Fast forward two weeks and the media obsession with Piketty has receded, he has been replaced in the public consciousness by self-driving cars and Rihanna’s see-through dress.

It wasn’t the errors found in Piketty’s spreadsheets that did him in, nor is it the ongoing compression of the international media cycle. Rather, it is the creeping awareness that Piketty’s argument for ending wealth inequality resolves into a great leveling process that does not conclude with everyone becoming tycoons. Meanwhile … in the background where no one is paying attention … the leveling process is already underway and feeding on itself. As billions of hyper-greedy wannabes maximize their rational self-interests they not only exploit whatever is within reach, they end up competing against each other = unseemly micro-tycoon fratricide:

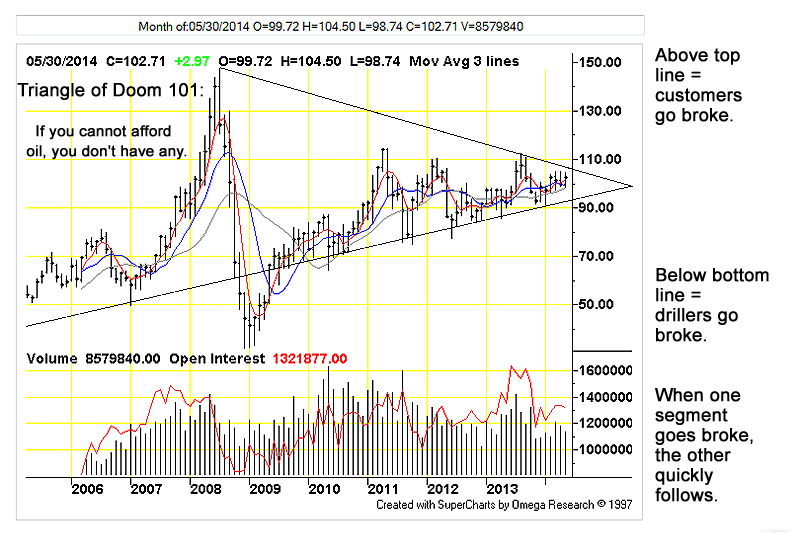

Kill them all and let God sort them out: the Triangle of Tycoonery; WTI continuous crude futures by way of TFC Charts (click on for big). How long with the party last? Only a few more days if Russia invades Ukraine or the Vietnamese navy fires torpedoes at a Chinese ship …

Largely left out of the peak oil- and energy discussions is the consumer side of the process. Generally, petroleum analysis focuses on how much we have left; extraction and the rate of extraction. We love talking about how much we have left, it makes our private parts seem that much larger, it reinforces our sense of how clever we are, it also distracts us from how much treasure we’ve already squandered along with what little we have to show for it. As with other critical areas of our society, we set out to get rich first so that we could afford to solve wealth-related problems later. To pursue the highest level of growth we put hundreds of millions of drivers onto the roads circling between gas stations like flying Dutchmen …

This is where the self-driving cars enter the picture, billions of them can motor aimlessly around the clock whether they carry passengers or not and make more growth all by themselves = singularity.

It’s a great pretty stupid plan, I didn’t come up with it.

Recently, there is a little bit more discussion about fuel industry costs as drillers confront the near-certain prospect of bankruptcy as their only product runs out. The focus on how much we have left is silly because the consumption (waste) side is where all the action is. Customers cannot earn by driving in circles so the fuel industry is funded by the same customers reaching for the plastic. When customers are unable to borrow it means that fuel supply is ‘unsustainable’; the drillers must borrow from their own lenders, from finance or from the government (which borrows for them). Customers also borrow to buy cars, homes, freeways, office-buildings, military forces, etc. Since 2000 the price of fuel has increased five times while the return on the use of the same fuel has remained the same: squat. Over the same period credit has ballooned in a frantic effort to keep pace.

