Unknown Photographer, Jacob Farrand house on Woodward Avenue between Sproat and Temple streets in Detroit (1881). Burton Historical Collection @ University of Michigan Library.

People say California is a good model for the rest of the country, it is “The Place Where The Future Happens First!”

Detroit is a much better model than California: it is the place where the future happened a long time ago. Persons seeking that ‘Mad Max’ dystopia — where law and order is very much a sometimes thing, where the house next door is a burnout and the neighbors down the street are dope-addled zombies — need look no further than the ex-Motor City.

How it got this bad in Detroit has become a point of national discussion. Violent crime settled into the city’s bones decades ago, but recently, as the numbers of police officers have plummeted and police response times have remained distressingly high, citizens have taken to dealing with things themselves.In this city of about 700,000 people, the number of cops has steadily fallen, from about 5,000 a decade ago to fewer than 3,000 today. Detroit homicides — the second-highest per capita in the country last year, according to the FBI — rose by 10 percent in 2011 to 344 people.

…Average police response time for priority calls in the city, according to the latest data available, is 24 minutes. In comparable cities across the country, it is well under 10 minutes.

The number of justifiable homicides, in which residents use deadly force in self-defense, jumped from 19 in 2010 to 34 last year — a 79 percent rise — according to newly released city data.

The city with the highest murder rate in the US is New Orleans, another post-future model. More information about world homicide rates can be found in the UN Global Study on Homicide in 2011. Places with highest homicide rates are third-world hell-holes such as Venezuela, Jamaica, Honduras and El Salvador, districts of northern Mexico adjacent to the US border and south-central Africa. These futures are a step or two down the ladder from Detroit into the energy abyss.

A consistent theme in this letter has been the connections between items that may seem to be far removed from each other but are actually linked at the very core. If you push on one end you get a reaction in what would seem to be the most unlikely spots. Today we explore the connection between the fiscal deficit and energy policy. Everyone in Washington is starting to “get religion” about wanting to fix the deficit, with serious thinkers on all sides acknowledging that there must be reform and a path to a balanced budget. Burgeoning healthcare and Social Security costs are rightly pointed to as the problem, and entitlement reform will soon be front and center.But the fiscal (government) deficit in the US cannot go away unless we also deal with the trade deficit. As we will see, it is a simple accounting issue, and one based on 400 years of accepted accounting principles. And dealing with the trade deficit in the US means working with our energy policy.

The trade imbalances among the partners in the eurozone are at the heart of the problems there as well. And while we will get back to Europe in a few weeks (remember when we seemed to be focused on Europe and Greece for months on end?), today we will explore the trade problem from a US perspective. Happily, this problem, while serious, does have a workable solution. And it might even happen in spite of government policy, though if a proactive energy policy were developed, it could ignite a true economic renaissance.

Mauldin carries on telling readers how friendly tycoons are going to save us all with huge reservoirs of crude oil:

I have been wanting to explore the implications of the shale oil revolution. Old oil fields are wearing out, as peak oil advocates point out. Where can we find the huge and cheap-to-exploit oil fields to replace them? Hasn’t all the easy oil already been found?

Because language is infinitely malleable, words can mean or imply anything the utterer wishes them to mean. Hasn’t all the easy oil already been found? What is ‘easy oil’? What does ‘easy’ mean: “Easy for me, hard for you?” Mauldin does not use the word affordable, nor does he mention costs. Over the course of five-thousand two hundred words the consumption side of the energy equation is never discussed … this is surprising/misleading because our crisis is the direct product of consumption. Decades of industrialized, highly-efficient guzzling of the cheapest, easiest fuels have bankrupted us! Because of our incredible ‘success’ we must now deploy unorthodox extraction techniques that might indeed be ‘easy’ but are unaffordably costly. Can anyone see anything wrong with that?

If cheap and easy have bankrupted us … what will expensive and difficult do?

Mauldin invests many words on the US trade imbalance, noting:

Not Everyone Can Run a Surplus… we are spending more for energy even as we use less of it, and that drives up our trade deficit. Let’s see why this matters. As long-time readers know, I have often written about how you cannot balance private and government deficits without a positive trade balance. Let me quickly review.

It is the desire of every country to somehow grow its way out of the current mess. And indeed that is the time-honored way for a country to heal itself.

No country has ever ‘grown’ itself out of debt or a debt crisis. Debts have been repudiated or restructured. Countries have abused foreign exchange, waged war and conquered or have been destroyed. Governments have bankrupted creditors or sent them to the gibbet. They have stalled for time until able to take on orders-of-magnitude greater debts from new- or the same creditors … thereby refinancing existing obligations.

In a global economy all the creditors have been tapped. There is no new source of credit except Bankers from Mars.

The increase of debt masquerades as growth. The US appears to grow which allows more debt to be taken on to create the appearance of still more growth which in turn enables additional debt. Right now the Establishment lies about growth in order to take on more debt. This scam of ‘growth-to debt-to growth-to debt’ is all there is to industrial prosperity … along with fuel-wasting garbage that breaks down and is thrown out in a few years. Unlike real output of goods and services which is constrained by thermodynamics, debt has no limits as long as the increases can be supported with good ‘progress’ stories.

Frakking and ‘shale oil’ are part of the narrative that serves to generate loans for energy tycoons. ‘Energy Independence’ is the empty abstraction that is offered as the narrative’s objective. Business customers and ordinary citizens are required to repay the debts … and their children and grandchildren.

But let’s look at an equation that shows why that might not be possible this time. We have here another case of people wanting to believe six impossible things before breakfast.

Good grief … the narrative is complete with Mauldin ‘folksy-isms’.

