Stock markets around the world took dumps yesterday:

– The only question about Gray Monday is why this hasn’t happened a long time ago.

– The Western world and its wannabes have been running on denial, unicorns and willful suspension of disbelief. Central bankers wave their arms and fresh doses of debt appear to prop up economies. Adding liquidity to markets pushes economies ever deeper into debt, shifting private losses onto public balance sheets. This is done against the will of the private investors who ‘vote with their feet’ by selling their shares!

The markets are like the Hotel California: you can check out but the economy never leaves. Your opinion about the state of the US and world economy does not count, only institutional fraud and actions of automated stock ‘bucket shops’ who create the appearance of a real economy and a real market.

Our crisis orbits around the inability to service debt: the scam involves adding more debt to service as the solution. Industrial economies are failures on anything like their own terms, they cannot earn organic profits, these must be borrowed. It falls to the workers to service and repay the loans, something that cannot be done because the same workers have been stripped of the means to do so. The shareholders lost the means along with the workers, now they are admitting it.

Institutionalized stupidity is not bullish in the longer term even as the same stupidity props the stock key men! There is the panicked short term sacrifice of the future for the immediate now. What happens is shade of 1933: there is no other economic activity other than robots pretending. This cannot go on much longer. It’s ‘two- plus- two equals five’.

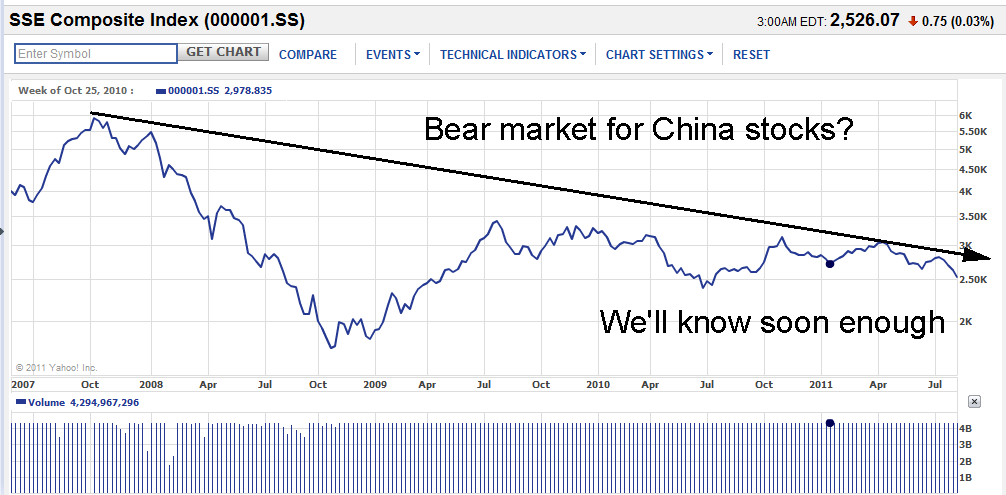

– A part of the ‘crisis’ that nobody talks about is the endgame in China. It’s here: big things are happening in China and most of them aren’t good. There is the beloved growth. China lies about growth and suckers around the world believe the lies. If American lies are not to be believed, why should China lies be any different? (Click on chart for big)

Figure 1: Is China in a bear market? Does the current slump in Shanghai shares signal a real recession in China? Keep in mind, the Chinese government buys shares to prop the market, the insecure Chinese turn their economy into a liquidity dependency of the Federal Reserve and the European Central Bank.

– Meanwhile, eight million tons of coal get sucked into furnaces across China every single day, marching toward that country’s inevitable day of energy reckoning.

– London and other UK towns are on fire. Disenfranchised youths have nothing better to do but blow up a world they never asked to belong to. Add disorder in the UK to that in Greece, Portugal, Spain and across the Middle East and Northern Africa. Youth rebellions are not bullish for stocks.

– West Texas Intermediate is currently priced below the trend set during the period following the 2009 price collapse:

Figure 2:This is the continuous monthly WTI price from TFC Charts. Note the lower high reached earlier this year relative to the 2008 high. We are in a long-term crude oil bear market. We should also see lower lows to confirm the bear market. A crude price below $34 a barrel would represent a calamitous deleveraging event.

– The 2011 high represents Ben Bernanke’s attempt to gain relevance as well as monetary control of a fuel-driven contraction. Bernanke wasted what little monetary ammunition the Fed possessed. With markets now declining again there is little the Fed can do but watch helplessly.

– The Brent market was more of a mini-bubble prior to the crash: the current low price remains above the trend, but probably not for long:

Figure 3: Charts by TFC Charts: The Brent price is above the cost of new production but a decline that endures more than a very short period will cause wells to be shut in. Right now it looks like chaos on the production side.

– As in 2008, holding the world crude price over $100 per barrel for six months is an economy killer. The EIA price average for the year 2008 was $99 per barrel, however the average from March through September was $114.22 per barrel. (Energy Information Agency weekly spot prices.)

The price average for 2011 from February to June has been $106.06, with the world arguably much poorer than it was in 2008. Definitely not bullish.

Today the world will get its dead cat bounce.

Tomorrow?