Figure 1: The Triangle of Doom, closing in on countries near you! The frenzy over a possible US-led attack on Syria resulting in a wider war has pushed Brent bidding to $119 per barrel the same way the possibility of a US- Israeli attack on Iran drove prices to $128 in 2011. A price much over $120 per barrel for more than the shortest time would cause a gigantic economic hiccup the same way $147 per barrel undid the world in 2008.

For this reason, there is diminishing likelihood of a US or NATO attack on Syria, only saber-rattling to keep the crude price from plunging below cost of production. The consuming world cannot afford to attack Syria, it cannot afford the risk of a wider war, it cannot afford for the Saudis and Iranians to launch missiles at each others’ tankers, pipelines, fuel terminals and desalinization plants.

Since 2008, the highest tolerable price has declined steadily as the world credit system of interlocking banks and debt-money unravels leaving less credit available for customers to bid for- and buy crude.

During the same period, short-term loans have been made in the US in dollars, this credit has been shipped overseas to become collateral for loans in local currency at a higher rate. The US loans tend to be of very short term: funds obtained from the money markets, commercial paper and repo. These loans require constant roll-over, that is new loans obtained to retire amounts due on maturing loans. When roll-overs cannot be had or are expensive, the flow of dollars overseas shrinks rapidly. Americans not purchasing overseas’ goods also reduces the flows of dollars; the effect is the need for overseas’ countries to stump up more dollars to maintain their exchange rates — a dollar margin call. No amount of foreign currency will satisfy the demand for dollars: in our ironic universe, the fewer the dollars, the greater the demand for them, (Ambrose Evans-Pritchard):

India pushes ‘shock and awe’ currency plan to save BRICS

“It is going to happen in a matter of days rather than weeks, Brazil and India can start the move,” said Dipak Dasgupta, a top Indian official.Mr Dasgputa told Reuters that China, Brazil, India, Turkey, Russia and South Africa have all been squeezed as the US Federal Reserve prepares to tighten monetary policy. Joint action would give emerging markets greater firepower, allowing them to deploy their combined $8.7 trillion (£5.6 trillion) of reserves and crush “speculators”, rather than being picked off one by one.

However, it is unclear whether such action would serve any useful purpose if the real problem is exhaustion of catch-up growth models in these countries, and boom-bust credit cycles. “This could backfire,” said Ian Stannard, of Morgan Stanley. “If they did this, they would have to sell US and European bonds and that would push up yields. It was rising yields that started this process in the first place.”

The side-effect of such intervention would be monetary tightening, pushing countries into deeper trouble. India’s growth fell to 4.4pc in the second quarter, the lowest since the post-Lehman crisis in 2009. This is eroding tax revenues and pushing the budget deficit back over 5pc of GDP, with a ratings downgrade looming.

“We are no doubt faced with important challenges,” said Indian premier Manmohan Singh. The rupee is in freefall, crashing 25pc over the past four months to a record low of 68.84 against the dollar.

Zero percent interest rate policies (ZIRP) by the Federal Reserve and others, the non-stop moral hazard and carry trades … all of these are of a piece with the strategy followed in Europe after the euro appeared in 2000. Rates were set to favor Germany which resulted in the Mediterranean PIIGS countries being flooded with cheap euro-denominated credit. The outcome is everywhere identical: ‘leveraging up’, asset price inflation, speculation and pyramid schemes that are all dependent upon perpetual ‘hot money’ flows.

This speculative impulse adds to petroleum demand while supply remains more-or-less unchanged … as it has since 2005. Over time, ‘development’ becomes toxic as the new demand balloons: cars are easier and cheaper to deploy than new oil fields. The car increase is considered to be ‘positive’ but what expands are the costs which emerge as interest rate increases. Hot money flows are reduced or reversed, the outcome is inevitable deleveraging and asset price deflation. In Europe, Irish and Spanish real estate were deflated along with state debt instruments. In the developing ‘tigers’ the vulnerable assets are the local currencies.

Fuel is a speculative asset, it can be bid by cheap credit. unlike stock- or real estate prices, the high fuel price has a real-world consequence; it forces a user-choice between speculation and gas for the precious cars. Something has to give and that is the carry. When the carry fails, so does support for inflated asset prices as well as fuel: Brazil, India and Indonesia are the ‘new’ Spain, Greece and Portugal.

What is underway is ‘energy conservation by other means’. There is to be no ‘recovery’ from the economic rout that is underway; the outcome of the process is to permanently exclude users in these countries from the fuel marketplace. Consumption is exportable: fuel not burned up for nothing in Delhi or Madrid can be burned up for nothing in Northern Virginia: underway is America’s car dealers versus the rest of the world.

Purchasing power is eroded by diminished worth of money. Elsewhere, money might be good but the banks are worthless, or the government or the central bank insolvent. The worst case scenario is that everything fails at once: both money and institutions are discredited leaving the citizens to their own devices or no devices at all.

Modern ‘money’ has been the proxy for various fashionable forms of capital/resource waste. Once the true nature of the forms are revealed as non-productive, the money is exposed at the same time … or it becomes the proxy for the resource that is wasted. In the first instance there is (hyper)inflation as the holders seek to rid themselves of their money before it becomes worthless … while there are still suckers gullible enough to accept it. Alternatively, money becomes impossible to find as it is hoarded as the last, best chance for fuel … or food.

In countries like India, there is inflation in rupees and deflation in dollars; in Brazil there is inflation in reals, deflation in dollars; in Indonesia, there is inflation in rupiah, deflation in dollars. Despite all the talk of US ‘money printing’ there really hasn’t been any. Dollar credit is not the same as dollar currency. It is the disappearance of dollars in countries such as India that is at the heart of the currency mess, not dollar persistence.

Unknown photographer, entrepreneurial hotbed in Mumbai, India (Lebbeus Woods);

Indians are confronted with the choice, to live in houses in useful cities or for some to drive cars and the rest live in rotting slums. So far the choice is to drive …

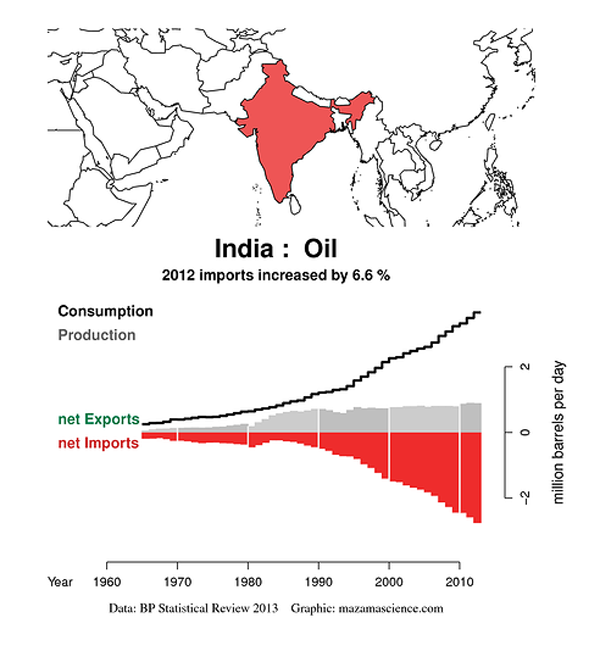

Figure 2: India crude consumption against production, (Mazama Science); galloping fuel consumption outstrips production, the shortfall must be financed somehow. Because so-called ‘growth’ does not provide a return, that leaves … what, exactly?

Look for Indian energy consumption to flop along with the rupee.