The Wrong Idea (NY Times)Stocks on Wall Street dropped sharply on Thursday, with investors spooked, again, about the euro-zone debt crisis and the sputtering United States economy.

Yet, even at this hour, leaders on both sides of the Atlantic seem determined to handcuff fiscal policies — the main tools that can increase jobs, consumer demand and economic growth — with an unquestioning devotion to rigid austerity.

Europe’s post-2008 economic problems have differed from America’s in many important ways. Washington has mercifully never had to cope with the problem of a dollar torn apart by the separate taxing and spending policies of 17 sovereign governments.

But as the crisis moves toward its fourth year, there are disturbing common threads.

One is the chilling specter of sovereign default, something that never should have come up in the United States but did for a while because of the reckless brinkmanship of House Republicans. A more real threat of default now haunts European bond markets, as chronically under-financed bailout plans with punitive terms have made it impossible for the debtor countries to grow fast enough to pay down their debts.

Another grim parallel is the refusal by leaders to take politically tough but economically necessary stands.

On Tuesday, Chancellor Angela Merkel of Germany and President Nicolas Sarkozy of France again ruled out the two steps most needed to stem the panic in the financial markets: issuing common European bonds and committing more money for Europe’s depleted bailout fund. Instead, they proposed more meetings and called on all European nations to enshrine an ill-advised “golden rule” of balanced budgets in their constitutions. Markets are rightly unimpressed.

Excessive indebtedness is a real, long-term problem. But Europe’s broad downward trajectory can only be turned around if governments — both those of lenders and debtors — spend more in the near term to put people back to work and get consumers back to spending.

It’s nice the NY Times agrees with the need for Eurobonds but does so for all the wrong reasons. The EU needs the Eurobonds to stifle its ongoing funding crisis and buy some time. It would use the time to draft then implement real monetary and fiscal reform before its too late to do much of anything.

One reform would be for the EU to use the euro as an reserve and exchange currency as the dollar was during the Bretton Woods period. The euro could be backed by gold or — preferably — all kinds of natural resources including gold, oil, topsoil, forests and fresh water. The euro would settle current accounts between members and exporters: being a hard currency it would impose its own discipline.

The euro would become a ‘savers’ currency’. Euros would be hard to find and harder to spend. The flood of capital overseas to fund fuel purchases would slow to a trickle. People will demonstrably trade their jobs, futures, democracy and much else in order to drive cars but the line would be drawn when the exchange is cars for gold.

I’m guessing the love for gold is stronger than the love for automobiles.

The EU members would also issue — not borrow — their own currencies for domestic use only. Drachmas, francs, lira, pesetas, d-marks would circulate within member countries. These currencies would preferably be demurrage monies that would act to drive local economic activity without the surplus building and inflation that occurs now. These local monies would be ‘spending currencies’ with the funds remaining at home rather than being shunted off to international banks, tax havens or to oil producers.

The so-called ‘recovery’ process promoted by the Times and the establishment it speaks for is self-defeating: should the EU gets its house in order the demand will be for more (borrowed) capital to consume. Stockmarkets will rise and the long-enduring idea of burning capital for immediate gratification will re-emerge. This will last only as long as there is new capital. After this is burned the crisis will return with greater force.

The establishment chooses to look past the elephant in the room: the economic input cost constraints that are the direct result of past decades of growth and consumer spending. Our economies take capital out of the ground and put it into furnaces to burn. At the end of the day there is nothing to show for the enterprise but more furnaces.

Meanwhile, the capital vanishes: this is where we are now, stranded with shrinking capital. The cost of replacement capital is greater than what can be ‘earned’ by the burning process. This simple capital flow cycle is beyond the grasp of economists, businessmen, politicians and newspaper editors.

We can make these more efficient and complain about the capital strictures but nothing can make ‘less’ go away … not even incantations by the Establishment druids.

The latest trend is the ‘think outside the growth box’ trend. The establishment is missing this trend: its promoters are ignored and scorned by the establishment. Unfortunately for the bosses, the trend’s foundation is rooted in physics and simple arithmetic: its operative entity is Mister Entropy. He has his own agenda and cares little about what politicians, economists, advertising managers and innovators ‘think’. The trendsters who understand Mr Entropy know that the next economy will not reward waste but extreme conservation and husbandry instead. Over a span of time the ‘hip, new’ conservation-based economy will promise a bright future of some kind or other.

To do otherwise has Mr Entropy remorselessly annihilating the waste based economy by means of own operation. If you think what he’s doing to ‘growth’ right now is horrible just wait and see what he has in mind for ‘food’.

