The ‘question du jour’ is — and has been for awhile — ‘when’?

‘When’ is the dam going to burst? ‘When’ will the coyote hanging in mid-air fall? ‘When’ is the decrepit status quo going to collapse?

‘When’ is so … yesterday! Coyotes have been dropping for five years. The process has been satisfactorily papered over to a large extent. Managers have learned a lot about crisis management since 1929 and 1973 and 1987. When there are difficulties the managers know to run out the shills. The public — and markets — are credulous. They want to believe. Nobody wants a Greater Depression and will do whatever is possible to avoid one.

There was no television in 1929. There was no Internet in 1973 or ’87. With modern media there are unlimited distractions that can be offered at near zero-cost. In order to divine reality one has to look for irretrievable actions on the part of managers themselves: you have to follow the running feet.

Here is some distraction right here:

Building the Next China

Stephen S. Roach (Caixin)

Concerns about the country’s economic situation are overblown and ignore a significant fact: urbanization will be the next engine of growth.

But the hype of the pessimists overlooks one of the most important drivers of China’s modernization: the greatest urbanization story the world has ever seen. In 2011, the urban share of the Chinese population surpassed 50 percent for the first time, reaching 51.3 percent, compared to less than 20 percent in 1980. Moreover, according to projections by the Organization for Economic Cooperation and Development, China’s already burgeoning urban population should expand by more than 300 million by 2030 – an increment almost equal to the current population of the United States. With rural-to-urban migration averaging 15 to 20 million people per year, today’s so-called ghost cities quickly become tomorrow’s thriving metropolitan areas.

Shanghai Pudong is the classic example of how an “empty” urban construction project in the late 1990’s quickly became a fully occupied urban center, with a population today of roughly 5.5 million. A study by international management consulting firm McKinsey & Co. estimates that by 2025 China will have more than 220 cities with populations in excess of one million, versus 125 in 2010, and that 23 mega cities will have a population of at least five million.

China cannot afford to wait and build its new cities until after newly migrated citizens have arrived. Instead, investment and construction must be aligned with the future influx of urban dwellers. The “ghost city” critique misses this point entirely.

See? Everything is going to be fine! Why? Because Roach says so! He’s a high-powered financier shill with fingers on the pulse. He makes the, “They aren’t making any more land,” argument. With more people and the limited amounts of build-able land certainly demand/prices/economies have nowhere to go but up, right?

Problem is nobody is making more people with money. The money trend is going in the wrong direction: the reality direction as James Howard Kunstler would put it. More people are going broke faster. What remains of money vanishes from circulation, lines of credit are cut off, putative apartment buyers are denied mortgages because they simply don’t earn enough to make the payments. The tens of millions of empty apartments that Steve Roach celebrates are mostly owned by a modest group of Chinese speculators with access to no-questions-asked, low-cost credit. These speculators are stranded, waiting for the horde of Chinese consumers who are never going to arrive. As in the West, the cost of credit … has become too high for individual buyers to afford.

The speculators are victims of their own greed. In order to sell and capture gains they must find buyers who are more successfully greedy than they are (or the government has to bail them out).

The 300 millions that Roach and the Chinese speculators are counting on are near-penniless rural peasants and sweatshop workers. Already these workers complain that urban housing is unaffordable. This worker-demand never really mattered, instead it was the supply of credit from overseas looking for yield. China has been at the end of a massive capital pipeline from the US and elsewhere. The Chinese narrative of perpetual real estate growth and ever-increasing prices is the same as the free-money narrative in America, UK, Dubai, Spain, Ireland and elsewhere. Credit flowed into real estate in all these countries at the same time. Meanwhile, economies were cutting workers’ earnings: something had to give … and has.

There is more to economies than assuming can openers, they are sub-components of culture. What economies manage are cultural goods, not ‘things’ but surrogates for things. What makes China China are the cultural fetishes that represent Chinese ‘modernity’ with an accompanying narrative of American-style material progress.

What American commercial artists, television producers and advertising managers devise, the unimaginative Chinese instantly covet. Their defining idea of America is post-Dean Martin-Joey Bishop-Liberace-Bugsy Siegel Las Vegas: the entire country is turned into a cheesy version of The Strip. The ‘Old China’ that passed the test of centuries is swept away as rapidly and completely as possible. It is replaced with forests of vacant, brutalist 60 story concrete towers, freeways, rail networks, shipping terminals, shopping centers, airports and the rest of Sprawl-America automobile detritus. All of this rests uneasily alongside gigantic, Earth-destroying/polluting industrial complexes … collateral needed to propel the whole mess forward.

