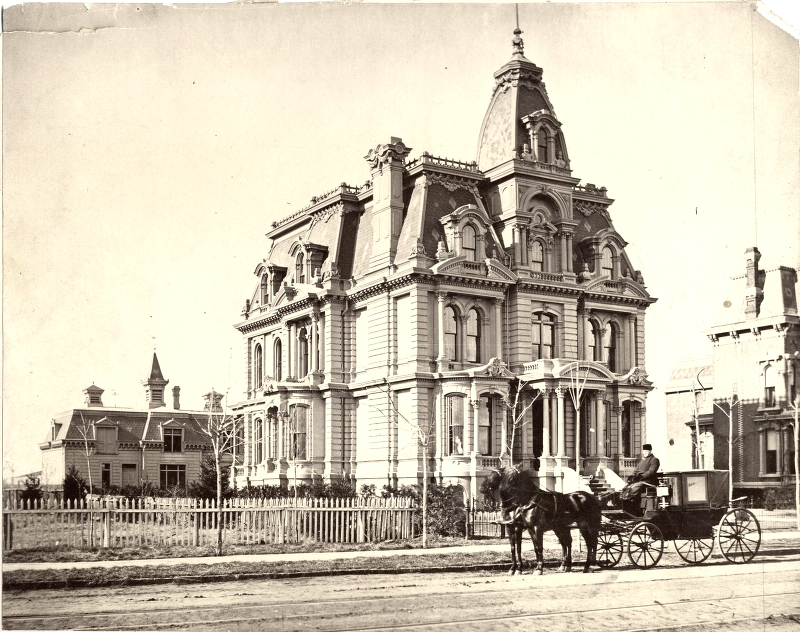

Unknown Photographer, Wilhelm Boeing house on Woodward Avenue at Kirby Street in Detroit (1881). Burton Historical Collection at University of Michigan Library. This house was replaced by the Cass Gilbert designed Detroit Public Library building in 1921.

The world did not end yesterday. The financial system did not crash. Petroleum did not run out and fluctuations in the weather were extreme but generally within historical limits. What comes next? A dislocation or more of the same?

What will going over the fiscal cliff mean? What happens when Spain — or France — needs a multi-hundred billion euro bailout? What happens when the new-old Japanese government fails to restart that country’s economy? What happens in China?

One thing to keep in mind, the world’s central banks are fully committed already. If/when there is a deleveraging event, there is little more that the central banks can do other than lend from their discount windows. Administrative interest rates are nearly zero in the US, Japan, the EU and in UK. They cannot be lowered further. Also, Japan, US, EU and UK central banks are now credit providers for both governments and large sectors of their respective economies. The (small) incentives the private sector had to lend have disappeared. It also means that promissory notes/IOUs for loans made in the past — which are the collateral for the central banks’ loans — are in diminishing supply. The central banks can lend additional amounts to governments and the private sector, but the positive shock of such lending is diminished and the danger of central banks making unsecured loans increases.

Unsecured lending by the central bank is a danger because leverage is the reason why the commercial lenders have failed in the first place. When the central banks take on all the private sector unsecured loans or they offer their own loans in excess of collateral they become super-sized, insolvent commercial lenders. The consequence is no effective lenders of last resort. Depositors look to remove funds from banking system which in turn accelerates system insolvency. Nobody wants to be caught where the only effective collateral is deposits (currency) and where claims against currency exceed it.

Will central banks be tested in 2013? Maybe not but that certainly does not mean clear sailing.

– In 2013, look for the ongoing bank/deposit runs underway in Europe to accelerate and for Spain and Greece to default (Greece is already in Selective Default according to the Standard and Poors rating agency). The depositor runs indicate that central bank has been making unsecured loans and that system is insolvent rather than individual banks.

– In a shocker, look for the French government to seek an IMF-EU bailout.

– France’s automobile- and banking sectors will collapse in 2013.

– EU fuel consumption will decline sharply in 2013. Regardless of the price for fuel in Europe, it will be too high.

– German auto production and sales will also decline … perhaps not as sharply as makers in other western European countries … as Chinese and US car buyers vanish.

– Look for auto sales, registrations and production to decline in western Europe while Eastern European manufacturers will continue to hold steady or decline more slowly than their western counterparts. The eastern European manufacturers have a wage advantage over the counterparts and a local market that has not been completely saturated. Furthermore, these manufacturers are not dependent upon sales to China (Germany) or the US (Japan) or to southern European countries such as Spain and Greece … as are the carmakers in France and Italy.

