Here are some forecast predictions for 2010. Currently, we Americans are fighting – and losing – an unknown war:

– Prediction #1: Deflation will intensify as real oil prices increase, even if nominal prices fall. This country is at the edge of energy impoverishment. Gregor Macdonald explains:

Energy analyst and author Richard Heinberg published a sobering piece on energy transition and climate change last week, and he hits upon a theme that I’ve been addressing in my recent work on coal. Titled, Trying to Save the World, Heinberg writes about the energy deficit one would be choosing to enter, as part of carbon reduction:

Reducing carbon emissions essentially means using less coal, oil, and gas (since carbon capture and sequestration is arguably unrealistic on any substantial scale, other than by reforestation and regenerative agricultural practices). Since “clean” sources of energy probably can’t be scaled up to replace fossil fuels entirely, this means the world will have less energy to go around. (It will no doubt soon have less to go around in any case, because fossil fuels are non-renewable and depleting, and we’ve probably already passed the peak of world oil production—but don’t get me started on that.)Historically, there has been a very close correlation between energy consumption growth and economic growth, so with less energy available it may not be possible to continue growing the global economy in customary ways. Almost nobody in the climate community wants to talk about that, because the very suggestion that strong, effective climate policies will have a significant economic cost makes such policies far less palatable to folks on Main Street, and certainly to politicians.

Yes, precisely. I have warned in my presentation Coal World that unless we start using oil to build Alternative Energy infrastructure, the world will continue on its pathway of energy impoverishment (as the cost of all energy inputs continues to rise) and we will soon enough reach a point where transition to Alternative Energy infrastructure becomes prohibitive.

Conducting other forms of commerce will become prohibitively expensive as well. Deflation is illuminated by the decrease in credit, in the physical or consumer economy where it is needed the most:

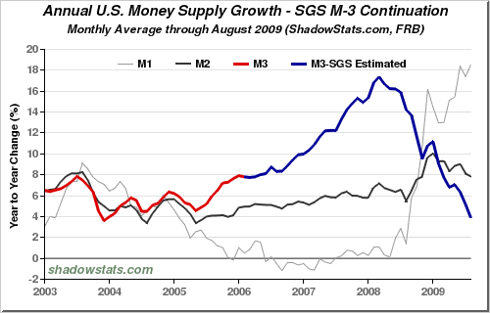

The decline in the M3 aggregate as estimated by Shadowstats illuminates a decline in borrowing by businesses and consumers. You can see the increase in M1 which is raw currency. Whilst it has expanded it does not exist in the real economy having been sped into the pockets of Wall Street/finance insiders. This $2 trillion dollar heist is the bank robbery of the millennium.

Unprecedented Contractions in Consumer Borrowing.

The next series of four graphs reflects the history of consumer borrowing in the post World War II period. Household credit market debt (including mortgages) is total consumer debt as reported in the quarterly flow-of-funds analysis published by the Federal Reserve. The first-quarter 2009 showed the first post-war annual contraction in the series. Consumer credit outstanding which includes credit cards, auto loans and other revolving and non-revolving credit (not mortgages) showed its steepest post-war decline in July 2009.

The Fed tracks credit cards (revolving credit) since the late-1960s. The current annual decline in credit card debt outstanding is the first for the series and, in conjunction with a smaller annual decline in non-revolving credit, has pulled overall consumer credit annual growth to its historic low.

Non- revolving consumer credit tends to decline over long periods which would indicate that there is much deleveraging to look forward to. It is hard to read any form of inflation into this credit regime.

Consumer Credit in U.S. Drops Record $17.5 Billion in November Share Business Exchange

By Vincent Del Giudice

Jan. 8 (Bloomberg) — Consumer credit in the U.S. dropped a record $17.5 billion in November as unemployment close to a 26- year high discouraged borrowing and banks limited access to loans.

The slump in credit to $2.46 trillion was more than anticipated and followed a revised $4.2 billion drop in October, Federal Reserve figures showed today in Washington. The median estimate of economists surveyed by Bloomberg News projected a decrease of $5 billion. The figures track credit card debt and non-revolving loans, such as those to buy autos.

A labor market that’s shed 7.2 million jobs since the recession started in December 2007 is restraining consumer spending that accounts for about 70 percent of the economy. Fed policy makers have said tighter bank lending standards and reductions in credit lines are hampering the recovery.

