The dollar’s obituary has been posted far and wide it’s apropos to prepare an eulogy so its tattered fragments can be swept away and us Americans — and the rest of the world — can prepare for the end of the dollar as the world reserve currency and the embrace of Mexican pesos or yens or something else as the new national currency!

Right?

Here is the cumulative euro front month futures contract priced in dollars from Estimable TFC Charts. (Click on any of these charts to get a larger, clearer version.)

Hmmm, not so fast … people are proclaiming dollar death and the indeed the buck sucks today, almost as badly as the buck sucked during the finance crisis. Nevertheless, we have a ways to go in order for the dollar to be as worthless in euros as it was a couple of years ago.

The short term trend appears ready to take us there. This is probably not the week to be a dollar bull. Nevertheless, currencies fluctuate. Best not to be caught up ‘in the moment’ unless there is nothing better to do and you have lots of worthless dollars you can afford to lose!

The dollar has fallen in value since last summer and there are reasons for this. The conventional wisdom is that Federal Reserve easing policies such as zero- percent interest rates (ZIRP) have weakened the dollar which is carry- traded for ‘risk’ in equities and commodities. Other analysts finger a deliberate strategy to depreciate the dollar. Keep in mind, currency ‘value’ is ordinarily measured relative to other currencies. This may not necessarily be the most accurate measurement, particularly when other currencies suck almost as bad or worse than the buck:

- Currency ‘value’ is an abstraction. There is no such thing as a currency ‘store of value’ since value is arbitrary/subjective and cannot exist outside of the context which enables it. Longer- term (over years) the dollar is worthless. It is a fetish- proxy for American ‘production’. What does America or other industrial countries produce besides waste?

- The Federal Reserve and other central banks are seeking relevance during a period when monetary policy revolves around the crude oil/dollar trade. The result has central bankers pulling whatever rabbits they can out of hats in order to pimp borrowing. To the extent that Bernanke can encourage folks to borrow, his antics effect demand and prices … and in turn, dollar value.

- The establishment in the US is clearly befuddled by ongoing scarcity events and is incapable of acting intelligently. The rationale given for economics is the allocation of scarcity: this is completely wrong. Economics exists only to manage the costs associated with increasing surpluses: in its current form it is useless the face of onrushing scarcity.

- The low demand for credit allows traders to ‘sell dollars’ and ‘buy risk’ in different markets which in turn allows a greater return from carry- trade speculation than there is in holding cash. The outcome is a depreciating dollar.

- There is a competition by exporters to devalue for competitive advantage and the US is a commodity exporter, particularly of food. Commodities markets are credit markets in drag; the ‘margin for sale’ inflates commodity prices, devaluing the dollars @ the same time.

- There is a strategy by US interests to take dollars out of circulation overseas by loudly and publicly damning the dollar and swapping it for (even more worthless) non- dollar assets.

There are reasons why the current dollar weakness is likely to be short- lived. Keep in mind, for every dollar seller there is a dollar buyer who happens to be somebody like Bill Gross:

- Nominal crude prices can only increase to a level where businesses that require fuel fail because they cannot afford an amount that keeps the doors open. Once another failure round begins, more deleveraging will take place as the fuel- dependent will be unable to service the massive Ponzi- debt overhang. Those in the cross- hairs look to be auto companies, restaurateurs and retailers in the US, entire countries such as Spain or Japan along with real estate speculators (the Communist Party) and exporters in China.

- Central bankers and policy makers tend to make the wrong moves particularly during times of stress.

- The dollar is ubiquitous within the underworld.

- The strong export economies cannot provide a currency substitute for the dollar (and the importing countries are not solvent enough to provide one, either).

- It’s an ugly contest out there! Japan is bankrupt due to the Fukushima debacle but does not acknowledge it. The EU is bankrupt due to being held hostage by euro- denominated debts to and from different parts of itself. China is bankrupt due to over- investment in industrial capacity and ‘luxury’ even as it’s mercantile trade ruins its customers. Blessed by still- adequate resources and no nuke meltdowns taking place right this moment, the USA is slightly less repulsive than its trading partners.

The easy thing to do is blame dollar weakness on the Fed and turn the Chairman into a piñata. “This is your personal fault Bernanke, you bearded bag of shit, you are single handedly ruining the American Dream of endless personal success.”

