The fuel use- credit mechanism is profitable only when the cost of the petroleum input is lower than the rate of credit expansion and the supply of ‘new money’.

Looking @ crude prices by way of Bloomberg and the prognosis for Mr. Economy is grim:

Energy

| PRICE* | CHANGE | % CHANGE | TIME | |

|---|---|---|---|---|

| BRENT CRUDE FUTR (USD/bbl.) | 113.960 | 2.710 | 2.44% | 11:21 |

| GAS OIL FUT (ICE) (USD/MT) | 932.250 | 19.500 | 2.14% | 11:21 |

| HEATING OIL FUTR (USd/gal.) | 293.030 | 2.540 | 0.87% | 11:20 |

| NATURAL GAS FUTR (USD/MMBtu) | 3.798 | -0.102 | -2.62% | 11:21 |

| GASOLINE RBOB FUT (USd/gal.) | 275.650 | 4.160 | 1.53% | 11:20 |

| WTI CRUDE FUTURE (USD/bbl.) | 99.090 | 0.990 | 1.01% | 11:21 |

What price shifts the house of cards? I use the EIA Brent Equivalent (BE) price levels of 2007- 2008 as a baseline: the average price for the year 2008 was $96.85 per barrel. The average price for 2010 was: $79.51. The price average for the past four months has been $88.98 or very close to $90.

During the last spike cycle, the high price period lasted for one year, beginning in September, 2007. The average monthly price for that period was $105.32. Lehman Brothers collapsed on September 9th of 2008 which was when the oil bubble burst. The period leading up to Lehman was marked by a fierce squeeze in credit and derivatives markets which paralleled the decline in mortgage- and mortgage securities’ value. Leaving aside the credit effects from the long runup in fuel prices prior to September, 2007 it appears the system endured extremely high fuel prices for a period of six months – from September, 2007 until June of 2008 – before fuel constraints manifested themselves as an acute credit squeeze.

It is fair to say that a period of six months or longer with a BE crude oil price higher than $105 per barrel will result in a credit collapse and recession. Right now the Brent spot and futures prices are both over $110. We are in the danger zone.

Competition for available credit is the mechanism by which acutely high fuel prices damage economies, even more so than the high retail gasoline or diesel pump prices. Think of high fuel price as a fee or tax that has to be paid at once that did not exist during previous months. The question is how to pay the fee? The answer is to tap whatever credit that can be made available. Since credit availability closely tracks existing demand for it, the length of time economic participants can survive high prices equals the amount of credit that can be accessed by these participants and whether their (diminished) activity can service the added interest charges.

How long participants can survive depends upon how long before their lending lines are cut by their creditors.

Credit enables bidders to turn demand into consumption. At the same time, adding credit bids prices higher increasing in turn the need for additional credit in a self- reinforcing cycle. At some point, crude’s relation with credit triggers a price- compounding spiral. The feedback that breaks the cycle is credit rather than demand destruction. Along with the credit, the means to repay is destroyed. Because of this, the crude price crash is as devastating as the price rise as the decline represents customer insolvency, the inability of the customers in the aggregate to service the credit taken on to withstand the price increases.

Meanwhile, the price decline does not liquidate the debts taken on by businesses trying to survive during the rise. Credit- strapped businesses cannot service or liquidate debts nor can they afford fuel: they are bankrupt. This renders upstream creditors bankrupt in turn as the credit regime falls in on itself. It isn’t the gross exposure to to fuel prices against gross credit- worthiness that matters but the effect of the rises on the marginal borrower and his marginal lender(s).

The issue in 2011 is whether there is more or less available credit within the US and other economies than there was in 2007- 08 and at what cost. In 2007 – 08 people had credit in the form of housing equity that does not exist today. It is this collateral constraint — which exists more or less world- wide — that is the brake on the overall bid price of petroleum.

At the same time, the sovereign credit bubble engineered by the central banks represents a form of collateral that could be turned to pricing energy into the stratosphere if the means can be found to access this value. For instance, Chinese- held foreign exchange allows China to bid for fuel in dollars and euros. The dollars/euros in China’s hands are the consequence of the dollar/euro credit bubble geared into Chinese mercantilist- and exchange rate policies.

The central banks have worked hard to counter the deleveraging resulting from the mortgage- bubble while refusing to understanding that the bubble credit inflated crude prices by subsidizing the crude oil bid price.