“Double-digit unemployment is eroding consumer confidence and the uncertainty is prompting consumers to pay down their credit card debts,” said Chris Rupkey, chief financial economist at Bank of Tokyo-Mitsubishi UFJ Ltd. in New York. “We have not seen such a wholesale reduction in consumer credit since the last time we had double-digit unemployment rate following the early ‘80s recessions.”

The secret to all large market trends whether inflationary or deflationary is public participation. The widespread belt- tightening in the US demands deflation regardless of the efforts of the establishment. Belt tightening is a response to unemployment but also an acknowledgement of the scarcity – and increased value – of currency.

– Prediction #2: nominal oil prices will decline slightly but the real price – oil against the cost of other inputs such as wages – will be high and continue to increase.

This is how ‘running out of oil’ goes. There are two factors; one is the ability of Saudi Arabia to maintain a rough dollar/oil peg, by using its spare capacity to move the small but vital crude markets and effect marginal pricing. It can do this as long as there are no serious disruptions – as would result from a military strike on Iran for instance.

Barring this, Saudia can keep a lid on dollar prices and thereby create the buck as a hard – highly deflationary – currency. The oil/dollar trade is the fulcrum around which the world economy tilts.

A second factor is the increasing money- credit impoverishment of US consumers and businesses. The ‘baked in’ US consumer profligacy does not work when oil has greater value as a speculative tool than as an enabler of commerce which is what happens when the oil runs out. Profligacy does not work when available dollars have scooted into the pockets and Swiss bank accounts of financiers and other criminals.

– Prediction #3: the US will avoid a 3d war in the Middle East, but become embroiled in a South American proxy war between Colombia and Venezuela. I predict this war will last a long time. Venezuela will become more like Nigeria and become a failed state (see below).

– Prediction #4: There will be sovereign repudiation of debts. Defaults are becoming more commonplace; witness defaults by state or state- sanctioned entities in Abu Dhabi, Ecuador, Iceland. The new trend is repudiation. Recent examples have taken place in China, Saudi Arabia, Iceland. Debtors are are telling creditors to bugger off. Since default does not eliminate the debt and the means to repay cannot appear – the oil to fuel the required ‘growth’ is not to be affordably found – escaping onerous indebtedness requires repudiation or creditor forgiveness. Repudiation means the fact of a debt will not be acknowledged at all. Countries that choose to repudiate – Greece, Hungary, Latvia, Ireland, Spain, Portugal, Argentina – will introduce their own currencies and print their debts out of existence; that is, repudiate by means of currency inflation. This will be the end of worldwide ‘free trade’ – this will not matter very much. The dissolution of trade pacts will simultaneously proclaim ascendancy of the state and assure thereby some measure of national survival. Small is beautiful.

Repudiation is an integral part of the ‘End of Finance’ (see below).

Nations at risk of inadvertent repudiation are increasing. There swelling numbers of ‘failed states’ besides the Somalias and Congos including Pakistan, Yemen and perhaps, Mexico. Failed nation status is de facto repudiation; blood cannot be collected from a (shattered) stone.

At some point the US sovereign will repudiate its stupendous debt but circumstances that would allow this would have to be extraordinary. Such a repudiation is not likely for several years.

– Prediction #5: a large- scale terrorist attack on the US. Look for this as a ‘false flag’ incident orchestrated by US intelligence agencies. The rather idiotic terrorist escapades of the past months suggest a significant encore.

– Prediction #6: a second and very destructive unwinding in finance markets. Any unwind that overcomes the current Fed/Treasury/taxpayer support will be uncontrollable by more Fed/Treasury/taxpayer support. The establishment has no ‘new’ medicine, it can only offer more of what has made the patient sick already.

– Prediction #7: the credit unwind will mean there will be no buyers at any price for most debt which will be rendered uncollectable. The entire derivatives structure of currency/rate swaps will collapse bankrupting most large banks worldwide, who trade these instruments. With the collapse of the banks, the insurance companies will follow. The health- care debate will be rendered moot. Debts and related assets will be given cash- and- carry ‘Pawn Shop’ values which will amount to pennies on the dollar, if buyers at all can be found.

