Oil-rich Saudis find new help in struggle to delay action on climate change: Cheap gasJoby Warrick

As the ruler of a country that sits atop 300 billion barrels of oil, Saudi Arabia’s King Abdullah was no fan of proposals to limit the burning of fossil fuels. During most of his reign, the king’s chief envoy to climate talks was a global-warming skeptic who boasted of his success at scuttling climate treaties.

But it was in the monarch’s final months that Saudi officials hit upon a more effective way to knock the clean-energy movement off its tracks: cheap gas.

Since Abdullah’s death last week, Saudi officials have recommitted themselves to recent policies that have helped drive oil prices to their lowest levels in a decade. The kingdom’s efforts to manipulate oil markets are wreaking havoc with Saudi Arabia’s chief oil rivals, from Iran and Russia to the tar-sands mines of western Canada. Now energy experts are seeing evidence that the oil bust is helping Saudi Arabia achieve another long-term goal: undermining global efforts to reduce dependence on fossil fuels.

Lower oil prices already have spurred demand for gas-guzzling SUVs and prompted a spike in miles driven by American consumers, new government figures show. Whether intentionally or not, the continued slump in prices could hurt sales of low-emission vehicles in Western countries and cool enthusiasm for renewable energy in the developing world — objectives that Saudi officials have long pursued through other means, analysts say.

This is more of the nonsensical ‘oil glut’ Internet meme that is so beloved by Wall Street and the mainstream media.

“You need to allow prices to go as low as possible to see those marginal producers move out of the market,” longtime Saudi oil adviser Mohammad al-Sabban said last week in an interview broadcast by Britain’s BBC. Sabban, who served as the kingdom’s chief climate negotiator before stepping down two years ago, said Saudi Arabia could survive low oil prices better than its rivals because of its production costs and massive cash reserves.“Saudi Arabia can sustain these low oil prices for at least eight years,” he said.

People either don’t get it or don’t want to get it: instead of a glut there is a shortage. Instead of a return to the ‘good old days’, the wheels are coming off. It isn’t just the oil markets: retail sales and revenue are being hammered. So are leading indicator commodities such as lumber, copper and iron ore. The Baltic Dry Index has fallen to its 2008 level; home ownership is at a multi-decade low. There are alarms going off in China and Japan, also Latin America including oil producer Venezuela; also Russia, Zimbabwe, Nigeria, Libya, Ukraine … The world’s customers are broke; it only looks like a glut in the oil patch because drillers are stuck with unsold inventory and the media is willing to lie about it.

Constrained supply will cause prices to increase as an outcome of competitive bidding … provided the bidders are solvent. There is no universal law that requires prices to rise in the event of a shortage: when customers are unable or unwilling to borrow prices will decline, even as the ability to meet the price declines faster. This occurs during deflationary recessions as the result of deleveraging. We are living at the end of a multi-decade long period of credit expansion and Keynesian economic stimulus. The price of everything including assets and the credit used to buy them have been inflated, in some instances wildly. Both fuel and loans needed to gain fuel have become unaffordable even though interest rates are in general extremely low.

The past few months has seen a frenzy of central bank activity wrapped around the annual World Economic Forum at Davos, Switzerland. After much hand-wringing the European Central Bank initiated a €1.1 trillion round of quantitative easing. The Bank of Japan added to its (already excessive) lending programs, as the Swiss shellacked currency speculators by jettisoning their franc-euro peg. The Bank of Canada cut its overnight policy rate a quarter of a percentage point to .75%. In addition, the Turks, the Danes and Peru cut rates or otherwise made borrowing less costly as if doing so might accomplish something.

Brazil bucked the trend and raised its overnight policy rate fifty basis points to 12.25%, this followed the 6.5% increase in rates to 17% by the Russian central bank in December of last year. (Updated) As with the rate cutting, the rate increasing doesn’t accomplish much. There are central banks, there is central bank monetary policy, but nothing of substance to show for either.