– As long as the European Central Bank lends there will be no pressure for any country to leave the euro-zone and (re)introduce their own currency. However, if any one country abandons the euro, all of them will be effectively gone as Germany will be the second country out the door. Europe’s liabilities are currently the shared burden of the ‘EU’ but will be effectively lodged against Germany if the EU cracks … Germany is one of the few countries in Europe with any money. The Germans will not invest it in European ‘solidarity’ that no longer exists.

– Look for the politics in Europe to become more conflicted as the governments endeavor to restart chimeric ‘sustainable’ growth and fail miserably. The economic problems on the Continent can only be solved by stringent conservation, not attempts to waste more resources, faster. Europe cannot afford the resources.

– Angela Merkel will easily win her re-election bid as the main opposition party is unable to find a candidate who can pass the sniff test. Merkel will remain in charge even if the Eurozone falters and Germany exits.

– Segments of the populations of Spain, France, Greece, UK and in many eastern European countries will descend further into poverty, with food- and fuel shortages and homelessness.

– Look for more weather ‘events’ in 2013 including more severe drought and flooding. The pressure on governments to ‘do something’ about climate change will increase … Europe, China and India will respond by burning more coal …

– Look for higher prices for grains due to bad weather. Humans have to buy and drive cars to keep economies alive. Humans have to buy and eat food to keep themselves alive: the marginal human will choose paying for food at any price … versus paying for expensive/useless cars.

– The US government will propose a minuscule carbon tax of $10 per ton along with a ‘cap and trade’ system that rewards energy speculators and big polluters.

– Look for at least two wide-area gasoline/fuel shortages occurring in the US as preludes to permanent shortages occurring in 2014. The prices needed to bring fuels to market are becoming unaffordable by rapidly impoverished Americans.

– Look for fuel prices on spot and futures markets to generally decline (as customers continue to go broke).

– Look for Japan’s Shinzo Abe government to fail over its pro-nuclear power policies. The nuclear industry is completely discredited in Japan, ‘Shinzo Abe 2.0’ will be a failure like the first version.

– Look for Japan to have a funding crisis next year: such a crisis has been predicted for the past twenty years but 2013 will be the year when the prediction becomes reality. The Bank of Japan will be unable to fund the government plus the country’s massive debts by itself. That the establishment cannot imagine a change from the current state of affairs indicates a change is imminent. The difference between next year and the past is Japan’s declining electronics industry and tepid car sales. The outcome is an decreasing foreign trade surplus, which has been the means by which Japan has financed itself.

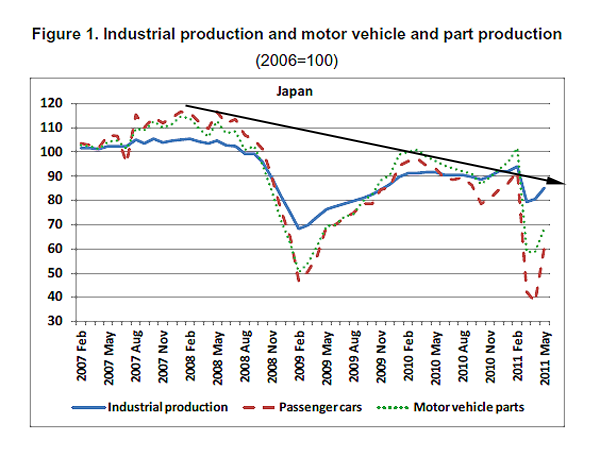

Figure 1: from the OECD, noting the secular decline in both the Japan auto industry and manufacturing in general. A business can borrow against its own account(s) such as credit lines or consumer credit (if an individual). A business can borrow against the accounts of its customers (when they borrow to buy the business’ products), against the accounts of the state (by direct credit subsidy, a tax benefit or by way of currency issue) and against the accounts of overseas customers (by way of foreign exchange). Japan has been able to borrow from foreign customers and undercut competitors: now the customers are broke or going.

– In light of the foregoing, Japan will do everything within its power to depreciate the yen to support its flagging car- and electronics industries’ exports: the Bank of Japan will lend without restraint.

– The other major economic powers will attempt to depreciate their own currencies by offering more central bank loans. The biggest issue for 2013 is how long can the economies function when sole provision of credit is by central banks … and when there are no real lender(s) of last resort?

– For this reason, gold prices will hold up relative to other commodities which will will tend to follow the price of crude oil.

