Remember all the liquidity we were supposed to have? Back in the ‘Good Old Days’ of 2010-2011? Banks … corporations … hedge funds … were gorged with central bank cash.

Fast forward to 2013, where has it all gone?

… To the Sea of Liquidity … it is on the Moon … close to the Sea of Tranquility … there is a Moon-base nearby … Let us all fly to the Sea of Liquidity, where we can drink ourselves into a stupor!

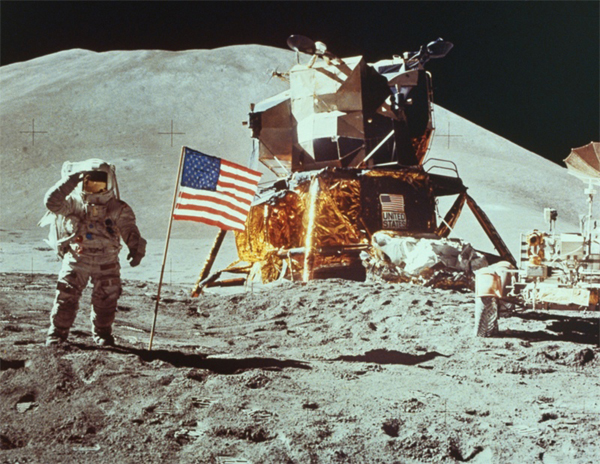

“No liquidity here, Boss”: ‘Astronaut John Young on the Moon, Apollo 16 Mission’, by Charles Duke Jr. (NASA). Like all Americans everywhere, the Moon-crew leaves its junk behind for others to clean up. When will this occur? When Mexicans fly to the Moon.

The Sea of Liquidity is on the minds of investors riverboat gamblers who are now wondering if the Establishment(s) have their backs after all.

The Wall Street Examiner by way of Wolf Richter):

The Big Four Central Banks Muddy The Same Sea Of Liquidity, And Then There’s ChinaShortly after I completed this post (sez Wolf), the BoE announced a 200 billion yuan ($32.6 billion) swap line with the PBoC, according to the Financial Times. This is the first time a G7 country has taken a step to provide funding for the PBoC, although Japan already has such a line, according to the FT. Might not the Fed be far behind? What a firestorm that would ignite. The headline, “Bernanke bails out China?” I can’t see it but it would certainly make things interesting if they did.

The world’s major central banks are now working at cross purposes, creating massive crosscurrents that are making life extremely difficult for investors. This isn’t likely to end soon. In fact, conditions should get worse.

There’s that word, ‘investors’ again …

The four big central banks in the world are the Fed, ECB (European Central Bank), BoJ (Bank of Japan), and PBoC (Peoples Bank of China). The BoE, (Bank of England) is far smaller but important from a policy signaling perspective and because of who its counterparties are. They include not only the three mammoth British (commercial) banks that are US primary dealers but all the other major players in world markets, who all have big operations in London.The Fed, ECB, BoJ, and BoE all deal with the same banks and the securities dealers’ affiliates of those banks. For example, of the Fed’s twenty-one Primary Dealers who are the Fed’s sole counterparties, only seven are US domiciled. Three are Canadian banks. Eight are European, including three British banks, and three are Japanese. All of these banks are also major players in Europe and Japan.

These banks are all playing in the same sea of liquidity. When one central bank pumps, that action may impact not only the central bank’s home market, but any or all of the world’s markets. When central banks buy securities, those purchases cash out the counterparty banks and dealers, who then use the cash and the leverage it creates to buy other securities and push asset prices higher. What they buy is up to them. They deploy the funds where their money gets the love. Over the past 7 months, until last week, that was mostly US equities.

Adler makes a common error of dumping all forms of funds into one pot … er, sea. There really is no sea. There is no liquidity, either. It was all a lie that we all bought into because acknowledging otherwise would have been the end of our precious waste-based economy. We can’t possibly have that!