Meanwhile, the Chinese have finally exposed some of their underground economy to view:

Foreign Exchange Regulator Says Hot Money Inflows on the RiseChen Lu (Caixin)

The State Administration of Foreign Exchange said it will continue to monitor hot money inflows and strengthen measures against illegal exchanges

China’s foreign exchange regulator said hot money inflows are a growing concern, with illegal exchanges up by over 20 percent in the first half of this year. According to the State Administration of Foreign Exchange (SAFE), over 1,800 cases of illegal foreign exchange businesses have been shut down since the start of the year, which involved a total of US$ 16 billion.

The amount of illegal foreign exchange businesses increased by 26 percent from one year earlier, according to SAFE.

SAFE said on August 16 that it will continue to monitor hot money inflows and strengthen against illegal exchanges.

You really have to hunt through Caixin regularly to pick this sort of thing up because the Chinese want to keep the underground ‘loan shark’ economy … underground. First of all, the $16 billion represents the tip of the iceberg. The hapless illegal foreign exchanges are those that didn’t pay the requisite bribes to the ‘correct’ princelings. Like the futile USA drug war punctuated with well-publicized interdictions, the amounts — of drugs pouring into the US and the dollars pouring into the loan sharks’ pockets — are orders of magnitude greater.

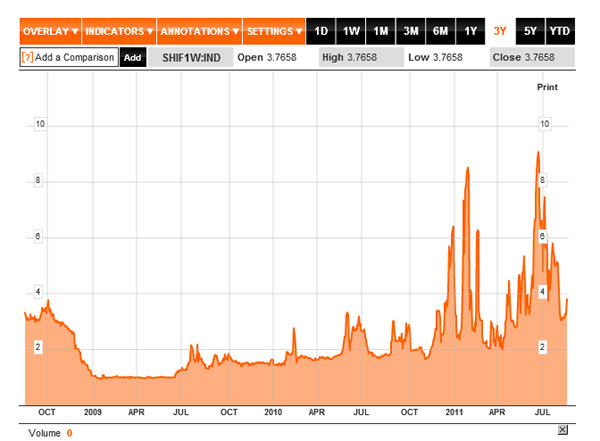

This has to be so because of the demand for short-term money in China! $16 or even $60 billion into the ‘illegal exchanges’ would not cause a demand great enough to effect the overnight interbank market. The interbank demand for yuan is jumping: (click for big):

When the loan shark economy needs yuan it borrows from the banking system as it cannot print yuan: the rise in rates indicates sharp demand, when rates decline the central bank is flooding the banking system with more yuan. Reading from the Chinese indicates more yuan are on the way …

Two things are taking place in plain sight: China’s economy is being dollarized and the process is driving yuan hyperinflation. Like the real currency amounts trading in ‘illicit exchanges’ the rate of inflation is understated, probably by an order of magnitude. The 6% admitted to is likely to be 60% and more is certain: after all the rates demanded by loan sharks — 35% to 90% — must exceed the rate of local inflation even as the rates themselves amplify the inflationary effect. China is stuck with the laissez fair capitalism it hoped and prayed for: the Full Tilt, no-holds-barred underground economy … is the economy!

If China cracks down on the sharks the result is a 1929 Great Crash and deflationary depression. Not cracking down means accelerating hyperinflation. The Chinese are stuck.

China’s whining about US ‘debt’ is identical to Irving Fisher’s ‘permanently high plateau’ prediction made three days before Black Thursday in October of 1929.

China is awash in money: what is hyperinflation but a self-amplifying excess of money? In hyperinflationary environments there are ALWAYS two currencies, one is the currency that people ‘need’ for one reason or another and the other is what the establishment makes available. Part of a citizen’s daily ‘job’ is to trade the currency he or she has for the one he or she needs: usually what is needed is food or — in China’s case — energy. The currency swap requires more and more of the currency that people have, the establishment responds by making more of the currency available by printing it.

As the process accelerates the all consuming job of everyone’s day is to obtain at whatever cost the currency that is needed. This marginal trade of the needed currency for a good sets the price of goods in the currency in hand. Right now the currency that is becoming needed in China is the dollar.

China needs to go on a dollar diet. China is living Steve’s First Law of Economics: the cost of China’s dollar surplus is the ruin of China’s economy by hyperinflation and the onrushing worthlessness of the yuan.

The China F/X surplus was a tactic to prevent speculative attacks on its currency … as are taking place in the EU right now against the euro. China’s accumulation of dollar reserves has guarded against foreign speculators repeating the assault made by George Soros on the Bank of England. What is happening is the speculative currency assault on the Peoples Bank of China is being waged by Chinese speculators inside China itself. The outcome will be the same as what took place in 1992: the sharp devaluation of the yuan and the impoverishment of millions of Chinese.

The price of importing the USA waste-based economy and its enabling currency: ugly death of China’s economy at the hands of Mr Entropy.