Stumbling Blocks to Figuring Out the Real Oil Limits Story

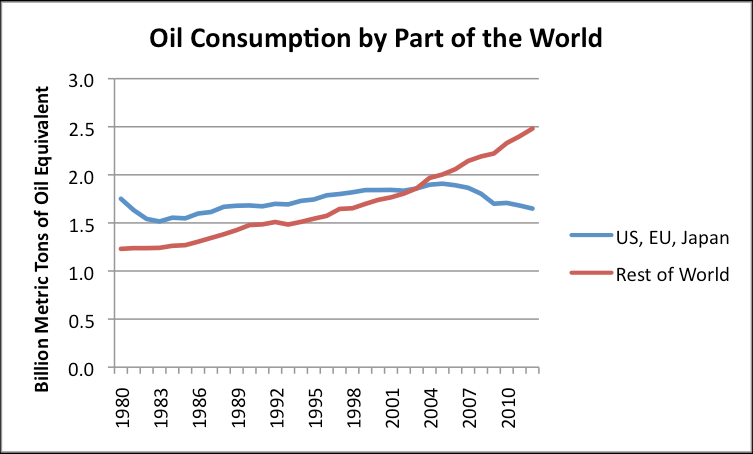

Chart; Gail Tverberg (click on for big)

Unfortunately, I cannot see that we have found a good oil substitute. Instead, quantitative easing is temporarily hiding financial problems of governments and individuals by forcing interest rates to be very low. This makes cars and homes more affordable, and keeps the amount of interest paid by the federal government very low. We know that these artificially low interest rates are temporary, though. Once they “go away,” tax rates will need to rise, and asset prices (stock prices, bond prices, and home prices) will drop. Oil prices may very well decline below the cost of production. (Gail Tverberg-Energy Collective)

New drilling technologies could give us so much oil, the climate won’t stand a chance

New oil drilling technologies could increase the world’s petroleum supplies six-fold in the coming years to 10.2 trillion barrels, says a report released today by market research firm Lux Research. (Quartz)

MORGAN HOUSEL: Peak oil is finally on scene

Rising production and falling demand is a dynamic few predicted even three years ago. But it’s today’s reality. And it can stop the end-of-the-world peak oil argument dead in its tracks. (Herald-Zeitung)

The Peak Oil Crisis: A Review of Richard Heinberg’s ‘Snake Oil’

This is an angry book, for it is intended as a rejoinder to the avalanche of half truths and optimistic estimates concerning the future of our energy resources which have filled our media in the last few years. (Tom Whipple- Falls Church News-Press)

A Production Chart and an IEA Prediction

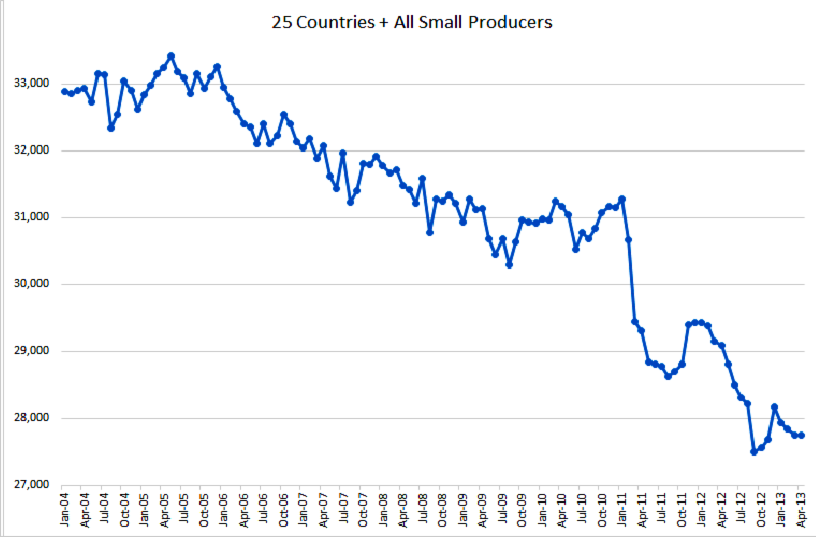

Chart by Ron Patterson, (Click on for big)

The combined production of all these countries peaked in May 2005 at 33,462,000 barrels per day and as of April 2013 their combined production was 27,754,000 bp/d for a decline of 5,708,000 barrels per day. (Peak Oil Barrel)

