The establishment’s charade of ‘recovery’ continues to be promoted instructing the hopeful masses that the good times will start rolling again any second now. The BLS tells us that more people are losing their jobs but the rate of unemployment is declining – from 10% to 9.7%. Greece and Dubai are going to be able to borrow again (and have done so already!) Ford Motor Company is the ‘Number 1’ auto manufacturer in America! China has a healthy real estate market, not an over- leveraged bubble.

“The economy is fundamentally sound!”*

The only indicator worth bothering with is the price of crude oil measured in dollars. The dollar – oil trade is at the center of the modern economic world. If oil gets too pricey, folks – and businesses – cannot afford the (relatively) high price and buy less. The consequence of this is economic shrinkage which is taking place all across the face of the world’s economy – what has been taking place since 1999. Available fuel at a price determines growth – or the lack of it!

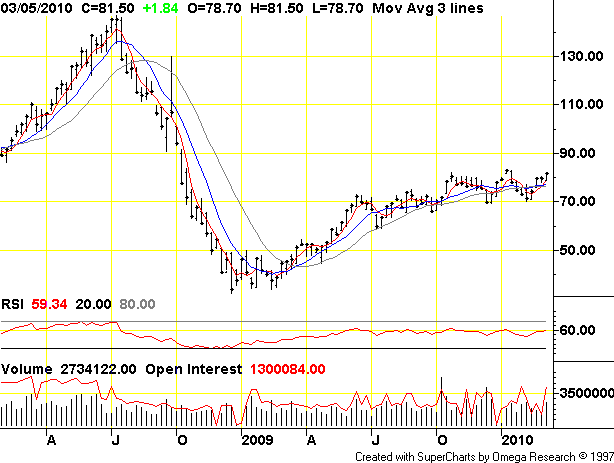

This is NYMEX weekly futures chart. Last week the closing price was $81 and change per barrel. As you can see crude has been trading within a $60 – $80 range since June of last year. I’ve pasted log charts of different commodities by the same graphic source for the last year so that relevant comparisons can be made.

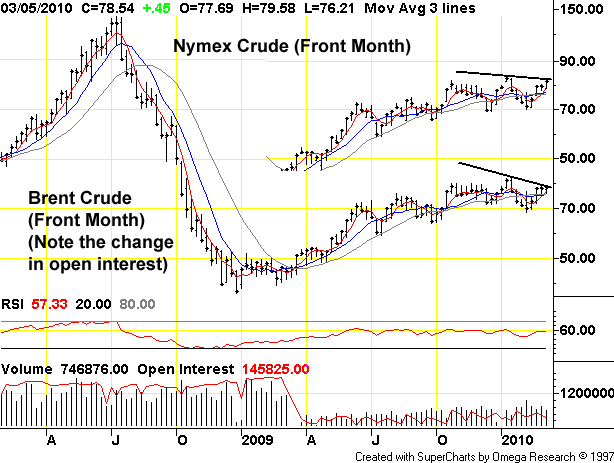

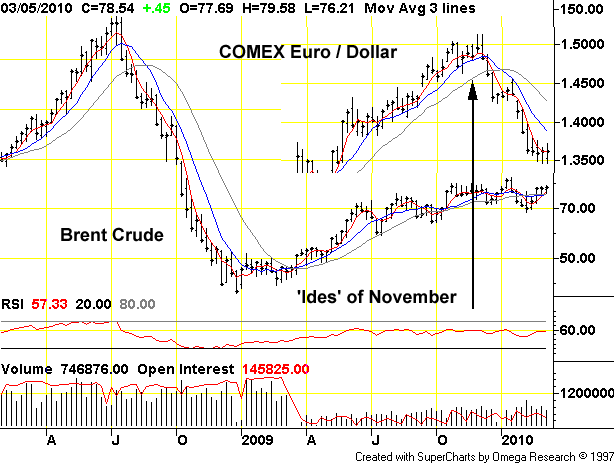

Here is an interesting comparison between the NYMEX market and the Brent exchange:

