“The people of Germany

have no right to democracy and a free market economy in the

future.” Angela Merkel

This ‘bailout’ goes to the banks, the Greek citizens see a pittance: must pay for the privilege of bailing the banks out!

ATHENS — After months in which Greece teetered on the verge of bankruptcy, European officials agreed Tuesday to give the country a second massive bailout in exchange for harsh austerity measures, as grim new estimates about the country’s economy pushed off a resolution until what some officials called the last possible day to reach one.The decision buys time for the Mediterranean country to try to fix its staggering problems, and gives assurances to the world that a Greek default — and its possibly disastrous ripple effects — will be forestalled, at least for now. If Greece had been cut loose, it would have defaulted in late March, and doubts about the viability of larger countries such as Spain and Italy might have grown.

After more than 12 hours of talks, the countries that use the euro reached an agreement early Tuesday to hand Greece $170 billion in additional bailout loans to save it from a potentially disastrous default next month.

Under the terms of the deal, private bondholders will take a larger loss than had previously been planned in an attempt to get Greece’s debt to what European officials consider a sustainable level by 2020. The officials also agreed to reduce the interest they charge Greece for the long-term loans.

“We have reached a far-reaching agreement on Greece’s new program and private-sector involvement that will lead to a very significant debt reduction for Greece,” Luxembourg Prime Minister Jean-Claude Juncker, who heads the bloc of 17 countries that use the euro, told reporters in Brussels after a 14-hour negotiation. He called the amount of aid “unprecedented.”

Washington Post

Here is odious debt: debt taken on by a tyrannical regime in the name of the state to serve the interest of the tyrant rather than the state or public. As such it is personal debt of the tyrant and his cronies, not any obligation of the public. The Greeks did not have a vote regarding the hundreds of billions of euro debt just now lodged against them. Such a vote is forbidden by the powers outside of Greece who run the country. This dead-money debt was imposed by a cabal of bankers using the outer forms of the European state and the IMF to ‘manage’ the sock puppet Greek government.

Meanwhile, there is no more Greek sovereignty, neither the government nor the Eurocrats can protect the country or defend its citizens’ interests. Institutions are de-funded, discredited and co-opted by the financiers.

About 100 years ago a German economic entity started to be formed out of many regional economies. As unification of the country was still way out of the question, economic treaties started to develop, finally reaching its peak in 1843 with the German ‘Zollverein’ (Customs Union) and bringing with it huge economic advances.What did the situation look like before? Anyone passing through Germany traveled on poor roads and had to pay countless duties and tolls on his way through dozens of states. Each of these states had its own sovereignty, financial system and currency attempting to form something like its own independent economy.

Those in charge then simply could not understand that their great neighbors, England and France, had advanced because they had created an economic area for themselves, which corresponded to the level of technology and transport reached at the time. Friedrich List, the great proponent of Germany’s economic union, criticized the situation at that time saying, “The chances for German industry to rise up would immense if each factory owner could choose from an pool of 30 million people! Mining, agriculture and cattle rearing could really take off if each branch of production could take its natural course!”

One of the decisive forces, which the small nation ideal finally had to bow to, was the revolutionizing effect on the economy and transport of technical progress, especially the steam engine. If we say Europe now, instead of Germany, then we come naturally to a similar, if not identical, conclusion – from a purely economic perspective. Once again it is the economic and technical progress, which pushes inexorably to the formation of large continental economic areas. Today technology offers possibilities, which cannot be fully utilized by individual national economies. Nations’ borders have been brought closer together by the increased speed of trains, the extension of the road network and waterways, the transcontinental energy supply, which offers so much potential and, above all, the airplane. Outside Europe, huge economic areas are already, or are in the process of being formed, from a combination of these factors. For its own good, Europe has to be dragged out of its romanticized backwardness. The difficulties, of course, of a European economic union are larger than those that had to be overcome by the German Customs Union. The means will be difficult and more complicated, and it certainly will not be achieved just through a customs union. Nonetheless, there will be a European economy entity because its time has come.

The Economic Face of the New Europe

by Walther Funk, Reich’s Economic Minister and

President of the German Reichsbank – 1942

Here is the world order: the engrossing trains, airplanes and automobiles: whomever embraces “romanticized backwardness” gets stuffed into a furnace.

The National Socialists represented the putsch of the German chemical and dyestuff industries: IG Farben, Bayer AG, Bosch/BASF: the post-war German political elite is the who’s who of Farben/chemical industry alumni including Hermann Abs, Konrad Adenauer, Otto Ambros, Etienne Davignon, Max Ilgner, Helmut Kohl, Karl Krauch, Anton Reithinger, Fritz ter Meer, Carl Wurter, Angela Merkel.