… a significant proportion of the hoopla over fracking is being orchestrated by those wonderful folks on Wall Street who brought you last decade’s housing bubble and bust, and the same kind of financial shenanigans that nearly capsized the global economy in 2008 and 2009 are being applied with gusto to a burgeoning bubble in shale leases and the like. (John Michael Greer)

Why Sand Is The Latest Front In The War On Fracking (Yes, Sand)

The anti-fracking crowd hasn’t been successful enough manufacturing unfounded fears about groundwater pollution to cause any meaningful slowdown in shale drilling and fracking. So they’ve found a new target for their antagonism — sand dust.(Forbes)

Fracking has boomed in America partly because local people have been paid off handsomely. (Economist)

Boomtown USA: 10 Photos from the Oilfields of North Dakota’s Bakken Shale

Earlier this year a NASA photo from space revealed that flaring in the Bakken has rural North Dakota lit up at night as bright as the continent’s biggest cities. Looking across the prairie at night is truly astounding as lights are everywhere — and the air quality is dismal to say the least. (Alternet)

Fracking Health Project Puts Numbers to Debate

“There’s a strong case that people in the U.S. are already leading longer lives as a consequence of the fracking revolution,” said Michael Greenstone, a professor of environmental economics at the Massachusetts Institute of Technology. That’s because many power plants have stopped burning coal and switched to natural gas, which emits far less fine soot, nitrous oxide and sulfur dioxide. (ABC News)

New tech to trace fracking fluid could mean more accountability

This fall, a company founded by scientists from Rice University in Houston will conduct a field test of a tracer made with what chemistry and materials science professor Andrew Barron believes is the key ingredient to success: nano rust. Barron and other researchers hope this tracer will settle once and for all whether oil and gas companies are damaging drinking water, and, in the event of contamination, allow communities to determine who – or what – is at fault. (High Country News)

U.S. says Syria offer to show chemical attack sites ‘too late’

Andrew Tabler, a Syria expert at the Washington Institute for Near East Policy, said Obama would have to make a strong case to Americans for any intervention. (Reuters)

U.S. readies cruise missiles, Syria allows inspections

An Iranian military official warned the United States on Sunday against crossing Syria’s own “red line.”

Massoud Jazayeri, a deputy chief of staff of Iran’s armed forces, said it would have “severe consequences,” according to the semiofficial Fars news agency. (WTKI)

CIA commandos, US special forces entered Syria

According to Le Figaro, the first group of these specially trained militant fighters, commanded by American special forces, crossed the border into Syria on August 17 along with a number of CIA operatives. A second group joined them two days later, the report said. (PressTV)

U.S. Weighs Plans to Punish Assad

Officers at the Pentagon on Thursday were updating target lists for possible airstrikes on a range of Syrian government and military installations, officials said, as part of contingency planning should President Barack Obama decide to act after what experts said may be the worst chemical-weapons massacre in more than two decades. (WSJ)

Brzezinski: Saudi Arabia, Qatar, their western allies orchestrated Syria crisis

“I’m afraid that we’re headed toward an ineffective American intervention, which is even worse. There are circumstances in which intervention is not the best but also not the worst of all outcomes. (Beyond the Mainstream)

Leaked Report Spotlights Big Climate Change Assessment

The New York Times reported on what it called the report’s “near certainty” that humans are responsible for the rising temperatures of recent decades and its warning that sea levels could rise by more than three feet by the end of the century. (National Geographic)

Bloomberg: Why Sandy forced cities to take lead on climate change

Around the world, city leaders are not wasting time debating the science of climate change or waiting around for international treaties to be signed; we are taking action. There’s simply too much to do and too much at stake. (Michael Bloomberg-CNN)

What’s Making the Floods Worse in Manila?

Manila is located in a catch basin sandwiched between Manila Bay and Lake Laguna to the southeast. The city was built on waterways, canals and creeks that have for centuries channeled floodwaters into the sea.

