Media and the establishment would have the proletariat believe that they have vanquished the latest ‘Great Recession’; what remains is the mopping up exercise leading to further decades of fabulous economic ‘growth’. So we travel down the sunken road, meeting our destiny, for good or ill …

Outside the media bubble, growth reveals itself as a cancer that stealthily hollows out every Earth-bound enterprise. Our economic tumor metastasizes; there is the increase of smartphone- and automobile ‘wealth’, at the same time there is less clean water, fertile top-soil and petroleum. We fetishize the former while mispricing the latter, ruining ourselves even as our magic mirrors connive us into believing how beautiful we are. The end is inevitable but also unpleasant and difficult to discuss. We have an economy in hospice; our way of doing business has become a stinky, embarrassing death in the family.

We are undone by our economic success, we are equally undone should (when) things fall apart: the paradox of progress.

The way forward is to develop a strategy and act upon it: Churchill famously remarked, “You can always count on the Americans to do the right thing after they have tried everything else.” We are in the ‘everything else’ phase, effective plans are stillborn. Strategy is replaced with denial, the vacuum is inhabited by meaningless media happy-babble. Reality can only be picked out of the shadows, it requires wit on the part of anyone seeking a ‘gestalt change’ that might rescue us from our self-annihilating stupidity …

Figure 1: While we are dilly-dallying with everything else, events are fast catching up. Enter that Dream- killing four dollar gasoline; the big car dream, the suburban tract house dream, the rock-around-the-clock dream, the fifteen miles from the living room to the bathroom dream: heat map from GasBuddy.com. (Click on for big.) Gas prices in California are shooting through the roof. Prices elsewhere in the US are rising fast, too.

Prices rise because of fuel constraints; in 2014 supply and demand still works. The tightly-coupled interrelationships between the various currencies and fuel results in shortages around the world emerging where residents are best-able to stump up needed funds … as in wealthy California. In other parts of the world, folks address the structural shortage of fuel by not buying.

Californians create the constraints the same time they battle their effects by destroying every bit of gasoline they buy. Californians are trapped: if they continue to drive they push the cost of gasoline to the level where buyers vanish and the price can no longer be met. At the same time, they cannot afford to stop driving because they have invested too much in the process. Aside from speculating in real estate, the entire economy of the state -— as well as the rest of the developed world -— revolves around buying and using cars for everything.

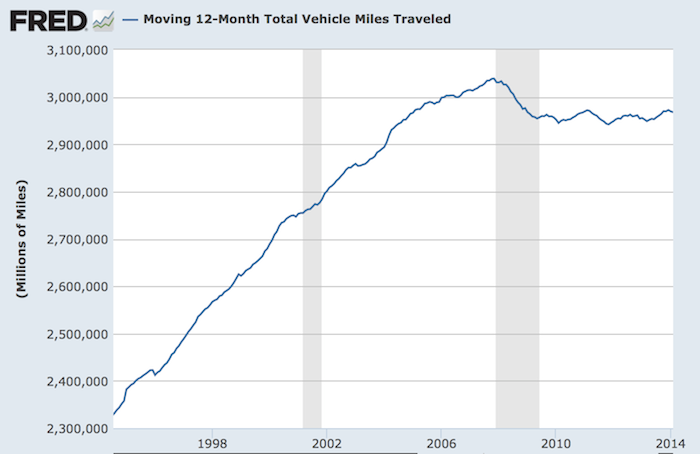

Figure 2: Vehicle Miles Traveled by way of the St. Louis Fed: Americans by right should be driving 3.6 trillion miles this year but are stuck in reverse. Paradoxically, diminished driving has had very little-or-no affect on fuel prices. Even less driving will be required to reduce prices … so that people can afford to start driving more … who says economics is a dismal science? Meanwhile, failure-to-drive causes prices to drop to the point where oil drillers are bankrupted. Horrors: the paradox of progress, where driving and non-driving lead to identical outcomes!

You know there is trouble when Art Berman and David Hughes appear in an article in Bloomberg .