– Prediction #8: there will be hyperinflation in China. I have expressed this prediction previously; there is currently high rates of inflation in China and there are few available assets to allow hedging. As China seeks to substitute domestic demand for export demand, it will be necessary to increase the Chinese citizens’ purchasing power. Since the citizens do not earn enough, some other means will be introduced; savings will be rendered less and less valuable and as these are turned into the marketplace, velocity will increase dramatically. In transition environments where central authorities can create ‘inducements’ at will, savings become rapidly wasting assets. The wasting process feeds on itself. It is hard to see how China can avoid hyper- inflation without raising interest rates to a Volckerian 12 – 20%. This will not be done, to support the mass of well- connected borrower/deadbeats.

Goodbye China and good riddance to your vanity and aggressive, stupid merchantilism.

– Prediction #9: the S&P will end the year below 650. This will not be the low of this cycle, only an intermediate low. There has been so far no ‘revulsion’ in stocks – or in real estate or other hedging assets. The washout will take place at far lower levels. These low levels will mark the end of industrialization as an organizing meme. The end of final liquidation of US manufacturing firms will determine the bottom in equities. This ‘wash out’ liquidation would take place 2015 or later. The S&P 500 may have far fewer than 500 solvent participants. Its final level might be 50 … or 15.

– Prediction #10 is more of an observation; finance as a strategy to create value has failed utterly. The failure has been long- standing. Japan has been enmeshed in deflation since 1990. Finance in Japan has only added to debt levels that must be serviced but nothing else.

Our current deflation is a logical and predictable outgrowth of rapacious and unconstrained industrial growth, which consumes the resource base upon which it absolutely depends. Finance is only a marketing enabler of this consumption, it seeks to expand markets for industry’s goods. It cannot create wealth, only redistribute it from the future to the present. The current failure of finance in its hour of greatest need suggests a future of great poverty. Future earnings have already been brought into the present, there is no wealth remaining.

2010 means the end of ‘money making money’. There are no/few good investments. There are no hedges against deflation.

Money will have to be made by work, talent or service, none of which provide much of a return now. To get to a point where work has value, revulsion must and will take place within the ambit of investment. Investment promises great returns on absolutely nothing but luck and the passage of time, the promise itself is a fraud. It violates the 2d law of thermodynamics which guarantees a decline in organization – and unrationalized value – over the passage of time.

2010 will be an historic year for the United States and the rest of the world. The meaning of ‘finite’ will be driven home, so that all – even the most obtuse – will comprehend. I suspect there will be variations on the themes of deflation, everywhere. This can only suggest a cause outside of credit as it is impossible for all to be credit- unworthy. At the same time, all are subject to the effects that emerge from the disappearance of inexpensive oil. There is an obvious lack of preparation on the part of governments and their business clients for what is coming. All citizens must prepare for themselves as best they can.

This is my personal task for 2010. This year means simplifying and finding useful services to provide in an energy constrained world.

What this means as far as this blog is concerned is hard to say. One ‘New Year’s Resolution’ is to get rid of the computer. I suspect that at some point the issue will become academic; the Internet will fail from a lack of maintenance in some critical area or that it will become more regional rather than world- wide. Satellite related communications will also fail as individual satellites fall silent or out of orbit. Complex systems will wilt. Auto use will become much more expensive, prohibitively so for many, if not most. There will be food crises, both in the greater world and in the US. The easy life that so many have known for their entire lives and take for granted … will be ended, forever.

At the same time, the world will acknowledge climate change. The opportunity to escape an extinction fate resides ironically in our gluttony, which renders carbon sources unavailable and too expensive to exploit. The onrushing energy shortages will begin to mark a decline in carbon entering the atmosphere as current shortages are demonstrating. At the same time, the breaking down of the energy system that runs industrialization will render the defense of the status quo pointless.

In the far longer term, famine will grip the world as Gaia brings about an ecological balance in her quiet and gentle manner. By 2020, the world will likely contain a much smaller human population, perhaps a tenth of current. That is, 600 millions. The unknown and unacknowledged war between man, Earth and machines will be lost by man and machine. With the inescapable consequence of acquiescing to nature’s preeminence and giving to her her due, the human experiment might hence allow a golden age of work, joy and beauty … and harmony.

Perhaps I will be lucky enough to witness it.

:>)