But half the 40 kilometers (25 miles) of narrow waterways and canals that would drain rainwater — constructed and modified during the Spanish colonial period — have been lost, cemented or paved over, said architect and urban planner Paulo Alcazaren. Many of the remaining ones are clogged with garbage and ill-maintained, teeming with squatter colonies occupying riverbanks and coastal areas. (ABC)

The Fifth — and hopefully final — Assessment Report (AR5) from the UN Intergovernmental Panel On Climate Change (IPCC) is due next month. The leaks are already here … (Joe Romm-Think Progress)

Reuters Slashes Climate Coverage, Pressures Reporters To Include False Balance

” … since Ingrassia was hired, they’ve felt pressure from management to add “balance” to climate change stories by including the views of global-warming skeptics.” (Joe Romm-Think Progress-Columbia Journalism Reviw)

Leaked draft of climate report struggles with drop in warming

An unreleased draft of the U.N.’s next major climate report reportedly states that scientists are more certain than ever that man’s actions are warming the planet — even as the report struggles to explain a slow-down in warming that climate skeptics have seized upon. (Fox)

Wildfire Threatens San Francisco’s Power Supply

San Francisco … gets 85 percent of its water from the Yosemite-area Hetch Hetchy Reservoir that is about 4 miles from the fire, though that had yet to be affected. But it was forced to shut down two of its three hydroelectric power stations in the area. (NY Times)

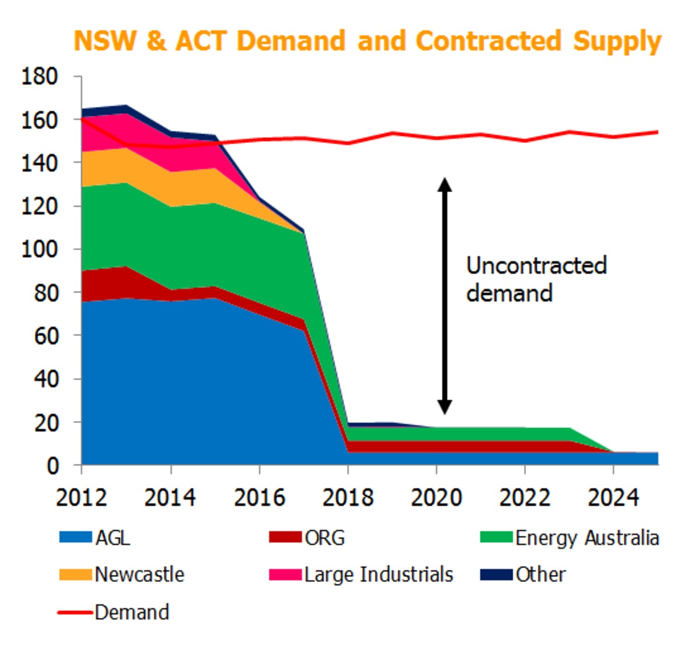

Coal seam gas and New South Wales’ looming energy crisis

The problem for NSW is this low-cost gas supply is disappearing. Queensland’s preference for selling gas to its export market, difficulty in processing and transporting Victorian gas, and the increased cost of extracting unconventional resources such as coal seam gas all threaten NSW’s supply. (Mining Australia)

Thousands sign anti-CSG petition

Stop Coal Seam Gas Illawarra have walked into the NSW parliament and handed over a 13,000 strong petition calling for a statewide ban on all CSG drilling in water catchment areas. (Mining Australia)

Alberta pipeline safety review criticized for lack of scope

A long-awaited review on pipeline safety commissioned by the Alberta government has taken an overall positive view of the province’s regulations.

However, the study released Friday was quickly dismissed by critics who said it lacked substance because it neither examined the effectiveness of enforcement nor drew lessons from specific spills in recent years. (CBC)

Pipelines a hard sell in Quebec’s post-Lac Mégantic world

“Alberta is desperate to get the oil out and so is Saskatchewan,” said Chris Damas, a Barrie, Ont.-based independent analyst who focuses on energy, chemicals and transportation stocks. “And I really am worried that they’re going to shove through something because they’re desperate. The Quebecois people are very, very sensitive now to oil going through their backyard.” (National Post)

Lac-Megantic disaster sole focus of federal rail meeting Thursday

Representatives of federal agencies and the railroad industry will gather in Washington next week to discuss rail safety in the aftermath of the Montreal, Maine & Atlantic train derailment that killed dozens last month in Quebec. (Kennebec Journal)

Shock at railway’s use of 1-person crews after Lac-Mégantic disaster

The company has blamed the train’s operator for failing to set enough hand brakes. (CBC)

With Proposed Rail Expansion, Northwest Confronts Its Clean Image

Last September, the first trains of crude oil from the Bakken fields in North Dakota began chugging through. Since then, energy companies have drafted proposals for new storage, handling and shipment capability almost equivalent to the controversial Keystone XL pipeline, which is facing a deeply uncertain path of federal regulatory approval. (NY Times)

