Port of Long Beach

Latest Month

Container Trade in TEUs*

|

September |

Fiscal Year to Date*** |

|

2010*** |

2009 |

%Change |

2010*** |

2009 |

%Change |

| Loaded Inbound |

288,905 |

224,924 |

28.4% |

2,982,320 |

2,612,227 |

14.2% |

| Loaded Outbound |

124,021 |

109,337 |

13.4% |

1,484,610 |

1,331,872 |

11.5% |

| Empties |

161,864 |

106,103 |

52.6% |

1,469,136 |

1,338,286 |

9.8% |

| TOTAL (T.E.U.) |

574,790 |

440,364 |

30.5% |

5,936,066 |

5,282,385 |

12.4% |

The TEU is a way to count shipping containers, the large metal boxes that goods are shipped in from overseas. The year- over- year increase @ Long Beach is from 5.3 to 5.9 million containers. These numbers are generally seasonally adjusted but that is not the issue …

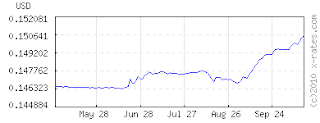

The modest increase in traffic parallels the modest shifts in foreign exchange rates. The ‘dumping of the dollar’ is of a piece with this – expanding US exports by lowering their dollar cost is a way to put into motion the president’s demand to do just that. The establishment cannot wave a magic wand and make it so. The amount of Fed intervention TO DATE has not been sufficient to change dollar value in F/X markets. What has?

Quantitative Easing has not begun although the various markets have already priced in an amount. This would have little effect on currencies as the daily F/X market is much larger than any amount of bond purchases suggested by the Fed.

The theory is China trading dollars for the currencies of exporting and developing countries. by doing so the Chinese accomplish two things; one is to export some yuan appreciation and the other is to overcome the resource ‘Net Export’ phenomenon where oil producers’ net exports shrink over time as the producers’ local consumption increases. Consumption increases because the increase in oil price has allowed producing countries to import it in the form of automobiles, development, highways and ‘industries’.

Since the trade imbalance between China and its customers overseas is persistent, the understanding is that the yuan is undervalued relative to the currencies of its customers – the dollar and euro. With the dollar and yuan more or less pegged the appreciation has nowhere to go even as dollars flood from Planet Everywhere to China seeking yields.

Keep in mind, these dollars are currency in circulation rather than base money or vault cash held in liquidity traps in the US. China would trade some dollars for yen so as to arbitrage its own currency appreciation; the yen rather than the yuan would increase in value. Consequently, the rapidly increasing value of the yen would crimp Japanese rather than Chinese exports. Ditto with exports from other surplus countries; the Chinese can buy their currencies and sell its currency appreciation to them rendering their products more pricey!

As for Net Export, this is the brainchild of Jeffery Brown and Sam Foucher who discovered that petroleum exporters were diverting more and more of their own production toward local consumption. As local consumption increased – along with oil prices and revenue – net exports of petroleum declined. This decline is significantly greater than the overall level of production in a country would suggest.

Brown and his fellow number cruncher, Samuel Foucher, a computer researcher, looked at two seemingly disparate cases, Indonesia, a developing country with a high growth rate for domestic oil consumption and a low production decline rate and the United Kingdom, a developed country with almost no increase in consumption, but a high decline rate. Indonesia went from peak oil production in 1997 to zero exports in 8 years. The U. K. went from peak production in 2000 to zero exports in 7 years.

The countries also represent extremes in policy. The U. K. had high energy taxes. Indonesia subsidized energy consumption. But despite the differences, their time to zero exports was very similar. Brown surmises that the most important factor in the length of time to zero exports is the starting point for domestic oil consumption. Both countries were consuming between 50 and 60 percent of their own oil production at peak.

Net exports is a dollar phenomenon; the steadily increasing dollar price of fuel steers flows of capital into producers who use this to purchase consumption. As overall oil supplies diminish and dollar flows shrivel accordingly dollar value will increase. It’s the Iron Law again, holding commerce down while increasing the value of money. Increasingly valuable dollars will become hard to find. China may not wish to spend its dollars and choose to spend local currencies, instead. The Chinese are hedging. Buying producers’ currencies provides energy access when dollars become scarce.

As I have pointed out elsewhere, when the dollar becomes an acknowledged hard, oil- backed currency, importers will sweep foreign exchange markets to gain oil producers’ currencies in order to buy oil. This will clear these currencies from F/X markets; China recognizes this danger and is getting in on the ground floor.