He makes another common error of accusing the central banks of creating ‘cash’ or ‘printing money’. He also makes the writer’s error of using the word ‘cross’ twice in the same sentence. The teeth grind …

While the PBoC doesn’t play directly in the world liquidity sea, it has dammed a major tributary and has inserted massive reverse flow pumps into the pool. As a result, the players along that tributary have not only stopped the flow of liquidity into the world sea, but in order to replenish their own liquidity which has run dry, they are pulling cash out of world markets that they had previously pumped in. These institutions are largely insolvent. The reverse flows going back into China aren’t likely to turn back toward the rest of the world again anytime soon unless the PBoC relents and prints money.

Central bankers are accused of so many crimes people are always shocked when it emerges that the banks are ineffective and that bankers are buffoonish witch doctors. The accusation is that “central banks print money … ”

Where Is All The F*&king Printed Money?

Analysts everywhere are desperate to make this idea stick because the same analysts are desperate to pull the plug on any government policy that does not put nearly-free gasoline in the tanks of America’s bloated Lunar Rovers. Central banks printing free money is ‘BAD’! The misguided, central planning fools in the Wiemar Republic and Zimbabwe printed money which is what Bernanke and Company are doing right now! The bankers must be stopped and the banks eliminated before there is hyperinflation! Even without the hyper- part, the printing mad central banks have “devalued the dollar”, they are the enemies of ‘honest money’, holy money, the most sacred of all things.

Analysts ache for the gas-guzzling purchasing power of the early 1900s … when one dollar was real money … and a day’s wage. Imagine how much gasoline the typical American on Social Security Disability in 2013 could buy if the price for it was adjusted to the 1910 level by way of reclaimed dollar purchasing power?

Of course, this sort of repricing cannot occur. When gasoline prices decline to World War One- levels, the citizens’ earning- or cadging power will decline further. Ordinary citizens are always behind the 8-Ball, they are the fools in the market and there are too many of them. For citizens’ purchasing power to increase would require much more than a change in banking rules of the execution of a few hapless central bankers, it would require a suspension of common sense and the laws of physics. Any purchasing power increase requires the diminution of funds in the aggregate which in turn leads to the absolute absence of fuel, which requires an increase of funds in the aggregate. There can be more- or less funds but never both at the same time!

An illusion related to the ‘money printing’ concept is that one country’s central bank will bail out other countries’ commercial lenders. According to this theory, once the printing party begins there is no ending to it.

The liquidity crowd veers into silliness: central banks offer credit in their native currencies only. The Federal Reserve can make dollar loans — only.

Dollars can afterward be swapped in various currency/derivatives markets for other currencies, provided the other currencies are available and that the the entire collateralizing-lending-swapping process offers a return. The US cannot bail out other counties either with swaps or without because it cannot create foreign currencies. If the currency isn’t available there is nothing to swap, if the other countries can create enough ‘printed’ currencies there is paradoxically no need for a swap! One either prints or not prints, lends or not lends; if there is a need for swaps it is because the world’s economies are humming along and there are good loans to be made across national boundaries … that being the reason for swaps in the first place.

The US can lend any RMB it possesses but cannot create them any more than China can lend dollars into existence. Whatever dollars China would lend — or has lent to us in the past — have been gained by way of trade or stolen elsewhere. Ditto, yen, sterling, euros, etc. America — Wall Street — supplies China with dollar credit it then lends at interest back to the US government.

Chinese use dollars and other foreign exchange as collateral for RMB issuance, as they have been doing since their capitalist experiment began. They can then spend the dollars on petroleum and while keeping the new RMB to build new gigantic empty office- and apartment towers. This is the virtuous (fraudulent) aspect of mercantilism, the exporter can double his fortune by issuing his own currency (lending) against foreign exchange held as collateral. This is how foreign exchange is the means to increase credit. Once the currency is lent, the collateral can be spent.

There are limits: altering the rate of exchange over time is fraught with peril; the outcome is almost always high rates of inflation or stranded finance assets and deleveraging; one or the other. This is being seen in both Japan and China as exchange rates fluctuate in official and unofficial marketplaces. Furthermore, everything under this regime depends on a continuing inflow of overseas funds; that is, trade surpluses. Countries like China or Germany can leverage against their flow of dollars, countries like the US must leverage against businessman’s lies and capital destruction … the old fashioned way.

