The hissing sound being heard in the background in countries such as India and Indonesia is the air leaking out of the latest in the long line of speculative gambling ventures cooked up by Wall Street buccaneers and their public-sector valets … ventures that make up what remains of our economy these days. Since the Great Finance Collapse in 2008, billions in cheap dollar loans have been flowing overseas looking for quick killings to be made by creating — then selling — ‘assets’ to greater fools. As long as there is a generalized increase in the flows of credit, there are more- and greater fools to be had. Once credit flows diminish, the fool supply is exhausted; there is nothing to support the inflated asset prices. Soon enough, ‘hot’ dollars exit and the first tier fools cash out; this is the dreaded Minsky Moment, when the credit scaffold that supports the speculation empire collapses under its own weight.

Panic is being felt right now by those within emerging markets that heretofore have felt themselves immune to such things. Like Americans and Europeans before them, the hopeful moderns in Asia, Africa and Latin America believe ‘It’s different this time’ … that the winds of history are at their backs because once-upon-a-time the winds were at the Americans’ backs; that progress is a certainty, that it can be conjured or brought forth by way of modernist fetishes … stock-and bond casinos; gigantic ‘glitzy’ concrete high rises and shopping malls, jet vacations and luxury performance sedans; five-star resorts and 18-hole PGA Championship golf courses … the Las Vegas-style excrescences that decorate modernity like pigeon feces. When it becomes clear to the marginal market participant that the fetishes are just that … empty and possessing of no virtue or anything else in and of themselves … there are runs!

The runs are reflexive and pointless; ultimately self-defeating … there is nowhere to run to. There is no alternate universe of functioning modernist symbols; there is even less functioning that is non-modern! There is only universal ‘worth-iness’; like truthiness, a hollowed out version of the real thing. We are living the ‘Paradox of Grift’: as the impulse to steal increases … the worth of what is stolen or steal-able evaporates … (FT);

Emerging markets endure wild roller coaster rideThursday was another day of turmoil for emerging markets.

Unimpressed by the Turkish central bank’s recent efforts to support its currency, investors sent the lira down to a record low against the US dollar; India’s rupee fell to its lowest-ever level; Indonesia’s rupiah dropped to the weakest since 2009.

As if that were not enough, Malaysia’s ringgit and Thailand’s baht ended the day in a three-year trough.

‘Unimpressed by central banks’ efforts’? The central banks enable the background conditions for the runs in the first place! Their ‘no questions asked’ loans are a form of limitless moral hazard: no lender will be allowed to lose money regardless how how stupid, venal or corrupt their business. Central banks misprice risk by over-paying for bonds which are lenders’ IOUs. By doing so they bid others out of the marketplace. The result is repressed interest rates. Risk is a product of the false-pricing process itself … particularly that relating to the business of the stupid, venal and corrupt.

Put another way, the recent rise in interest rates and decline in many currencies is commonly held to be the result of Federal Reserve ‘taper’ or promised future reduction of monetary stimulus. This is backwards: interest rates are rising and currencies depreciated as the consequence of five years of ‘temporary’ easing; tapering is not an alternative but the conclusion of the short-term lending cycle that began in 2008.

Central bank lending will decrease if for no other reason than the ongoing exhaustion of the supply of good collateral. The central bankers have been strip-mining good collateral from the private sector. When it is gone what remains is bad collateral and grave danger for central banks which risk becoming indistinguishable from their commercial lender clients … insolvent.

Reality is revealed as is the sun from behind a cloud; revelation is underway right now within emerging markets. At some point the central banks’ actions are measured against outcomes. Easing has been underway for five years. Where is the beef? This sort of examination is fatal to speculation which requires increasing hordes of credulous fools eager to borrow and lose, returning to borrow again and again. Reality emerges => fools are unmasked => central bankers ‘lose control’ of the processes they have been entrusted to properly manage, (WSJ);

Ten-Year Treasury Yield Nears 3%Treasury bonds took a beating for a second consecutive session, sending the benchmark 10-year note’s yield to a two-year high.

Most of this movement in price has occurred since May … this is another run!

The yield is nearing the 3% mark, a level the market last traded at back in July 2011. Bond prices fall when their yields rise.Better-than-forecast manufacturing reports from China and the euro zone drove cash out of safe-haven bonds and into stocks. Persistent anxiety over a shift in the Federal Reserve’s easy-money stimulus continued to push investors to lighten up on bond holdings.

When a central bank loses control, there is nothing that can be done on the monetary front when the need arises other than to wring hands and weep; there is effectively no lender of last resort. This might seem to be a small matter in abstract … but imagine the outcome in 2008 if the Federal Reserve and the European- and UK central banks had been ineffective or their programs ignored by the market participants. Stock markets would have collapsed entirely and the banks shuttered … as occurred in the United States during 1932- and 1933.

Because the central banks cannot create ‘new money’ (they are collateral constrained), because the central banks cannot create natural resources or real capital, because central banks cannot determine by command the money-cost-of-money … which is set at gas stations around the world by motorists buying fuel with money millions of times per day … the banks’ reach is limited. At the same time, they are integral to the operation of the credit system itself and the stability of all the different kinds of credit-derivatives markets: they are ‘Schrödinger’s banks’; important and useless at the same time.

Both industrial firms and sovereigns are credit dependencies. Industrial economies monetize resource capital destruction; commercial banks finance finance the process. Central banks stand behind commercial lenders with reserves. This position within the credit system is what makes central banks vital. At the same time, the banks overreach. The credit system is more than a few central banks propping up commercial lending zombies and lending back and forth to each other plus their governments. Central banks are designed to be lenders of last resort. When they become lenders of first resort and sole credit providers, there is effectively no credit at all. This is the point that is approaching right now.