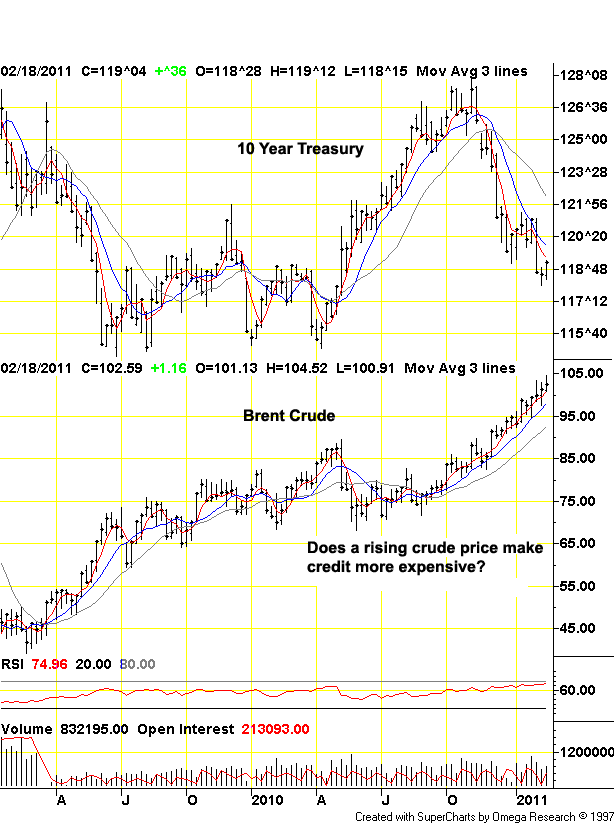

Here is a chart I cobbled together putting the Chicago 10 year weekly contract alongside the weekly Brent crude contract. This chart is suggestive: as crude prices started climbing in the summer, the price of 10 year Treasury bonds declined. It seems there is more competition for credit:

A leap in the price of an irreplaceable input requires a surge of new money from somewhere. Since monetary and fiscal funding recycles rather than creates wealth any funds ‘borrowed’ must be claimed from other parts of the economy. ‘Easy Money’ is an accounting gimmick. Funds are transfered from one pocket to another in the same pair of pants: any ‘deficit’ to the account of the public party is a ‘surplus’ to a private party account! This is is simple, double- entry bookkeeping.

Crude oil is a natural resource. It cannot be recycled the same way as credit can be exchanged between accounts. There is no accounting counterpart to the transformation of valuable fuel to a worthless atmospheric gas. Real wealth needs to be exchanged for crude so the user can have at it. The use of petroleum does not participate in credit exchange, rather it competes with the credit swapping regime itself.

This petroleum demand is persistent. New funds require new output along with a return on that output greater than the combined costs. The fuel use- credit mechanism is profitable only when the cost of the petroleum input is lower than the rate of credit expansion and the supply of ‘new money’. Higher crude prices shrink returns on existing output while the necessary new output cannot generate enough new credit to afford to bid. The competition for funds becomes fierce and credit costs increase which are then folded into the fuel price. Business entities are left ‘out in the cold’ and starved for funds, like Lehman was in 2008.

Other pathways for disaster are the increasing burden on retail customers for gas and diesel fuel. Retail diesel is $3. 80 in my area now and bolting upward along with gasoline prices which are increasing rapidly toward $4 per gallon. For those making long commutes in new SUVs and giant pickup trucks the weekly fuel bill often exceeds $100. The customers are in a trap: a new vehicle must be used to justify its purchase but at some point the operating cost becomes unsupportable. At that point both the vehicle and the fuel to run it are ‘underwater’. A $2,000 a year increase in fuel cost per vehicle becomes a major strain on a household budget under credit siege elsewhere.

For those who are unemployed or underemployed the fuel bill becomes an abstraction. The current unemployment represents demand destroyed during the the 2008 spike-n-crash event. At that time the unemployment rate was a little over 5 percent unlike now with aggregate un- underemployment @ 17% and realistically higher in many areas. Unemployed don’t participate in the auto- fuel consumption economy. Unemployment is a persistent form of demand destruction and energy conservation.