Sez Dian Chu:

The Fed Must End QE2 on April 27thThe Federal Reserve has lost all credibility on Wall Street, and most of the American public with the absolute refusal to recognize the dire effects on asset prices that QE2 has created. But the refusal is part of the problem. It reinforces the wide spread belief of investors that the Fed is out of touch with reality, and that they sit in their Ivory Tower implementing an exceedingly loose monetary policy, with the stated goal of inflating asset prices

Like this asset?

Stimulus by Fed Is Disappointing, Economists SayBinyamin Appelbaum (NY Times)

WASHINGTON — The Federal Reserve’s experimental effort to spur a recovery by purchasing vast quantities of federal debt has pumped up the stock market, reduced the cost of American exports and allowed companies to borrow money at lower interest rates.

But most Americans are not feeling the difference, in part because those benefits have been surprisingly small. The latest estimates from economists, in fact, suggest that the pace of recovery from the global financial crisis has flagged since November, when the Fed started buying $600 billion in Treasury securities to push private dollars into investments that create jobs.

As the Fed’s policy-making board prepares to meet Tuesday and Wednesday — after which the Fed chairman, Ben S. Bernanke, will hold a news conference for the first time to explain its decisions to the public — a broad range of economists say that the disappointing results show the limits of the central bank’s ability to lift the nation from its economic malaise.

“It’s good for stopping the fall, but for actually turning things around and driving the recovery, I just don’t think monetary policy has that power,” said Mark Thoma, a professor of economics at the University of Oregon, referring specifically to the bond-buying program.

What’s it going to be, children? Please make up your minds!

As pointed out here repeatedly, the latest round of quantitative easing has been a public relations stunt. The Fed cannot print ‘value’ or crude oil or jobs, it doesn’t add anything except ‘reserves’ to accounts held by banks at the Fed. ‘Reserves’ are an abstraction; they appear when the availability of credit is greater than demand for it … like now.

Modernity runs on crude oil, money and credit are used to keep score. Credit can be substituted for ‘other things’ so an appearance of output can be maintained when facts suggest otherwise. As in bowling, this is called ‘cheating’. Real output is required to bring more crude, gold, silver, corn, etc. out of the ground. Credit is for those who have little output but are glib enough to convince producers that they can use it to steal output from somebody else.

The ability of America to steal — as priced in dollars — is being depreciated against the abilities of other countries who appear able to do a better job!

Goldman- Sachs and other finance ‘players’ can kite each other checks (with the blessing of regulators). All that is required is sufficient physical goods in hand to maintain margin. This is in the unlikely event the markets must endure a short- term reversal and there is demand for collateral. Priced in dollars, the ability of financiers to kite checks to each other appears to be waning.

The outcome of this is that oil producers/terminals can be flooded with oil while prices for the same oil are increasing in apparent violation of the laws of supply and demand. What is being priced is not only the oil available but also the cost of margin in the fuel markets … which is conveniently set by the traders themselves by their use of the exact same margin!

Happy, happy, joy- joy! The traders have their hands on another perpetual motion machine! They can bid prices higher which increases their leverage on the sell- side which increases the amount of credit available which is then used to bid prices higher still. They can ‘flip’ their goods to some strapped- out sucker and pocket the leverage- amplified profits. Steadily increasing prices means ever- more leverage is needed by the Ordinary Joes to access the markets at all. The cost of leverage is constantly ‘bidded onto’ the goods- price. The result is rationing by access to credit and price: no credit, no oil.

Priced in dollars, the ability of the US to pay for fuel out of cash flow is diminishing …

Commodities markets are pricing margin availability along with that of that of the commodities themselves. If there was a lot of crude on the markets the need for leverage would not exist. The fact of increasing crude price alongside ‘well- supplied’ markets indicates the crude market has become a credit market.

It also indicates that crude is hard to come by.

It’s not the Fed or its proxies that are effecting prices but those with the goods and the willingness to leverage their own market- making power. The producers can hold goods off the markets: the Saudis say they have oil that nobody wants to buy. What does this really mean? It means perhaps that Saudia has oil that nobody wants to buy @ $500 per barrel.

Tomorrow?