The China narrative has been offered as the improbable Horatio Alger communist-rags to riches story: gritty (fanatically xenophobic) workers competing with the rest of the world to make its shoes, pants, salad shooters, lawn furniture, oil tankers, catalytic crackers, CNC machines, automobiles, nuclear reactors, poison dog food and other consumer ‘durables’. According to the narrative, Chinese are ambitious, hard-working, enduring, risk-taking hyper-capitalists. The Chinese planned economy is well-managed. The Chinese don’t make foolish policy errors as do Americans or Europeans, they aren’t lily-livered softies, they crush anyone and anything who stands in the way of progress. They do whatever is necessary to become rich as fast as possible.

This is the establishment’s narrative, one of non-stop ‘sustainable growth’ … Despite hiccups, growth is assured to begin … tomorrow!

Tomorrow: if you have to ask how much it costs you cannot afford it, (BBC):

China city party chief ‘fled with money’

A Chinese report says billions of dollars have been stolen by corrupt officials in recent years

A former top official of a city in northeast China has fled the country – reportedly with millions of dollars, Chinese reports say.

Wang Guoqiang, who was party secretary of Fengcheng city in Liaoning province, left for the United States in April with his wife, the People’s Daily said.

Local officials said Mr Wang, who was being investigated for corruption, had been removed from his post, it said.

Several reports cited 200m yuan ($31.5m; £20m) as the amount taken.

The local officials did not elaborate on allegations that he had embezzled and transferred the funds to the US, where his family is believed to be.

A report released by China’s central bank last year said more than $120bn (£74bn) had been stolen by corrupt officials who fled overseas, mainly to the US.

Between 16,000 and 18,000 officials and employees of state-owned companies left China with the funds from the mid-1990s up until 2008, the report said.

Officials and other prominents taking wads of cash and going to another country is irreversible. Rather than happy multitudes goose-stepping toward prosperity and their very own high-rise apartments, the rats are fleeing from the sinking Chinese ship as fast they can.

If the Treasurer for the city of Las Vegas (Pop. 580,000) stole $30Mn of tax payer money and fled to Canada or Australia, the US FBI would have the Aussies and Canucks hunt them down and have them extradited back home. Why aren’t the Chinese doing the same thing?

The authorities enacted a ban immediately to report on the case, and blocked Wang’s name in search engines. However, in blogs, the news spread faster than censors could delete it.

What matters is the sanctity of the narrative, who cares about the money? Under everyone’s noses, China is morphing from a capitalist paragon into (another) nose-diving coyote.

It’s not just the thievery and corruption, it is the business ‘slowdown’. Steel makers, ship builders, property developers, banks and finance guarantee companies and manufacturers are corpses floating down the river. It really is different this time: none of these enterprises are ‘coming back’.

China + modernity = business collapse is not the dynamic the bosses had in mind when the made the jump to the America Way. As such, the Chinese arrived at the party just as the last line of cocaine was being snorted: the US narrative has fallen apart, so has the hyper-snobbish stiff-little-finger bourgeois narratives of Americanized Europe and Japan. Perhaps the Chinese should have examined the old whore’s fake boobs and pustulent genitalia more carefully before deciding to climb in bed with her.

Join Up!

James Howard Kunstler

Meet the new third party in national politics: Reality.

Reality is the only party with an agenda consistent with what is actually happening in the world.

Heh heh … reality IS what’s happening in the world.

Reality doesn’t need to drum up dollar donations from anyone. Reality doesn’t have to pander to any interest group or subscribe to any inane belief system. Reality doesn’t even need your vote. Reality will be the winner of the 2012 election no matter what the ballot returns appear to say about the bids of Barack Obama and Mitt Romney to lead the executive branch of the government.In the vicious vacuum that national party politics has become, the Republicans and Democrats are already dead. They choked to death on the toxic fumes of their own excreta. They are empty, hollow institutions animated only by the parasites that feed on and squirm over the residue of decomposing tissue within the dissolving membranes of their legitimacy. Think of the fabled Koch brothers as botfly larvae and the Securities Industry and Financial Markets Association PAC (SIFMA PAC) as a mass of writhing maggots.

The Reality Party is something that can be gotten behind here at Economic Undertow. Where does one go with all this? Managers race out the door with whatever loot that can be stuffed into suitcases. Here is the Euro-style reality, by way of Mark Grant:

The central bank of Spain just released the net capital outflow numbers and they are disastrous. During the month of June alone $70.90 billion left the Spanish banks and in July it was worse at $92.88 billion which is 4.7% of total bank deposits in Spain. For the first seven months of the year the outflow adds up to $368.80 billion or 17.7% of the total bank deposits of Spain and the trajectory of the outflow is increasing dramatically. Reality is reality and Spain is experiencing a full-fledged run on its banks whether anyone in Europe wants to admit it or not.