Alongside credit disruption there is an effect of price on availability. The steady rise in fuel prices since 2004 has not brought large new flows of fuel to the markets but has added to production costs. These ‘dry hole’ costs are added to the price per barrel. At the same time, there is a question whether the vaunted ‘spare capacity’ of Saudi and other OPEC producers is real or Memorex. The uncertainty over spare capacity — brought to light by recent Wikileak records of conversations between Saudi and US authorities — is a price driver. At the margins, fuel demand is both inflexible and growing. The tools to waste fuel are expensive and cannot be justified unless they are put to constant use. Buying cars and suburban tract houses and all that go with them represent sunk capital that is stranded unless fuel is available. Right now that availability is being called into question.

Meanwhile, the cars and other capital goods represents collateral. Credit derived from what remains of cars’ and houses’ collateral value is thrown into the fire to bid up that marginal barrel. Participants have no choice but to bid or do without.

What saves the world from $200 oil is the shortage of collateral in flattened housing bubbles rather than the willingness of fuel users to bid. In a sense the current demand was destroyed by the previous spike-n-crash. It is the remaining demand that is being destroyed right now.

The new face of Peak Oil, is found on those failed Key Man autocrats. Having expended much new wealth to prop up bankers and bank- dependent sovereigns there has been little attention paid to oil producer regimes which have been considered ‘stable’. Consuming economies (and their intelligence services) have been taken by surprise by the unraveling of demand- constraining autocracies. The effect of the failure of these Key Men is a massive expansion of real demand. How this demand materializes and how fast wil be determined by the amount of credit these new democracies can muster. Here, the Key Man approach is at odds with itself.

Stability requires added credit to post- autocracy states to provide palliative consumer goods including food. The added credit equals more demand and higher bids along with increased input costs for all.

At the same time, the rising costs resulting from the new credit increases the existential threat that high demand poses for the credit regime as a whole!

From a simple credit standpoint, the proper Key Man strategy is to reduce new democracies to ‘failed state’ status such as Somalia or Haiti. These states have little credit and do not add to demand. A failed state in Libya would still produce 1.5 million barrels of oil per day but would consume little or none for itself.

This is the Key Man Third Way in Nigeria, Iraq, Angola, Central Asian Republics, soon to be in Libya, Algeria, Venezuela, Iran and perhaps Saudi Arabia. While the KMTW works well in Nigeria, the transition to failed state is risky in the short term in that unrest can permanently remove or reduce oil flow substantially and destroy credit and credit- dependent nations’ economies before the oil infrastructure in the failed states can be secured.

This is what is taking place right now in Libya. Uprising in that country effects economies such as that of Italy which is dependent on 400k barrels of Libyan crude per day as well as the euro- credit trade between countries. Any interruption in trade jeopardizes billions of euros worth of bank loans which undermines shaky Italian finance and banking. Exposure to Italian banking debt by EU bondholders becomes risky as a consequence. The outlook is for a debt- deleveraging cascade to take place before oil infrastructure can be secured by NATO or ‘private’ mercenary forces.

If dictator Qaddafi was to remove himself rapidly from Libya the oil price situation would probably stabilize. Taking Qaddafi at his word suggests that the New Democrats will win but the price will be high. It also marginalizes the remaining Key Man autocrats, leaving them hanging on the laundry line, including the ruthless Iranian and Saudi regimes. Struggle and victory in Libya indicates much higher prices and even interruptions in the shorter term driving the credit- driven crash.

The spike-n-crash scenario appears inevitable and underway.

The effects of this cycle will be hard to bear in the US. Along with retail disruption and knock- on effects on other businesses, the credit squeeze will cause the dumping of collateral to gain cash liquidity. We are looking @ the mother of all liquidity squeezes here. The effect across finance will be a system- wide margin call. The large banks with impaired balance sheets will be the most vulnerable. Since the establishment is already providing easy credit at some- near zero cost it is hard to see where further easing is effective or even possible. A credit freeze is going to be much harder this time to relieve. Money market- and commercial paper accounts will be put under intense redemption pressure adding more to credit costs.

Demand for credit then liquidity will also put pressure on equities as business profits are revealed not as retained earnings but off- balance sheet aggregates of laundered debt’.

I think it’s gonna get ugly from here, folks. Tighten your chin straps.

NOTE: This just up @ Zero Hedge:

In other words, as we have shown, everyone is now purchasing on margin and the level of investor net worth is the lowest in over 3 years. Which means that should the market decline from this week persist and the Fed be unable to stop it, the margin calls will start coming in fast and furious, and unwinds in otherwise stable products like gold and silver are increasingly possible as hedge funds proceed to outright liquidations.

Credit is impaired and the demand for it and liquidity is only going to become more intense.