Long Treasury bonds, US municipal issues, and overseas sovereigns were all hammered, yesterday. All of this is part of a longer- running trend of declining bond prices and a flight from risk.

What kind of risk?

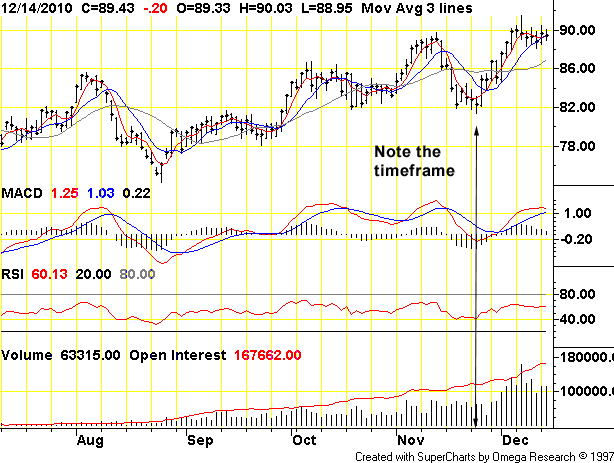

Both the 10 year above and the 30 year took significant losses yesterday. These are March, 2011 futures charts from estimable TFC charts.

Here is some of the carnage in munis. This sector has not been exhibiting risk even as state and local governments have been suffering sharp decreases in revenue along with increased demands for services. This typical muni fund chart is from Mike ‘Mish’ Shedlock:

Read the entire article, it is sobering, The problems in non- Federal government borrowing and spending are long- standing. What is surprising is that reaction in the credit markets has been so long in coming.

Eurozone debt crisis spreads to Belgium on rising political riskEurope’s debt woes have moved closer to the core of monetary union after Standard & Poor’s threatened to downgrade Belgium over the failure of Flemings and Walloons to form a government.

The yield spread on Belgian 10-year bonds has ballooned to 102 basis points over German Bunds, raising fears of a funding squeeze next year. S&P said the country needs to refinance debt equal to 11pc of GDP next year, leaving it “exposed to rising real interest rates”.

“It’s ugly for our reputation,” said Jean Deboutte, head of Belgium’s debt office. “This is bearable but the premiums are mounting little by little.”

The country has been limping along with caretaker ministers since Flemish separatists emerged as the biggest party in June. Talks have broken down over the scale of subsidies to the poorer French-speaking areas, making Belgium a microcosm of EMU’s North-South divide.

It is unclear whether the political system can muster the discipline of the early 1990s when Belgium came back from the brink of a debt compound spiral with an impressive fiscal squeeze.

“We believe Belgium’s prolonged domestic political uncertainty poses risks,” said S&P. “Belgium’s current caretaker government may be ill-equipped to respond to shocks to public finances. If Belgium fails to form a government soon, a downgrade could occur, potentially within six months.”

Spain also faced fresh debt woes at an auction on Tuesday. The yield on €2bn (£1.7bn) of one-year bills jumped to 3.4pc, up 100 basis points in a month. “It was pretty dire,” said David Owen from Jefferies Fixed Income.

Mr Owen said the surge in yields on US Treasuries is causing the cost of capital to jump across the global system, including Spain. “This is raising the bar for everybody,” he said.

While Spain can still borrow at a manageable cost, it is storing up rollover risk by issuing debt at short maturities. The IMF said Spain must refinance €220bn this year. Moody’s this week raised its estimate of Spanish bank losses to €176bn, up from €108bn a year ago.

Here is the March NYMEX crude contract. Energy prices have vaulted from merely outrageously expensive to unbearably so:

The so- called ‘Credit Crisis’ is far from over, folks. In fact, a new and far more ominous chapter is unfolding right now.

Risk is migrating away from markets that can be propped up with low- cost credit bailouts toward markets which cannot be bailed out at all. Cost shifting from the wealthy to the non- wealthy has reached point of diminished returns.

– Many analysts suggest hyper-inflation as the cause of the downturn. This is not likely but hard to measure. Areas that already acknowledge inflation such as China have relatively inaccessible bond markets that cannot accurately reflect inflation risk. In the US, the lack of wage pressure and the high fuel costs make inflation a non- factor. Added funds from monetary authorities are swept into liquidity traps and remain out of circulation. What circulates instead is ongoing moral hazard.

– Much of the current downturn reflects the lineup of finance beggars waiting their turn at the bailout trough. Falling bond prices are a consequence of endless moral hazard. The bailout of one entity leads to the impossible condition of bailouts for all. Refusing to bail a particular entity results in finance holding entire economies hostage. A point is reached when markets acknowledge the limits of both moral hazard and the possibility of endless bailouts. What is taking place right now are markets reflecting this increase in risk.