There are two interlinked problems: when one buys fuel at the higher price there is the tendency to buy fewer other ‘Brand X’ goods; driving cars competes with retail sales. The second problem is that higher fuel costs hit that plastic a lot harder than the lower variety. Debt retirement and service costs become burdensome … they increase exponentially … eventually these costs are breaking. The ‘Minsky Moment’ occurs when total borrowing capacity is insufficient to service existing debt. We aren’t quite there yet but getting close enough to hear the weeping; (Jim Quinn, Burning Platform):

Retail store results for the 1st quarter of 2014 have been rolling in over the last week. It seems the hideous government reported retail sales results over the last six months are being confirmed by the dying bricks and mortar mega-chains. In case you missed the corporate mainstream media not reporting the facts and doing their usual positive spin, here are the absolutely dreadful headlines:

- Wal-Mart Profit Plunges By $220 Million as US Store Traffic Declines by 1.4%

- Target Profit Plunges by $80 Million, 16% Lower Than 2013, as Store Traffic Declines by 2.3%

- Sears Loses $358 Million in First Quarter as Comparable Store Sales at Sears Plunge by 7.8% and Sales at Kmart Plunge by 5.1%

- JC Penney Thrilled With Loss of Only $358 Million For the Quarter

- Kohl’s Operating Income Plunges by 17% as Comparable Sales Decline by 3.4%

- Costco Profit Declines by $84 Million as Comp Store Sales Only Increase by 2%

- Staples Profit Plunges by 44% as Sales Collapse and Closing Hundreds of Stores

- Gap Income Drops 22% as Same Store Sales Fall

- … etc.

Beginning in the 19th century, petroleum fuel supply was intended as loss leader for auto- and retail industries which grew to become giants. High fuel prices are now cannibalizing this paradigm. The more stores that die, the fewer ex-employees are able to drive, those that can afford to will have fewer places to go and spend money. The bloodletting in retail adversely affects credit provision, the ability of the country as a whole to afford higher priced fuels is diminished.

Thomas Malthus in the 18th century observed that human population expanded geometrically while agricultural output increased arithmetically. Malthus erroneously discounted the ability of farmers to increase production, he did not live long enough to witness the effect of fossil fuels on agricultural output. His thesis turns out to be right when applied to machines: fuel-guzzling gadgets multiply much faster than industry can grow the fuel supply. The means of sustenance is outstripped and the costs multiply; the excess of machines is like every other surplus, subject to the First Law which holds that the costs associated with managing any surplus increase along with it until at some point they exceed the worth of the surplus itself.

Surplus- associated costs flow where they will; stranded machines don’t experience finance difficulties, they simply rust. The surplus of cars and other machines bankrupts the owners, exhaustion of the fuel supply is another associated cost, so is the death ride of retail.

The deathly triangle pops up in odd corners of the mainstream media where the focus is not entirely on the see-through dress, (NY Times):

America’s Highways, Running on EmptyJoshua L. Schank

IF you think your commute is getting worse, it’s probably not your imagination. And no, it’s not because there are more cars on the road. The potholes, the stalled construction projects, the congestion — it’s because the highway trust fund is almost empty and, without a fix, could run out of money this summer.

Federal transportation funding relies heavily on user-based fees, in the form of gas taxes. While that worked for decades, it began to break down after Congress stopped raising the tax, which has been stuck at 18.4 cents a gallon for over 20 years. Since then, people have begun driving less and using more fuel-efficient cars, which means less tax is paid. Even worse, the tax is not indexed to inflation.

The only solution is to supplement the tax with dedicated federal funding — which would not only solve the money problem, but open the door to long-dreamed-of innovations in our transportation system.

The obvious solution, raising the gas tax, is a political nonstarter. And even if it could pass, Congress would be tempted to direct some or all of that revenue to other purposes, like deficit reduction — it did just that in 1990 and 1993.

