which can be extracted through hydraulic fracturing or fracking. But even if the optimists are correct — and there can be no guarantee that they will be — this source of oil will only add 3 to 4 million barrels of daily production. What Sweetnam’s chart tells us is that we must find and bring into production the equivalent of five new Saudi Arabias between now and 2030 in order to meet expected demand even if the volume of tight oil reaches its maximum projected output.

Maybe Shane MacGowan can write a song …

“Kelly’s Last Stand” … about delusional central bankers, government officials and fracking shills looking for a miracle.

I could have been someone …

— Well so could anyone!

You took my dreams from me,

When I first found you.

— I kept them with me babe,

I put them with my own.

Can´t make it out alone,

I´ve built my dreams around you …And the boys of the NYPD choir’s still singing Galway Bay …

And the bells are ringing out,

For Christmas day.