Merkel is the ‘reformed’ Stalinist rather than the Nazi but an authoritarian, nevertheless:

Angela Merkel became German Chancellor

in 2005 and has close connections to

the chemical lobby.• Merkel studied physics at the university

of Leipzig in Eastern Germany

from 1973 to 1978. Later, she was awarded a doctorate for a

thesis on quantum chemistry. Between 1978 and 1990, Merkel

worked and studied at the Central Institute for Physical Chemistry

at the Academy of Sciences in Eastern Berlin.• After the reunification of Germany, Merkel was elected as Member

of Parliament of the German Bundestag in 1990.• In 1991, Merkel became Minister for Women and Youth in

Helmut Kohl’s cabinet. From 1994 to 1998, Merkel served as

Minister for Environment and Nuclear Safety. She had a close

relationship with Kohl and became known as “Kohl’s Mädchen”

(Kohl’s girl). In 2000, Merkel succeeded Kohl as the party chair

of the CDU party.• In 2005, Merkel became Chancellor in Germany. In a speech,

shortly before being elected, she said: “The people of Germany

have no right to democracy and a free market economy in the

future!” It was obvious that Merkel had been briefed by representatives

of the cartel.• One of her close advisors is the chief executive of BASF, Jürgen

Hambrecht. During WWII, BASF was one of the members of the

IG Farben cartel.

Old ideas die hard, the model for the European Union is from Alexander Hamilton by way of Friedrich List. It turns out Magda Goebbels had very little to worry about:

We’re talking about ALEC, the American Legislative Exchange Council, a secretive organization from the Koch Brothers made up of politicians, corporations and think tanks, and this is the first in a multi-part series about the group, its goals and the people behind it.What is ALEC?

The one thing it’s not is a lobbying group. As their page at SourceWatch states:

ALEC is not a lobby; it is not a front group. It is much more powerful than that. Through ALEC, behind closed doors, corporations hand state legislators the changes to the law they desire that directly benefit their bottom line. Along with legislators, corporations have membership in ALEC. Corporations sit on all nine ALEC task forces and vote with legislators to approve “model” bills. They have their own corporate governing board which meets jointly with the legislative board. (ALEC says that corporations do not vote on the board.) They fund almost all of ALEC’s operations. Participating legislators, overwhelmingly conservative Republicans, then bring those proposals home and introduce them in statehouses across the land as their own brilliant ideas and important public policy innovations—without disclosing that corporations crafted and voted on the bills. ALEC boasts that it has over 1,000 of these bills introduced by legislative members every year, with one in every five of them enacted into law. ALEC describes itself as a “unique,” “unparalleled” and “unmatched” organization. It might be right. It is as if a state legislature had been reconstituted, yet corporations had pushed the people out the door.

An “unparalleled” and “unmatched” organization, funded by corporations who craft “model” legislation that is then filtered through to state legislatures through their political members. Not something that inspires any sense of security. But this is the real fight, people. In many ways, this is not red vs. blue, this is not Democrat vs. Republican, or Progressive vs. Conservative; this is democracy vs. a corporate coup of the United States of America.

Who is behind ALEC?

It should come as no surprise that the Brothers Koch, Charles and David, are major players in ALEC.

It is always the power elite Nazis who conspire to deprive the rights of the ordinary citizens rather than the other-way around:

The membership of ALEC should scare the pants off of anyone who values a true democratic government and society. It is made up of a combination of politicians and corporations from almost every state. Their “Public” Board of Directors consists entirely of Republican lawmakers:Executive Board:

• National Chairman – Rep. Noble Ellington (R-Louisiana)

• First Vice Chairman – Rep. Dave Frizzell (R-Indiana)

• Second Vice Chairman – Rep. John Piscopo (R-Connecticut)

• Treasurer – Rep. Linda Upmeyer (R-Iowa)

• Secretary – Rep. Liston Barfield (R-South Carolina)

• Immediate Past Chairman – Rep. Tom Craddick (R-Texas)Board Members:

• Sen. Curt Bramble (R-Utah)

• Rep. Harold Brubaker (R-North Carolina)

• Sen. Jim Buck (R-Indiana)

• Sen. Kent L. Cravens (R-New Mexico)

• Rep. Jim Ellington (R-Mississippi)

• Sen. Billy Hewes, III (R-Mississippi)

• Spkr. William (Bill) Howell (R-Virginia)

• Sen. Owen Johnson (R-New York)

• Sen. Michael Lamoureux (R-Arkansas)

• Rep. Steve McDaniel (R-Tennessee)

• Sen. Ray Merrick (R-Kansas)

• Sen. William (Bill) Raggio (R-Nevada)

• Sen. Dean Rhoads (R-Nevada)

• Sen. Chip Rogers (R-Georgia)

