The North Dakota Department of Mineral Resources made a presentation to native peoples’ tribal leaders in the state last fall regarding oil and gas production in the Bakken area, (PDF alert). It’s a comprehensive report and worth the time to examine it. This jumped out:

Figure 1: “Oil price could fall enough to make some areas uneconomic” (click on for big). At issue is whether prices in certain areas of the US are low enough to shut in marginal production already.

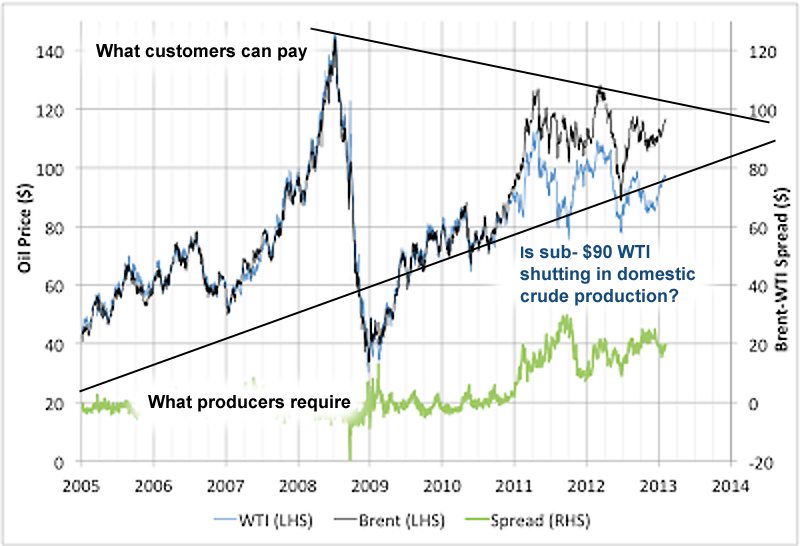

Figure 2: the cost of Brent crude vs. the ability of crude customers to pay for it made graphic, from TFC Charts. What the chart can’t say is that the industrial world is impoverished by the high cost of crude in a vicious cycle. What it also doesn’t show is that real fuel prices will increase relative to other costs, even when nominal prices decline. Funds must be diverted toward obtaining fuel away from the purchase of non-fuel goods and services. When the drillers gain credit the customers are deprived of it … the alternative is less fuel.

Little has changed over the past two weeks except that Brent prices are a little higher due to war fears in the Middle East, moral hazard by central banks and nonsense bullish frenzy that has overtaken asset speculators. Right now, customers are borrowing at the expense of drillers. If the prices climb high enough, listen for ugly noises from the euro-zone or Japan as the higher prices bite hard … and businesses (banks) start to fail. That will be the end of the bullishness.

Keep in mind if the economy starts deleveraging (again), there is little the establishment and central banks can do but stand aside and wring their hands. Everything has been committed already: interest rates are at near zero, governments are at the borrowing limit, there is little in the way of collateral remaining for central banks to take on as security for new loans.

Speculators don’t realize conditions are fundamentally different this time … nations, regions, individuals and firms have experienced temporary shortages of fuel, credit and other resources in the past due to wars, droughts and other disruptions: the world in its entirety has never run out of energy before, which is what is underway right now.

| Commodity | Units | Price | Change | % Change | Contract | Time(ET) |

|---|---|---|---|---|---|---|

| Crude Oil (WTI) | USD/bbl. | 95.72 | -0.11 | -0.11% | Mar 13 | 17:15:00 |

| Crude Oil (Brent) | USD/bbl. | 118.90 | +1.66 | +1.42% | Mar 13 | 18:00:00 |

| RBOB Gasoline | USd/gal. | 305.88 | +5.89 | +1.96% | Mar 13 | 17:15:00 |

Is $118 the new $147? Here is another look from Stuart Staniford:

Figure 3: Brent and WTI performing together on the same stage (click on for big). The lower West Texas Intermediate price is good for refiners who can sell products outside the Midwest at the world price. This is a burden for drillers as Bakken formation supports the most expensive, fastest depleting wells on Earth. Landlocked wells put the squeeze on drillers: if the Bakken oil field was near the Gulf coast, drillers could sell their crude at the Brent price, putting the squeeze on refiners instead.

– Drillers have to keep pace with depletion in the Bakken and similar tight fields so large numbers of wells have to be drilled continuously.

– Drillers also have to keep pace with depletion in conventional formations which is occurring at a rate + 4% per year.