The problems arise when you look at how quickly production from these new, unconventional wells dries up. David Hughes — a 32-year veteran with the Geological Survey of Canada and a now research fellow with the Post Carbon Institute, a sustainability think-tank in California — notes that the average decline of the world’s conventional oil fields is about 5 percent per year. By comparison, the average decline of oil wells in North Dakota’s booming Bakken shale oil field is 44 percent per year. Individual wells can see production declines of 70 percent or more in the first year.Shale gas wells face similarly swift depletion rates, so drillers need to keep plumbing new wells to make up for the shortfall at those that have gone anemic. This creates what Hughes and other critics consider an unsustainable treadmill of ever-higher, billion-dollar capital expenditures chasing a shifting equilibrium. “The best locations are usually drilled first,” Hughes said, “so as time goes by, drilling must move into areas of lower quality rock. The wells cost the same, but they produce less, so you need more of them just to offset decline.”

As easy-to-gain irreplaceable capital is exhausted, it has to be replaced … with the harder-to-gain variety. One would think humans could learn: replacement capital cannot keep pace with either the rate of increase of new drivers or with depletion of conventional sources of capital. It costs less up-front to put new cars on the road than find and exploit new oil fields. Energy discussions tend to emphasize production and technology, the problems emerge from the consumption side of the fuel-waste process — all those new cars. Drivers do not gain any return by their use of energy which is simply waste.

Driving a car does not pay for the car or the fuel or the fuel delivery-processing system or the roads. What pays for these things is debts that are taken on, directly and indirectly, by the drivers and the obligations handed forward to their grandchildren and their great-grandchildren. The debt is guaranteed by way of the various children’s discounted labor. Enter the Paradox of Stupidity: empirically, fuel use cannot retire system debts — it certainly hasn’t so far. Human labor is depreciated to favor fuel use so it also is unable to pay: there is no agent in the system that can pay, the system is designed from the ground-up to fail.

Humans don’t extract fuel to store it. The road between worthless and worthless is remarkably short: worthless fuel in the ground becomes worthless gases in the atmosphere. What is gained by way of the process is nothing: the fuel waste enterprise in its entirety is non-remunerative. This includes finance, insurance, real estate; cars, airplanes, highway construction, government-military along with the petroleum extraction-, processing and distribution industries. No single sector or industry can thrive independently of the others: there would be few cars without highways and real-estate destinations for them to cycle between. The outcome after + 100 years => cost of the credit added to the cost of necessary fuel and other capital inputs exceeds what the enterprise can ‘earn’ by borrowing. We are insolvent, this is the reason for our crisis …

Loans are a substitute for organic returns. Every at-scale enterprises is loss-making; every at-scale enterprise is subsidized by credit. ‘Profits’ are loans from customers’ banks, wages are loans from bosses’ customers’ banks. Cash-in-hand represents third parties’ unpaid debts. All of our debt is money, likewise, all of our ‘wealth’ is the unpaid debt of others, ‘money’ is the residue of destroyed capital.

We humans enjoy wasting fuel the same way we enjoy smoking crack; that this activity does not pay its own way is irrelevant: we borrow then lie to ourselves about it. Finance- and credit providers enable our self-destructive proclivities; we assume debt-system permanence but there is no evidence for it.

Because of geology, the driller must gain proportionately more credit than the customer over time, without exception. There is no way to ‘adjust’ … or for economies to ‘get used’ to the drillers’ demands for funds, the driller must gain more of the available pool of credit from now until eternity … or until the credit system breaks down under the weight of its own success. Should ever the customer gain a greater proportion of credit, the driller is starved of funds, there is no more oil!

Because the drillers are over-consuming credit, they are slowly bankrupting their customers! Put another way; the drillers are competing with their customers as well as their own lenders for funds. This is exactly the same thing that happens within mercantile economies; countries bankrupt their customers by way of trade, they themselves decline as they exhaust their customers’ credit. The bankrupting process is currently underway in Japan and China. In the end, everything levels out, reverts to mean …

Enter the ‘credit paradox’: credit is technically unlimited because it is intangible and costs nothing to produce. At the same time, credit is a finite, material resource that is limited by the credibility of both issuers and borrowers. As Walter Bagehot famously remarked: “Every banker knows that if he has to prove that he is worthy of credit, however good may be his arguments, in fact his credit is gone … “ Multiply this by all the world’s bankers and the world’s credit is at the point of ‘depleted’.

Don’t forget the ‘Paradox of Thrift’, which states that one-way markets — all buyers or all sellers (or all savers) — cannot exist without severe consequences. A market where all participants are buyers means a market that is ultimately deprived of them. Everyone who is willing to buy has done so: no one remains able to ‘buy from the buyers’. A market where all are thrifty is one where money is ‘saved’ out of circulation so that day-to-day business becomes impossible. A market crash occurs when free-spenders are forced by conditions … to be thrifty all at once!