Central banks shift funds from customers toward lenders and big businesses who use the funds to buy their own shares and inflate stock prices. Because the banks do not create anything new; because they cannot ‘print’ oil or put resources back into the ground they can do nothing to affect outcomes longer term, they can only pretend. Because of their helplessness, they are now panicking. The media won’t say anything but they don’t have to, the ‘hair-on-fire’ antics of the central bankers speak for themselves.

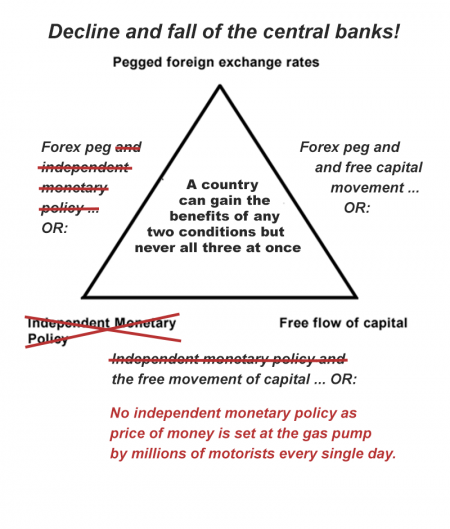

The incredible ‘Impossible Trinity’ because no more than two optimum macroeconomic policies can be exercised at one time. Millions of motorists around the world buying gasoline every day make monetary policy, not bureaucrats fiddling with interest rates in an office building somewhere. To the same degree, all currencies are ‘hard’: they are exchanged on demand for a valuable physical good. Gasoline has become the ‘new gold’. What is different this time is that economists do not recognize the money-oil trade as having monetary policy implications or if so, they are doing a good job keeping quiet about it. The internal (in)efficiency of fuel wasting process determines what all currencies are worth. In Japan a car wastes btus about the same as a similar car in France or in Canada. The car fleets of various countries waste fuel more or less the same. The fuel wasting rate or (non-)productivity determines the funding pace and amounts needed to gain that fuel. Regardless of the central bankers intentions, they cannot affect change how fuel is burned or how much motor fuel the drivers will swap for their money. To that degree all the different currencies are more or less the same, what is variable is their availability.

Risks in the economy cannot emerge in interest rates because of deflation- plus central bankers efforts to ‘buy’ rates down and cap them. Risks emerge in markets where prices cannot be easily ‘controlled’ for more than the shortest periods such as commodities, currencies and in the ‘real’ economy. Most of the risk that would be priced into interest rates such as default risk or maturity mismatches — is now being priced into currency pairs or the oil market. Saudi Arabia does not control the oil markets or the customers, it cannot control the money, either. Like the bankers, the Saudis are left with PR, they can lie about how badly they are (not) being hurt by their oil customers’ instant parsimony. Unlike the bankers, the Saudis are wise enough not to try to ‘fix’ anything. Customers do and are voting with their empty wallets, crashing the price of fuel and other important sectors of the economy.