In any case, raising the gas tax wouldn’t help in the long run. When America planned the Interstate System in the 1950s, only half the country was urbanized and the number of cars was growing rapidly. Now more than 80 percent of Americans live in metropolitan regions, and total driving has stagnated. Even if we could raise the tax, it would only reinforce an outdated program.

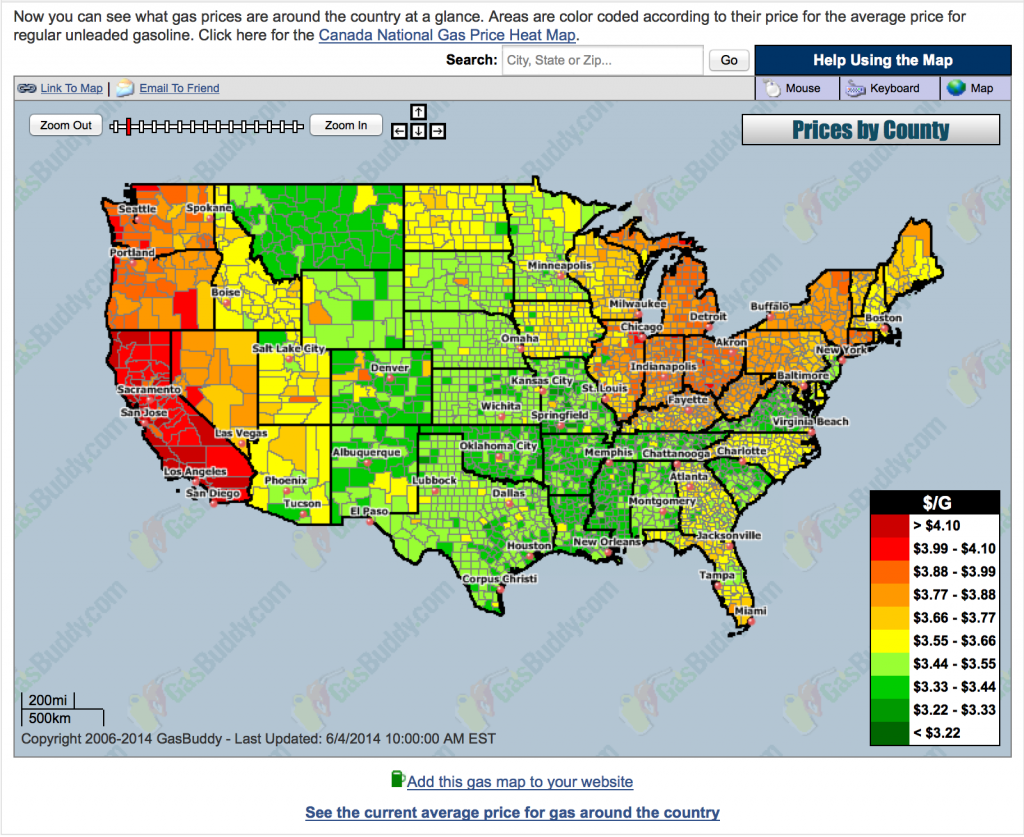

If the Federal government raises the puny 18.4¢ gas tax, the higher retail price will discourage aimless circling, which will adversely affect growth. Already gas prices are in the danger zone with the 2014 Summer circling season just underway:

Heat map from Gasbuddy.com. Prices are high in California because the need to formulate special gasoline blends for the state, because of higher state taxes, Californians are richer and can afford to pay … and there is a gasoline shortage otherwise gasoline would cost less than a dollar per gallon and the world would have plenty.

Because gas price increases are an incentive to reduce consumption, the government cannot afford to tax users to fix the roads. The government must borrow and fund repairs by way of the back door, the same back door that funded the roads in the first place. Debt service payments and principal retirements must be borrowed as well; in the end it does not matter about the repairs but rather how far away is the Minsky Moment?

