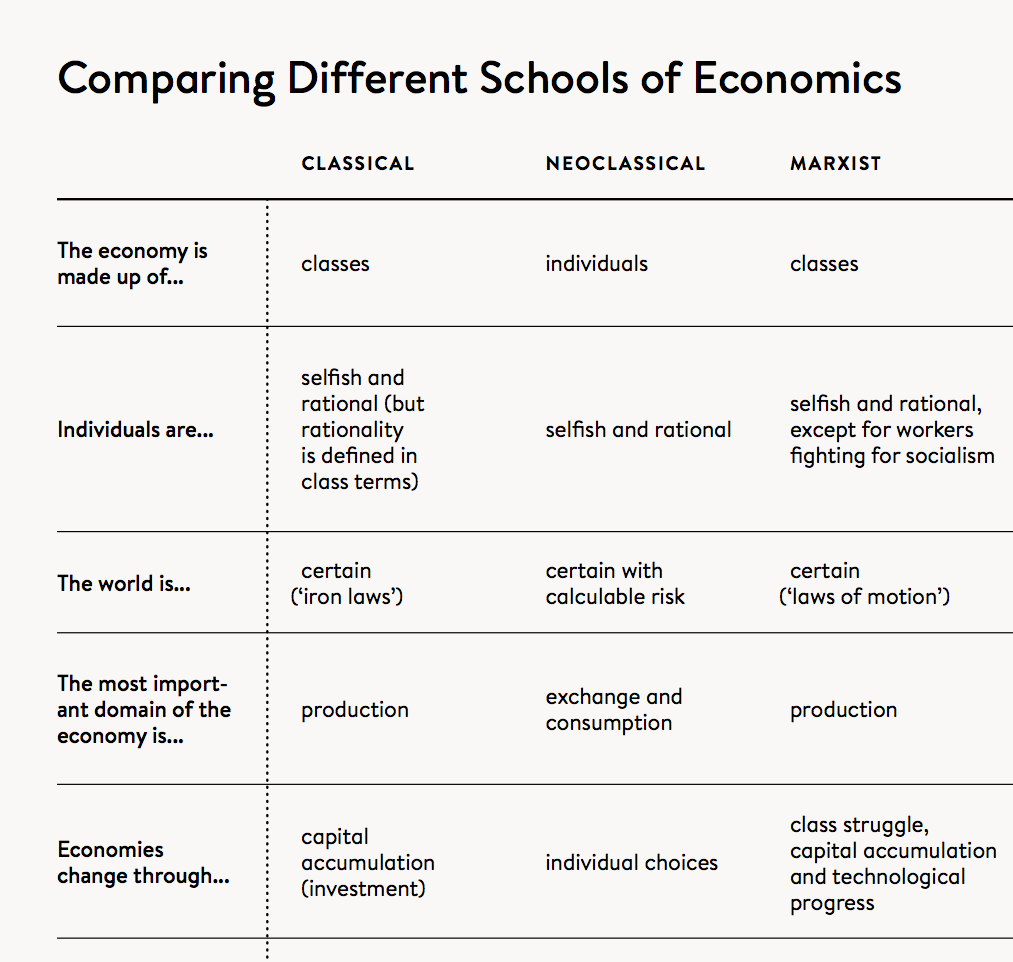

Economist Ha-joon Chang has just published; “Economics: The User’s Guide”, an attempt to deconstruct some of the myths that have grown up around our ways of doing business. Along with the book is an excellent chart that breaks down what Chang describes as the nine most significant of the ideological trends within economics, along with outlines of how these schools of thought presume to make sense/use of our world. Click here for a full-size version.

Click on this thumbnail for big or on this link to see the version that includes Debtonomics.