The Brent market is where Chris Cook suggests Saudi Arabia and other producers monetize reserves in order to control the price as described in the Asia Times and The Oil Drum. Two things you will notice on this chart are the large fall- off in open interest at the end of the giant price spike and demand destruction phase that ended in March of 2009. Another is the relative decline in Brent compared to New York as noted by the black trend lines on the right side of the chart. Here is the key part of Chris’s article:

Banking on Oil

What follows is necessarily speculative in the absence of hard evidence, but in my opinion the 2008 ‘spike’ was driven by one or more major commercial oil producers leasing and hence monetising oil stored in the ground to one or more investment banks. In return the banks collected and deployed fund money through opaque structured finance products or otherwise. Liberal helpings of hype in relation to oil shortages helped to inflate and support the market price.

In the course of a 2 hour meeting in London in 2004 Mr Kazempour Ardebili -who had by then been the Iranian OPEC representative for some 18 years – explained that he had for almost all of that time been advocating an OPEC bank, and an OPEC investment institution, but that this had never found favour with the Saudis. Moreover, he looked back with nostalgia on the long periods of stability which pre-dated the development of the current market pricing structure. He pointed out that while high oil prices are in producers’ interests, wild price swings destroyed Iran’s ability to budget and invest.

The oil market in 2009 saw a rapid re-inflation from $35.00 to around $70/bbl and the price has for several months been relatively stable within a range of $75 to $85 per barrel. Commentators have suggested that perhaps $50.00 of that price is accounted for by supply and demand, while the balance is purely financially related.

It appears to me that Saudi Arabia – their participation is essential – could currently be playing the role of a Central Bank whose currency is crude oil, and backed by their reserves of crude oil in the ground. Through extremely opaque market interventions by investment banking intermediaries they could lend oil to the market – financial oil leasing – against dollar loans from investors in oil, and buy back their forward sales of crude oil in order to support the oil price within their chosen parameters.

The outcome – which has the effect of ‘monetising’ oil in the ground – is very similar to the way in which some governments maintain their currency more or less ‘pegged’ to the dollar and illustrates the reality that oil is not priced in dollars: dollars are priced in oil.

Whether or not it is in fact, as I suspect, macro manipulation by producers which accounts for movements in the prices of crude oil and oil products, and the flows and storage of crude oil and oil products, is a judgement I must leave to expert traders. But I am absolutely certain that the “speculator” investors blamed by US politicians and public for the movements in oil prices are not in fact responsible.

Chris suggests that this activity takes place on the Brent Exchange:

The Brent Complex

Over 60% of global oil production is priced against the price of UK’s North Sea Brent, Forties, Oseberg, Ekofisk (BFOE) quality crude oil. Most of the rest is priced against the US West Texas Intermediate (WTI) price, but in the past 10 years the WTI price has increasingly become the tail on the BFOE dog through ‘arbitrage’ trading.

There are typically 70 or less cargoes, each of 600,000 barrels, which are produced by the BFOE fields each month, and in order to support the global oil price it is necessary to ensure that BFOE ‘spot’ cargo transactions take place at the or above the support level. This may be achieved by forward purchases or other contracts in the opaque BFOE complex of contracts where transactions take place off-exchange.

By the standards of the relatively few major market participants involved in the market, this is easily achievable if the funding is available.

If you look at Figure 2, it is hard to avoid the conclusion that someone – Saudi Arabia, perhaps – is putting volumes of oil on the Brent market sufficient to press dollar prices lower. With the low level of open interest, small amounts of oil sold on that market would accomplish the task. Keep in mind that trading futures on the Brent exchange is a window on what takes place both on and off the BFOE spot market. The actual price fixing takes place at delivery. As for the futures prices themselves the Brent Friday price closed $78.54 whereas the WTI price was $81.50. The point is that the Brent complex is open to ‘fixing’ while the US exchanges are less so.

The swing producer has the ability to set the value of crude and at the same time set the value of the dollar that is traded for it, quid pro quo. Chris points out that the upper bound of producer price is where demand begins to fall along with consumption, keeping clear of that bound is essential.