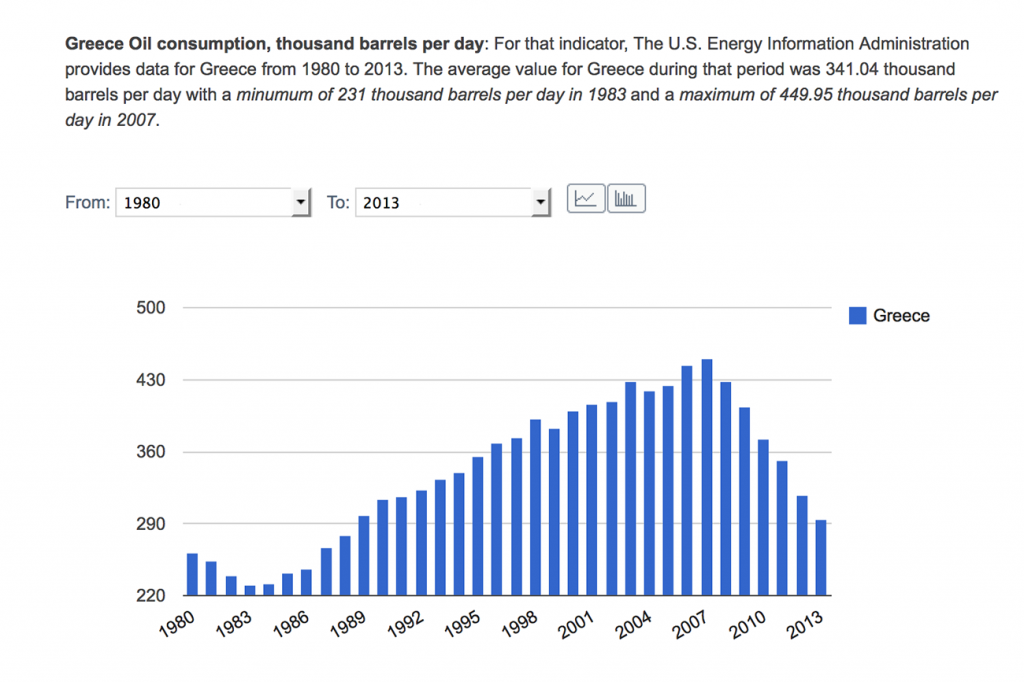

The decline in fuel prices is supposed to be ‘all good’ for consumers yet this is not the case in the real world. The Greeks just held an election to replace one group of corrupt fools with another, their intent is to reverse the crashing Greek fuel consumption trend and stimulate ‘growth’:

Figure 2: The idea is that new ‘growth’ will allow Greece to repay its debts. Oil consumption is plunging because the entire enterprise “Greece Inc.” is bankrupt. No amount of finagling with interest rates or balances due will allow Greece to ‘grow’, chart by EIA, Global Economy.com (click for big).

To grow economies and countries must borrow as ‘growth’ is the increase in unsecured loans. Greece’s problem is because it is insolvent it cannot borrow, because Greece cannot borrow it remains insolvent, (Bloomberg):

The Syriza-led government came to power on a platform of writing down Greek public debt, raising wages and halting spending cuts while remaining in the euro.“Talks won’t be easy, they never are in Europe,” Finance Minister Yanis Varoufakis, 53, said as he took over from his predecessor. “There will be no duel, no threats, or an issue of who blinks first.”

Market Meltdown

Greek stocks and bonds slumped for a third day, after new ministers said they will cease the sale of some state assets and increase the minimum wage. Yields on three-year bonds rose 2.66 percentage points to 16.69 percent. The benchmark Athens General Index decreased 9.2 percent to its lowest level since 2012, led by a collapse in the value of banks.

Yields on 10-year bonds rose back above 10 percent after being as low as 5.7 percent in September. In mid 2012, they exceeded 30 percent, the highest since the country’s debt restructuring, the largest in history.

Nobody has an idea how to make up for the non-sale of state assets or to pay for the increase in the minimum wage. At the end of the day the Greeks have to travel to Frankfurt, hat in hand. It is either that or jettison the euro and reintroduce the drachma, neither of which is a solution.

The Greek government can issue its own fiat currency (greenbacks) but is held hostage to lenders who would crash the Greek banks. The banks themselves are too weak to distribute fiat euros into the rest of Europe and hold off the Troika. Greece is large enough to suffer but not ‘too big to fail’ like Spain or Italy.

A 21st Century Left Rises: Syriza’s Victory and Its Relevance for the U.S. and the WorldAlan Minsky (Truthdig)

Syriza has maintained throughout this election cycle that it wants Greece to remain within the European Union, and to do so would agree to pay back at least part of its debt while seeking only partial debt relief, in largely unthreatening ways that could be facilitated by the very quantitative easing that the ECB initiated a few days before the election. However, Syriza calls for something that is at the root of its popularity with the Greek people, but which utterly cannot be tolerated by the neoliberal rulers of the new Europe. That is the reversal of domestic austerity policies, by taking actions such as reinstating the minimum wage, once again respecting collective bargaining agreements, and expanding public programs and infrastructure. Indeed, while Syriza’s core members have Marxist backgrounds, their immediate economic program is little more than progressive Keynesian social democratic proposals adjusted for a crisis situation. No Joe Stalin, that. More like a modest FDR trying to alleviate the immediate suffering of people, but 100 percent unacceptable to Angela Merkel’s crew.