What has been creating whirlpools in the finance oceans has been decreased flows of foreign exchange into mercantile economies. The outcome of this in turn is less lending in local currencies leading to cash squeezes. Exporter countries are as dependent on foreign exchange as Greeks or Italians; when Yanks aren’t buying poison dog food and wealth-destroying automobiles the world’s exporters discover how broke they really are.

Carry Trade Unwind

A primary instrument of currency exchange is the carry trade, there are many, the dollar carry trade centers on the Eurodollar market. What is a Eurodollar? (Minyanville):

Bernanke’s Misfired Shot Heard ‘Round the WorldWhen considering both the global economy and the US economy, take into account Eurodollars

By Vince Young

When Chairman Bernanke took the podium on Wednesday to deliver the FOMC’s policy initiative, he probably didn’t think he would blow up the most liquid and most important market in the world, but that’s exactly what happened. I’m not talking about the Treasury market; I’m talking about the Eurodollar market. Eurodollars are USD 3-month LIBOR futures contracts and are used to price dollar-denominated credit across the global banking system.

On Wednesday, aggregate volume totaled 5 million contracts, equaling a notional value of $5 trillion. When prices settled, implied yields in the 2016 and 2017 strip rose by over 30bps. This was a massive move, with big money moving a giant market. The carnage continued on Thursday with volume trading 5.3 million contracts that saw another 13-15bps rise in the strip. On Friday, volume subsided a bit, trading only 3.5 million contracts with yields rising 10bps in the 2016 and 2017 strip. To close the week, the June 2017 Eurodollar contract’s implied LIBOR rose by an astounding 88bps to settle at an implied yield of 2.975%.

The initial reaction to the magnitude of the move in the front of the curve was that the market had misinterpreted Bernanke’s forecast for tightening. In an article floated late Friday, the Wall Street Journal’s Fed reporter Jon Hilsenrath wrote in Fed Toils In Vain to Calm Markets:

Many investors appear to have missed Mr. Bernanke’s signals that the Fed might wait longer than expected before raising short-term rates. He said on Wednesday that the 6.5% unemployment rate threshold might be too high and that the Fed might decide to keep rates low for long after the rate drops below that level, especially if inflation remains low.

According to projections released after the meeting, only four Fed officials saw short-term interest rates rising before 2015, while 15 saw rates remaining near zero until 2015 or 2016.

In theory, that should reassure investors that borrowing costs are going to stay relatively low for years.

Then why are Eurodollar futures markets pricing in a 3.0% LIBOR by June 2017?

Last week in The QE Carry Trade is Imploding Right Under Everyone’s Noses, my theory was predicated on two assumptions: one, that the tapering was a renege of the Fed’s open-ended inflation target after it got the market levered long the trade and two, that it was the bond market’s discount for the inflation premium embedded in real interest rates and not the flow of purchases that was responsible for market pricing. Both of these assumptions came to a head on April 10 when the Fed released the minutes from the March FOMC meeting’s QE III cost/benefit analysis signaling a reduction in stimulus was forthcoming.

The QE trade was predicated on permanent easing, that is, easing would continue until there are Iranians on the Moon … until unemployment declined to a ‘reasonable’ 6.5% (later 7%) unemployment rate. Prior rounds of easing were given fixed time periods: with little chance of full employment any time soon, the Fed was offering permanent easing. When Bernanke hinted an end to the easing it was the end of ‘permanent’ at the same time … and the end of the Eurodollar carry in its ‘permanent’ form.

An implication is deflation far into the foreseeable future with the Federal Reserve unable to effect it. Deflation indicates a demand for circulating currency instead of debt, this unmans the Fed which can only offer more debt. Increased demand for currency makes it worth more. This increase in turn unravels the carry trades that depend on ‘cheap’ currencies. There is less available funding, in this case in the form of Eurodollars.

Deflation is dangerous because the increase of currency worth renders outstanding debts more costly to repay. Deflation is the result of deleveraging, that is, the retirement of loans or default, over time the process feeds on itself. The danger here is that deleveraging occurs while the central banks are doing everything they can to prevent it; this is the Fed and the rest of the central buffoons ‘losing control’.