• Sen. Bill Seitz (R-Ohio)

• Rep. Curry Todd (R-Tennessee)

• Sen. Susan Wagle (R-Kansas)ALEC also has a Corporate Board, made up of a plethora of corporations who have their dirty paw prints on legislation across the country:

• CenterPoint 360, W. Preston Baldwin – Chairman – Lobbying firm

• Altria Group, Daniel Smith – Formerly tobacco giant Phillip Morris

• American Bail Coalition, William Carmichael, Jerry Watson – Criminal court appearance bonds

• AT&T, William Leahy – Communications giant

• Bayer Corp., Sandy Oliver – Pharmaceutical giant (Bayer AG: Nazi Germany chemical industry kingpin)

• Coca-Cola Company, Gene Rackley – Soft drink giant

• Diageo, Kenneth Lane – Global, consolidated liquor company

• Energy Future Holdings, Sano Blocker – Texas energy company

• ExxonMobil Corporation, Randall Smith – Oil giant

• GlaxoSmithKline, John Del Giorno – Pharmaceutical giant

• Intuit, Inc., Bernie McKay – Software company

• Johnson & Johnson, Don Bohn – Healthcare/pharmaceutical giant

• Koch Companies Public Sector, Mike Morgan – Largest private company in U.S.

• Kraft Food, Inc., Derek Crawford – Food giant

• Peabody Energy, Kelly Mader – Coal company

• Pfizer Inc., Michael Hubert – Pharmaceutical giant

• PhRMA, Jeff Bond – One of the largest lobbying organizations in the U.S.

• Reed Elsevier, Inc., Teresa Jennings – Professional journal publisher

• Reynolds American, David Powers – RJ Reynolds tobacco company

• Salt River Project, Russell Smoldon – Arizona utility company

• State Farm Insurance Co., Roland Spies – Insurance giant

• United Parcel Service (UPS)[2], Richard McArdle – Shipping and freight company

• Wal-Mart Stores, Maggie Sans – Retail giantIn addition to the politicians and corporations, several think tanks serve as members including the National Rifle Association, the Friedman Foundation for Educational Choice (started by the “shock doctrine” mastermind Milton Friedman), Dick Armey’s Institute for Policy Innovation, and the Mackinac Center for Public policy, which spent a lot of time meddling in the Wisconsin protests.

Also on board are several “scholars,” the majority of whom have direct ties to the Koch brothers. The most recognizable is Stephen Moore, the founder of the Club for Growth and a former senior fellow at the Cato Institute, founded by Charles Koch in 1977.

Debtonomics:

– There are two forms or sectors within debtonomy, the so-called productive sectors; mainly the automobile, aircraft, energy supply/transmission, basic metals and materials, chemical and warfare industries, industrial agriculture; the ‘health’care rackets; pharmaceutical, house-building and highway construction; the mining industries and ‘retail’. These are the instruments of waste and tyranny. Supporting the industrial sector is the finance sector which provides credit without which the industrial sector cannot exist.

– Classical Economists who purport to run the ‘economy’ have not seen fit to include credit into their operating models.

– Debtonomics argues that industrial enterprises are empirically not productive. These industries have no special rights or claims to debt subsidies but have simply overthrown the credit establishment. The productivity claims are lies repeated enough — by way of advertising — to become the truth.

– Debtonomics argues the way to end the abuses of industrial enterprises is to end their subsidies, to make industries pay their own way. The instrument of self-financing debt then can be used for other activities, such as to undo the damages done over the decades by the industrial enterprises. These ‘undoing’ activities would in turn tend to be productive over the longer term as they would represent capital husbandry rather than its erosion or destruction.

– Currently, industrial enterprises are fatally undermined by their own operational efficiency. Physical limits in the form of relative resource scarcity reprices inputs out of the reach of the industries that require them to waste. The feedback loops effect both finance/debt and the enterprises themselves, the effects including strong deflationary vicious cycles and compounding spirals as is seen now in Greece.

Greece does not produce any petroleum energy to speak of: a few thousand barrels per day from offshore fields. It has to import fuel from overseas, mostly from Middle East producers such as Iran. Where does Greece get the hard currency to swap for petroleum overseas?From an energy standpoint Greece is insolvent. It once borrowed — euros — from banks to buy fuel. Now it has to borrow from new banks to pay off the old banks AND to buy the fuel. Greece is on the road to oblivion. It buys less fuel even as it falls further into debt. Without some drastic change Greece will not only default but collapse.

Like the other countries, Greece obviously failed to earn enough from using the fuel to pay its energy bill otherwise it would not be insolvent.