Opposing austerity means nothing more than bringing back the mainstream policies of mid-20th century industrial societies, but that represents an existential threat to the logic of neoliberalism and must be drowned in the bath. Thus, even before Syriza has a chance to introduce modest social democratic policies (which remain in place in Northern European countries), let alone anything more radical, Tsipras and Syriza will spend their initial days, weeks, even months in government in a diplomatic trial by fire, attempting to win concessions from the (hostile) Troika in order to end domestic austerity programs without being expelled from the euro currency or going bankrupt.

Greece doesn’t offer hope, it offers the latest flavor of fashionable ‘delusional thinking’; that the new government can somehow turn back the clock, to the bring back “the mainstream policies of mid-20th century industrial societies” … the glory days of car-saturated modern American-style living: that it’s “morning in Greece, again”. Austerity cannot be wished away any more than winter can. The Greeks and the rest of us are reaping the consequence of our own vast waste over the course of centuries. The entirety of Europe is insolvent, not just Greece. The prior success of mainstream policies of the mid-20th century is the cause of our distress: there is nothing to show for the stupendous sums borrowed to gain the millions of barrels of fuel burned up for nothing each and every day, no return and no way to repay.

At the same time, borrowers in Europe are held hostage to their own financial innovation from which they cannot escape: euro = gasoline. The euro was created specifically to be an trade currency alternative to the US dollar or sterling, to provide little countries such as Greece the same access to credit (motor fuel) as powerhouses such as Germany, to provide a captive market in Europe for German, French and Italian auto manufacturers. The euro was intended as an energy price hedge against dollars and dollar inflation which is why the needed fiscal structure to support the currency was never put into place.

Governments have to play ball w/ Brussels and IMF or there is no euro, there is no motor fuel. At current prices, exporters will not ship fuel in exchange for depreciated drachma, lira, peseta, etc. The outcome in countries such as Greece would be local fiat that everyone has and is desperate to be rid of against the black-market euro that everyone wants if they wish to drive. As long as the euro exists there is no escape from it … and that is the best case scenario! Instead of the current ‘official’ euro with Frankfurt’s conditions there will be the ‘unofficial’ euro with conditions set by the various criminals trading it on the streets of Greek cities.

A worse case scenario has Greece with some euro trade in- and out of black markets but no euro loans. The outcome would be default and a severe depression or rather, a continuation of the current depressed state of affairs. The new Greek government would find itself becoming the tiresome old government then the ex-government in a rapid sequence.

Even worse would be drachma hyperinflation as the Greek central bank makes unsecured loans to insolvent Greek banking sector aimed at ‘kick-starting the economy’ and ‘getting it moving again’, this is actually most likely outcome as new premier Tsipras is a grandstanding Peronist like his counterparts in Argentina and Venezuela. Unlike them, he has no oil to bargain with.

The absolute worst outcome is rapid dollar preference within Greece and Europe; there could be multiple currencies in play, the euro, drachma, lira, franc, sterling … and dollar. The result would be complete chaos. This outcome is less likely as the euro itself would likely vanish with a Greek exit: if Greece is first country out, Germany is likely the second. Afterward the Greek external trade would be in black-market dollars: Greeks would have to buy them at a steep premium in order to buy fuel as well as repay whatever euro-denominated loans have been converted to dollars.

There is a great deal of sentimentality on both sides of the political divide. Everyone wants more prosperity even as the foundations of prosperity are cannibalized by those seeking it. While reducing inequality is fair and necessary, the resources necessary to support everyone in the world @ the lifestyle- and consumption level of Americans do not exist. What that means in turn is that standards of living must adjust … this is happening under everyone’s nose.

Right now the car manufacturers and drivers are pitted against everyone- and everything else. There will be no real change in Greece or elsewhere until the driving, ‘progress’, fuel-supply, debt regime falls apart under its own weight. For there to be change would require the Greeks and others to get rid of the cars. One way or the other they are going anyway.