With China buying production around the world buying local currencies is a part of that strategy.

Whether it succeeds is another matter. There are many counter- currents in both goods and currency trades. China, like the energy producers is dependent upon flows of currency and credit. US bankruptcy means China bankruptcy. With the US being overly- dependent upon real estate values – as collateral for legacy loans and bank solvency – the current foreclosure- gate and its ramifications threaten both US and Chinese flows.

China, in turn, is overly dependent upon manufacturing for exports. Reductions in goods export flows is probably fatal to China – and in turn the US. This symbiosis makes any systemic crisis of one a crisis for the other.

The six biggest banking zombies are potentially on the hook for hundreds of billion$ while the all- important flows of funds into and out of the banks are constrained. With another version of TARP off the table for political reasons – and logical reasons as well – the burden of bail will fall on the shoulders of Planet Bernanke. Here, the total of $1 trillion suggested as an amount of QE will be shoveled down the zombie rathole instead.

Why stop there? The total mortgage capitalization is over $14 trillion. All of this is threatened by valuations that have no support outside of establishment intervention. Perhaps the Chinese would like to buy some tract houses to go along with their millions of vacant apartment buildings!

The problem from the get- go has been the lack of accountability. The same entities responsible for inflating the bubble with shoddy underwriting are the same entities evicting citizens with the same shoddy underwriting. Neglect and regulatory capture have become the gift to the Obama administration that keeps on giving … more and more headaches.

The rising public anger over bank/mortgage servicer improprieties can lead to a payment revolt. The public has been a punching bag for lenders and is eager to punch back. This bears watching most closely. Action would be deferred until after the election. If the outcome reinforces the status quo or what is perceived to be the status quo there is likely to be trouble.

All it will take is a YouTube video and the Black Swan will take flight..

EDIT: Reply to comments below::

Lynn, the problem now is sellers misrepresented their products (mortgages, notes, CDO’s) and as a byproduct created a paperwork morass which renders opaque the misrepresentations. A trust would unravel the morass by brute force, by the application of tens or hundreds of thousands of hands to the task. The bits and pieces of loans would be reassembled and suitability determined.

Only an entity that can marshal the required resources – such as the US government – could really do this task properly. It will be about the same size job – and require the same amount of manpower – as did the just finished census. The banks did not have the resources, consequently ‘Robo- signers. The Feds have the resources.

The trust could (more effectively) examine the reassembled bits and determine if fraud played any part in the underwriting process. Likewise, the aggregation and distribution of mortgage derivatives would be scrutinized. Since much of this product was marketed overseas in the form of CDOs, the Feds are better positioned to make determinations about suitability and then settle with these investors. The trust would be a proxy for the (large, zombie) banks which would be held responsible, which means they would pay all costs.

The banks would agree to this as the potential tort damages are in the hundreds of billions. The banks would be buying certainty at a discount. The public would benefit because it would demonstrate someone is finally in charge. It would also inject some reality into the crisis management paradigm as a consequence would be a (substantial) decline in real estate values and a return to deleveraging.

This will take place anyway and having some control would temper the effects.

The 2d aspect of the trust would include a fund- in lieu of tort action where structured payments would be substituted for damages. The idea is to streamline the process rather than let anyone off the hook. The morass created by lenders is too granular to allow easy passage through multiple overlapping venues. A fund would eliminate over 90% of the litigation (as the 9/11 fund demonstrated). The rest can be handled in court and any criminal violations prosecuted by courts of appropriate jurisdiction.

Accountability is the most important part because nobody trusts the system, anymore. Having heads roll would help convince the public that the government is on someone’s side but the bankers. Absent trust, there is nothing to commit participants to the current ways of business. The outcome here is mass default and the collapse of ordinary business.

Once suitability is determined for any given property, local agencies would take the required steps, as was the case with the Resolution Trust Co.

This is a complex issue that requires more than a comment.

As for politics; the issue of the haves v. have nots is far from being settled and the courts have been all over the map from the Florida Kangaroo Foreclosure Mills to the oddball Federal bankruptcy judge who tosses the bankers’ out on their ear. Who knows what happens next?

The crisis at the door is political as the Gingrich flesh- eaters rise from the grave the first of the year and shut down the government. It may be a joke to them but it may also be the end of US as a credit- worthy entity. 90 day Treasuries @ 9%? Stay tuned …