I just returned from a week’s trip to Maine, to look at boats and houses. This is the beginning of my sustainability program. I drove from the Washington, DC, area to Kittery, Maine and thence to Rockland and Vinalhaven Island then back. The trip up was direct by way of infamous I- 95 while the return was by way of the Hudson Valley south from the Albany area. I entertained the idea of visiting James Howard Kunstler in Saratoga Springs but felt the pull of ‘responsibility’.

It’s interesting to look at the world the way it is designed to be looked at in America, through a windshield. It is hard to escape the conclusion that we have ruined our country completely for the almighty dollar. The highways themselves are the ‘Big Empty’ crammed with automobiles and semis, all going as fast as possible, all trying to live the ‘possibilities’ that are suggested by advertising. That is, racing down the ‘open road’ to experience the ‘thrill’ of driving for its own sake. The highways are therefore empty of everything other than what is required to focus concentration and reflexes … in order to keep oneself alive.

We are indeed rats in a (linear) maze. Why?

Integral to the highway ‘experience’ is the endless and futile highway repair process. The repairs are needed to keep up with ‘projected’ demand: the need for endless ‘growth’ suggests that the exponential doubling phase is here and now. In order to maintain the level of growth that carried forward up to the middle- aughts a duplication of the current Interstate highway system needs to be built and populated with a number of rolling metal boxes equal to what exists already. This on top of a system that is too large and complex to be properly maintained now.

For what, exactly? Do we exist to ‘serve’ growth or is it something that should serve us?

Seems as if Kunstler was on the road to Maine, himself:

The world has never before seen an array of seaside cottages so uniquely hideous as the ones we passed from Seabrook to Portsmouth. The owners had managed to try every proportioning system and every color scheme known to man — except the right ones. They made your eyeballs wobble in their sockets just motoring by them on US Route 1-A — and we were not unaware, of course, that our presence on the road, along with ten thousand other pleasure-seeking tourists, only made these houses seem worse by dint of the highway’s toxic proximity.

He’s right: the two- lane highway from Bath to Down East once lined with farms and forest is now the province of the usual depressing American roadside detritus: tire stores, auto dealers, fast food restaurants and wholesale outlets all surrounded by asphalt and thousands of parked cars. With these – the excreta of ‘prosperity’ – come the new houses for the vacationers who arrive to escape just this: by their arrival propelling demand for lumber and building materials, furniture, televisions, processed food and propane, as the virtuous cycle of business expansion reinforces itself. Until it cannot, anymore; the costs then continue to gallop while the level of consumption begins its (inexorable) decline, what with fuel shortages on their way perhaps as soon as next year. This will leave the fast food franchises and dollar stores to fend for themselves while marooning the giant pickup trucks and SUVs that are the best selling products of the ‘New’ GM and Jeep/Chrysler dealers.

The small towns in Maine are less pervious to the effects of commercialization which cannot exist at all out on the (stunningly beautiful) water. Vinalhaven town is on its island, it is prosperous enough, the local economy is based on two foundations, one being the harvesting of lobsters from Penobscot Bay. Its ancient industries – granite quarrying and lumber, farming and fin- fishing – have faded, mostly replaced by summer cottages (palaces) of and for the wealthy: money- tourism being the second economic pillar. The plain majesty of the place is completely vulnerable … what holds everything together here as well as the rest of the country (world) are cheap petroleum and credit. What the locals will be left with after both exit the stage is hard to say at this time. Smuggling, perhaps? There are rumors of ‘farming’ and ‘sustainability’ but the costs are high during this period when transition must begin; the individuals who see what is coming are few and relatively poor. They must compete with speculators for land, money and government influence. The sustainers struggle on the margins instead of informing the center.

Too damned bad for the center …

The lobstermen rely on markets in New York and Boston, truck transport and diesel fuel to supply those relatively nearby markets along with air freight to serve markets more far- flung. At the same time, Haven fishermen have been coopted by salesmen and a culture that worships horsepower. The outflow of lobsters and the influx of wealthy tourists supports a vast local pickup truck culture. It is hard to see that this will end well when fuel shortages take hold.

