After watching the Greek theater last week there is the ironic possibility that the mighty Triple-A-rated, hyper-power United States of America might default on its debt before the hapless Greeks!

A resolution to extend the nation’s debt ceiling above the current $14+ trillion must be passed by Congress and signed by the president before the ongoing USA borrowing binge can continue. Right now, members of Congress are ‘Doing the Paulson’ and demanding bailouts or else. Some of the bailouts are for US millionaires who don’t want to pay taxes, just like their friends, the millionaires in Greece.

It’s very important that America close the Greek ‘tax evasion gap’!

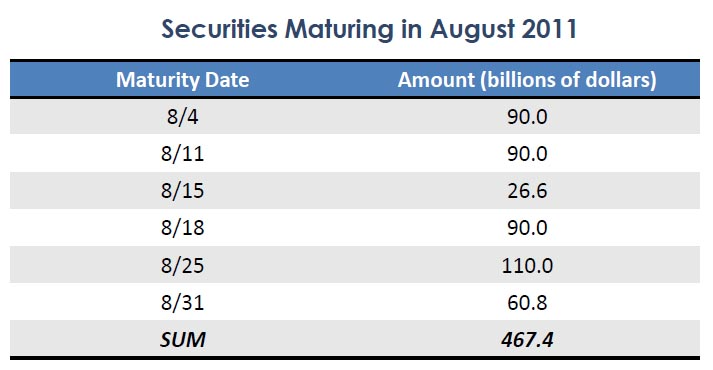

The Treasury faces a mountain of maturing debt in August. It must redeem this by ‘rolling over’: issuing new debt — borrowing — and using the proceeds to pay off old lenders. This is from the Bipartisan Policy Center published @ Zero Hedge a few days ago:

$467 billion is a lot of money to have to come up with in a hurry! No problema, the money is there. What matters is the ‘net cost’ of that money. The interest on $467 billion is a large sum, almost $30 billion. Currently, Mr Geithner isn’t permitted to ‘borrow’ that additional $30 bil from the bond market (the Fed).

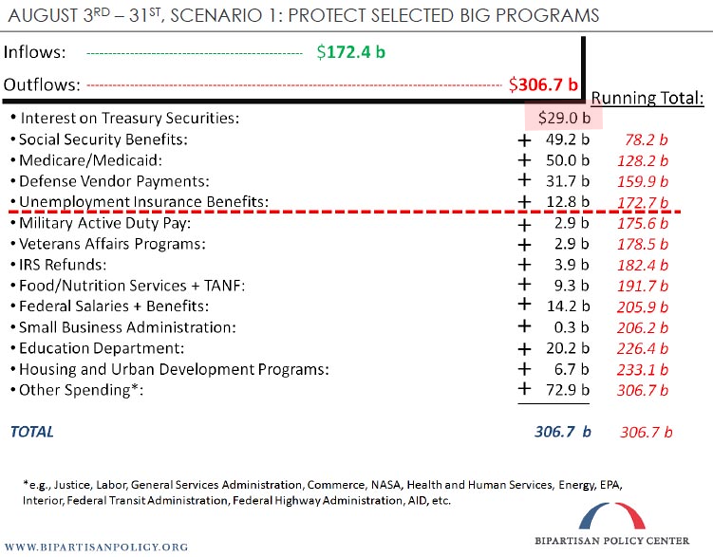

Treasury ‘borrows’ from US government employee retirement accounts, instead. Geithner takes cash out and leaves IOU’s. The retirement cupboard will be bare when these redemptions materialize. The $29 billion for interest is high-lighted below in red: net expense is what the Feds spend less- tax receipts: (Click for big)

The ongoing expenses aren’t exactly a bagatelle: the net $140 billion is new money the Treasury has to pull out of a hat. Without a resolution the Treasury cannot ‘legally’ gin up cash from the ‘markets’ which means a lot of the spending on the list stops. The Treasury can roll over debt but cannot pay soldiers … or Social Security beneficiaries. This is that ‘technical default’ that may or may not wreak havoc on the credit markets.

The real ‘inner game’ is the monetizing: the Treasury continually borrowing to pay accumulating interest. Borrowing takes place to service each preceding round of borrowing. With the complicity of the Federal Reserve, the government essentially borrows from/lends to itself. It can do this endlessly: everything proceeds without a hitch until the numbers become absurdly huge and the government loses all credibility.

That political types are croaking about mere trillion$ indicates absurdity lies right around the corner. The US can have a quadrillion- dollar economy when there are flying cars and robots that can battle super-human adversaries … while cleaning the house and speaking French. Since none of these things are likely to happen, a quadrillion- dollar US economy is either a hyper-inflated paper fraud or absolutely idiotic or both.