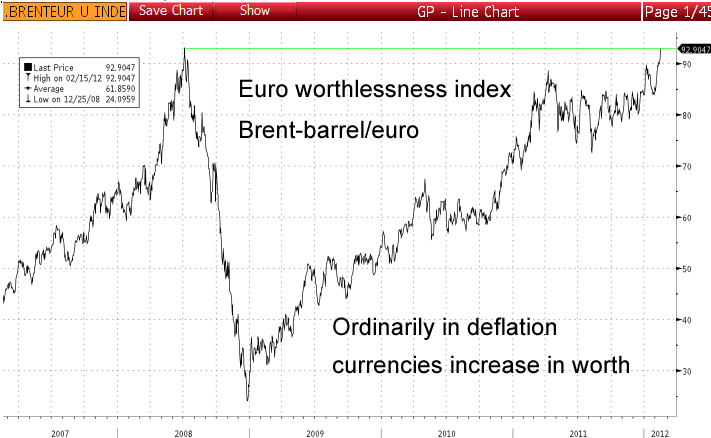

Credit is needed to save the Euro-states from bankruptcy, adding credit pushes up the price of crude petroleum in the ‘asset’ markets. A severe recession is underway in the Eurozone regardless of what takes place in Greece and elsewhere:

Figure 1: The barrel of crude in the Eurozone, priced in euros as expensive as it was in 2008. The outcome of the high price is demand destruction.

Carmaker Sergio Marchionne of Fiat (unwittingly) speaks the truth about his industry:

“We need to remove the fact that we’ve got the mass car market in Europe, which is economically unproductive and which, just in raw, pure economic analysis, does not deserve capital allocation of any kind,” Fiat chief Sergio Marchionne said on a conference call with analysts Feb. 1.“If volumes stay where they are, I think if you took out 10 to 15 percent of the capacity, maybe 20 percent of the capacity in Europe,” it would result in a sustainable level of production, Marchionne told reporters.

“Such a dramatic reduction — which would require mass layoffs at a time when Europe is reeling from economic turmoil and has not yet resolved its crippling government debt problems — would be very difficult to achieve,” he said. “It s a tough discussion.”

“I guarantee you re going to have some very negative reactions from industrial European countries to my suggestion.”

Asked what his forecast is for European vehicle demand, Marchionne said he expects it to “stay flat through 2014.”

Fiat’s Italian plants are currently operating at less than 60 percent capacity, a situation Marchionne said is untenable and is mirrored by other European automakers.

The Europeans are broke, prices of all goods are simply too high. This includes the prices for fuel. The Europeans are in a trap. Finance can continually expand without restraint as long as it continually expands without restraint. The fear of large numbers on the part of administrators AND the failure of important finance establishments such as dollar- ‘shadow banking’ in 2008-09 has slowed the expansion of credit, the amount of debt taken on. The slowdown itself is the economic crisis, not the result of it.

Renault, Fiat Pace European Car-Sales Drop as Demand Stalls

Tommaso Ebhardt (Bloomberg)

Renault SA (RNO), Fiat SpA (F) and PSA Peugeot Citroen (UG) led the biggest decline in European car sales since June as consumers balked at making big purchases after the region’s economy shrunk.

Registrations in January fell 6.6 percent to 1 million vehicles, marking the fourth consecutive monthly decline, Brussels-based European Automobile Manufacturers’ Association, or ACEA, said today in a statement.

Sales in France, the region’s second-biggest market after Germany, plunged 21 percent, while deliveries in Italy, the third-largest market, slumped 17 percent. Gross domestic product in the 17-nation of euro area fell 0.3 percent in the fourth quarter, the first drop since the second quarter of 2009.

The Establishment solution is to ramp up the Nazism: starve the European periphery of credit granting it to the car industry and the finance which supports it. What is taking place in the EU is a contest over debt subsidy, Germany rendering Greece and the rest car-free.

What vanishes now is the confidence in systems, which purchase oppression and sell common-sense and any longer-term view. Bankrupting Greece will not cure Europe’s ills. Instead of relief such things lead straight to the bankruptcy of the other Euro-nations including France and Germany. The center of the industrial vortex is the German auto industry, for which the entirety of Europe and the ‘euro enterprise’ trembles at the edge of the pit. The instrument of German finance and industry is the euro. The finance costs associated with the euro are now greater than what the car industry and its finance supporters pretend to earn. If this was not so there would not be a crisis in Europe! The outcome of this will be stupendous: a major currency does not simply vanish without consequences.

But the euro with all of its baggage cannot pay its own way. The clock is ticking … don’t look now … dollar!

– Debtonomics: credit amplifying or triggering price changes.

– Debtonomics: the dollar/crude trade which determines the worth of both.

– Creeping dollar preference and amplified deflation.

– Debtonomics: ongoing collapse of the euro currency as a ‘going concern’.

– Bilateral international trade deals involving crude production that exclude the dollar.