Let’s divide a country’s economy into three sectors: private, government, and exports. If you play with the variables a little bit, you find that you get the following equation. Keep in mind that this is an accounting identity, not a theory. If it is wrong, then five centuries of double-entry bookkeeping must also be wrong.Domestic Private Sector Financial Balance + Governmental Fiscal Balance – the Current Account Balance (or Trade Deficit/Surplus) = 0.

This is correct but not particularly relevant. America’s current account is not a problem. America creates its own dollars as needed, the oil sheikhs recycle their imported US dollars back into the US economy. The imbalance that really matters is at home, at the end of Americans’ driveways:

These machines are not farm tractors or delivery vehicles, they are not used for work, they are luxuries, a drug, a form of crack cocaine. What they earn is zero, their cost must be met with debt, the cost of the fuel they consume is also met with debt, so is the cost of the infrastructure that these machines require. If the individual users are unable to obtain the needed credit then the economy as a whole- and the state must obtain it in the individual’s place. Otherwise, the consumption components of the string economy are deprived of funds. This credit starving process is underway, even as the cost of debt has become unmanageable. While frakking costs are extraordinary, the consumption side debts are galactic! Realistically, nobody/nothing can hope to repay them.

The consumption side is a money-loser. Sez Mauldin: “Play with the variables a little bit, you find that you get the following equation. Keep in mind that this is an accounting identity, not a theory. If it is wrong, then five centuries of double-entry bookkeeping must also be wrong:”

The Cost of Fuel + The Cost of Credit Needed to Pay for Both Fuel and Fuel Use/Waste Infrastructure – Returns on the Use of the Fuel = 0

Right now, returns are juiced with credit otherwise the process would have failed a long time ago. The ability to set a price is also the ability to meet that price. If the driller’s price is bid by access to credit, the consumers must have access to the same credit to meet that price. In model cities such as Detroit where the consumption side started losing purchasing power in 1929 the consequences of rationed credit are obvious: welcome to the death spiral, where costs race ability to meet them into the basement!

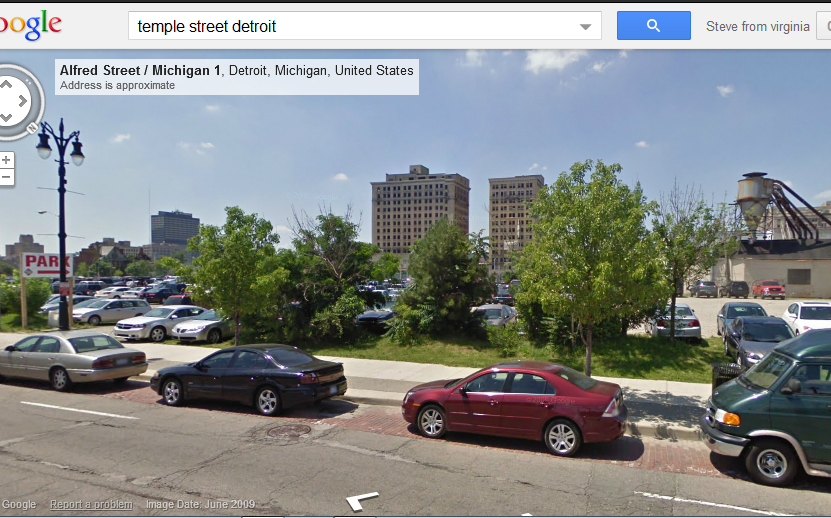

The banality of future world: the Woodward Avenue location in 2009. The towers at the rear of the photo are abandoned as are other structures in the area.

The best way to look at the peak oil dilemma is to ignore physical production — which has little to do with anything — and to consider the City of Detroit as the model customer for all of John Mauldin’s newly frakked crude oil. The shattered city filled with desperately impoverished people is somehow supposed to afford more costly fuel when it can barely afford what it has now.

Energy products can be obtained but only if someone’s grandmother is gunned down inside her house by a gang of dope-crazed teenaged hoodlums. The reason for the hoodlums has been the success of industries in pauperizing the city. Either consumers must become richer or costs of fuel-plus-credit must decline. Since the trend — as seen in the model city — is for consumers to become impoverished the outcome is for costs to be unmet and the production/credit side to be de-funded …

When customers cannot afford fuel it remains in the ground. Right now, Detroit — that model for America’s future in today’s present — cannot afford cops. It cannot afford firefighters, it cannot afford basic services. It has been bankrupted by the short-term success of its own consumption tycoons … hard to see how it can pay for high cost petroleum!

“We got to have a little Old West up here in Detroit. That’s what it’s gonna take,” Detroit resident Julia Brown told The Daily.The last time Brown, 73, called the Detroit police, they didn’t show up until the next day. So she applied for a permit to carry a handgun and says she’s prepared to use it against the young thugs who have taken over her neighborhood, burglarizing entire blocks, opening fire at will and terrorizing the elderly with impunity.

“I don’t intend to be one of their victims,” said Brown, who has lived in Detroit since the late 1950s. “I’m planning on taking one out.”

The Detroit model of house-bursting brigands is scalable: for the country to afford energy products Congress must rob grandmothers in their own houses by absconding with their retirements.

Fuel Costs + Credit Costs – Returns on Fuel Use = 0.

The implications of this little formula are profound. As with current accounts, the sum of costs and real ability to pay are always zero. As returns on fuel use are negligible, fuel and credit costs must decline … and they are. Underway right now is the desperate, last stand pillaging of what remains of the world’s wealth to obtain fuel and credit, every bit wealth is up for grabs. The real cost of fuel and credit must fall to what the fuel and credit users can afford. Looking at Detroit, the affordable amount is very small indeed.

The question is whether there will be any fuel available and the affordable price? Time will tell.