Having just endured the ghastly performance taken place in the Capital, it’s back to ghastly business as usual, watching the flotsam circle the drain and wonder who gets sucked down first …

– America dodged the default bullet but the same interests who held the country hostage are still alive and free to walk around outside.

– Budget roulette shows that people learn fast, everyone is ‘Doing the Paulson’ like crazy and taking hostages. Obviously some sort of default will take place at some point in the future and the game-playing will end. Interests won’t be walking around outside, anymore. Part of the big picture problem has been the excess moral hazard, nobody is held accountable for anything.

– The fact of economic hostage taking and its necessity indicates ‘Business As Usual’ is losing its grip. The enterprise cannot justify itself by way of rational economic arguments: it must threaten its own extinction in order to obtain permission … to undermine itself! How Bizarre. Business is in a coffin corner: it needs exponentially expanding debt to continue to profit even as the costs of that debt have become far too great for any economy to service.

Nothing new here: industrial economies lose money. They cannot operate for long out of their own cash flow. Our ‘innovative’ businessmen have decided our money-losing economy is so important the government itself needs to be sacrificed to it. This is pure desperation: it means there country is running out of things/places/ideals/processes/resources to hurl into the furnace! Now what?

Extortion is showing diminishing returns. The thing held hostage is diminished in worth by the process of being held hostage! The currently decrepit economy hardly justifies the effort, it must borrow from the hostage-taker to pay its own ransom.

Indeed, business has been awful, for years and years. Why else did the country run up fifty trillion dollars in debts in the first place? Where are the organic profits? When do these show up? Do they ever?

Debt is monetized losses or risk, rented to ‘entrepreneurs’ and finance ‘innovators’. That is why the world’s economies embrace finance: their ‘productive’ petroleum-driven enterprises all lose money! Some means must be found to disguise the onrunning indebtedness that results and spread the losses to … the elderly or cats and dogs!

A failure at such profound levels needs to be replaced by something better, right?

Figure 1: Chart of sovereign nations’ debt burden relative to GDP. (Atlantic) Click for big:

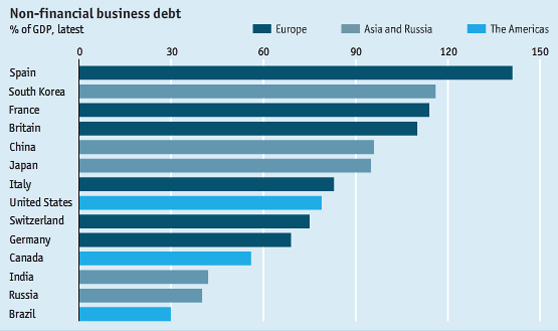

Figure 2: Non- Finance Business debt/GDP.

All the countries are broke. Industrialization does not earn enough to support itself. Instead, its artifacts become collateral for promises that are ultimately never honored. It is not that our economies contain the occasional Ponzi scheme, our economies ARE Ponzi schemes. In order to keep our enterprise lurching along some significant economic entity must continually absorb system losses and be able to monetize them.

Otherwise nobody would earn anything!

This is why there aren’t any real cuts in the debt ceiling agreement. There can’t be! Any cuts and businesses will fail which in turn would lead to the debt overhang to delever.

Because private entities cannot carry losses for more than very short periods without failing the governments become the ‘designated failures’ or debt sinks. A government can theoretically carry unlimited amounts of debt because it can create the currency the debts are denominated in and can never be rendered insolvent.

This is why the debt-ceiling brouhaha has been so silly. The US government cannot default unless it chooses to do so. The US has a Treasury: it has its own assets, it can simply issue currency or cancel debts to itself.

The US could and should ‘default-proof’ itself and put into place administrative mechanisms that would enable automatic interest and principal/roll-over payments regardless of external conditions. This would take debt service out of the reach of politics. Automatic debt service would be more useful than the fatuous and impossible ‘Balanced Budget Amendment’ … it would also be difficult for Congressional interests to oppose.

Meanwhile, the US Treasury is in its own ‘Coffin Corner’: it must continually borrow more to keep the massively indebted private sector afloat. At the same time, the amount of debt is so great that it has lost its ability to increase GDP: the subject economy has become debt- saturated. This is Steve’s First Law at work: the cost of managing the excess- or surplus of debt is greater than the ‘value’ or return on the debt itself. The cost manifests itself in the US and Japan in the form withering output and deflation, the same way China’s foreign currency surplus is costly to China in the form of hyperinflation.

As debt levels rise the economy becomes buried by costs. If the debt level doesn’t rise, profits vanish and deleveraging takes place. Despite the ‘austerity’ talk, the Establishment is doing everything in its power to prevent this from happening. When the markets teeter, the hard-liners are the first rush in to authorize more borrowing to prop up pet enterprises.

This reality is why the debt-ceiling ‘crisis’ is a charade. The government isn’t going to cut anything. It can’t. Doing so would torpedo its natural constituency of rich people, who lend government money in the first place! The idea that the wealthy will refuse to pay themselves is nonsense! Paying themselves is how rich people become rich!

None of this keeps the various fraudulent interests from publicly pretending: Here’s Michael Hudson:

…financial schizophrenia extending across the political spectrum from the Tea Party to Tim Geithner at the Treasury and Ben Bernanke at the Fed. It seems bizarre that the most reasonable understanding of why the 2008 bank crisis did not require a vast public subsidy for Wall Street occurred at Monday’s Republican presidential debate on June 13, by none other than Congressional Tea Party leader Michele Bachmann – who had boasted in a Wall Street Journal interview two days earlier, on Saturday, that she voted against the Troubled Asset Relief Program (TARP) “both times.”She complains that no one bothered to ask about the constitutionality of these extraordinary interventions into the financial markets.