The chart is formatted below into tables that can be viewed on the web page …

Comparing Different Schools of Economics Part I

| CATEGORY | CLASSICAL | NEOCLASSICAL | MARXIST | DEVELOPMENTALIST | AUSTRIAN |

| The economy is made up of … | classes | individuals | classes | no strong views but more focused on classes | individuals |

| Individuals are … | selfish but rationals (but rationality is described in class terms) | selfish and rational | selfish and rational, except for workers fighting for socialism | no strong view | selfish but layered (rational only because of an unquestioning acceptance of tradition |

| The World is … | certain (‘iron laws’) | certain with calculable risk | certain (‘laws of motion’) | uncertain but no strong view | complex and uncertain |

| The most important domain of the economy is … | production | exchange and consumption | production | production | exchange |

| Economies change through … | capital accumulation (investment) | individual choices | class struggle, capital accumulation and technological progress | developments in productive capabilities | individual choices but rooted in tradition |

| Policy recommendations; | free market | free market or interventionism, depending upon the economist’s view on market failures and government failures | socialist revolution and central planning | free market | free market |

This graphic represents Ha-joon Chang’s opinion, yet it is representative of those across the discipline, it should be self-explanatory to anyone with interest in economics. Keep in mind, economists and policy makers are little able to manage any- but the smallest components within larger economic regimes. Economists are like five-year-old food critics: they love to eat but they can’t reach the stove. For good or ill, economies are the property of the billions who relentlessly re-invent (degrade) the world and its processes for their own purposes every day. Analysts describe how they believe the larger processes should work, at best these descriptions make up an imperfect feedback loop: degradation => more subtle rationalizations => mass media distribution leading to => more degradation.

Comparing Different Schools of Economics Part II

| CATEGORY | SCHUMPETERIAN | KEYNESIAN | INSTITUTIONALIST | BEHAVIORALIST | DEBTONOMICS |

| The economy is made up of … | no particular views | classes | individuals and institutions | individuals, organizations and institutions | a) firms, and b) everything else |

| Individuals are … | no strong views but emphasis on non-rational entrepreneurship | not very rational (driven by habits and animal spirits); ambiguous on selfishness | layered (instinct, habit, belief, reason) | only boundedly rational and layered | a) advantage seekers, and b) those being taken advantage of |

| The World is … | no strong view but complex | uncertain | complex and uncertain | complex and uncertain | deterministic and ruthless |

| The most important domain of the economy is … | production | ambiguous with a minority paying attention to production | no strong views but, puts more emphasis on production than do the Neo-classicals | no strong views but some bias toward production | borrowing and debt |

| Economies change through … | technological innovation | ambiguous, depends upon the economist | interaction between individuals and institutions | no strong view | resource exhaustion and periodic crashes |

| Policy recommendations; | ambiguous – capitalism is doomed to atrophy, anyway | active fiscal policy, income redistribution towards the poor | ambiguous, depends on the economist | no strong view, but can be quite accepting of government intervention | a) restructure, or b) crash, then restructure if possible |

Familiar sub-categories such as mercantilism are found within the larger schools. The prevailing ideology is a synthesis of Keynes and neoclassicism. Economic fashions are fickle and are subject to change. No one particular school is dominant for very long; out of fashion ideologies vanish only to re-emerge decades after being rehabilitated. The schools promote academic theses that are more-or-less fanciful to begin with; no school conforms to observable reality. Ha-Joon Chang is a leading institutionalist economist along with Lars Pålsson Syll. A forerunner of Chang’s is John Kenneth Galbraith;

Chang’s economic subdivisions are without exception modernistic and industrial, all promote economic growth. All emerge from the same physiocratic root; they (re-)combine the philosophical characteristics of Burke and Bentham, Marx and Keynes. Every one offers a handsome surface that obscures the crude Debtonomics lurking within. Modernity’s primary processes add up to a sausage-making enterprise that hesitates to reveal itself because it is too repellent.

All things modern — including post-WWII economics — are components of pop culture. Creating energy demand is that culture’s primary function, the rest is fiction rationalizing that demand. Culture’s instruments are the super-sexy products it wheedles into existence along with the supposed benefits that the use of the goods is intended to provide. Among the benefits are theatrical roles which participants adhere to closely. This is another feedback loop: role-playing acknowledges the participant’s place in the culture while reinforcing culture’s supremacy at the same time.