It can be said that what has overtaken the United States is a condition where all Americans have been consumers and there are too few savers: the paradox of non-thrift. Americans are forced into penury on account of it, there has been too much business, goods have been over-consumed, goods-markets are saturated. Businesses cannot endure periods when there is no consumption and they fail, the outcome is the same as too much thrift. Instead of a shortage of currency, there is the shortage of timely demand.

The quantitative limits to credit are real: at any given time there is a finite amount of credit. This does not mean that the amounts are always the same — these amounts vary instant to instant. Rather, the amount of credit at any particular time is all the credit there is; that credit is finite. Out of each succeeding instant’s available funds, a larger percentage must be directed to oil drillers … otherwise there is no oil! The energy industry’s need for credit holds the entire world hostage. When there is no more credit, when drillers have exhausted their own credit and/or that of their customers, there is no more oil. When the credit system breaks down there is no more oil.

Meanwhile, credit itself depends upon readily available, inexpensive fuels. A fuel shortage does not enrich industrial firms nor does a shortage add to firms’ borrowing capacity. This includes energy industry … at bottom all at-scale manufacturing and commercial businesses are energy firms. Industrial ‘growth’ economies do not work backwards; they exist to shift costs associated with surpluses onto third-parties. At the same time, economies destroy capital, the destroying process is the collateral for the cost-shifting regime (debt). When there is a shortage of capital, the economic activity ceases at the (presumably) higher level and declines to a level where surpluses reoccur … whose costs of can thence be shifted to others. Right now, there is a shortfall of capital — not sufficient to cause economic activity to completely stop — but enough of a constraint to cause activity to slow down => less credit available or made use of => even less available capital to destroy => diminished collateral for the cost-shifting debt regime => credit instability and creeping insolvency.

Customers credit worthiness is diminished as they are not credibly solvent; as it is with the lenders; as it is with business managers and government administrators who are widely perceived to be either criminals, compromised or incompetent.

Keep in mind, there is no easy-to-access, inexpensive oil to fall back on when the high-cost fuels are unavailable. When drilling costs and declining ability to meet them intersect, the ‘underwater’ fuels will be shut in; drillers cannot afford to ship fuel @ zero- or negative cash flow for more than modest intervals. At some point, insolvent drilling companies fail. Shortages that occur because fuel is unaffordable will be permanent because fuel shortages do not make anyone credit-worthy and the newly-impoverished sans-fuel have no means to ‘catch up’.

Because our extractive economy has been so successful for so long — 500 + years — we humanoids have, a) become complacent and believe in fairies, b) we have extracted and destroyed capital needed to provide alternative outcomes, and c) the consequences of economic success are now indistinguishable from consequences of economic failure: the paradox of progress.

Energy companies cannot magically start producing $40/barrel oil. When such a price appears it will be because half the people in the US have lost their jobs.

Times change, shortages do not materialize as lines at the gas station, odd-even days or the ‘double-nickel’ … but as lines at the bank. A fuel shortage in the 21st century appears as credit breakdown. The process is shortages => credit crises due to absence of organic returns/non-existent collateral => driller inability to borrow or their customers to borrow for them due to credit crisis => less fuel available => self-amplifying vicious cycle. Credit breakdown can occur rapidly as credit itself requires predictability and confidence in the worthiness of both creditors and borrowers. Bagehot added: “Credit is a power which may grow, but cannot be constructed. Those who live under a great and firm system of credit must consider that if they break up that one they will never see another, for it will take years upon years to make a successor to it.”

The obvious solution is stringent conservation of our capital resources and a re-ordering of economic priorities around husbandry and long-term stewardship of capital. This is common sense as well as inevitable: the administrative program required to accomplish resource husbandry is easy, the wishful thinking component of our waste-based system almost impossible to overcome. Complacency leaves us with an ascendent belief in unicorns and ‘better luck, tomorrow’. Conservation is excluded from the discussion even though it is the only approach that not only can hope of success. Paradoxically, conservation will be the outcome regardless of all other efforts to the contrary! Failure to make any positive conservation efforts guarantees ‘conservation by other means’.

Light at the end of the tunnel: getting rid of the cars. Young people are turning their backs on driving and sprawling American-style suburbs; the auto industry frets.

Next: What the Piketty phenomenon means.