Monetary risk emerges from duration mismatches. Lenders ‘borrow short and lend long’: they obtain loans at usually very low cost in overnight- and other short-term lending markets. These funds are then re-lent for longer time periods. The danger is the unpredictability of risk over the longer term. By pressing yields downward the central banks misprice repayment risks; low yields are insufficient not compensate lenders for the increased hazards they take on. At the same time, increasing yields to more appropriate levels is a risk by itself: the higher interest cost strands borrowers. The stranding process sets off a desperate scramble for any funds available regardless of cost; short-term rates balloon as in China:

| Date | O/N | 1W | 2W | 1M | 3M | 6M | 9M | 1Y |

| 2013-06-28 | 4.9410 | 6.1630 | 6.3310 | 7.3500 | 5.4390 | 4.2412 | 4.2863 | 4.4148 |

| 2013-06-27 | 5.5610 | 6.6840 | 6.6680 | 8.3840 | 5.5390 | 4.2425 | 4.2898 | 4.4198 |

| 2013-06-26 | 5.5530 | 7.2010 | 7.1030 | 8.5450 | 5.5820 | 4.2444 | 4.2933 | 4.4215 |

| 2013-06-25 | 5.7360 | 7.6440 | 6.7730 | 8.4180 | 5.6410 | 4.2551 | 4.3025 | 4.4295 |

| 2013-06-24 | 6.4890 | 7.3110 | 7.0890 | 7.3550 | 5.7240 | 4.2450 | 4.2856 | 4.4210 |

| 2013-06-21 | 8.4920 | 8.5430 | 8.5660 | 9.6980 | 5.7900 | 4.2591 | 4.2844 | 4.4156 |

| 2013-06-20 | 13.4440 | 11.0040 | 7.5940 | 9.3990 | 5.8030 | 4.2425 | 4.2674 | 4.4005 |

| 2013-06-19 | 7.6600 | 8.0750 | 7.8390 | 7.6150 | 5.4080 | 4.1032 | 4.2611 | 4.4000 |

| 2013-06-18 | 5.5960 | 6.7030 | 5.7100 | 7.1780 | 5.3290 | 4.1026 | 4.2610 | 4.4000 |

| 2013-06-17 | 4.8130 | 6.8480 | 5.9440 | 7.2820 | 5.3190 | 4.1000 | 4.2600 | 4.4000 |

No liquidity here, boss! Data table from Shibor.org. Note the very high overnight rate as borrowers bid desperately for cash from a rapidly shrinking pool. More loans made = the need for even more loans with the passage of every day, the world’s finance establishment is propped up on a crumbling pyramid of short-term loans.

The central banks are in a corner, they cannot eliminate risk only shuffle it around. The temporary success of various easing programs have shifted risk to the degree that additional easing offers diminished- or negative returns. Risk-increase strips away returns from the monetary system, the absence of return unravels the central banks. The more the banks ease, the more diminished they become, if they fail to ease the system — dependent on cheap credit to get to the end of each day — falls apart.

The Fed cannot win: more easing increases risks on the long end of the yield curve, less easing increases risk on the short end. There is nowhere for the Fed to go; Bernanke slinks off the public stage as a failure by his own hand. Left behinds are shiny new credit bubbles in stocks, bonds and US real estate … along with diminished ability of speculators to repay.

Falling apart under everyone’s nose is the conceit that central bankers can effect anything outside the color of the drapes inside their offices. They cannot print anything much less the needed -$20/barrel crude oil needed in starship quantities to expand our institutionalized wastefulness to the point of ‘sustainable growth’. They cannot fix anything and they haven’t, this includes the price of money, which is set by tens of millions of drivers every single day at millions of gas stations around the world, where dollars, yen, euros and other currencies are exchanged on demand for a valuable physical good. The dynamic of capital destruction — the availability of fuel, the size and mileage of the auto fleet and the length of its daily average trip — this and nothing else determines the worth of currencies. Central bankers are irrelevant, their credibility is kaput along with that of the finance system they are supposed to manage.

Citizens confront government meanness and ineptitude, boundless tycoon- and corporate greed and heedlessness, willful ignorance on the part of the public, hyper-partisanship and cranky ideology that sanctifies free lunches … now, the central banks’ ongoing failure … Credibility = drowned in a sea of phantom liquidity.