The market- making dynamic triggers self- amplifying vicious cycles which cause prices to ‘run away’. The escape of the crude price in dollars would be the end of the US as a going industrial concern. We import two- thirds of the oil that is consumed in this country, The establishment has not thought through the hazards of its finance nonchalance. Farmers would lack the fuel to plant their crops, the auto and airline industries would collapse. There would be a tremendous panic …

… which would be excellent for the dollar.

A bubble is when a self- generating increase in margin amplifies the increase in price of the good being leveraged. There is more dollar- credit available now for gold than there was ten years ago, more dollar- credit for silver, certainly, almost but not quite as much credit available for crude as their was in 2008. Given enough ‘confidence’ (that the participants will be bailed out when the bubble breaks), the credit mechanism becomes self- actuating the same way it was during the mortgage lending bubble.

We just don’t see the sell side except its effects on rapidly increasing prices.

Finance’s credit machine bids up fuel and other commodity prices to levels that Main Street business cannot support. A credit bubble can be blamed on the Fed, it can also be blamed on phases of the Moon or itchy feet. Finance/business lends into existence what credit it requires to do business — regardless of the nature of that business. Remember, the dollar is ubiquitous in the underworld and finance is an integrated part of it. ‘Bidness’ is only required to provide returns sufficient to service the loans, which a bubble can do … for a little while.

Long before the end of the bubble, the bad- guys will have taken the (dollar) loot and have left the building ..

Restraining the Fed is unlikely to effect bubble prices in commodities unless interest rates rise making margin too expensive.

A bubble is simply a Ponzi scheme. All end the same way, with bubble- death and deflation. Credit Ponzis are particularly pernicious as the debts taken on to inflate them far exceeds what could be inflated by cold, hard cash. Credit bubble debts cannot be supported by cash flows. This is why the first credit bubble has to be superseded by others. Only additional rounds of credit can replace/service legacy bubble credit. The row of successive bubble ends up with a cumulative ‘hyper- bubble’ which is what the developed world is trying to support this minute … by pumping up yet another Ponzi scheme!

This is not so good for the dollar which is seen — rightly — as a Ponzi enabler. Our Ponzis aren’t magic anymore. Tragically, our current commodity- credit bubble cannot possible roll over the gigantic bubbles inflated since the end of Bretton- Woods. It’s ‘returns’ are counter- productive, crippling the output the bubble needs to support itself. We have collectively reached the end of the bubble gang- plank.

Once the bubble explodes, leverage will collapse in the ‘Mother of All Margin Calls’. The dollar will be ‘chastened’ and in tremendous demand. Finance in extremis will suck dollars out of circulation. For a time, the dollar will rule … and everyone will regret it!

Meanwhile, there is little in the way of velocity, the sign of a liquidity trap:

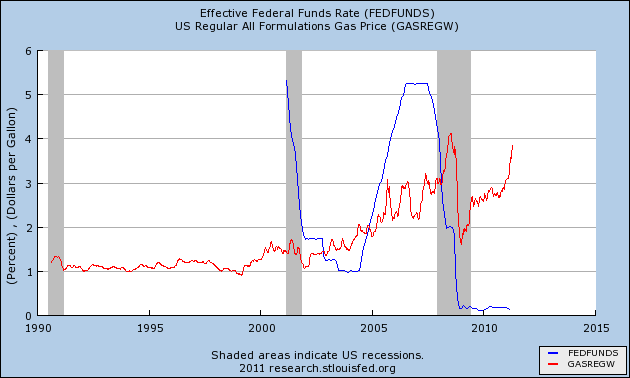

Monetary easing/tightening has had little effect on gasoline prices:

There is no relationship whatsoever between Fed easing and gasoline prices. Prices were rising when the Fed was putting capital into the system and rose when the Fed tightened. Gas prices are driven by endogenous factors. Monetary policy is more or less irrelevant.

Here’s Comex silver, inflated by commodity credit:

Here are the Brent Crude futures:

The increase in credit made available to finance fuel purchases and thereby bid up prices is suggestive. If ‘alternative’ forms of energy or even crude were on the market, the credit- carry trade would not be profitable. The reason such a carry trade exists in the first place is because fuel supplies are limited to those who can leverage themselves.

Monetary policy in the US is made in Riyadh — and at the gas pump — rather than Señor Piñata’s office: