The world’s economic enterprise is a tightly-coupled, massively complex array of interlocking establishments, each highly complex in their own right. The failure of one component effects all the others. The analog is removing a pinwheel from a watch: the watch will still appear to be a watch but it won’t keep time.

The relative scale of the European economic enterprise compared to Cyprus is the same as the gigantic balloon relative to the tiny pin … any hole the pin might cause has consequences to the balloon wildly out of proportion to its size.

The Russians can simply refuse to accept euros, they will accept only dollars, instead!

The David Whitney house in winter, 1955, on Woodward and Canfield Street in Detroit, Michigan, from the Burton Historical collection, Detroit Public Library, University of Michigan. In our shiny new zero-sum post-petroleum world, some places succeed because other places are disposable. Detroit is the way Detroit is because New York City is the way New York City is.

Germany is the way Germany is because Spain, Portugal, Ireland, Greece — and Cyprus — are they way they are. The worse it is for them, the better it is for Germany.

There are references to Archduke Ferdinand and the cold war all over the Internet. Somewhere in abeyance the gauntlet has been thrown down. What is absent is any understanding of … why.

Bruce Krasting channels Barnum instead of Armageddon:

On the Circus in EuropeI’m flabbergasted that Cyprus is the cause of the circus in Europe. Cyprus was an avoidable problem in my opinion. That view is supported by the fact that all of the words, actions (and threats) by the deciders in Northern Europe have been decidedly negative. There was no “Can Do” talk. All I heard was, “We won’t do” or “Here is a deadline” – “Here’s a gun to your head”.

Two possibilities – Either this was a completely bungled effort in Brussels. Or this this was a deliberate effort to weed out the weak members of the EU. If the intent was the latter, this will not stop with little Cyprus.

Next week there will some broad confusion following the resolution in Cyprus. Either Cyprus is out of the Euro zone by Wednesday, or the +E100k depositors are going to get whacked big. There is no soft landing potential any longer. If the folks in Brussels and Berlin who are pulling the strings are really serious about stabilizing the Euro zone they will respond with a series of “positive” measures next week. Things that might be considered to ring-fence Cyprus include:

– Doubling the deposit guaranty to E200.

– Creating a Transaction Account Guarantee. This would insure all accounts that were related to the settlement of goods and trade. (protect the economy)

– Financial measures – From some minor stimulus stuff, to monetary measures like LTRO or a cut in % rates.

These would be “calming” steps. They would be proactive in that the intent would be to get ahead of any contagion. We could also see “nothing” from Brussels. That silence would be a “tell” that “they” don’t want to resist gravity any longer. The most significant sign would be if capital controls were established more broadly in Europe over the next few weeks. These will scare the crap out of folks, especially those in Spain and Italy.

If the EU was serious about managing the currency/credit flows there would be some discussion of the foregoing already. In fact there would have been discussions along these lines long before last weekend.

Instead there is noise about confiscating deposits in Italy and Europe-wide capital controls. In a currency union, capital controls are a death sentence. The ‘natural’ form of control is different currencies for each state. Under the condition of currency controls there are de-facto independent ‘euros’ with different prices for each. The next step — toward independent currencies — is a very small one.

What is underway is beyond the reach of language to adequately describe. Not only have best practices for deposit banking for 200 years been undone but so has long-standing management policy of money-capital flows across national boundaries. It can be inferred that every euro sent to Russia since 2000 has been a fraudulent instrument. Why would Russia sell more fuels to Europe under current uncertain circumstances? If the Russians do not accept euros, why would Saudi Arabia or any other oil producer?

Apoplectic Steve Keen says the Russians can cut off European natural gas supply.

Steve from Virginia says the Russians can simply refuse to accept euros, they will accept only dollars, instead! How retro! How … 1990!

Why would the Russians accept euros when they are subject to confiscation? Why would they accept French francs or Spanish pesetas? It’s the same bunch of thieves … the same bankrupt national economies!

The entire euro-as-energy-hedge is undone in an instant. By stiffing bank depositors, the EU has defaulted. There are no two ways around it.

The Chinese bosses are reaching for those Maalox bottles right now. China holds a trillion in euro-denominated debt instruments, so does Japan. Germany appears not to have thought this through. Regardless of what happens in/with the eurozone, Germany is on the hook for the overseas euro-trillions. Germany is the only EU country with money: it is responsible for all those Target 2 liabilities as well — this is another trillion euros. If not Germany, who picks up the tab?

Germany is declaring that overseas holders of euro currency are going to pick it up — starting with the Russians! Off the hook is the euro-establishment itself and its pet tycoons. High-level finance acumen is not necessary to understand how outrageous and destabilizing such an arbitrary action is: head-loppage was never part of the euro sales pitch! The euro was to be a ‘better, sounder’ dollar, always ‘good as gold’. Now, its fairy money, worthless in the hands of ‘not-quite-special friends’ who only discover they are so after the fact.

Exposure to currency derivatives presently denominated in euros is another liability. According to the Bank for International Settlements, the current derivative exposure including options and futures is twenty-four trillion euros. Who is on the hook for that? If the answer is ‘nobody’ then the entire edifice comes crashing down.

From here is looks like a lot of agony to come around the world: if Germany doesn’t default it is ruined by its ‘share’ of EU liabilities. If Germany defaults then China’s finance system is bankrupted along with Japan’s.

Don’t be surprised to see the European ‘bank run’ materialize over the next few weeks in the foreign exchange markets as countries seek to offload their euro risk onto suckers and market fools as quickly as possible. Unlike the bond and equities markets, F/X markets are difficult to manipulate. One reason is because they are too large: trillions of dollars and other currencies are exchanged every day. Who would volunteer to be the sucker? Not even the Fed is large enough — or dumb enough — to take over China’s or Japan’s massive euro positions.

Who is going to take over these positions? If the answer is nobody China and Japan — along with Russia — are left with with massive, instant F/X risk.

One outcome of this risk would be an increase in interest rates! Such a rate increase in the US and elsewhere would be very unpleasant: there would be instant hits to government spending as borrowing would become less affordable. Government bond holders would face immense losses. Eventually, the governments would be forced to bail out their bond markets simply to function!

Sacre Bleu! Capital flight to support the dollar and bond prices would only last as long as the euro was a viable currency. If the euro fails there is no readily available substitute for it. If Germany made good euro liabilities with d-marks … it would be for show only. The European euro-liabilities are simply too enormous. The end-game would be Germany refusing all non-German liabilities and restricting d-mark circulation to native Germans within Germany. Euro-credit everywhere would be re-denominated into (worthless) local currencies. There would be intense competition for international dollars, a massive deflationary contraction as these dollars vanish from circulation.

Believe it or not the Fed cannot ‘print money’. It can only make loans against ‘good’ collateral. The demand for US dollar currency would become overwhelming … Congress would have to act … in the highly complex, interconnected finance universe, the smallest perturbation effects everything else.

All of this could take place next month week! Look to the world’s money authorities to start leaning on the eurozone to put the genie back into the bottle. Matters could spiral rapidly out of control.

The motive behind this nonsense is presumably ‘bailout fatigue’: to spare the Germans the minuscule cost of keeping Cyprus banks functioning until after the German elections in September. There is no reason why the ECB could not continue to fund these banks by way of ELA and use the time to craft a solution that leaves depositors intact.

Export of petroleum consumption is the real reason behind the onrushing European default. When countries fail their allotment of petroleum is exportable. There is no substantial difference between the thievery underway in Cyprus and that in Libya or Egypt. Ultimately, all of Europe’s petroleum consumption is exportable leaving the various citizens in distress. The hope is to default on the small scale and hive Cyprus’ petroleum consumption toward the rest of Europe. With luck the default is contained and the losses in Cyprus can be offset by more affordable fuel elsewhere.

Cyprus is a test case. If the Cypriots can be jettisoned from the EU energy hedge then other countries can be safely ejected such as Spain and Italy. These countries can fend for themselves in the fuel-for-dollar market while the ‘core’ uses the hard euro to gain that fuel price discount and a guaranteed supply.

Europe’s strategy can only work if the euro-establishment is able to convince the Russians there are currency gains to offset depositor losses. The problem is that deflation follows its own rules: harder currencies cut into consumption which in turn presses the fuel suppliers. When customers hoard hard currency they do not buy fuel, the fuel suppliers go out of business. This is the reason why fuel prices have been declining since February.