What happens with regard to the upper bound is critical. Here’s Brent crude against Nymex unleaded gasoline:

While crude prices are at or near the upper bound, the wholesale price of gas has jumped in the past week. Chances are that the higher pump price will translate into lower gasoline volumes sold as cash- in- pocket (or credit on card) is less available because of personal deleveraging taking place in the US and elsewhere. The effect of shrinking volumes at increasing price is felt first in refining which has seen profit margin declines since the Great Oil Spike. This is really nothing new: ‘rationing by price’ has been taking place across the length and breadth of the world’s economies since oil prices doubled the first time from $12 to $25 annual average in 2000.

Those with access to money (credit) can outbid the rest – those who have less credit or none. Those who cannot win the oil auctions or who win less oil become less productive. At the same time, those who win the auction for energy may not be particularly productive, either. The high price is itself an incentive to speculate rather than produce – to sell and resell the same oil over and over again or to hold it against even higher prices.

With dollar/crude relationship fixed the nominal crude price does not have to increase: the value of the dollar – in exchange for other goods and services – increases instead. This is taking place around the world right now and the establishment – as well as economics profession – is not paying attention.

Setting the value of the dollar against what is arguably the central input to modern commerce is reflected in the dollar- relative values of other goods. If there is an upper limit to the price of oil, any increase in value will be measured by what the dollar is traded for. In other words, there may be the same or fewer dollars but each will become more valuable.

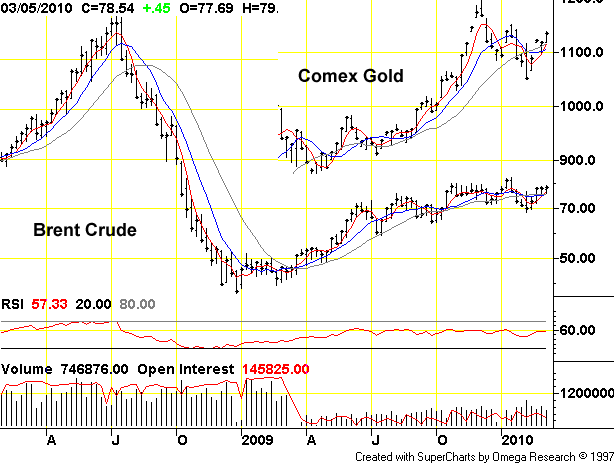

Let’s compare the dollar value of some other commodities against the dollar value of crude. Here’s Gold:

These charts are all from TFC Commodity Charts. This chart illustrates the price of gold in dollars compared to the Brent oil complex in dollars. You can see that gold is off its high price in mid- November of last year, presumably when traders began to notice that the dollar had real value when traded for oil. Let’s call this period the ‘Ides of November’. This is when dollars priced in oil became a hard currency. That is: dollars began to act in the way most economists suggest a gold- backed dollar should behave.

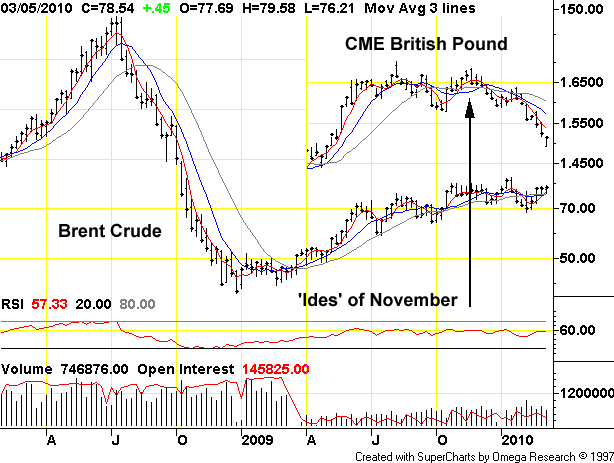

Here’s another comparison:

When the Ides of November illuminated to currency traders and others that the dollar was a hard currency, the British pound began its descent. Right now, there is no bottom in sight for the pound as UK does not have its domestic fuel reserves any more and the Middle Eastern producers show a strong dollar preference. Those in the UK seeking to buy oil will have to buy increasingly scarce dollars first.