– Drillers in the US face an inhospitable environment: oil-field labor shortages, skeptical regulators, anti-fracking activists and the price squeeze.

Rune Likvern (Oil Drum) called keeping up with Bakken depletion rates ‘Running With the Red Queen’ Drillers need to punch holes in the ground at ever-increasing rates just to maintain current rates of output. Any slacking in efforts and flows of product decline sharply, says Likvern:

In reality, it was the growth in the oil price to an apparent structurally higher level that secured commercial support for crude oil production from shales. In that respect it was the oil price that was the true game changer and unleashed the “shale/tight oil revolution”. There is a saying that goes like; “Do not listen to what they say (technology). Look at what they are doing! (spending borrowed money)”. This may as well go for the Bakken formation.The oil service giant Baker Hughes recently expressed concerns about slowing activity levels in shale plays if oil prices moved below $80/Bbl. Further the oil companies Marathon and Occidental recently cut back on their activities in the Bakken formation. Oil and gas companies still care about the colors of the numbers at the bottom line for their projects.

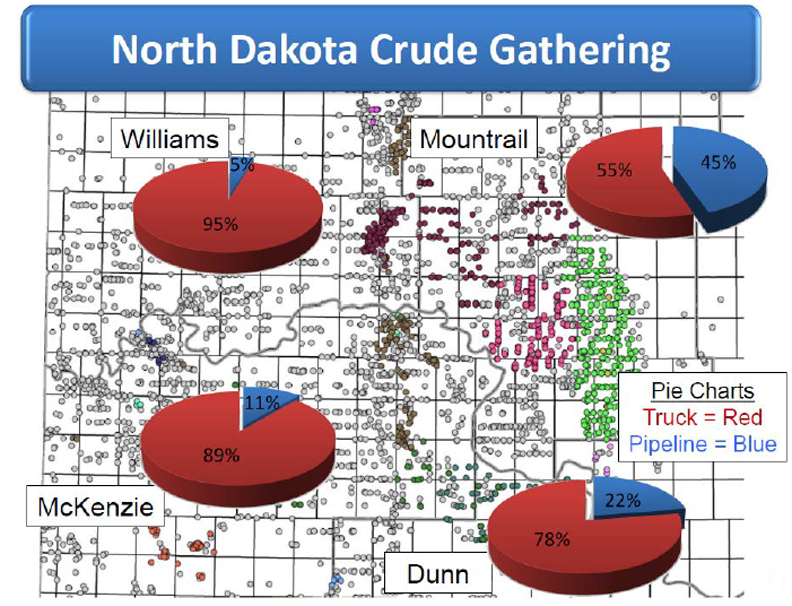

How landlocked is the Bakken crude? Most of the product is shipped by truck to pipeline terminals and railheads, (from the Mineral Resources presentation):

Figure 4: Running with the Ace of Spades: by the time the transportation mess is straightened out the Bakken fields will be depleted.

Coastal refiners must pay world prices for crude while selling high cost products. As a result of the squeeze, coastal refiners are going out of business. Here is a clip from Stillwater Associates:

US East Coast Refinery for Sale: Who’s Buying?Earlier in September, Sunoco had announced plans to sell its Marcus Hook and Philadelphia, PA refineries, noting that the refineries had been profitable for only two of the last 10 quarters, and stating that both refineries would be idled in July 2012 if buyers have not been found. However, in an early November conference call with analyst, Lynn Elsenhans, Sunoco’s CEO and Chairman, stated that “…if at any point we believe it’s in the best interest of the shareholders to either stop operating (Marcus Hook and Philadelphia) or change their utilization rate, up or down, even if that’s before July, 2012, we would take the appropriate action.” Sunoco Refining and Supply reported a $17 million pretax loss for 3Q 2011, the ninth quarter out of the last 11 for which Sunoco Refining and Supply lost money.

When ConocoPhillips announced that it was seeking a buyer for the Trainer refinery, Willie Chiang, then ConocoPhillips’ Senior Vice President of Refining, Marketing, Transportation and Commercial, noted that their decision to sell, like Sunoco’s, was based on unfavorable economics caused by a competitive and difficult market environment characterized by “…product imports, weakness in motor fuel demand, and costly regulatory requirements.”

So, who will buy these refineries?

Valero has been mentioned by some as a possible buyer, but Valero exited the refining business on the US East Coast when it sold its Paulsboro, NJ and Delaware City, DE refineries in 2010. Valero has said it plans to move gasoline from its recently acquired Pembroke, UK refinery, which can process heavier sour crude, to the US East Coast.