Pop culture is the product of advertising managers and commercial artists (not economists). The highest form of art on 21st century Planet Earth is advertising, the highest form of that particular art is the self- referential or self- advertising scam. As described by economist Hyman Minsky, the Ponzi schemes that make up much of the modern world’s economies are self- referential scams. These schemes thrive and prosper simply because they are. Modernity is the Ponzi blown up to the largest scale, we believe our so-called ‘wealthiness’ is returns from our cleverness and big businesses, ‘honesty’ and hard work. Instead, our success is ephemeral, a phantom: nothing other than monetized plunder- and capital destruction for which the Debtonomy is the enabling mechanism. We have been able to maintain our illusions only because we have always had affordable capital for ourselves and our industries to destroy.

Keep in mind; within Debtonomics, ‘capital’ is non-renewable resources rather than infinitely-renewable money or money-analogs.

- Within convention, economic agents are presumed to act as individuals or fall into classes made up of like-kind individuals. Within Debtonomics there are two sets of actors, firms and everything else. A firm is nothing more than a business, able to produce a ‘good’ or perform a service; more importantly, able to borrow and lend. A firm can be a listed corporation, an individual, a group or informal business or even a government, state or nation; the structure of the firm does not matter, only its behavior. Firms are ascendent over non-firms which are simply objects to be made use of. Non-firms include capital-resources; also animals, plants, water courses and the land, what is contained on- and under the land, the atmosphere and oceans … also individuals who by choice or circumstances do not produce either goods or services; also individuals who are unable or unwilling to borrow or lend.

Status as a firm does not guarantee anything; firms are continually engaged in competition with all other firms. Firms make whatever use they can of non-firms to gain competitive advantage. Non-firms are ‘inputs’ for firms’ industrial-service processes otherwise they are sinks for firms’ waste and surplus-related costs. Successful user-firms cannibalize- or destroy both competitors and non-firms to become larger and obtain economies of scale. Up-scaling is offered as the way to increase ‘productivity’ but is rather a defense against competition and the means to gain more loans. Another function of the economic system is to distribute the costs associated with industrial surpluses away from the firms themselves toward others.

- Within conventional economics, individuals are considered to be largely rational and selfish. Debtonomics goes further: individuals are either advantage seekers or those being taken advantage of. These categories are fluid and can change at any time. It does not matter whether the individuals are firms or parts of firms. The bulk of the disadvantaged are advantage seekers who have failed in competition with others. Within the globalized economy there are fewer economic spaces for the disadvantaged to retreat to. A shortcoming of conventional economic analysis is the inability to consider of crime and criminal advantage as economic factors: Debtonomics does not suggest any bounds or limits to advantage only that there will always be those who will attempt to gain it by any- and all means.

- Conventional economics paints a world that is more-or-less benign: ‘certain’ and predictable, alternatively complex and anodyne … and thereby neutral regarding outcomes. Certainty implies manageability with the proper techniques also boundary conditions (invisible hands). Neutrality extends toward agents whose ambitions in the aggregate tend to revert to some sort agreeable mean (‘Self-regulation’ and The Great Moderation).

Within Debtonomics, the World is considered to be deterministic and ruthless. That the actual world is not this way is irrelevant: firms are compelled by a false-reading of natural selection to obtain for themselves as much of a competitive advantage as possible … by doing so foreclosing any advance on the part of other firms. Debtonomics is red in fang and claw; its only law is that of the jungle, competition is survival of the fittest. There can only be one fittest, everything- and everyone else is ruined, lost or process waste.

- Conventional theory tends to suggest production as the primary activity of an economy leaving Austrian and analogous neoclassical economics to presume consumption. Within Debtonomics borrowing is the primary activity of the economy, debt is a primary ‘good’. All industrial production is loss-making and consumption is non-remunerative waste; by necessity all system returns must be borrowed. Economic activities are collateral- and rationalization for ongoing rounds of loans; proceeds are siphoned off wherever possible by elites, repayment obligations are directed toward others.

- Technology and institutions are suggested as change-agents by conventional analysts. Within Debtonomics, the change agent is the process itself. Increasing the capital burn-through rate results in more changes which in turn serve to amplify capital exhaustion. Technology is the instrument of waste, institutions take form to rationalize the use of technology and to provide credit to enable more waste.