If you think the oil price in dollars is tough on the pound, check this chart:

Here is the euro priced in dollars against Brent crude in dollars. With no reserves except Norway’s and a pittance in Romania and hundreds of millions of poor, sad, thirsty automobiles demanding more and more and more fuel – and Middle Eastern producers demanding dollars – the euro is a Gloria Swanson- esque has been.

You will notice the absence of ‘Greek talk’ or debt deflation mentions in the foregoing. The central issue is the amount of oil available, how much it costs and what is exchanged for it. All else is commentary, manufactured on the spot by the establishment to make subscribers feel good about themselves. I suspect that when + $80 is tested a few more times, the price of oil will decline again. Higher prices destroy demand which in turn drive prices too low to provide sufficient returns to finance continued oil production. It’s a vicious cycle alongside another where the the upper and lower bounds are meeting in the middle. An area where this is being seen now is in the refining industry:

The company also highlighted the “very challenging” operating conditions for its refining segment. The global recession has beaten down demand for gasoline, diesel, jet fuel and other refined products and has crushed margins. Exxon cited previous years’ strong margins that led companies to build too much refining capacity.

Here’s Valero’s and Sunoco’s problems:

Demand for fuel has been falling for some time and the recession has made things worse, squeezing profit margins for refiners everywhere.

Refiners are pulling capacity offline and are now operating at levels more consistent with the aftermath of a hurricane in the Gulf of Mexico.

Valero, based in San Antonio, said in September that it would idle two units in Delaware City, cutting about 150 jobs. Last month, the company said it would cut another 100 jobs at its Paulsboro, N.J. refinery by the end of the year.

The Paulsboro announcement came just days after Sunoco Inc. said it would indefinitely idle its Eagle Point facility, which employs about 400 workers in New Jersey.

In June Valero shut its refinery in Aruba, which had a capacity of about 275,000 barrels a day.

More bad news from Total: (France):

The Dunkirk refinery complex has a total crude distillation capacity of 137,000 barrels per day (b/d) and also houses a propylene plant with capacity of 90,000 tonnes per annum (tpa). All operations at the complex have been halted since September 12 in response to weak refining margins.

As fuel retail prices rise the amount of fuel sold diminishes placing an upper bound on refinery returns.

Major Chinese refineries see refining margins shrink on higher crude costs, lower product prices

C1 Energy (Shanghai) – Feb 3, 2010

Major Chinese refineries could get fewer refining margins early February as crude costs rose while domestic petroleum product prices edged lower, C1’s survey found. Margin for refining domestic Daqing crude was Yuan 119/mt (equivalent to US$2.45/bbl) on Feb 3, down Yuan 174/mt from two weeks ago. During the meantime, refining margin for those refineries processing Oman crude, a representative of imported crude, declined Yuan 128/mt to Yuan 488/mt (equivalent to US$9.6/bbl).

Here you have the Great Economic Meltdown in one sentence:

“Major ______________________ see __________________ margins shrink on higher (real) crude costs, lower (real) product prices!”

Refineries process fuel directly so the shrinking refining margins and declining profits are clear. All businesses process fuel in some form or other and the rising input costs cause profits to vanish. No profits =’s no business. When crude processing margins shrink sufficiently more refineries will close and there will be shortages.

There are other profound implications as well. Some of these – by no means all:

– The oil producers understand – and live – Peak Oil while the consumers clearly do not.

– The oil producers understand economics – particularly money and credit creation – while the consumers do not.

– The current price metric is backward compatible to the hypothesis that Peak Oil took place in 1998. That peak was determined by price against relative demand. The current value fixing of dollars to oil could not take place in an energy environment where peak production relative to demand lies in the future. The bottom line of this implication is that the opportunity to address the energy problems effectively passed ten years ago!