Keep in mind, the transport bottleneck is the reason for so much gas flaring in tight oil formations. Gas does not command a price high enough to support a crash program to build out distribution infrastructure. Meanwhile, enough gas to heat a big city like Minneapolis is wasted.

Keith Schaefer @ Oil and Gas Investment Bulletin says:

A vertical well into a conventional oil field costs something like $1 million. The Bakken’s horizontal, multi-stage frack wells cost an average of $9 million, according to the North Dakota Department of Mineral Resources.That’s a huge upfront cost. Each well produces approximately 615,000 barrels of oil, meaning the breakeven price for each Bakken well ends up in the $70-$90/barrel range, once taxes, royalties, and expenses are included. If oil prices slump below that level, a lot of people say Bakken wells aren’t worth the cost.

A lot of people like grade school arithmetic teachers. Because businesses cannot lose money perpetually, low prices keep crude in the ground … conservation by other means.

As the wells in the Bakken grow closer together, initial production rates are sliding. According to some sets of data, average first year well output climbed steadily from 2005 to a peak in mid-2010, then declined almost 25% over the following 12 months.With more wells tapping into the same resources, there is simply less oil pressure available to each well. And when initial well output starts to fall, an accelerating number of new wells must be brought online to sustain overall production volumes.

Such is the heart of the pessimist argument: that sliding initial flow rates will tag-team with the Bakken’s high decline rates to mean that, no matter how many new wells are drilled, production will stagnate.

One thing to keep in mind is when oil-bearing rock is fractured, it is turned into gravel, the stones held apart by propants: sand or ceramic grains. Once rock is fractured, it cannot be fractured a second time. Fracking is ‘one and done’.

Of course, the real problems are on the consumption side, not the production. Consumption is waste, it does not and cannot pay for itself. What does the heavy lifting is debt and lots of it. We’ve had debt around for so long we’ve gotten used to it. What we are starting to realize is the monumental costs that debts impose. Debts are too large to repay, they must be refinanced with new debts. Repayment obligations compound exponentially. We ‘fix’ debt problems by taking on new debts, falling deeper into a hole with each round of debt.

The outlines of our condition are becoming more defined, the clock is ticking … Numerian says (Economic Populist) HT Usman:

Even if another credit blow-out occurred, we all know how that would end – very badly, as in 2008 credit crisis all over again. Unfortunately, without another credit splurge the results are the same. When the credit stops flowing, income is hit hard, because most of the growth in income in the economy is produced by debt, and it is not organic growth that would result from a normal recovery generated through capital investment, wage and benefit increases, revenue advances, and expanded global trade. This is precisely what the Fed understands, and why it is expanding its balance sheet ceaselessly, and enabling the Congress and Administration to build up debt at the tune of a trillion dollars a year. All this credit is the lifeblood of the economy, allowing the government to make Social Security and Medicare/Medicaid payments, feed 48 million people through food stamps, fight wars in multiple hot spots around the world, pay interest on the debt to keep bondholders happy, and shift unemployment money to the states.The problem for the Fed is that the unraveling is already beginning. The stock market may be testing its highs, and 50 out of 50 economists may be anticipating a solid economic recovery, but without new sources of credit that is going to be impossible to achieve. Credit has already dried up in the real economy, which is why you hear so many retailers say “nobody has any money” …

“Nobody has any money …” should be familiar: What the charts can’t say is that the industrial world is impoverished by the high cost of crude in a vicious cycle.

When credit stops flowing, income is hit hard because ALL of the growth in income in the economy is produced by debt … without it there is no industry!

What we are experiencing are two interrelated phenomena: an energy shortage due to our wonderful economic ‘success’ over a period of 400 years and the consequences of exponential growth of loans needed to ‘buy’ this success..

Debt is taken on to capitalize industries and their customers. More debt is taken on later to fill the pockets of the industrialists and roll over the first rounds of debt. Finally, debt is taken on the service the previous rounds and nothing more, the economy is saturated with debt.

The first round of debt gains the industrialist tools to produce goods and provides customers with purchasing power. The second round gives the industrialist his fortune and repays the venture capitalist: during this round fewer tools are gained and less in the way of goods are produced. The third round pays the moneylenders’ interest and nothing more, customers and industries are bankrupted by their debts.which are unproductive. Eventually, the moneylenders also fail.

‘Moneylenders’ here must also include the central banks.

Our economy is in the third stage and has been here for awhile, perhaps since 1980 and the ‘Reagan Revolution’.

