Apropos to being outed as a Pigman in the hillbilly infested hoots and hollers of Tennessee darker corners of the Internet, here is an article in FT Alphaville regarding the subject nearest and dearest to pigmen’s hearts everywhere: GOLD.

Mwah-hahahahahaha!

As gold is the ultimate fetish object it holds to reason that those who own gold or pitch it online are pigmen and that those who don’t, aren’t … they are the chaste and proper ‘Anti-Pigmen’ such as those who grace the pages of the Financial Times.

… if irony cannot be found here it does not exist anywhere in the universe.

Man walks into a gold bar. Au!By the lovely and brilliant Izabella Kaminska,

Part of the Cash-for-Gold series:

FT Alphaville participated in a “Gold Bulls vs Bears” event hosted by the Association of Mining Analysts (AMA) on Wednesday.

The motion being discussed was:

Is gold’s role as a safe haven asset in the global financial system outdated and redundant and if the ubiquitous QE programs have been successful and the global economic upturn is confirmed, the price of gold will continue to struggle?

FT Alphaville was on the bear team with Tyler Broda, from Nomura, and Robin Bhar from Societe Generale.

On the bull team there was Sharps Pixley’s Ross Norman, MoneyWeek’s Dominic Frisby and Edison Research’s Charlie Gibson.

The bears lost the motion.

Mwaa-hahahaha! Frisby is a stand-up comic … the bears lost a highly technical finance argument to a television personality! How embarrassing … like losing a courtroom argument to Fred Davis … or the Italian establishment doing very much the same thing.

This was the consolation price, Izzy drank it all. What the winners received is not mentioned. Probably cases of beef jerky.

Sez Izzy:

Since we (the Alphaville side) now have the platform, we’ll unashamedly reiterate the bears’ case. Any gold bull rebuttal that actually makes logical sense (you’ll be working to convince independent adjudicator Jamie Chisholm) has a chance to win the Goldschlager.SocGen’s Robin Bhar made three stellar points:

– Where is the inflation?

Simply put, the current gold price appears to be discounting a huge, sustained increase in inflation over the coming years. For example, we can calculate the required annual US inflation rate over the next five years that would justify the current gold price (using 1968 as the starting point): US inflation would have to run at an overwhelming 45% per annum for the next five years.

But inflation is subdued. Gold prices have soared in recent years despite the fact that US CPI has stayed below 4% for the bulk of the time.

– The dollar’s strength and US growth:

The US economy currently offers the best potential for stronger-than-expected growth. This suggests a stronger US dollar in such a scenario with its obvious impact on gold.

– The end of QE:

And now we are beginning to see: 1) the economic conditions that would justify an end to the Fed’s QE; 2) fiscal stabilisation that has passed its inflection point; and 3) a US dollar that has begun trending higher. Ot seems unlikely that investors would want to add much to their long gold positions in this context. If so, the gold price would trend lower at pace as the physical gold market is seriously oversupplied without continued large-scale investor buying. Selling by investors would add fuel to the fire.

The inflation argument has just torpedoed itself! The pigmen score! “Gold prices have soared despite!” There is no direct relationship between gold prices and inflation only a correlation. The gold price discounts all sorts of risks including inflation … which in its virulent form is a default or a policy choice of managers … as was unloaded upon sleeping Cypriot bank depositors a few weeks ago.

Ask Bank of Cyprus depositors whether they would have rather had their now-severely-diminished or unavailable bank accounts or gold instead. “Gold is too expensive!” howl the bearish anti-pigmen, but how expensive was not having any? Sometimes people cannot see the current lessons being given right under their noses.

The ‘inflation-is-kaput’ argument presupposes the United States or the EU make up the entire economic world. There is deflation in Europe and Japan, at the same time there is inflation in China, India, Argentina and Iran and elsewhere. This is due to hot-money flows and restrictions leading to foreign exchange arbitrage, that is, there are different exchange rates between the public- and private sectors within these countries in addition to wage pressures. The consequence of the harder dollar is more arbitrage in these countries rather than less, more and stronger inflation … along with increased demand for gold.

