Ugly noises are starting to come out of China with questions being asked about the quality of Chinese loans and the accounting behind them. People have also been looking at all the empty buildings in China and wondering. Investors have been willing to give the Chinese the benefit of the doubt for various reasons but relentless increase in Chinese inflation and the obvious over- building are motivating a reassessment of risk. The Chinese government has not outlawed the business cycle.

The Chinese having an “Uh oh …” moment.

The ‘China Narrative’ has been all about Chinese Exceptionalism and decoupling. Whatever happens any- and everywhere else in the world, nothing will change China’s growth story, simply because China’s ‘different’. A lot of investors have bought into this ‘different’ story and are sticking with it.

This may not be the best move. It’s starting to look like a lot of China’s lending might be as bad as Greece’s and for the same reasons. It may be that China is simply the world’s largest Ponzi scheme.

Government Platforms Taint ‘Safe’ Bond MarketZhang Yuzhe and Tian Lin (Caixin)

By shifting assets and borrowing from banks, local government financing platforms are scaring a lot of bond holders

Default fears are unnerving investors with stakes in bonds issued by local government financing platforms across China.

Institutional holders of so-called urban investment bonds, once billed as the safest way to back the platforms behind all sorts of government building projects, are currently on edge as first-round payback deadlines rapidly approach.

“There are signs of contract breaches for urban investment bonds,” said a debt market source. “While this hasn’t triggered a sell-off, the willingness to purchase new urban investment debt has fallen.

“Everyone is watching to see whether the situation will deteriorate further,” the source said.

Fears of potential bond losses parallel broader concerns about possible defaults for trillions of yuan in loans issued mainly by banks to government platforms since the 2008 financial crisis. The central bank has estimated that, as of late 2010, platforms collectively owed approximately 10 trillion yuan.

The source said investor holdings of urban investment bonds, which are hard to track due to the market’s loose standards and a lack of accurate data, now total “at most a few hundred billion” yuan. It’s a modest level limited by banking regulations that limit bonds issued by any one platform to a value equal to 30 percent of its net assets

Here’s more platformism, this also from Caixin:

Dieting Plan for Bloated Government BorrowersAfter borrowing trillions for all sorts of projects, the credit feast may be over for local government financing platforms

They come in all shapes and sizes, dishing up financial sustenance for county governments, property developments and infrastructure projects across the country.

More than 10,000 of these so-called local government financing platforms were operating nationwide as of December, according to a June 1 report by the central bank, up from less than 7,500 just two years earlier.

But because these platforms have gobbled down so much borrowed money from the nation’s banks – racking up as much as 14 trillion yuan in outstanding debt as of December – the central government appears ready to curb their appetite.

Questions about whether local financing platforms can adequately repay all this debt are figuring into the latest assessments of China’s economic health, and prompting calls from some corners for a diet.

To that end, banking sources told Caixin that a central government survey of the debt expected at the end of June is likely to coincide with an end to loan recycling by platforms, through which old loans are sometimes paid off with fresh borrowing. Policymakers are also likely to tell banks they can no longer transfer platform assets and collateral among themselves.

This was the big news a couple of weeks ago that nobody paid attention to because people were watching the end of QE or Greed Greece or some other nonsense. The Chinese government was going (to try again) to eliminate platform roll-overs. If this is something the Chinese authorities actually do, more than a few Chinese investment interests will default. China’s construction relies on the roll-overs, without them projects will grind to a halt due to lack of liquidity. How many projects? Maybe all of them. This is a big perception problem within China, nobody really knows.

Commodity prices tumbled more than five percent the same day and not because greed had been outlawed.

‘Hot money’ flowing into China by way of the ZIRP- driven dollar carry trade along with sales of Chinese goods in the US and elsewhere has dollars and euros burning holes in companies’ pockets. These same companies need yuan: manufacturers need liquidity to keep the doors open and toxic products flowing onto container ships to your local Wal-Mart. Some dollars are obediently swapped to the Chinese central bank for shiny new yuan. The rest flows into China’s pulsing underground or ‘loan shark’ economy which can offer a higher yuan rate for these dollars. Since the underground economy cannot print yuan and must borrow them from banks, the borrowing pressure on the banking side is intense.