CP and UP forge Canada-to-California CBR corridor

For the past year, BNSF Railway has dominated in the shipment of crude by rail (CBR) from North America’s Bakken shale formation westward to refineries and ship terminals along America’s Pacific Coast. Now, Canadian Pacific and Union Pacific are teaming up to move crude oil from Canada south into California. (Railway Age)

Teekay Predicts Depressed Tanker Market Throughout Rest of 2013

(TK-gCaptain)

Technip Wins Ultra-Deepwater Installation Contract at Stones

On May 8th, Shell announced their plans to develop the Stones field located approximately 200 miles south of New Orleans in Walker Ridge. This 100%-owned field is the world’s deepest at approximately 2,900 meters (9,500 feet).

A critical element of any deepwater field is not just the drilling and completion of the wells, but also the installation of the complex subsea architecture that connects the wells to the production flowlines. (gCaptain)

4 Year Old Girl’s Vegetable Garden Must Go, Says USDA

The property management company claims that gardening goes against the rules set by the USDA’s Rural Development Agency which forbids residents to have structures of any kind within landscaped areas. (Healthy Home Economist)

Nowhere to Run, Nowhere to Hide

All of a sudden here is the interest rate of 10-year Treasury paper rising like an angry carbuncle on Ben’s pale tuchus just when he thought he could sit back and watch the mud wrestling contest between Larry Summers and Janet Yellen. (JH Kunstler)

Brazil, Indonesia launch measures to shore up their currencies.

The central bank of Latin America’s largest economy said late on Thursday that it would launch a currency intervention programme worth about $60bn to ensure liquidity and reduce volatility in the nation’s foreign exchange market.

Then on Friday, Indonesia’s chief economic minister Hatta Rajasa told reporters that the government would increase import taxes on luxury cars, introduce tax incentives for companies investing in agriculture and metals industries and aim to reduce oil imports. (FT)

Britain to be roped into EU rescue aid for Greece

Use of EU budget funds appears not to be targeted against the British government but would have the effect of drawing Britain into the morass, compelled to spend scarce resources perpetuating an EMU policy that many view as deeply misguided. (Ambrose Evans-Pritchard)

Summers, Yellen allies wage behind-the-scenes effort to win Federal Reserve nod

The fight pits allies of Summers, who also was Obama’s top economic adviser during the darkest days of the recession, against those of rival candidate Janet Yellen, the Fed vice chairman who has been an architect of the bank’s effort to reduce unemployment rates. (WaPo)

This is a job that no sensible person would want …

Tank Has Leaked Tons of Contaminated Water at Japan Nuclear Site

Workers raced to place sandbags around the leaking tank to stem the spread of the water, contaminated by levels of radioactive cesium and strontium many hundreds of times as high as legal safety limits, according to the operator, Tokyo Electric Power … (NY Times)

THE SATURDAY ESSAY: Fukushima disaster’s owners Tepco admit three leaking tanks were second hand

The more Fukushima unravels, the more it resembles the famous 1970s disaster film, The Towering Inferno: poor design, contractors cutting corners, and then deliberately watered-down warnings leading to loss of life on an unnecessary scale. Except that on this occasion, it isn’t 200 people trapped on the 102nd floor, it’s the entire ecosystem of Planet Earth at risk. (John Ward)

A Warning Regarding Broken Speculative Peaks

My concerns are more extended, and are specifically related to the likelihood that the present market cycle will complete in a way – as market cycles have historically – that wipes out more than half of the gains of the preceding bull market advance. My impression is that the losses even in a not-so-terrible completion of the present cycle may come closer to three-quarters of those gains. (John Hussman)

Emerging markets are most affected by the adjustment. They experience triple whammies in currency declines, interest rates rising and credit spreads expanding. Some emerging markets were shaken hard in the first round. The risk of one or more tumbling over is still significant. Brazil and India are the risk spots among major economies. (Andy Xie-Caixin)

All the Makings for a Major Top

A strong case can be made that recent years have seen the greatest episode of global securities mispricing in history. Global yields collapsed throughout, although nowhere has this mispricing been more pronounced than with EM bond markets. (Doug Nolan)

Environmentalists sue Missouri over renewable energy

In 2011, the Legislature blocked part of an administrative rule that would have required the electricity from renewable energy sources to be produced or sold in Missouri. (Kansas City Star)