There is no real immediate cost to a government borrowing in its own currency. As James Galbraith puts it, a sovereign borrowing in its own currency is like bowling: the alley never runs out of ‘points’. Instead, the costs instantly accumulate when the government stops borrowing. When a government borrows it credits ‘Mr. Lender Dude’s Account’ at the same instant plus some interest. It’s a great game: the illusion of free money, something for nothing: a perpetual motion machine.

As long as a government keeps keeps the wheel turning the interest cost of this money is extremely low, since the lending/borrowing continually adds funds to be invested. The added funds means an ongoing surplus chasing ‘investments’, the best of which just happen to be government debt!

When the wheel stops as it is doing now, interest costs rise and the private surplus shrinks. Since all the dollar lending rates are interconnected across finance, a rise in Treasury rates would ricochet though the entire finance universe. The question would become, ‘what level of interest expense triggers a recession greater than the version the country is mired in now?’ The answer is, ‘not much’. A two or three percent rise in borrowing costs would bankrupt the Federal government; it would be unable to service the debt out of tax receipts which it is able to do now. Monetizing by additional borrowing would become very costly.

The euro- bound Greeks cannot do use the fiscal perpetual motion machine. Like all the other EU nations, it must borrow euros outside the country from ‘nobody in particular’: a cabal of unaccountable banks that are the substitute for Europe’s fiscal system. The banks have imposed breaking rates on Greek government borrowing. Greece is stuck: it cannot afford to borrow any more and it cannot afford to go out of business, either. To do so and abandon the euro would leave a Greece unable to afford imported fuel for its beloved automobiles.

Meanwhile, the Japanese can borrow/lend endlessly to themselves in their own currency at infinitesimally small interest cost. Japan can do so … as long as she keeps doing so. Once begun in earnest sovereign self- borrowing/lending becomes a trap, like ‘Hotel California’.

“You can check out any time you like but you can never leave.”“Insanity is repeating the same experiment over and over and expecting different results.” Albert Einstein

That the US Treasury and others can borrow/lend endlessly to/from itself is a poorly understood aspect of ‘modern monetary economics’. This is the plank that Congress is stumbling over. The US Treasury can never ‘go broke’, the US can — and should — run an unbalanced budget … and do so from now until the cows come home. Basically, any government deficit is a surplus in private hands. The opposite is also true. Running the US government like a business means other businesses elsewhere in the country must fail.

It is ironic that the most extreme pro- business interests in Congress are dead- set on doing what is certain to derail business activity! This is ‘conservation by other means’: the ‘fail’ dynamic is taking place because the ‘energy surplus’ belongs to oil producers overseas and mercantilists which are parasitising their neighbors and clients.

The government cannot print oil or lend it into existence — it can only gift a small amount to consumers as a gesture. Governments have been issuing debt as a substitute. Nothing wrong with this per- se, but the debt is taken on to expand consumption. This is a fatal error. The debt is needed to create a husbandry economy instead of the faltering consumption version, but doing so requires a form imagination that the consumption economy cannot provide.

The theater taking place in Washington, DC has the US Treasury asking permission to borrow/lend from Congress. The childish parties play chicken with each other as if nothing but short- term political advantage matters. This is absurd: an administration that engages in three wars overseas without permission from Congress can ignore sanctions against borrowing/lending and do as it pleases.

If this Administration had any imagination it would introduce its own currency rather than borrow from finance by way of the Federal Reserve. The president could ask Treasury Secretary Warren to use the Treasury gold hoard @ Fort Knox — 50 ounces or so it has left — to back the issue of a fixed amount of currency necessary to continue the functions of government. We can call this currency ‘United States Notes’ or ‘US Silver Notes’ as opposed to the current toilet paper ‘Federal Reserve Notes’. The Treasury could imply limited convertibility of notes to gold/silver.

The Treasury would lie … as it ‘implied’ full faith and credit toward mortgage- backed securities offered by Fannie Mae and Freddie Mac. Nobody would risk calling the Treasury on its lie or otherwise rock the boat. There would be no reason for anyone doing business with the government to do so. The government would run a paper- gold ponzi scheme the same way the bullion banks do now!

The Treasury could also swap a few of its new notes for all the gold and silver held on the Fed’s account @ the New York Fed to make a lie the truth. Unlike the bullion banks and the Fed, the Treasury possesses the tools of eminent domain and a public service mandate.

A hard US dollar would be a reverse- or negative ‘anti-default’. How amusing!