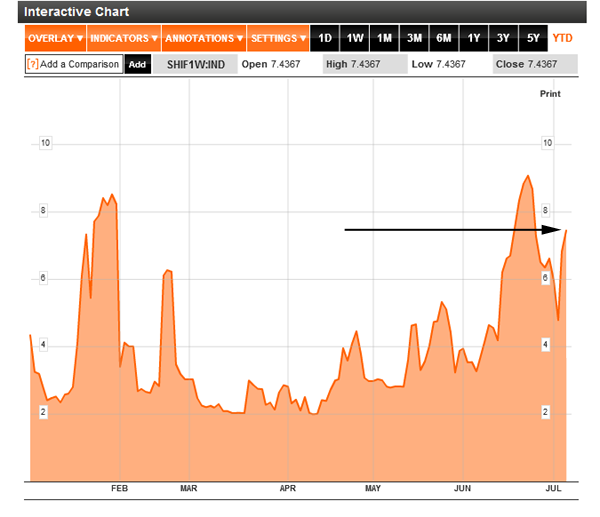

The Shibor is the Shanghai Interbank Overnight Rate, the 7% represents demand for weekly, short- term money in the banking side of the Chinese economy. Add the Shibor to the 6% inflation and the discount offered for dollars is 13% or one more yuan per dollar than the BPOC offers. If the inflation ‘on the street’ is higher, the yuan discount is also higher.

How can the yuan brokers profit by this scheme?

Only by offering dollars for the purchase of commodities to propel continuing price appreciation — and inflation — while supporting a liquid yuan lending platform at the same time. The liquidity provision gives Chinese shadow banking a reason to exist beyond the reach of regulation, just like identical liquidity provision gave dollar shadow banking freedom from scrutiny during the mortgage lending bubble.

Given enough scale, loan shark lending feeds on itself: there is pressure inside the loan shark- shadow banking structure to make loans that promise high returns no matter how shaky. Besides manufacturers, real estate developers, construction companies and ‘investors’ are there to borrow. Once a handful of gamblers made money on concrete towers in Beijing and Shanghai, concrete towers began erupting all over the country. China obviously needs more concrete towers because if some towers are good, more towers are better! This is the ‘herd effect’ which has all speculators becoming mindless, robotic trend followers, incapable of thinking for themselves.

Those who think for themselves don’t build any towers, they don’t make any money, either. Does all this sound familiar? It should, it’s what happened in the US beginning in 2003.

Platforms, businesses and banks swap loans on the same kind of collateral back and forth to each other just like speculators did during the US and EU credit bubbles. The process self- inflates collateral value. The hot- potato lending cycle takes place with participants looking for the the ‘fool in the market’ — the now legendary Chinese saver — to accept the debt burdens once the vacant concrete towers/malls/Mongolian cities are finished.

The realization is dawning on speculators that the debt accumulated during the ‘hot potato’ phase is now too great for any real humans to retire. This is an ugly noise indeed. The Chinese establishment can shuffle this debt onto the central bank balance sheet by issuing even more yuan than it is doing currently — but enough to make a difference would be default. Since China is well down the ‘yuan issue’ highway it is likely there will be hundreds of trillions more yuan printed by the central bank — and an equal amount of sovereign debt issued — to ‘shift’ much of this debt as possible.

Loan shark liquidity and the dollars-into commodities trade are reasons why the central bank’s anti- inflation efforts have failed so far. The efforts have been too puny and not directly targeted toward the sharks. Shifting bad loans onto the Peoples Bank balance sheet has been self- defeating because it created room for even more loans! Perhaps this is why the establishment’s aim is now directed toward the platforms. The problem now is the efforts are contradictory. The movement against platforms represents dangerously real monetary tightening while the ‘fake inflation fighting’ charade provides a distraction behind which more central bank money printing takes place.

Right now it doesn’t seem like China knows what it wants to do. It’s as if China doesn’t want to hurt anyone’s feelings — or risk a deflationary recession. This creeping ‘Nice Guy-ism’ is unsettling because the singular characteristic of the Chinese establishment to date has been its total ruthlessness.

Analysts suggesting that Chinese lending is manageable do not have a good explanation for the increasing Shibor minus a credit/liquidity crisis or a bubble inflating somewhere accompanying a steep increase in credit demand. With the arguably massive currency float inside China (yuan-plus-foreign exchange reserves) the accompanying bubble has to be equally massive … and it is:

Building Boom in China Stirs Fears of Debt OverloadDavid Barboza (New York Times)

In the seven years it will take New York City to build a two-mile leg of its long-awaited Second Avenue subway line, this city of nine million people in central China plans to complete an entirely new subway system, with nearly 140 miles of track.

And the Wuhan Metro is only one piece of a $120 billion municipal master plan that includes two new airport terminals, a new financial district, a cultural district and a riverfront promenade with an office tower half again as high as the Empire State Building.