Keep in mind, high fuel prices are a special kind of tax paid to the energy companies and their material suppliers. Highway contractors, drivers, lenders, refiners and drillers are all competing against each other for the proportionately largest slice of the credit pie. If one of them succeeds he does so at the expense of the others. At the same time, the failure of any of the others becomes the failure of all.

Policy makers are caught in a familiar trap: without repairs, the poor quality of roads will reduce driving. If the government borrows more to fix the roads, the borrowing costs are added to the fuel costs and everything becomes more expensive including driving. More driving destroys capital inviting destitution, less driving = reduces growth which also invites destitution … the end of the gangplank has very little maneuvering room.

More triangulation underway everywhere not just in California, (Nouriel Roubini, Project Syndicate):

The Great Backlash

NEW YORK – In the immediate aftermath of the 2008 global financial crisis, policymakers’ success in preventing the Great Recession from turning into Great Depression II held in check demands for protectionist and inward-looking measures. But now the backlash against globalization – and the freer movement of goods, services, capital, labor, and technology that came with it – has arrived.

This new nationalism takes different economic forms: trade barriers, asset protection, reaction against foreign direct investment, policies favoring domestic workers and firms, anti-immigration measures, state capitalism, and resource nationalism. In the political realm, populist, anti-globalization, anti-immigration, and in some cases outright racist and anti-Semitic parties are on the rise.

Globalization has done little but accelerate destruction of capital while funneling credit to a handful of tycoons. That there is a backlash isn’t surprising, neither is its form. The capital exhaustion that undermines economies in 2014 would not have arrived until 2050 had consumption been limited to Japan and the Americanized West. The development rabbit has long fled from of the hat: demand for cars, TVs, appliances, tract houses and luxury jobs is infinite, it exists everywhere there are televisions and credit money.

Popular nationalism does not provide an armature for a conservation economy, it offers instead strident demands for a ‘fair share’ of capital to consume and for ‘enemies’ to exploit. The nationalists in Greece, Egypt, Ukraine and elsewhere promise, “if the technocrats and moderate Old Guard cannot give us what we want, the Nazis will!” Countries are deprived of fuel because because the have exhausted their domestic supply; they are destitute and have nothing to offer in trade nor can they borrow. Ideology is not an economic good, it cannot be swapped for petroleum. Euro-Nazis stomping across television screens are irrelevant to the oil sheiks who want purchasing power. The Nazis have the same ability to marshal purchasing power as do pigeons who flutter in the parks of Rome, Athens or Lisbon.

A competent approach would target bankers and billionaires rather than migrants, it would include forensic audits of national debts, with the ‘odious’ variety cancelled outright. The state treasury of (any) South European country or countries would issue euros and put them into circulation, to end bank-driven money shortages and provide basic services such as sanitation and education, while making retirees whole. Fiat euros would be issued to retire those debts not judged to be odious. The countries would challenge the ECB or Brussels to do anything about it, as the alternative is continuation of current ruinous policies that fatten political cronies and banking criminals.

Borrowing would be much reduced as banks would rebel and refuse to lend to fiat-producing countries, but it would not matter. Coupled with stringent resource conservation, the South European nations would actually become more credit-worthy as debt-reduction would be certain and the need to take on more — to buy and waste fuel — would be reduced. If the Germans or others did not like ‘new euros’ appearing across the Continent they could buy them on the open market. Germans can exchange goods or finance paper for them … but not automobiles. Fiat euros courtesy of Greece, Spain, Ireland and/or the others would put the requirement on Germany to manage its own trade surplus related costs within Germany rather than distributing them to others who lack the means to bear them.

Roubini does not offer any suggestions to remedy the current situation … neither do other ‘Brand X’ economists. There are no useful suggestions in the conventional economists’ toolkit other than muddling through. The only real solution to the exhaustion of capital is to carefully husband what remains. Our current way of doing business including its blandishments, is obsolete and needs to be replaced. If nothing is done, replacement is taking place by itself; the time remaining to continue muddling is shrinking fast.