Would the good drive out the bad for once and unmake Gresham’s Law? It would be interesting to find out. The issue of gold- backed ‘Treasury dollars’ would instantly end Federal Reserve/finance monetary monopoly and give the government the liquidity advantage that it ceded to the Fed after the Second World War. The Treasury would gain instant, immense leverage/ bargaining power over its own debt which it could service or retire at its pleasure. Issuance of a hard dollar would be a sort of ‘Mini- Plaza Accord’ that would allow dollar-for-dollar and dollar-for-debt arbitrage opportunities that the Treasury could ‘broker’ at a (stupendous) profit. In the casino economy, the Treasury would become the ‘house’. It could create its own rules such as whether the ‘new’ dollars would exchange for ‘old’ ones where and at what rate. At a stroke, the dead hand of baronial finance would be loosened from the public interest. The Fed currency ‘Reserve Notes’ would become the ‘hippie scrip alternative’ that could be printed or not at Mr. Bernanke’s pleasure with diminishing effect on the rest of the economy.

Just like now, but more-so.

Treasury Secretary Warren could take the next step and compel the Fed to treat its Reserve Notes as ‘demurrage money’. This kind of money requires the holder to pay a fee to the issuer to hold onto it. An entity would have to increase his holding’s value by a fixed amount on a regular schedule per year.

Imagine this strategy applied to the trillion$ in excess reserves or in corporate vaults? Rather than holding money, the rational entity would spend it instead, hoping to push the demurrage cost onto another. The increased spending would stimulate business activity. Without the addition of a single penny of currency created, the economic effect of inflation would be produced without there being actual inflation. Demurrage money is a strange form of inflationary/non-inflationary money. To hold money you have to be actually earn more money by way of economic activity so as to afford the fee which usually amounts to 1.0- 1.5% per year. Since the money becomes that much more valuable with time, the incentive to ration liquidity by hoarding — becoming super rich — vanishes.

The Greeks could issue demurrage money as drachmas to stimulate their euro- starved economy and get people off the streets and out of Syntagma Square. The ‘New Drachmas’ would only be acceptable in Greece yet freely convertible to euros. The counter- productive IMF- ‘austerity diktat’ would be bypassed. Economic activity would increase while anarchy and disorder would decrease.

Folks from the rest of Europe would feel comfortable again going to Greece to enjoy the unspoiled countryside and delicious food and wine. The visitors would spend euros. The Greeks could earn something that could be used to retire some the currently oppressive debt.

US demurrage dollars would do the same thing. Right now, Americans are sitting in front of televisions, collecting food stamps and hating life. The unemployed have given up on getting jobs. There is little for the policy makers to lose.

Without an attitude adjustment, the current Capital stalemate is likely to end with a ‘technical’ default. The last US default took place when the Treasury closed the gold window in August, 1971 and abandoned the Bretton Woods currency accord. The initial cost of default to the US economy was low. Most folks didn’t realize when it happened. American defaults have not been dramatic. The default previous was in 1933-34 when Roosevelt took gold specie out of circulation and Congress ended the gold clause in contracts. Most Americans only knew the economy improved but not by much. In 1971 there was dollar volatility on foreign exchange markets as traders stumbled to discover the proper value of US money relative to other currencies. Americans was experiencing inflation but the country was not in a recession.

The US was a net energy importer and the cost of default emerged at the gas pump. Prices doubled and doubled again in the six months after the OPEC oil embargo instituted in October, 1973. There were gas shortages and lines at service stations. There was a severe recession that ultimately cost millions of high- paying American manufacturing jobs.

A default now would effect energy imports as overseas producers would not know what any given dollar was worth. The producers/exporters might demand more dollars for each barrel of oil or dollars might vanish from circulation as a credit freeze vacuums liquidity out of finance. The US economy is a ponzi scheme with claims exchangeable for dollars not sheaves of wheat. Either increased dollar costs or increased dollar value will take a percentage of motorists off the road. This ‘percentage taking’ demand destruction along with interest rate volatility will trigger the double- dip recession that the Establishment is in such a panic to avoid.

Congressional Follies viewed through an energy prism becomes a choice for each individual: to drive a car or have a functioning government? Add this to all the other ‘drive a car’ choices: to drive a car or have a job, to drive a car or have something to eat, to drive a car or have a future world your grandchildren can live in without having to wear lead suits.

Silvio Gesell invented demurrage money which has been used in all parts of the world as an ‘alternative’ currency, usually alongside an official version. It has worked well when attempted. Since it threatens the finance- centric establishment it has been barely tolerated and usually outlawed. An excellent article about Gesell and demurrage money can be found at Brad DeLong’s web site.

Keep in mind, there is no currency solution to an energy constraint problem, imaginative currency regimes are useful tools.