Renewable energy lifts hopes of a safe return

With yields on index-linked government bonds at desultory levels, investors could be forgiven for craving an asset that could offer similar long-term, inflation-linked sustainable returns, but perhaps with a little more juice. Some believe they have found it in the shape of renewable energy installations, such as solar power, wind farms and biomass plants. (FT)

Powder River Basin Coal Lease Auction Receives No Bids For First Time In Wyoming History

Economic analysis that accounted for market conditions and political and regulatory uncertainty showed that not all of the coal was economically recoverable, Cloud Peak President and CEO Colin Marshall said in a release. (Huffington)

Algae Creeps Slowly Towards Viability

For the Obama administration, 2022 is the Year of Algae—the year it hopes to see commercial viability. We’re not entirely convinced of the timeframe, but we’re giving algae the benefit of the doubt—for now, especially since it has plenty of commercial applications beyond fuel. (Oil Price dot com)

The country can afford algae … but it cannot afford coal?

Iran Willing to Begin an Oil Price War to Win Back Old Customers

Zanganeh told the Fars News agency that, “revival of Iran’s lost oil markets is among my top priorities. We only ask those who have replaced us in the world’s oil markets to know that when we are re-entering these markets they will have to accept that the oil prices decline or they should reduce their production to create enough space for Iran’s oil.” (Oil Price dot com)

PDF article considers the total energy use of IT infrastructure including data centers. (Digital Power Group)

Big Data and the Doomsday Machine

“Algorithms will predict the likelihood that one will get a heart attack (and pay more for health insurance), default on a mortgage (and be denied a loan), or commit a crime (and perhaps get arrested in advance). It leads to an ethical consideration of the role of free will versus the dictatorship of data. Should individual volition trump big data, even if statistics argue otherwise? Just as the printing press prepared the ground for laws guaranteeing free speech—which didn’t exist earlier because there was so little written expression to protect—the age of big data will require new rules to safeguard the sanctity of the individual.”(Financial Sense)

SWAT team called in to evict squatters from Oakland property

Thursday, Bank of America said it sold the property to a third party in March. Five months later, squatters were still holed up in the building. (KTVU)

Our Decreasing Tolerance To Risk

We have allowed the police to turn themselves into a paramilitary organization. They deploy SWAT teams multiple times a day, almost always in nondangerous situations. They tase people at minimal provocation, often when it’s not warranted. Unprovoked shootings are on the rise. One result of these measures is that honest mistakes — a wrong address on a warrant, a misunderstanding — result in the terrorizing of innocent people, and more death in what were once nonviolent confrontations with police. (Forbes)

Overmilitarization: Why Law Enforcement Needs to Scale Down Its Use of Military Hardware and Tactics

Police departments have even started sending in SWAT teams to enforce regulatory laws. From August through October of 2010, heavily armed deputies raided several barbershops in the Orlando area, holding barbers and customers at gun point and handcuffing some of them. They made more than 37 arrests. The basis for the arrests was barbering without a license. (Heritage)

The 11 Most Bizarre SWAT Team Raids

In Indiana, a SWAT team raided an 18-year-old girl’s house smashing her windows and throwing flashbangs inside, despite the fact that the girl had her front door open and was just watching TV. (Alternet)

Ernest Callenbach, Last Words to an America in Decline

“We have even evolved, spottily, a global understanding that democracy is better than tyranny, that love and tolerance are better than hate, that hope is better than rage and despair, that we are prone, especially in catastrophes, to be astonishingly helpful and cooperative.” (Ernest Callenbach-Tom Engelhardt)

Moyers: America’s Gilded Capital and Losing Democracy to the Predator Class

“The political class has reached some kind of critical mass in the 21st century. There is something going on in Washington that needed to be called out. I do not think it can be sustained, and I think it is indecent. It is not how Americans want their government and their capital city to be.” (Video- Jesse’s Café Américain)

Up Against Hard Limits: Food and Finance

“I recently spoke with a longtime friend and former colleague in international aid and development work from “back in the day” with 30 years of experience in the field, and he notes from his work that global food production per capita has peaked (not coincidentally with crude oil extraction per capita), and growth of consumption against supplies could result in acute shortage conditions in the marginal areas as soon as this year or next, with China and parts of Southeast Asia experiencing intractable shortages as soon as 2015-2018. He estimates the risk of “permanent drought and famine” in parts of Africa now at well over 50%.” (Charles Hugh Smith)