Just like China only more so …

Between December of 2011 and the end of March 2012 the Spanish banks bought $109 billion of the Spanish sovereign debt. Much of this was facilitated by the ECB who lowered and lowered again the collateral rules and handed the money to the Spanish banks in such a size that bad things, very bad things will result if Spain hits the wall and defaults. Then since March, as forced by their own inadequate capital positions, the trend has reversed and the Spanish banks have sold $21.3 billion of Spanish sovereign debt with $11.7 billion in July alone as capital flees from the Spanish banks and the actuality of the balance sheets overcomes the “dynamic provisioning” that helped to cause the fantasy.The friendly “suggestions” by national governments in Europe are also getting a push back from European buyers. BNP recently imposed a $12.5 billion debt limit by country and many other banks in Europe are following suit. BNP has reduced their sovereign debt holdings by 35% since June 2011. In July, the aggregate of sovereign debt reduction for all of the French banks was $8.7 billion as they took advantage of the ECB speculation to lower their holdings.

When the central bank is insolvent because it makes leveraged/unsecured loans or appears to do so — there is no lender of last resort. No lender of last resort and there is no guarantor for deposits. If all institutions are insolvent the currency which represents these things is worthless.

Capital flow is from bank account => account at another bank => account in another country => account in another currency => out of currency into durable good/asset. Unsurprisingly, the gold price is increasing during a period of credit deflation.

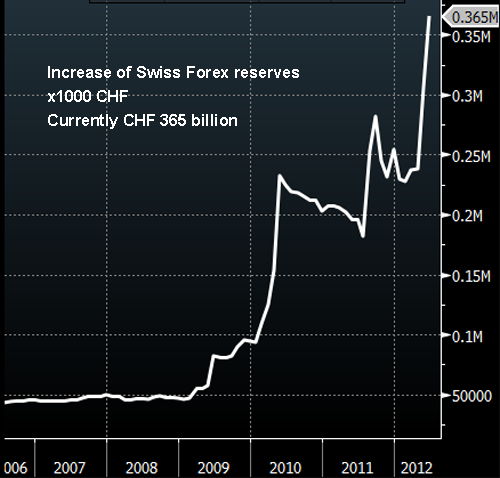

Figure 1: Keep in mind there are also bank runs out of Greece, Italy, Portugal and Ireland. funds flow from Europe into Switzerland, the flow itself jeopardizes the viability of the Swiss franc as it becomes a proxy for the increasingly worthless euro … the reason to prop up the euro at some stable rate of exchange is to facilitate removing funds from one country to another.

Spanish Bank Runs and Struggling Deutsche Bank:

There is a fully fledge bank run ongoing in Spain that is not being adequately reported in the mainstream news media. In June $70 billion dollars left their system. In July it was $92 billion which is 4.7% of total banking deposits. This means that from January to July of this year $368 billion or 17.7% of total banking deposits has fled Spanish institutions. Previously this money was heading for Switzerland and Germany but with the truth filtering out concerning the weakness of German and Swiss banks alternative destinations are now being chosen. The emerging weakness of Deutsche Bank is a particular worry for the ECB and the situation is being exacerbated by a sharply contracting German economy. As reported in Spiegel today:

“Euro Crisis Starts to Bite. German Export Orders Fell Sharply in August.

Exports are a major pillar of the German economy, but now the sector is starting to feel the impact of the euro crisis and the global economic slowdown. German export orders fell in August by the highest rate in more than three years, the Markit financial information company announced Monday after conducting a survey of 500 industrial firms.

“Survey respondents commented on a general slowdown in global demand and particular weakness in new business inflows from Southern Europe,” the institute said. The firms hardest hit by declines are manufacturers of machinery and other investment goods as well as producers of intermediate goods such as chemicals.

In the first half of 2012, German exports had still grown thanks to demand from Japan, the United States and Russia. But it was already evident then that exports to crisis-hit countries were falling sharply, and that trend is now continuing.

Markit economist Tim Moore said the German industrial sector is going through its worst quarter — the three months to the end of September — in more than three years.

“The new orders figures are especially disappointing, with export work dropping at the fastest pace since April 2009 amid an ongoing deterioration in global demand,” he said in a statement.”

ECB Boss Mario Draghi is trapped. He needs to keep propping that euro even as doing so is fatal. Direct bond-buying by the bank will accelerate bank runs and there will be nothing to be done to stop them.

Building/not building more concrete towers in China is fatal. Germany selling/not selling more automobiles in Europe is fatal. Adding more carbon/not adding carbon to the atmosphere is fatal. As for the Americans, the running game has been underway since the crisis began. The smart money is long gone from speculative markets, all that remains is the dumb money milling around waiting for tomorrow to arrive.

Comes that happy day, there are runs out of currencies. The Chinese thieves, the Spanish depositors and the rest are voting with their feet. The game is over and they are taking their balls home. All of them. It’s every man for himself and devil take the hindmost.