After that long and rambling collection of musings about inflation went over like a lead balloon, time for something completely different!

First of all, let me stick my neck out:

Look carefully @ the inflationists’ critiques: inflation is an event that will take place starting tomorrow … What is happening now is the modest increase in the cost of some goods and services, not others.

Critics insist the dollar is GOING to die, the price of gold is GOING to explode, the price of gasoline is GOING to reach $10 per gallon … soon. When is ‘soon’ going to arrive?

It’s not just the inflationists! Over @ The Automatic Earth those impatient for immolation demand of Ilargi and the ever-charming Stoneleigh: “When is the deflation you promised us going to arrive, you two bums?” Kunstler gets the same treatment as well: with some people Armageddon is a relief!

Tomorrow … it’s always tomorrow. In the meantime, the daily dose is the same ‘blecchh’: the rich get richer, etc.

As a character in industrialization’s ‘Pimp-o-rama’, utopia’s kissing- cousin dystopia is always right around the corner. Establishment concern about inflation/deflation in the US is of a marketing piece with the rest of consumer culture: it’s the ‘fad of the moment’.

Nobody can predict the future, not even brilliant geniuses like Stoneleigh. Most analysts have problems describing the present: what is taking place under their feet.

Analysis is mired in modernity. Modernity is entirely self- contained, self- rationalizing and self- referential. Modernity includes all of its necessary enabling components including ‘monetary’ gold, silver, crude oil, dollars … everything. Whatever modernity fails to absorb or conquer, it counterfeits. All of modernity’s components contain within themselves a crude oil ‘liability’ as a sub-component.

Inflationists implicate assets as assets and nothing more. Self- created paper is both internally interchangeable with other forms of paper and all is declining in value … at some arbitrary rate relative to the crude liability. This decline in value is what inflation is.

The surrounding argument is that value relationship dynamic is permanent … when it cannot possibly be so! The implied value of assets may decrease or not … there is no way to predict.

There are two kinds of assets: those that are readily exchangeable for the crude liability (extinguishing it) and everything else! Swappable assets have value. All the other assets are worthless trash even if it’s hard to tell @ the moment which assets are which.

Okay … if you just have the liability and nothing else … on the corporeal balance sheet, you have no economy! Congratulations! You’ve burned through your oil and ‘bounced the rubble’ out of frustration! The liability is represented by the abandoned ‘ghost suburbs’ that rot from sea to fetid, stinking, radioactive sea!

If you still have an economy (which we do to a point) assets exist which are equal to the liability … that’s just the way it is!

Then … there are the superfluous rest. These so- called assets are worthless regardless of whatever claims anyone makes for them. ‘Inflation’ as it exists today is the spread between the ‘hope value’ attached to the excess assets and the underlying reality.

In a world with a semi- functioning economy and an obscure crude oil liability worthless assets can gain (large) nominal value when- and wherever believable- appearing lies can be spread about them. Inflationists insist that ‘money’ in all forms is freely interchangeable: that simple quantity of of money will bid the price of all that is worthless.

Perhaps the intent of the central banks is to do just this but it is self- defeating. Stranded goods are unable to service their own costs: increasing costs by whatever means is not going to ‘un-strand’ them?

All forms of money are not interchangeable. Credit is a form of money that is bought with other forms. How can credit avoid being stranded like gas-guzzling SUVs if it cannot ‘pay for itself’? Mr Bernanke, brilliant as he is did not take the opportunity of his press conference to address this central question.

Asset market mechanisms also conspire to push up prices. This is taking place right underfoot in the precious metals exchanges where dubious paper assets are unredeemable for anything but more paper. There is an excess of assets — EFT shares, futures contracts and options on futures –against precious metal liabilities, represented by the actual amount of metals available in the markets.

The ‘paper gold’ and ‘paper silver’ are the inflationary equivalent of QE2 or whatever. Some small part of the paper will be traded for real gold or silver. The rest is in the hands of market fools who will wind up with nothing.

