Here is a good overview of our growth industry, poverty:

Somehow this expanding industry is supposed to support an expensive and expansive transition to a high- tech ‘clean energy’ regime. You know, to replace the 300 million US autos with 300 million electric carz.

What am I missing???

Here’s more job cutz from the LA Times:

Government job cuts ravage California

State, county and city agencies, beset by plunging revenues, make their biggest payroll cuts in decades, and more layoffs are ahead, analysts forecast.By Alana Semuels, Los Angeles Times

Weighed down by a struggling economy, government agencies in California shed 37,300 workers last month — more jobs than were lost in the private sector — as cities and counties made their biggest payroll cutbacks since at least 1990.

What’s more, analysts see more job cuts ahead as California faces an estimated $10-billion shortfall in the state budget that the next governor must address. Cities and counties, meanwhile, are still struggling with tepid sales and property tax revenue.

“Local governments are adopting austerity measures,” said Jerry Nickelsburg, an economist with the UCLA Anderson Forecast. “They don’t have confidence that they’re going to get money to do otherwise.”

Joe Galvez, 43, was hit with a double dose of government cuts. He lost his job with the Los Angeles County Public Works Department in 2007 and hasn’t been able to find steady work since. And, he said his son’s high school is so strapped for funding that it has asked parents to donate money for school supplies.

“It’s gotten so bad that schools are reaching out to the parents,” said Galvez, a single father of three who collects scrap so he can come up with rent for the family’s Baldwin Park home. “It’s bad, man.”Cities across the state have taken stringent measures to balance their budgets, said Eva Spiegel, a spokeswoman with the League of California Cities.

Oakland laid off 80 police officers and delayed pothole repairs. Fullerton laid off 14 police officers and three firefighters, cut library hours and closed restrooms at several parks. Oceanside laid off 28 police officers and three firefighters, closed a swimming pool and a recreation center and eliminated the city Bookmobile.

This bears watching this carefully as a spike in unemployment might suggest the beginning of QE. The putative connection is between companies and the Fed. Companies hire Fed money and fire humans. Humans complain and throw trash, money does not.

States cannot discriminate in favor of cash the same way businesses can. If company layoffs jump it is because of cash inflows to companies. US companies are hedge funds instead of goods- providers.

Cash flows to companies leading to layoffs would effect States and localities downstream as consequent to declining wage earner tax revenue. Since revenues have been declining to states since 2008 the current job losses reflect company layoffs in prior periods. New company layoffs would not show up as state job losses until later.

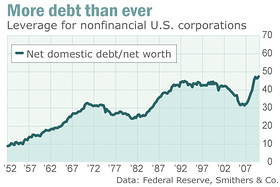

A reason for this wage/cash arbitrage is the large debt overhanging US non- bank companies. They have little business but must service debt, nonetheless.

According to the Federal Reserve, nonfinancial firms borrowed another $289 billion in the first quarter, taking their total domestic debts to $7.2 trillion, the highest level ever. That’s up by $1.1 trillion since the first quarter of 2007; it’s twice the level seen in the late 1990s.

The debt repayments made during the financial crisis were brief and minimal: tiny amounts, totaling about $100 billion, in the second and fourth quarters of 2009.

Remember that these are the debts for the nonfinancials — the part of the economy that’s supposed to be in better shape. The banks? Everybody knows half of them are the walking dead.

Central bank and Commerce Department data reveal that gross domestic debts of nonfinancial corporations now amount to 50% of GDP. That’s a postwar record. In 1945, it was just 20%. Even at the credit-bubble peaks in the late 1980s and 2005-06, it was only around 45%.

No wonder US companies are looking to unload workers. They cost too much. Add to this the high cost of fuel and overseas competition catching up and these companies don’t look so solid.