– The energy markets are Key Men that cannot be propped up as the necessary prop is a sharp increase in the amount of fuel made available on these markets. The Establishment has been whistling past this fuel- price/availability graveyard since the current debt crisis emerged in 2007. New, low cost fuel is not forthcoming. Peak oil is real and in the past. The percentage of economic output directed toward the fuel input is increasing with the effect being felt @ the (profit) margins of businesses marketing fuel- dependent goods and services.

High input prices are felt throughout the world’s economies as these are forms or extensions of the energy business. All goods are repackaged petroleum to some degree, most services require petroleum in their exercise. Increased fuel costs are charged against margins. The first to feel fuel price effects are workers whose jobs are sacrificed in efforts to maintain profits.

Unemployment effects municipalities downstream as workers morph from taxpayers to consumers of government services. The productive, ‘real’ economy loses the ability to service debts.

– The contest is between input and output. High fuel prices allocate funds toward fuel away from fuel’s products and fuel- dependent services. This is the margin- shrinking mechanism of peak oil and high nominal fuel prices. High fuel prices puts companies dependent upon cheap fuel out of business. At some point the consequent decline in economic activity destroys demand. Fuel prices then decline.

– Fuel price allocation has reached finance as funds ordinarily spent on bond market ‘products’ are now diverted to the products’ fuel supply. The connections between debt service and worker output are not tenuous. The only source of debt service funding is output, not bailouts or central bank monetization. Without fuel at a price that allows profits, the ability of those at the bottom of the economic food chain to support speculators evaporates. Plummeting bond prices indicate increasing awareness of this bit of economic common sense on the part of speculators.

As they see rising fuel and commodity prices as a ‘sure bet’, speculators shift funds away from bonds toward commodity inputs. By doing so they amplify the condition they seek to avoid! Increased input costs reduce the ability of workers to carry rapidly increasing debt service burdens. The bond decline becomes a rout as fuel prices remain at the business- destroying high levels, held there by flows of speculative funds from bonds into fuel futures.

The outcome of this shift is the end of hyper- inflation within finance. Economic output is seen as ‘risky’. This risk amplifies credit reallocation in the short term from output to input. A vicious allocation driven- compounding spiral is not out of the question, gaining force until demand destruction and consequent declines in fuel prices remove the allocation ‘incentive’.

The economy is in grave danger! Adding central bank funds to finance will make matters worse. Funds will either flow to commodities increasing credit risks and amplifying the spiral or flow back to central bank ‘reserves’ where they make visible the irrelevance of the central banks when relevance is most needed.

The current run- up in fuel prices appears to represent a reprise of the 2008 Great Oil Spike at much lower dollar levels. Declines in fuel prices will be reflected across the entire risk/finance ambit. Bonds will be revealed as the liquidity traps they have always been, along with other risk assets. If the bond decline continues or increases, margin calls will reveal insolvencies and deleveraging will turn ugly.

Derivative positions held by speculators are also @ risk. Major banks such as JP Morgan- Chase are increasingly vulnerable to margin calls and consequent failure. According to Steve Organ.

As I pointed out to you on many occasions, it is the rapid fall in bond prices that are disturbing the bond derivatives. You see there are over 70 trillion dollars of interest rate swaps owned by the bankers and the majority is owned by JPMorgan. In a nutshell, these guys have bought trillions of long bonds in the future and shorted an equal supply of short term say 30 days notes at zero yield. Thus a rise in future bond yields of say one full percent is causing massive dollar losses for JPMorgan ie. say 40 trillion x 1% interest rate loss = 400 billion dollars enough to wipe them and just about every other banker into oblivion. This is the paper default that I say will happen. The other default of course is a physical default which will produce the same bank run.

‘Physical’ here means gold and silver positions on metals exchanges that cannot be filled by the banks. What supports all the finance ‘Key Men’ is a web of claims that exists only when the validity of both the claims and the integrity of the web itself is not called into question.

– The bond markets are Key Men that cannot be propped. They are simply too large and doing so would amplify any risk that propping can only amplify. The propping efforts to date, including the recent, budget- busting tax ‘deal’ in Washington are a large reason why bond yields world- wide are skyrocketing.

At the same time, the central banks are limited as to the amount of monetizing they can effect. Monetizing is an ‘end around’ the markets, which would likely respond by dumping the much larger amounts of existing debt on the central banks at any price. This would precipitate the crisis the central banks are so desperate to avoid!

This Christmas season is going to be ‘interesting’, folks. What is likely is a change in perceptions, a present that not all will welcome. Hang onto your hats, folks!