During the Great Oil Spike of 2008 assets purporting to represent crude were created far in excess of the actual black goo available in the market. The paper excess did indeed drive up the price … to the point where economic activity could not support it. The asset bubble mimicked inflation that ended with a lopsided sell side market and long- speculators being annihilated.

The fuel- dependent world will be forced to recalibrate its crude liability after the buy- side games have fatally undermined fuel- dependent economies. The undermining process is visible but only just, behind a scree of propaganda, asset creation and pseudo- inflation.

Not only is there a fuel shortage but a corresponding cash- money shortage. Some inflation: who has all the cash? Rich people, of course …

There is another intertwined self- amplifying issue: modernity is useless without oil, remove the modernity and oil becomes worthless as well. Nicole Foss makes this point repeatedly: oil scarcity demands increasingly efficient extraction/consumption ‘innovations’. These innovation are in turn stranded by the increased costs and shrinking margins. Which assets will escape stranding? A complex and counterintuitive calculus hangs over how to transition away from oil dependency.

Transition to what, exactly? Electric carz? Solar panels? Thorium reactors and business as usual or a return to small farms and agrarianism? All are assets, some of these will wind up marooned along with the giant pickup trucks, jet airliners and factory chickens.

Alternatives to Nihilism, Part Three: Remember Your NameDuring the Seventies, a great many Americans came face to face with the hard fact that they could have the comfortable and privileged lifestyles they were used to having, or they could guarantee a livable world for their grandchildren, but they couldn’t do both. The vast majority of them – or, more precisely, of us – chose the first option and closed their eyes to the consequences. That mistake was made for understandable and profoundly human reasons, but it was still a mistake, and it haunts the American imagination to this day.

The impact of that choice is perhaps easier to trace on the conservative end of America’s social and political spectrum. Forty years ago, the Republicans had at least as good a record on environmental issues as the Democrats, and the idolatry of the unrestrained free market that pervades the American right these days was a fringe ideology widely, and rightly, considered suspect by most conservatives. For that matter, creationism and speculations about the imminence of the End Times were consigned to the fringes by most American Christians, who by and large considered them irrelevant to the task of living a life centered on the teachings of the Christian gospel.

All these things changed in a hurry at the end of the Seventies. Why? Because the attitudes that replaced them – the shrill insistence that the environment doesn’t matter, that the free market will solve every problem, that the world was created in 4004 BCE with as much oil, coal, and gas as God wants us to have, and that the world will end in our lifetimes so our grandchildren won’t have to deal with the mess we’d otherwise be leaving them – are all attempts to brush aside the ugly fact that the choices made at the end of the Seventies, and repeated by most Americans at every decision point since then, have cashed in the chance of a better future for our grandchildren, and spent the proceeds on an orgy of consumption in the present.

Take that future generations, you undeserving scum! By the way, do you think you can lend us … twenty trillion bucks? How about thirty?

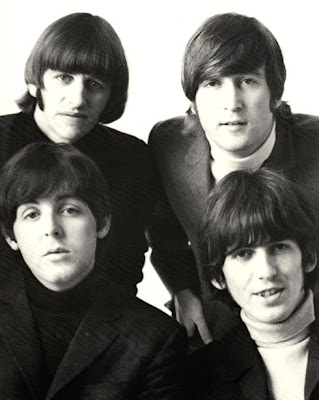

Far more important is whom to blame. Greer fixes on so-called ‘conservatives’ (conserving what, exactly?). Better to blame the Fab Four and the bleary, paisley nonsense that drifted along like flotsam in their wake.

If you remember the sixties you weren’t really there … irresponsibility became acceptable, institutionalized. After Ringo, Richard Nixon was inevitable. Greer’s implication is the transition to our current state from our current perspective represents a ‘Hyper- wicked problem’.

What is a hyper-wicked problem, you ask?

I’m really glad you asked! Let’s look @ wicked problems:

Jeff ConklinSeeking to generalize the concept of problem wickedness to areas other than planning and policy, Conklin identifies the following as defining characteristics of wicked problems:

- The problem is not understood until after the formulation of a solution.