The central banks are painted into a corner of their own making. If they offer unsecured loans hoping to generate waste-based ‘growth’ they become insolvent which kills what they attempt to create. Not making the loans removes fuel required by speculators, which also kills growth! Making loans that distort interest rate mechanism ‘poisons the well’ and interest rates increase … which kills growth. Likewise, not making the loans results in exactly the same thing. Over the longer-term, the banks cannot win: all roads lead not to Rome but toward rising interest rates, non-growth, insolvency and credit collapse.

According to the analysts, the bottom is dropping out of the Treasury market because of ‘good news’ in China and the eurozone. The fool supply diminution is made out to be something other than what it is; a bit like fracking: tens of thousands of holes are drilled into the ground so that the fools might dribble out …

A very bad man, indeed. There is in fact no end to them. The world is submerged under their mountainous claims. The costs associated with this ‘claims-surplus’ are far greater than any possible gain from it … indeed, more than what the claims are worth:

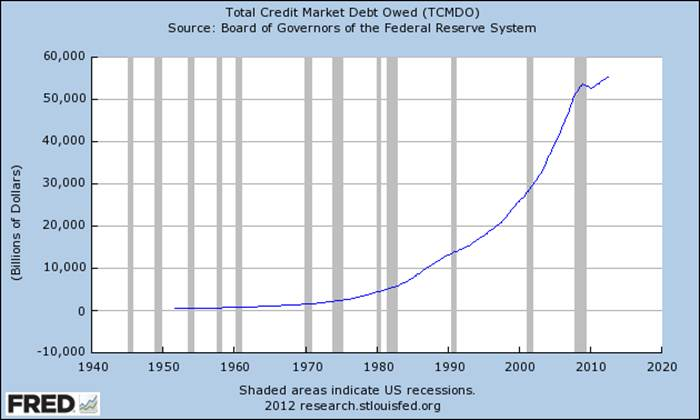

Here is the ‘Paradox of Grift’ in a chart: total US credit market debt in billions of dollars. This debt = assets of the rich, their intent is to compel the non-rich to repay the debts with their labor. The ambition to steal everything outruns itself as debts in question are unmanageably enormous. They cannot be retired by anyone or anything and are therefore worthless.

A large percentage of this total is compounded debt service costs which by themselves increase exponentially. If the mean rate of interest on this debt is 4%, annual debt service costs for our credit market debt is greater than US$2 trillion. This is the bankers’ ‘cut’, no wonder they are well-dressed.

Meanwhile, a look at commodities’ prices suggests — as does interest rate panic — that $110 crude is the ‘new $147 crude’, (Bloomberg):

Energy Commodity Futures

| Commodity | Units | Price | Change | % Change | Contract |

|---|---|---|---|---|---|

| Crude Oil (WTI) | USD/bbl. | 106.42 | +1.39 | +1.32% | Oct 13 |

| Crude Oil (Brent) | USD/bbl. | 111.04 | +1.14 | +1.04% | Oct 13 |

| RBOB Gasoline | USd/gal. | 300.72 | +4.24 | +1.43% | Sep 13 |

| NYMEX Natural Gas | USD/MMBtu | 3.49 | -0.06 | -1.69% | Sep 13 |

Precious and Industrial Metals

| Commodity | Units | Price | Change | % Change | Contract |

|---|---|---|---|---|---|

| COMEX Gold | USD/t oz. | 1,395.80 | +25.00 | +1.82% | Dec 13 |

| Gold Spot | USD/t oz. | 1,397.73 | +21.59 | +1.57% | N/A |

| COMEX Silver | USD/t oz. | 23.78 | +0.70 | +3.04% | Dec 13 |

| COMEX Copper | USd/lb. | 335.60 | +2.15 | +0.64% | Dec 13 |

| Platinum Spot | USD/t oz. | 1,541.13 | +0.88 | +0.06% | N/A |

Graph by Bloomberg. Relentlessly rising fuel prices tax funds away from consumption economies toward oil drillers even as the flow of funds to drillers returns diminished increments of crude. Each dollar spent to gain crude today returns less crude than yesterday … just as every dollar spent by drillers tomorrow will return less crude than today. The waste of 90+ million barrels of crude- and crude like substances every single day year after year has consequences: none of those barrels will ever be retrieved except in forms toxic to our grandchildren.

Underway around the world right now … is the very predictable outcome of conventional monetary- and economic policies. Governments and central banks succeeded in stimulating resource waste-capital destruction for a few short years under circumstances that did not — and will not in the future — favor it. In a sense, policy in the present has been the extension of Reaganism and reaction against the message borne by the oil shortages of the early 1970s: ‘pedal to the metal’ unrestrained exploitation of all resources including credit … and hoping for the happy ending because we’re Americans and we deserve it!

The result is a witches’ cauldron of misanthropic so-called ‘policies’: the liberalized bourgeois world with Adolph Hitler’s Boy’s Town fashion sensibilities, Sarah Palin’s “Drill, Baby, drill” energy policy, Joseph Stalin’s and Joe McCarthy’s reactionary paranoia … General Motors’ ‘Good for America’ waste and Madison Avenue ‘Mad Men’ rationalizing all of the above. Soon enough we are set to learn in real time that all of the above is a hoax; an empty bag. In the end nobody can fool Mother Nature, that claims against the human race are not found within the credit ledger but instead within the solar budget that we balance or else.

… or else … (Finger cutting gesture across throat.)