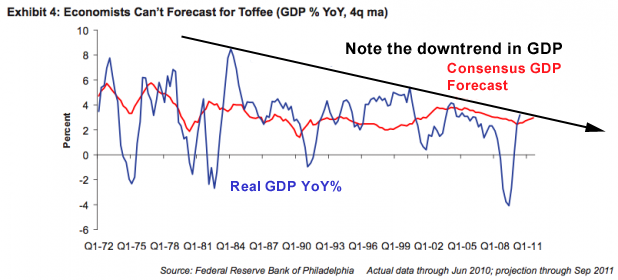

According to this article in the Business Insider, economists have no better idea of what the economy is going to do than ‘normal’ people. Consequently, they simply follow the herd as published in the media. The consensus opinion is GDP growth of approximately 4%.

Notice a few things about this chart: the first is that real GDP is extremely choppy. Except for a five year period beginning in 1995, economic activity swings dramatically from year to year. Another thing to notice is the long- term downtrend in GDP from the dramatic +8% explosion in 1984. Even with a big increase in productivity over this period with cheap computers and means of communication and the widespread introduction of robotics/automation in all areas of production from retail self- checkouts to PC- controlled CNC machines, the overall output has been steadily declining. Notable in this regard is the period from 2003 to 2008 where real GDP growth was diminishing even as the country was recovering from the ‘Dot- Com’ recession.

This period was known as a ‘Jobless Recovery’, what will economists label the current ‘recovery’? Notice too, that every period of negative growth has been accompanied an energy ‘shock’ of some kind or other. These crude oil prices @ or above $90 per barrel are something to pay attention to.

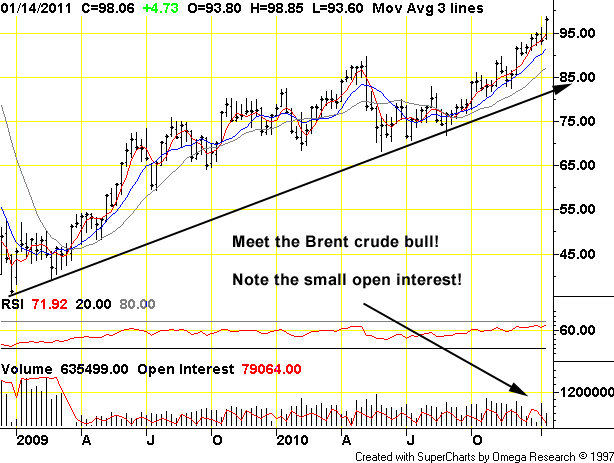

Here’s the Brent crude weekly chart from the estimable TFC Chartz:

The trading on the exchange exceeded $99 per barrel on Friday. The question for the economists is what sort of activity can be done profitably when a gallon of crude oil costs the wholesaler $2.50? Certainly not run around in circles for the ‘fun’ of it.

The small open interest relative to the OI in 2008- 09 indicates this is not an index fund- or speculator- driven market.

Here’s NYMEX/WTI crude, there is a $8 spread between Brent and Cushing fuels. One reason is weather demand has been higher in the Eurozone. Another is the NYMEX market is larger and represents a lower grade of crude product. Keep in mind that there is usually a very small price differential between the two markets:

The moral of this article is the contra- economist notion that there are limits to use/consumption of inputs and we are reaching them. Even if GDP does not plummet next week the current fuel price level has a constraining effect on output.

For example, the estimable Jeffrey Brown discusses with others @ The Oil Drum the Brent- WTI spread:

My guess is that it is due to a combination of a few million extra barrels of oil in a remote area of Oklahoma, (WTI) combined with the fact that the US is more or less in the process of being outbid for a (so far) slowly declining supply of global net oil exports. One would think that this kind of imbalance can’t continue indefinitely. Something will have to change.

The question is who is outbidding whom and to what end? High prices as the outcome of F/X intricacies means oil traders are being forced to outbid currency traders. It’s also hard to see the point of countries pushing petroleum prices higher when doing so bids up the cost of food at the same time! The same countries presumably supporting faddish ‘modernity’ and more auto use are the same countries who cannot afford food!

How long can this last?

Food riots in turn lead to instability and the overthrow of governments which happened last week in Tunisia. It’s all part of the current dynamic where choices must be made: whether to either drive a car or have a job, to drive a car or have something to eat.

Modernity has obviated the need for choices. Americans in particular have been able to choose, ‘all the above’. That era is past. Americans and those who wish to imitate them from this point forward are going to be disappointed because they are going to have to make existential choices.

At some point society is going to have to acquire less costly forms of transport. Our current ‘system’ is too gluttonous. The world cannot afford all the above: both a reasonable living with a modicum of control over ourselves, a nature that provides vital services and a massively inefficient and wasteful means of transport.