Bhar’s second argument assumes US ‘growth’ is meaningful and is re-pricing the dollar rather than deflation, fuel shortages and the flight-to-safety. Growth in the US is disconnected from physical reality. The US is the healthiest patient in the cancer ward. Graded on its own curve: labor force participation, gasoline- and electricity consumption, goods imports have all declined; the demand for government supports such as food stamps and disability relief has increased. The remaining ‘growth’ component to the US economy is the debt-supercharged stock market … a rise that suggests currency weakness rather than strength, by the way …

The physical economy offers investors little- or nothing in the way of returns, only non-stop capital destruction and fleets of creditors demanding repayment-or-else. What remains is speculation in finance markets where gains are dearly bought with moral hazard.

Meanwhile, the economic conditions on the ground in the US and elsewhere are unrelated to QE which is an exchange of assets between banks. What is pounding the world’s economies to rubble is not the cost of credit but rather the relentlessly increasing real cost of petroleum fuel. It’s hard to find fiscal stabilization anywhere, governments are playing catch-up trying to bail out bank investors and themselves at the same time they encourage more petroleum consumption which makes everything worse.

Bhar suggests there is excess gold inventory.

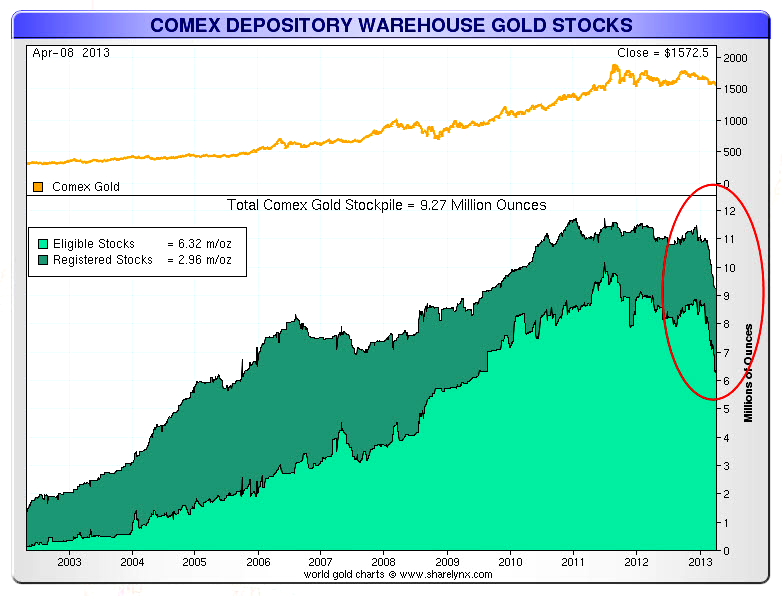

Figure 1: Gold disappears from the Comex metal vaults/JP Morgan, (Tekoa Da Silva-Nick Laird-Sharelynx): maybe it’s not seriously over-supplied after all (click on for big).

Keep in mind, the amount of gold does not change except for small increases year over year due to mine output, less what is lost in boating accidents. What changes is ownership, from merchant pigmen to whom gold is another transferable good to hoarders who are resistant to selling pressures. In order for an investor to gain gold he must either trade with another … or he must borrow. Bhar suggests that increased private sector lending renders QE unnecessary. More credit is just as likely to support the price of gold … as it would any other asset. Bhar argues gold prices will collapse, why should they? A rising tide lifts all boats including those made from solid gold.

Enter Nomura’s Tyler Broda. According to Izzy, he is … “focused on flows and changing tastes:”

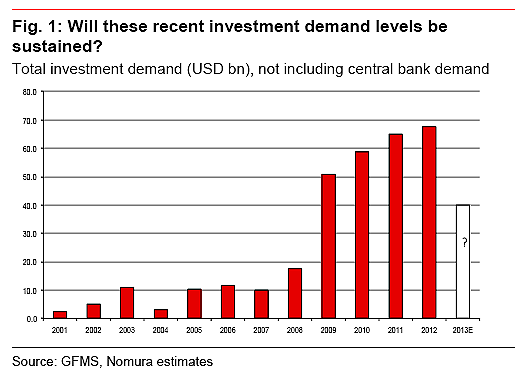

… he said it’s unlikely that the gold market can continue to sustain the investment demand needed to take the price higher:

Figure 2: Investment demand (FT Alphaville-Izzy Kaminska-Nomura): Whom to believe, Broda or his own chart? His only possible argument favors one asset class over another. If overall investment demand collapses as suggested by the chart there will certainly be solicitous central banks offering more cheap credit. Remember, pigmen always come first!