Keep in mind these shortages will not end as have previous episodes. These will be permanent, driven by the inability of commerce to fund its own inputs. The commerce required to replace the current iteration does not exist yet and in fact cannot as the establishment refuses to allow it, nor can a replacement commerce produce the level of output able to support both the physical infrastructure and our massive debt loads.

The unwind is not going to be either easy or pleasant which is one reason why the authorities are anxious to keep putting the denouement out of sight, as far into the future as possible. Unfortunately, the future inevitably arrives …

Vinalhaven generates its own electricity with wind turbines which some object to because they make noise.

In Rockland, the local theater is owned by Matt Simmons; the film feature of the day (Thursday) was “Houston, We Have a Problem” an examination of US oil industry insiders. Other than observing that these individual do know something about the oil business and … are also swinish, the film dodges the conclusion that is its central premise. I guess it is obvious to the viewer that the insiders realize that they are pumping themselves out of business and the outcome is a generalized collapse of the oil- dependant economy. The film is largely a timeline of energy development with little else that is new to followers of Peak Oil Theory.

The Hudson Valley is a study in contradictions. The empty prosperity that emerges from Wall Street contrasts to the faded trading towns and bleak ex- factories that march downriver toward Manhattan. As in Maine and elsewhere in New England, the primary resource – arable land with good water that is available for agriculture – exists in abundance waiting for the future generations of farmers. All that is needed is the escape from the thrall of the advertisers and their government lackeys.

Meanwhile, the inflation level in China is beginning to creep/accelerate. As the four or five longer- term readers of this blog are well aware the inflation juggernaut in China has been promised to unleash itself and fan out across the defenseless countryside. The Chinese political apparatus cannot survive a deflationary collapse and in that command economy banks lend on demand and the people willingly borrow. The outcome is inflation. With currency rather than finance assets the basis of exchange, hyper- inflation will be hard for China to escape. Any real decline in real estate prices will be met with new base money and the rush of Chinese out of (newly worthless) savings will be on …

In the USA, the empty- gesture Federal Reserve cannot demand anything. Inflation would solve many problems but neither the public nor the business interests are cooperating. The real game for the Fed is to swap illiquid finance assets for cash, or to swap one kind of asset for another. This is quantitative easing (QE). It by itself does not create new money but instead shuffles assets around like deck chairs on the Titanic. QE is a feel- good kind of gesture. it has no effect when the borrowing market is saturated, returns diminish and yields are driven to very low levels. See Japan since 1990. The QE project is counter- productive as the flattening yield curve reduces bank profits …

Watch carefully if the Fed actually creates new base money or M0. Steve Keen made note of the rise in unemployment when the Fed increased base money during the Great Depression. The same phenomenon took place a couple of years ago; the doubling of the Fed’s balance sheet accompanied the shocking and current rise in joblessness. I asked Professor Keen about this when he was in New York a couple of months ago. He felt that this was correlation rather than causation.

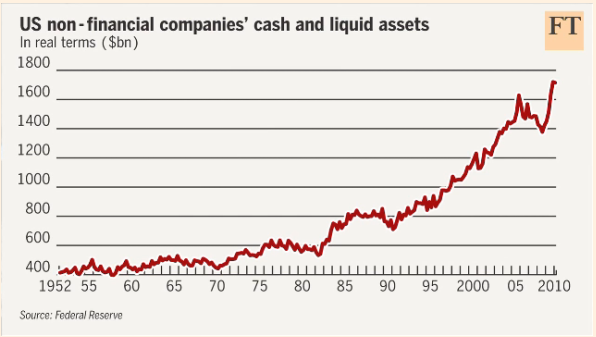

It may be, but with corporations hogging cash and the Fed liquefying finance the profits of firms are gained by the hard- dollar carry trade rather than by production. Adding cash gives those closest to the money faucet incentives to fire staff and make money by making money:

At the same time, a real increase in unemployment from the current 9.5% (U3) would push the Fed to do more than swap assets (QE) but actually increase M0. Keep an eye out on this …