“During a recent hearing I asked Secretary [Timothy] Geithner three times where the constitution authorized the Treasury’s actions [just [giving] the Treasury a $700 billion blank check], and his response was, ‘Well, Congress passed the law.’ …With TARP, the government blew through the Constitutional stop sign and decided ‘Whatever it takes, that’s what we’re going to do.’”

Clarifying her position regarding her willingness to see the banks fail, she explained:

I would have. People think when you have a, quote, ‘bank failure,’ that that is the end of the bank. And it isn’t necessarily. A normal way that the American free market system has worked is that we have a process of unwinding. It’s called bankruptcy. It doesn’t mean, necessarily, that the industry is eclipsed or that it’s gone. Often times, the phoenix rises out of the ashes.

There were easily enough sound loans and assets in the banks to cover deposits insured by the FDIC – but not enough to pay their counterparties in the “casino capitalist” category of their transactions. This super-computerized financial horse racing is what the bailout was about, not bread-and-butter retail and business banking or insurance.

It all seems reminiscent of the 1968 presidential campaign. The economic discussion back then between Democrat Hubert Humphrey and Republican Richard Nixon was so tepid that it prompted journalist Eric Hoffer to ask why only a southern cracker, third-party candidate Alabama Governor George Wallace, was talking about the real issues. We seem to be in a similar state in preparation for the 2012 campaign, with junk economics on both sides.

More often times, the phoenix doesn’t rise: Bachmann could not endure the consequences of a default, nor could any in Washington. What is doing the cutting is the ongoing energy waste. Deleveraging will result from the next real increase in fuel prices.

Note, it is hard to know what China’s debt loads actually are as China barely acknowledges its underground economy. Chances are the Chinese debts are very great, particularly after a period of uncontrolled lending post- September, 2008. The other countries with small debts are the transitioning ‘developing’ countries like Brazil and Russia which are energy exporters.

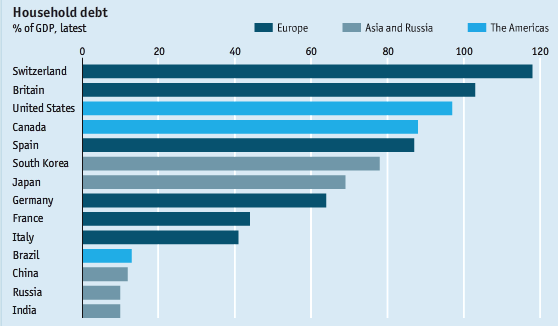

Figure 3: Household debt/GDP.

So much for those supposedly frugal Swiss. It’s hard to dig a deeper hole than Yank households but somehow the Swiss have managed! It must be the high cost of cuckoo clock parts.

Swiss banks have lent large amounts of francs to Eastern Europeans. The bolt upward in the ‘franny’ has become a crushing burden in countries that have seen their earning power in local currencies or euros erode. Eventually, the burden will become too great, The borrowers will give faraway Swiss banks the finger and dare them to take possession if they can. The entire debt structure will fall apart.

Like the rest of the industrial world, the Swiss have attempted to press the costs of their economy onto others in Eastern Europe. These ‘others’ are struggling, now what?

Here’s Paul Krugman complaining bitterly:

The President SurrendersPaul Krugman (NYT)

A deal to raise the federal debt ceiling is in the works. If it goes through, many commentators will declare that disaster was avoided. But they will be wrong.

For the deal itself, given the available information, is a disaster, and not just for President Obama and his party. It will damage an already depressed economy; it will probably make America’s long-run deficit problem worse, not better; and most important, by demonstrating that raw extortion works and carries no political cost, it will take America a long way down the road to banana-republic status.

Start with the economics. We currently have a deeply depressed economy. We will almost certainly continue to have a depressed economy all through next year. And we will probably have a depressed economy through 2013 as well, if not beyond.

The worst thing you can do in these circumstances is slash government spending, since that will depress the economy even further. Pay no attention to those who invoke the confidence fairy, claiming that tough action on the budget will reassure businesses and consumers, leading them to spend more. It doesn’t work that way, a fact confirmed by many studies of the historical record.

Krugman makes the point that the US has accepted certain responsibilities that accompany being a super-power. The establishment is supposed to behave a certain way, with ‘just so’ manners:

Make no mistake about it, what we’re witnessing here is a catastrophe on multiple levels.It is, of course, a political catastrophe for Democrats, who just a few weeks ago seemed to have Republicans on the run over their plan to dismantle Medicare; now Mr. Obama has thrown all that away. And the damage isn’t over: there will be more choke points where Republicans can threaten to create a crisis unless the president surrenders, and they can now act with the confident expectation that he will.

In the long run, however, Democrats won’t be the only losers. What Republicans have just gotten away with calls our whole system of government into question. After all, how can American democracy work if whichever party is most prepared to be ruthless, to threaten the nation’s economic security, gets to dictate policy? And the answer is, maybe it can’t.

Failure happens: ever higher fuel prices are driving costs past the point where cost shaving anywhere else is an exercise in futility. That is the real lesson of the debt ceiling exercise: the US enterprise has not been profitable and cannot be with increasing real energy/resource costs regardless of what the managers try to do. The only thing that remains is the answer to the question, now what?

How about a ‘Plan B’?