There was also a question of evolving tastes. Who really would want to be seen in the same shirt as their father?

James Bond’s Nehru jacket … Why not?

Sez Broda:

– In the scenario of a US recovery, and an associated appreciation of US dollar, most gold demand categories could weaken after 12 years of bull market growth.

Just as there are other investment reasons to own gold besides dollar depreciation.

– Investment comes under pressure (and even puts supply back on the market as is happening now) with normalising interest rates.

Broda can’t have it both ways, either gold is an investment or it isn’t. If it is, there is no reason for gold investors to behave differently than other investors. Under the hide, all investors are pigmen, even if the investments are cases of 9mm ammo, canned beans or composting toilets. Meanwhile, normalized interest rates are unaffordable, credit has painted itself into a corner.

– Commodity currencies weaken thereby lowering the cost curve support.

Commodity currencies are repriced relative to each other for many different reasons that often have little to do with interest rates. For instance, supply and demand — currency float/liquidity during a particular period — as well as marketplace momentum chasing and front-running affect currency prices.

– Lower gold prices mean less equity market interest in gold production, so debt and private equity financing increases which could lead to a return of hedging (adding to current supply).

Hedging adds to the supply of claims against gold, it cannot add the gold itself. Problems begin when the hedges are unwound and the claims are exercised. When there is less gold then claims are either worthless and extinguished in bankruptcy or they become bidding licenses.

– US dollar strength, reshoring and lower energy imports, reduces the size of EM trade surpluses, which could see EM central banks not accumulate gold at as fast as recent levels.

Exporters have currency reserve positions that are illiquid due to their size. There is little to buy with these reserves other than different currencies, debt or resources (capital). Gold is appealing because it’s different: it’s the resource that isn’t burned up for nothing.

There are lower energy imports in the US and elsewhere is because customers in these places are going broke and becoming ex-pigmen. This in turn adversely effects money supply, the EM’s forex reserves become stranded. This is not a problem with gold, instead the issue is EMs finding enough of it to buy … to do so without blowing the price sky high.

– Longer-term, jewellery demand could be negatively influenced by increasing sophistication within the emerging market economies.

Then again, it might not …

– The further adoption of globalised tastes means the affinity towards gold could ebb.

Tastes change in unpredictable ways, however, the Pharaohs 3,000 years ago wore gold jewelry like brides in India do today. A difference: there are far more brides now than there were Pharaohs, then.

– Gold’s dynamics are cyclical in nature. In this scenario, after these trends take hold, there will come a time where lower mined grades, continued nominal income growth (especially in Asia) and a return to investment demand push gold prices higher. However, with the market having built up $250 billion in investment demand alone over the past 4 years, supply and demand suggest the risks are still to the downside.With respect to any increase in hedging, he added this would naturally bring forward tomorrow’s selling pressure to today, adding to current liquidation pressure.

Today’s selling pressure looks to be the result of margin calls by massively over-leveraged European banks as best-collateral is liquidated first.

– FT Alphaville pointed out that gold’s time as a safe asset had come and gone mostly because of technological evolution.

Add buzzwords here … ‘fill-in-the-blank technology’ … is going to save us all, blah, blah, blah …

– Gold certainly used to fulfill a store of value role in deepest darkest history because at that time there weren’t many other means to independently verify and record social liabilities. Gold was often the only common denominator between communities that did not know each other due to its fungible state and relative global scarcity.

2013: a ‘mark to fallacy’ world filled with shaggy-haired, moth eaten debts, most of which will never be repaid … what are the social liabilities worth, exactly? Nobody can verify what institutions hold on their balance sheets now; only a form of self-interested desperation is what is keeping the various components of the establishment knit together under enormous strains.

– But its value always lay in what it represented: a social liability. Debts and favours have always come before commodity money.

Broda says gold is poor quality money … compared to what? Keeping accounts straight is never the issue, for that purpose all forms of money work the same.