Crashes are the consequence of resource depletion (Great Finance Crisis) or aggregated surplus-related costs that cannot be shifted. The outcome is that costs rebound against the aggregators themselves; (Great Depression, Long Depression, ongoing Great Finance Crisis). In advance of a crash there is no general incentive to make management changes so as to reduce risks … even as risks compound. Crashes result in mass bankruptcy and obvious changes including public demand for accountability. Crashing is the hardest way to change but seemingly the only way for Debtonomies.

- Conventional economists’ policy recommendations tend to be tentative- to irrelevant; trivial adjustments to monetary policy, interest rates or the substitution of one feeble institution for another. The basic Debtonomic engines of capital destruction, ruinous competition and borrowing to pay for it all are left in place, the aim is to re-construct the facade while leaving the structure undisturbed.

It is necessary to replace or restructure Debtonomics while we still have the means and organizing ability to do so = not easy. Consider modernity as a kind of religion that has emerged to both supersede- and superimpose itself upon the obsolete doctrines including Christianity, liberalism, reason, democracy, capitalism, etc. Within the ‘modernity faith’ there are sub-doctrines and narrative myths. ‘Capitalism’ has been emptied of independent meaning along with socialism, communism, Keynesianism, the other economic isms: they are little more than fairy tales cynically adjusted to create illusions of control. The ‘big idea’ is that industrialization is ‘benevolent’, ‘well-managed’, ‘progressive’ … Meanwhile, in the background, deterministic modernity follows its own machine-logic without hesitation, grinding itself toward annihilation. We don’t have to wait for a singularity, we are living in one right now.

Modernity insists that development ‘progress’ alleviates poverty and that labor by itself is the genesis of goods along with wealth. These claims are made out of context. Economic theorists begin their narratives with the desired happy endings then work backwards. The outcome is self-contradictory nonsense … advertising and public relations.

By comparing Debtonomics to the other economic schools, a better idea can be had about how the world’s economic systems actually work. Because modernity is a religion, it stands upon a foundation of broad public support and shared belief. Debtonomics is the drive-train of modernity but exists safely outside of that shared belief. People want to believe they share a higher purpose. They refuse to accept that their daily activities are components of a mindless competition between alien-like firms bent on out-destroying each other … where everyone is predator or lunch. Doctrines are there to fool us: Debtonomics is monstrous, it can only live in the shadows. This means it can be overthrown by stripping away the false-doctrines and lies leaving it to wither in the sunlight. This would leave a space for a more useful alternative … an economy that husbands its capital rather than cannibalizing it.

It is not enough to change economics but the (cultural) container, says Jay Hanson:

We are “political” animals from birth until death. Everything we do or say can be seen as part of lifelong political agendas. Despite decades of scientific warnings, we continue to destroy our life-support system because that behavior is part of our inherited (DNA/RNA) hard wiring. We use scientific warnings, like all inter-animal communications, for cementing group identity and for elevating one’s own status (politics).Only physical hardship can force us to rewire our mental agendas. I am certainly not the first to make the observation, but now, after 20 years of study and debate, I am totally certain. The “net energy principle” guarantees that our global supply lines will collapse. The rush to social collapse cannot be stopped no matter what is written or said. Humans have never been able to intentionally-avoid collapse because fundamental system-wide change is only possible after the collapse begins.

We’ve become what we are today because of the ability of our myths to motivate- and direct us. We underestimate our myths’ compulsive power. Our forebears scooted along forest floors picking up- and eating figs. We ate those figs day-after-day for hundreds of thousands of years. We are genetically predisposed to do so; evidence can be seen by looking in a mirror. We have scooting feet, grasping hands and fig-eating mouths. The figs taste delicious to us no matter how many we eat. We are not predators, we don’t have the equipment. Since we aren’t lions or wolves we can only fake it. In the place of DNA sequences we have crafted a defective ideology that misunderstands fundamentals, that proposes a kind of lion that destroys all the other animals. Our myths made us into hunters two million years ago, but only to a point. Our behavior changed but not our natures. We are still fig-eating monkeys, scurrying around, pretending to be gods but falling far short. To become more god-like we must adopt new myths, jettison our bankrupt culture … and learn something new rather than repeat what we already know to be false.

We can do it … we just have to screw up the courage to try.