The recent editorial “SANDAG wins for North County” demonstrates a tragic and potentially fatal flaw in the current American conversation. The editorial applauds a decision by SANDAG to commit $4 billion to a widening of the I-5 corridor. It dismisses the informed opinion of thousands of residents who have thoughtfully explained transit alternatives in many town hall meetings. The editorial lauds the idea of a muscular expansion as transportation progress.The flaw derives from three essential facts. First, America is now a second-tier economy, because the love of personal mobility has shut out societal advances in shared transportation. While Europe expands its high-speed rail in all countries, including Croatia, Poland and Western Europe, and while China completes 9,900 miles of 200-plus-mph rail, San Diego will still be constructing a completely useless 23-mile widening of an already massive freeway. Is widening an already wide freeway transportation innovation and progress? Where are the voices in San Diego planning who speak for transportation innovation?

Second, our domestic security depends on weaning ourselves from fossil fuels lest we continue to be held in the grip of those societies who will export every last drop of their oil to dominate one of the great democracies in history. With peak oil comes the realization that the price and supply of oil is a risk too high for domestic security. The widening of I-5, like a co-dependent or alcoholic enabler, says: “I like my citizens dependent on fossil fuels.” Wrong now —- and future generations will scorn the expansion as criminally wasteful.

It’s us or our machines! Modern auto transport returns very little on the capital expended on it while the ‘environment’ this transport requires is both soul- destroying and unproductive. Creating the transport environment of roads, stores, tract houses, freeways, parking lots and all that supports this infrastructure precludes other profitable uses of the land- and money capital.

The economists cannot see the zero- sum forests because of the trees. They ignore high fuel costs undermining economies. Finance combined with a slowdown in production creates a condition where economic dynamics converge. ‘Market forces’ in finance are driving fuel costs higher along with other asset classes such as gold and stocks. The same increased costs are undermining the productive economy which needs cheap oil to run profitably. Further increases in finance asset values destroy more wealth in the real economy than is gained by finance. We need to get serious, ditch the cars and the wasteful infrastructure and come up with a ‘Plan B’.

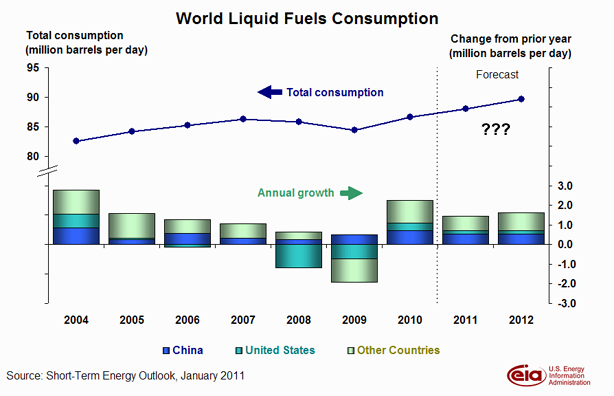

This chart from the Energy Information Agency proposes a large consumption increase both in this year and next. Where is this new oil going to come from? USA energy consumption is shown to have a modest growth in consumption. How does this align with a 4% rise in GDP? Our energy consuming mechanisms are not any more efficient than they were a couple of years ago. Demand destruction and accompanying deflation stifled energy use in 2008 and 2009. Of the 250 million vehicles on the US highways the percentage that are hybrids or electric- only is minuscule. Three of the top- ten selling vehicles in the US were the ‘Big Three’s giant Pickup Trucks.

$95 crude is presumed to be safe to enrich oil traders and ‘friends’ in the Middle East and elsewhere with no harm to the rest of the world’s economies. This is a fantasy. $97 was the average price of crude during 2008 when the US and the developed world was overflowing with credit. This price level was unsupportable and the economies unraveled. According to the EIA the average price for crude last year was almost $78 per barrel. The average for the last four months of 2010 was $81.60. The noose is tightening. The 2 million barrel per day increase in consumption is not matched by an equal increase in production or an equivalent increase in discoveries.

Oil prices may spike higher to the $97 annual price limit or the economy could turn down from this point forward following a fuel price decline. Current price levels are unaffordably high for a system built upon an assumption of $25 per barrel fuel inputs.

This last chart from estimable Gregor Macdonald indicating the last ten year’s crude output. I’ve taken the liberty to make a point: about the slowdown in production that began in 2005. The dashed line is a growth in production more or less equal to the 6 million barrel per day increase in extraction from 2002 to 2005. Equivalent growth would peg petroleum production ‘off the chart’!

Take ten minutes and be a ‘pretend economist’ and ask yourself if the world was producing 80 million barrels per day or more of crude oil would there be a recession now?