Added to this is the ongoing shortage of liquid fuels which results in higher prices which must be met with debt. The cost of new fuel rises past what customers can borrow using fuel waste … as collateral. Waste of the fuel does not provide an organic return so all returns must be borrowed adding to the demand for debt… during a period when productivity of debt is diminished.

More about central bank-n-market head-fakery and wishful thinking, (Naked Capitalism):

Is the Euro Crisis Over?By Robert Guttmann, Professor of Economics at Hofstra University and a visiting Professor at University of Paris, Nord. Cross posted from Triple Crisis.

A strange calm has settled over Europe. Following Mr. Draghi’s July 2012 promise “to do whatever it takes” to save the euro, which the head of the European Central Bank followed shortly thereafter with a new program of potentially unlimited bond buying known as “outright monetary transactions,” the market panic evaporated. Since then super-high bond yields have come down to more reasonable levels, allowing fiscally and financially stressed debtor countries in the euro-zone to (re)finance their public-sector borrowing needs a lot more easily than before. Even Greece has been able to borrow in the single-digits for the first time in three years.

This calming of once-panicky debt markets has led to optimistic assessments that the worst of the crisis has passed. Draghi himself declared at the beginning of the new year that the euro-zone economy would start recovering during the second half of 2013. He talked of a “positive contagion” taking root whereby the mutually reinforcing combination of falling bond yields, rising stock markets and historically low volatility would set the positive market environment for a resumption of economic growth across the euro zone. Christine Lagarde, as the head of the IMF part of the “troika” (i.e. ECB, IMF, and European Commission) managing the euro-zone crisis, declared at the World Economic Forum in Davos a few weeks ago that collapse had been avoided, making 2013 a “make-or-break year.”

Here is conventional economic analysis that never gets around to mentioning energy.

– A strange calm has settled over Europe … following Mr. Draghi’s July 2012 promise “to do whatever it takes” to save the euro,

Draghi didn’t actually do anything, he talked about it.

– the market panic evaporated.

That’s an assumption. The more likely is credit strangulation eased a bit.

– This calming of once-panicky debt markets has led to optimistic assessments that the worst of the crisis has passed.

Not by a long shot, the crisis is the cost of energy and the inability of the Europeans to earn anything by wasting it.

– we can see that Ireland, Spain, Portugal or even Greece have been able to lower their current-account deficits substantially,

Automobile sales in these countries along with France have collapsed, petroleum use has significantly declined. Consequently, there is less fuel being imported by these countries. Keep in mind, their fuel use will decline to zero if they do not effect conservation measures. What is underway is not a rehearsal, it is the effects of entropy being felt along with diminishing supply of fuel overall. Fuel is being rationed, conservation by other means.

– renewed turmoil in the sovereign-bond markets will be just a matter of time. Most troubling in this context is the doom-loop dynamic of persistent fiscal austerity across the continent.

Withholding credit is a way to compel the export of European fuel consumption to credit issuers such as the US. Any fuel not burned in Italy or Spain is available to be burned in Los Angeles. America’s energy ‘surplus’ is by way of theft from Europe and elsewhere, not fracking. The problem with the professor is he is not cynical enough!

– This dialectic centers above all on the euro’s trade-adjusted exchange rate.

Not in the sense that the professor implies: the more deflation-priced euro gives those who hold it the means to buy fuel at a bit of a discount … and an incentive to keep the euro. Any replacement currency would be depreciated violently, there would be small likelihood of any petroleum exporter accepting any replacement currency other than d-marks.

– will undermine the competitiveness of the euro-zone’s economies,

The assumption is that countries like Greece or Portugal are industrial countries with factories filled with overpaid proletarian workers like China. Instead, they are senior centers filled with retirees. Peoples’ pensions are being looted, this is called ‘competitiveness’, stealing on a grand scale is what is showing up on the ‘stats’.

– But the euro-zone cannot afford this stop-go pattern of policy-making in the face of a systemic crisis. It will have to undertake far-reaching reform on several fronts beyond what Europe’s leading politicians have been willing to entertain.

Europe is being de-carred by pauperizing the populations. The necessary reform is for governments to take charge of this dynamic and decar the continent on purpose while sparing the citizens. Europe can stand to jettison its useless cars and the fuel waste these things represent. It is the waste that has undermined the European — and world — economies, not trivial real interest rate movements or currency exchange rates. These last are abstractions, petroleum waste is permanent: when the fuel is gone baby, it’s gone, forever.