- Wicked problems have no stopping rule.

- Solutions to wicked problems are not right or wrong.

- Every wicked problem is essentially novel and unique.

- Every solution to a wicked problem is a ‘one shot operation’

- Wicked problems have no given alternative solutions.

Problem examples

Classic examples of wicked problems include economic, environmental, and political issues. A problem whose solution requires a great number of people to change their mindsets and behavior is likely to be a wicked problem. Therefore, many standard examples of wicked problems come from the areas of public planning and policy. These include global climate change, natural hazards, healthcare, the AIDS epidemic, pandemic influenza, international drug trafficking, homeland security, nuclear weapons, and nuclear energy and waste.

In recent years, problems in many areas have been identified as exhibiting elements of wickedness – examples range from aspects of design decision making and knowledge management to business strategy.

A wicked problem has solutions that are themselves problems, which may be of greater consequence than the original problem … and there is no way to know if this is so until the solution is attempted. Of course, there may be no solution at all rather an expansion or amplification of the original problem or a cascade of successive unsolvable problems.

A hyper-wicked problem is not a large wicked problem but rather one whose existence is not perceived until it is too late for any possible solution to be attempted. Few outside the Club of Rome in 1970 could have articulated Greer’s ‘hard fact’. The concept of Americans having to confront some kind of choice existing outside the boundaries of privilege was invisible at the time. It’s largely invisible now, which directs a great deal of credit to the observation by Greer:

Americans … face to face with the hard fact that they could have the comfortable and privileged lifestyles they were used to having, or they could guarantee a livable world for their grandchildren, but they couldn’t do both.

The observation of Greer’s insight within our shared present is not a critique of Greer. He brilliantly rearranges the inscrutable past coherently and by doing so exhumes the hyper- wicked in its frightening dimensions. Unfortunately, the dim light of realization has not penetrated much farther than Greer’s circle of readers and hard- core anti- establishment cynics like myself.

Americans — and ‘American wannabes’ worldwide — are still reaching for the Kool-aid.

When reality strikes it will be massive … and far too late to contemplate solutions outside those the problem itself has already begun to impose. This has to be John Lennon’s fault …

Meanwhile, if you haven’t already shoot over to The Oil Drum are read Jeremy Grantham’s ‘Inflection Point’ article. Grantham is a trend- follower who sees that the road has forked and that the ‘old rules’ of industrialization do not apply. It IS different this time …

Time to Wake Up: Days of Abundant Resources and Falling Prices Are Over ForeverThe purpose of this, my second (and much longer) piece on resource limitations, is to persuade investors with an interest in the long term to change their whole frame of reference: to recognize that we now live in a different, more constrained, world in which prices of raw materials will rise and shortages will be common. (Previously, I had promised to update you when we had new data. Well, after a lot of grinding, this is our first comprehensive look at some of this data.)

It’s a grim article. Grantham boots mathematicians, I’m not sure why. Any decent mathematician would understand that 3000 years of 4% annual compounded growth of anything would pretty much fill a large part of the observable universe. Keep in mind that Grantham’s insistence on higher prices does not mean inflation. What matters is the cost of fuel versus the return on its use.

Speaking of mathematicians: here’s the Taylor Rule (from Zero Hedge):

For The First Time Since The Great Financial Crash, Taylor Rule Implies A Federal Funds Rate Higher Than Actual …Submitted by Tyler Durden

Following yesterday’s release of advance Q1 GDP and deflator data,for the first time since the full unwind of the Great Financial Crisis in late 2008, early 2009, the Taylor rule is not only positive (it hit 0.1% in Q4 2010, in line with the federal fund’s rate) but has now jumped substantially above the prevailing interest rate, hitting +0.4% in Q1 2011.

A rate is change over time: I need a tool that re-states the change in energy cost over time as an interest rate change. In other words, a rise of ‘X’ in fuel costs is equal to a ‘??’ rise in money cost. Any math peeps out there?