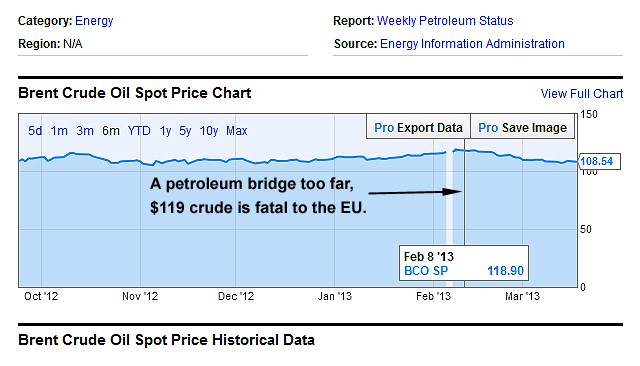

Figure 1: Brent spot crude from yCharts (click on for big). Along with consumption export is the recent rise in fuel price to near $120 per barrel on Brent market. $120 is the new $147: the fuel price is too high, there are the ugliest of all possible noises coming out of Europe …

Cyprus imports 95% of its fossil fuel energy. The euro- and euro denominated credit have been the means by which Cyprus could afford fuel and the thousands of cars needed to waste it. Cyprus earned exactly nothing by driving those cars: nothing remains to retire the multi-billion-euro debts taken on to facilitate the waste. Meanwhile, the country fashioned itself into a mercantile (banking) state so as to arbitrage fuel like Japan. Its banking products have now been deemed redundant and expendable to the European mercantilists. Cyprus’ arbitrage has been devoured by the greater European version. Cyprus was a poor relative to the rest prior to the euro, it is on the way to becoming a poor relative again.

What is occurring in Cyprus is destruction of purchasing power by administrative fiat: this is, conservation by other means. Cyprus’ consumption is exported, its citizens will drive less because they will have less money, what money remains will be hoarded. Fuel not purchased in Cyprus will be available elsewhere so that others can drive in the Cypriots’ place.

Right now it is clear that the establishment will sacrifice anything — good relations with other countries and peoples, economic stability and predictability and best financial practices — to enable automobile use.

– One casualty of default is the media-promoted pseudo-recovery in America and elsewhere. This farce is now a child’s fantasy that can be safely dumped into the trash. Economies that required more easy credit last month now require human sacrifices. Today Cyprus gets the Black Spot, next month’s fall guy is France. Who’s next?

– Bernanke could come up with the ten-billion-or-so euros needed by the EU and end the panic. If he was smart he would do so — very publicly — tomorrow morning. This would buy some time and allow a chance for a comprehensive … etc. round of can kicking.

– If there is an EU ‘handshake’ with Russia => Panic in Southern Europe => contagion and derivatives implosion. This does not have to happen, but avoiding it will require extraordinary efforts, that will cost much more than anything gained at Cyprus’ — and Russia’s — expense.

– If there is no handshake — which seems likely as the European establishment is incompetent — Default in Cyprus is part of generalized euro default => failure of the euro, contagion in China and Japan => severe worldwide recession => collapse of fuel prices and physical shortages.

– Right now, Europeans are busy, opening new bank accounts in Norway, UK, Miami, Panama City and even Switzerland … It takes time to set up yr bank run, there has to be a place to run to.

– The Cypriots are trying to figure out how to evade the capital controls sure to come. Russians are trying to figure out how to remove their funds … Greeks are figuring out how to emulate the Cypriots who in turn are reading about the Icelanders. There is a lot of scheming — and fretting — going on right now.

– Nobody on Planet Earth wants a Greater Depression, everyone knows the score, this is the ‘Big One’ and people have their game face on. If a crisis can be avoided with a small payment most people will make the payment and not complain. It is the analysts who are upset about the consequences of the past few days. Most of the analysts are wrong about which consequences matter the most. They are wrong b/c they ignore the big energy story right under their noses.

– Citizens generally aren’t libertarians and they don’t take ideological positions, they are flexible. Right now the system does not appear to be ruined. That it is indeed ruined has to be proven by events.

The David Whitney house in Detroit in 2013. Out of the current wreckage some fragments will survive.

The only possible exit from currency death by energy strangulation is stringent conservation. Europe needs to cut its fuel bill in half right now. So does the rest of the world. This word ‘conservation’ is never mentioned, the conservationist is excluded from the management dialog. The conservationist offers options that are unhappy for the capital wasters. What the system managers refuse to understand is this: if nothing is done to conserve voluntarily there will be conservation by other, ongoing, extremely unpleasant means.