– Gold was an obvious token to be used to represent social wealth because only a wealthy society could justifiably waste its time doing something so pointless as digging up gold.

Somehow, digging up a trillion barrels of oil, then burning them all for nothing by driving aimlessly in circles while poisoning the atmosphere at the same time is not pointless!

– In that sense gold was naturally associated with free time and social standing.

So are a lot of other things … Goldschlager, vacation homes, mega-yachts, Rolls-Royces … so is finance in general. This is Financial Times for crying out loud, the discussion is about rentier assets not alms for the poverty stricken! At issue is relative pig-mannishness … or is it relative pig-mannery?

– But even in Roman times gold was mostly used as a last resort settlement option between strangers and foreigners only. The Romans actually had a very evolved debt-based system, with coins representing a memory device for social debts in an age when liabilities could not be verified with electronic ledgers.

Broda just torpedoes his own argument over and over. Gold did indeed exist as a tradable asset alongside credit … as it does so today. Markets have not changed, there are same funding sources, same pigmen; some of wallow more comfortably than do others.

– Those who believe gold has value beyond what a gold coin represents in the context of a wider “paper” liability based system suffer from the “Emperor’s New Clothes” delusion.

That’s another hole under the waterline. As a natural resource, gold has value, it is capital.

Unlike money, gold is non-reproducible. Our industrial money is value-negative, that is, it destroys value. Money is capital’s residue: it annihilates capital so as to substitute worth in the place of resource value. Or money creates perverse incentives: it enables those humans who destroy capital to live better than those who do not. Here is our ongoing crisis – slash – omnicide that is taking place right now! The human race requires intact capital not its residue; credit brings capital destruction forward. We congratulate ourselves for our cleverness: we have destroyed our grandparents’ capital and our parents’ … we are devouring our grandchildrens’ and theirs in turn. What will be left for them besides empty promises?

It is not gold … nor is it the perception of gold’s abstract characteristics … that argues against liability money, rather it is the ordinary operation of our day-to-day business which does all the heavy lifting. We sit back and watch the destruction taking place all around us helpless to do anything about it because of the hold our swinishness has on us!

– Unless gold turns out to hold the key to eternal life, its utility is non-existent (outside of some small use dentistry or the chemical industry).

How hyperbolic! Gold is expected to transcend physics in order for it to outperform credit even as credit is unable to outperform itself. If it were otherwise — if credit could simply meet its own costs for longer than a few measly years — there would be no finance crisis. Instead, we are enduring the abysmal success of credit money, which has pitched our economies at the edge of the pit.

– As Warren Buffett famously reflected about the absurdity of the gold market: we take something out of the ground only to immediately rebury it.

Buffett, the Ultimate Pigman …

I am Pigman, hear me roar (Yahoo)

– Which is why in a crisis people defer to objects of real utility for social exchange: cigarettes, favors, food, shelter, medical services and medicine.

… when they don’t have any gold. This last remark could be rephrased, “in a crisis people prefer real objects over airy abstract promises from con- pigmen”.

– If gold has value it’s because its abundant supply is being constantly manipulated by hoarders who suffer collectively from the same gold delusion.

Don’t start with central banks’ currency tricks and moral hazard, the pot calls kettle black!

– Roman gold hoards are a good example of this absurdity. They exist mainly because the Romans who buried those hoards never rediscovered them. The hoards were hardly a good insurance policy for them.

Nobody knows about the Roman gold hoards that were dug up by the Romans themselves …

– A social obligation authenticated by peers, however, cannot be lost as easily.

Another self-torpedoing: Peers authenticating credit is okay, but the same peers authenticating gold is not okay … enter the pigman attempting to appear to be something other than what he is! Gold = Pig. AAPL also = Pig.

– Thus if gold’s value went up during the crisis, it was only because temporarily people were reburying gold more quickly than they were unburying it.

Hmmm … that one sounds vaguely … Keynesian …

– But even at this time, the key trade was cash for gold, not gold for cash. The real commodity being demanded was in fact the cash. This created a delayed liquidation effect, as more gold became financialised and hedged by the industry lifting the price of the free-float.