– US Congress will not agree to tax increases by January 1, the sequestration process will take effect the following day. Thousands of Federal government employees are set to be furloughed as the Congress struggles to resolve related debt ceiling/revenue issues in a politically palatable way.

– The US debt ceiling will be reached at the end of January (approximately) and the tedious discussion will take place regarding increasing US debt and by how much. The Congress will ultimately cobble together a can-kicking ‘solution’ that lifts the government’s debt ceiling while leaving the US debt burden largely unaltered. The debt is an unproductive claim against economic output … the debt can only be serviced by more borrowing. The US public sector deficit finances the private sector’s surplus. The US cannot increase output to effect the debt as increases are borrowed, the alternative to borrowing is default … the US economy is trapped.

– Look for the Chinese economy to continue to unravel as its overseas customers find it difficult to borrow.

– Look for more repressive measures in China as its downturn effects workers in cities rather than farmers losing property rights. There will be more riots and work stoppages followed by crackdowns.

– There will be more business bankruptcies in China and capital flight as Chinese tycoons take whatever dollars they can find and run.

– The Syrian government of Bashar al-Assad will fail with US-supported militant jihadis gaining ascendency. This in turn will give a reason for the US to intervene and destabilize the country further.

– Look for Salafist consolidation in Egypt. That Salafi- and Shiite extremism are the only coherent, ongoing anti-modern enterprises reflects a world-wide failure of imagination.

– As US military involvement decreases in Afghanistan, look for compensating increased involvement in Somalia, Yemen, Uganda, Kenya, Mali, Democratic Republic of Congo, Nigeria, southern Africa, Venezuela, Honduras, Bolivia and elsewhere.

– Look for more diplomatic- and military crises in South China Sea between China, Vietnam, the Philippines and India; between China and Japan over the Sea of Japan; between Iran and the West in the Persian Gulf; between Russia, Norway and Canada over the Arctic Ocean. All of these disputes — plus US military operations in Africa — concern petroleum and mineral resource claims.

– Argentina will default in 2013.

– Canada will have a banking crisis as the worth of real estate in areas of the country outside of Vancouver, BC, will plummet. The government will be forced to bail out its major banks.

– Australia will likewise have a banking crisis due to declining real estate prices and an over-leveraged banking system.

– US real estate prices are now in a short-term quasi-bubble peak and will decline over the course of 2013.

– US natural gas prices will increase due to declining output in shale plays. The cause will be less drilling activity and declining prices for gas liquids and stock prices of gas drillers (sez the New York Times):

“… while the gas rush has benefited most Americans, it’s been a money loser so far for many of the gas exploration companies and their tens of thousands of investors.”

– The recent increase of US oil output will level off. This will be ‘a big shock’ to the public which has been promised increased production and lower prices. There will be declines in conventional oil fields to offset gains from tight-oil deposits. Any gains in high-priced export market will be more than offset by losses in domestic markets as customers cannot meet the higher world price.

What progress looks like in Detroit: the renumbering of Detroit’s street addresses in the 1920s put Wilhelm Boeing’s house here. At least it isn’t a parking lot, a metal-and-plastic shed or an abandoned building.

– Russian petroleum production will continue to decline: keep in mind, the arc of Vladimir Putin’s political career has paralleled the output of Russian oil fields.

– Kurdistan will make a deal with arch-enemy Turkey to ship its oil and turn away from dealings with the Shiite Iraqi government. The Iraqi government lacks the military horsepower to have its way with the Kurds, the decline of petroleum revenue will weaken the Iraqi government further.

– Israel will not attack Iran in 2013. The country cannot afford a major war because the Israeli’s sponsor America cannot afford one. At the same time, any significant petroleum shortage will be blamed on Middle Eastern suppliers, if a war is necessary to provide cover for politicians in Washington, one will be started.

– The steady unraveling of the string economy will continue. Both bonds and stocks in the US will be largely unchanged over the course of the year, largely due to ‘capital’ flight from Europe and the Far East. Given large-scale central bank lending, the credit spreads for European sovereigns and the UK will narrow somewhat. Japan credit costs will climb as the need for credit will be greater than what the Bank of Japan can provide by itself.

– A wildcard would be gunmen shooting up a police station in the US instead of a school. Government would be exposed as vulnerable, the militarization of the police would be demonstrated to be a failure. Putting police into fortresses as a reaction would make them even less effective, would further isolate government police power. There is a reason for militant attacks on police stations overseas: they work.

Steve adds:

2013 will be the year of the Marginal Human: among other things, Mr. and Ms. Marginal will have less purchasing power.