The construction frenzy cloaks Wuhan, China’s ninth-largest city, in a continual dust cloud, despite fleets of water trucks constantly spraying the streets. No wonder the local Communist party secretary, recently promoted from mayor, is known as “Mr. Digging Around the City.”

The plans for Wuhan, a provincial capital about 425 miles west of Shanghai, might seem extravagant. But they are not unusual. Dozens of other Chinese cities are racing to complete infrastructure projects just as expensive and ambitious, or more so, as they play their roles in this nation’s celebrated economic miracle.

In the last few years, cities’ efforts have helped government infrastructure and real estate spending surpass foreign trade as the biggest contributor to China’s growth. Subways and skyscrapers, in other words, are replacing exports of furniture and iPhones as the symbols of this nation’s prowess.

But there are growing signs that China’s long-running economic boom could be undermined by these building binges, which are financed through heavy borrowing by local governments and clever accounting that masks the true size of the debt.

The clever accounting is the Enron- style asset shifting that is identical to what Moody’s Investors’ Service called a default when applied to Greek debt. Here’s more from Caixin:

Asset SwapBond investors smelled trouble when news spread that some local governments were getting around mandatory borrowing limits by creating new financing platforms with core assets transferred from existing platforms.

These maneuvers lowered asset values for existing, bond-backed platforms without investor input. Bond holders were left with fewer options for recouping losses in the event of default.

The local governments, however, were able to rack up more credit to finance pet projects.

In Shanghai, for example, the platform Shanghai Shenhong Investment Development Co. restructured a loan in late June and sent bond owners scrambling to weigh their risks. They were especially shocked that the move occurred in Shanghai, which is said to have China’s best local government financial administration.

A source at a Shanghai urban investment company responsible for bank financing told Caixin that several local platforms recently failed to make loan payments on time, and then requested payback extensions or transferred debt to long-term, fixed-asset loans.

Some banks stung by the Shanghai maneuvering have asked the China Banking Regulatory Commission (CBRC) for assistance.

“The way to mitigate the problem is to ‘move out,’ (that is) to sign a three-party agreement with the government and CBRC that transforms special platform loans into general corporate loans” with more lenient terms, said a bank source.

Sources quoted by the Hong Kong Economic Journal on June 29 said a platform involved in real estate and road construction under the Shanghai government fell behind on repaying working capital loans that month. It also tried to avoid default by asking banks for loan extensions or restructuring.

Chinese lending back and forth to each other on imaginary collateral with ‘hot money’ capital that is amplified by an opaque lending mechanism that feeds upon itself. What is there not to like?

Nobody in ‘Analysis Land’ mentions energy which is at the center of the ‘China Growth’ narrative. Everything the Chinese build enables energy waste whether it is concrete towers, freeways, dams or high speed rail. In this (wasted) effort, the Chinese emulate the Americans who have ‘set the example’ of creating consumption vehicles of every sort and labeling them ‘production’.

As the world’s resources become less available at profitable rates of use this excess infrastructure becomes stranded. Like many similar ‘improvements’ in Japan, Spain, Ireland, the United States and elsewhere, much of what the Chinese are building today will simply be abandoned: too expensive to use, to expensive to return debt service, too expensive to tear down.

What China is doing is is bankrupting itself with concrete towers as fast as it can.

Subways and skyscrapers, in other words, are replacing exports of furniture and iPhones as the symbols of this nation’s prowess.

What the Chinese are doing is building symbols, fetish objects of ‘economic growth’ which is a nice story in 1911 but as useful in 2011 as an Archie comic book. That China’s toys cannot earn for themselves is indicated by two things; China’s energy consumption per unit of GDP which is twice the incredibly wasteful US.

The other reason is the Enron- style finance shell games now emerging from behind the shadows cast by Chinese banks and lending platforms. These push costs off the books and onto the Chinese empty bag holders, These would be the ‘savers’ that do not likely exist in sufficient numbers to make a difference. Like America and the EU, the establishment is doing its level best to ‘extend and pretend’ and keep losses from being realized. Like America and the EU it will only be able to do so for a short period. China is within that extend and pretend period now.

China’s ‘growth’ is an American-style pop culture phenomenon like Fabian, poodle skirts and the hula hoop. These things look and sound like something special and are for a little while, but they earn less than the Fab Four did during their career. In the end the toys wind up being discarded: the concrete towers are a fad. China looks likely to follow the hula-hoop … if not into the dust bin, at least to the garage sale of history.

Sad for China which bulldozed a 3,000 year old civilization into the landfill for nothing.