– Dollar preference will be a factor going forward both in currency markets as well as in fuel markets in oil- producing countries outside the US. The dollar preference will be a way of rationing demand in producer countries that now are seeing declining exports on account of rising domestic consumption – which is denominated in local currencies. These currencies are favored over dollars but the assumption that this will always be the case is just that. Call this process the creeping dollarization of the oil producing countries’ economies.

What will happen is that local currencies such as the Mexican peso or Brazilian real would be bought where available in currency markets until these disappear from circulation overseas. These currencies would be used by refiners and others outside the producing countries to purchase crude in those countries’ domestic markets. The local currencies would then be subject to arbitrary pegs within the producing countries with strong black markets appearing in dollars. Dollarization and black markets already exist in the oil producing regions of the world.

Arbitrage between the currencies will prevent producing countries from sterilizing dollars which would then price goods and services alongside oil in these countries. Gresham’s Law would be applied in full force; the ‘Bad’ local currencies would drive out the ‘Good’ dollars. Dollars would be hoarded and consumption in the producing countries would fall as a consequence. Few businesses would sell fuel in the ‘bad’ local currencies preferring good dollars, instead. These businesses would always be out of fuel – but would have something available ‘in the back’ to sell for more valuable dollars. The more hoarding, the more value to the dollars.

Ironically, this dollarization will be encouraged by the producing governments which will also crave dollar exchange and will seek to escape the ‘Net Export’ trap at the same time. They would (have to) allow a trickle of new dollars into the local economies to keep dollar preference intact. There would be a reason for this:

There won’t be much in the way of commerce alternatives.

– As the dollar becomes more valuable, the returns on commerce itself will become less so. This is ever way with human businesses and currencies! Commerce gains value at the expense of currencies … and vice- versa. Both conditions cannot exist at the same time; one has valuable commerce or valuable money. As commerce declines, the value of the increasingly scarce dollar will accelerate, Eventually this currency value will exceed that of all other forms of work. Accumulating dollars will become the purpose of economies, which in turn will become less functional as the process establishes itself. As was the case during the early 1930’s when the world’s currencies were pegged to gold, the obtain of gold by arbitrage and manipulated business failures – to seize those businesses’ gold – became all the world’s economy. Such is taking place right now in diverse locations such as Dubai and Southern Europe, the trend will continue as dollars – and oil – become increasingly scarce.

– At the same time, the value of oil is such that using for productive purposes – leveraging commerce – becomes less valuable than using it as a speculative instrument. This is a hazard that even the significant Peak Oil advocates seem to miss. At some point oil will become exactly like gold and be hoarded.

How Are Things Different Now?

Conventional reasoning suggests that steady or falling prices will eventually lead to more economic activity as the overall price structure for goods and services adjusts to normalize the relationship between oil and the commerce that is derived from it. This reasoning would be correct if the decline of real or relative price indicated large new crude production was entering the market to support the exponential expansion of demand. Right now the price of crude reflects the natural tendency for economies to congeal around value. Commerce – fueled by cheap oil – is pricing itself into obsolescence. Because reactionary politicians and nostalgic economists along with the rest of the establishment have neglected to install replacement mechanisms and institutions to manage them, speculating in – and increasing the value of money is becoming the entire economy. The steady and lowering price of oil in dollars indicates dollars are becoming more scarce and more valuable. Everything else is becoming irrelevant. This parallels the condition of oil production, where oil is becoming more scarce and more valuable, priced in equally valuable dollars. Welcome to 1931, when the entire world’s economy was focused on speculating on increasingly scarce and valuable gold.

The only way to escape the deflationary outcome is to emphasize conservation as the central organizing meme of the world’s economies rather than consumption. The first step is to replace the ‘C’ factor in the GDP formula with small- ‘c’ for ‘capital husbandry’. Then, monetize the resources being conserved and resource bases that are improved with no distinction or discrimination against the various forms of capital. The alternative is the ongoing monetization of the oil shortage and increase of the value of currency at the expense of everything else.

* The quote is from Herbert Hoover.