“A man has two reasons to do anything, a good reason and the real reason.” __ J. P. Morgan

– In conclusion, we commented that gold’s value rests entirely on a belief system as zealous and subjective as any fundamentalist religion …

… like all other assets including credit money. All money is a mutually agreeable understanding with the past predicating the future. Gold has as good a record in this regard as any other form of money … or any other asset, for that matter.

The anti-pigman argument is that gold isn’t as ‘efficient’ an investment asset as others that pay dividends … that is, unearned income. The pigman counter-argument is gold carries less risk than other dividend-paying assets such as shares. Anti-pigs cannot argue that dividend-paying assets or other asset regimes carry little risk, even as least-risky of these assets are being crushed by policy on one hand, energy depletion-driven deflation on the other. Religion has nothing to do with behavior of money and money-users, rather it’s the very reasonable disillusion with religion.

– What’s more it’s a belief system that is driven by selfish and anti-social instincts, obsessed with concentrating wealth among the few on the arcane notion that gold’s value is somehow a constant in a world of variables.

The stock, bond, real estate markets are belief systems driven by selfish and anti-social instincts, obsessed with concentrating wealth among the pigmen!

… But there is no constant value system in a social system. Everything is relative.

When everything is relative, the anti-pigman argument vanishes, it can only take form where there is at least one constant as a reference point. One is either pregnant or not. The anti- constant is GDP growth in industrialized economies … a slender string indeed.

A few other things to keep in mind:

– On Ebay gold is ±$1,800/oz. More or less the same as it has been since end of 2011.

– Gold will depreciate when Picassos depreciate and not before: both are collected by Pigmen who can afford them regardless of price. Whatever is said about the investment worth of Picassos can be said about gold, after all, they are nothing more than bits of paint smeared onto pieces of cloth.

– Unlike petroleum where the high price is economically destructive, a high price for gold is economically irrelevant. $5 gasoline in the US = a severe recession or depression, $50,000/oz gold would not trigger anything but celebration among pigmen.

– Gold offers zero-returns, negative when cost of carry is added … the world’s risk-free securities offer nothing better.

– Gold can be exchanged directly for goods such as real estate. These sorts of barter trades occur outside of ordinary finance markets, traders therein cannot gain their accustomed percentage, the traders do not like these trades and they don’t like gold.

– At the same time, gold is held largely by the wealthy pigmen and central banks. Do they know something the rest of us don’t?

– Choice: do you keep wealth in gold … or as cash in a bank where it can be ‘bailed in’? There are more kinds of risk outside that of inflation. Unlike a national currency that is specific to a country, gold is portable, fungible and readily exchangeable everywhere in the world.

– The folks promoting OECD economic recovery are pro liars and media propagandists. Europe is in another recession and the US economy is misrepresented by ‘official’ figures. Even China is hiccuping.

– Japan’s trade deficit is deadly poison for Japan and for those who hold its paper. The yen is on a knife edge, JGB yields look to increase, the next step is a funding crisis both inside and outside of Japan. Inside; funding of the government’s interest burden and ordinary citizens’ purchases of imports, outside; to fund the yen carry trade (hedge). There will either be a flood of yen in circulation due to Abenomics’ success or too few due to its failure. Either one- or the other will occur, Japan’s trade deficit requires it.

Japan’s customers are now too broke to subsidize Japan’s mercantile economy any longer, they cannot subsidize themselves and their own wasteful consumption.

– What are (sovereign) securities really worth? (A: what Jim Cramer says they are!)

– The alternative collateral to gold is … what exactly? Non-gold collateral includes shiploads of bad loans spirited from the private sector onto the central banks’ balance sheets. Nothing is improved, nothing ever has been improved only papered over with new loans: finance is insolvent.

– The German government asked the US and France to return … something. Was it lederhosen? Cuckoo clocks? Porsche hub caps? Pigmen within the German government set their gold-retrieval process in motion: ‘Law of averages’ suggests not all the German government pigmen are daft.

– Market call: gold is a natural resource, like the others, it’s real price — that relative to other goods and services — will relentlessly increase.

There is more … more always more. More is the nature of Pigmen to always require more. Izzy can send the bottle of Goldschlager over here, at her convenience.

NOTE: All the non-book comments on the previous post will be brought forward over here.