When you wish upon a star … the auto industry … you don’t get a pony you get Detroit. This is the lesson the world is in the process of learning right this minute.

Kyle Bass speaking about debt. Like most analysts, Bass blames Japan’s fix on excessive debt …

“Thematically, the bottom line is … the total credit-market debt to GDP globally is 350%, it’s $200 trillion dollars worth of debt … against global GDP of roughly $62 trillion … “

Nobody bothers to ask why there is so much debt in the first place. The question is a finance analyst taboo … something not discussed, like underwear with dollar-signs printed on it.

The reason for the silence is that industrialization is unable to retire its debts. If machines could pay for themselves and ‘earn’ a profit they would be doing so already and there would be no debts at all. That machines cannot pay their own way is self-evident.

The debts taken on to make the ‘machine idea’ work are impossible to retire because they are too large. @ $200 trillion and 350% of global GDP — plus additional hundreds of trillions in non-tendered liabilities — even if the world’s industries were to function magically ‘properly’ the debt burden is out of reach. What is available to service and retire debt is the modest marginal increase in GDP year-over-year: this increase itself is borrowed!

Debts cannot be serviced — much less retired — with the economies at death’s door: future GDP growth is theoretical.

Repayment is a fairy tale … it is also the cudgel of creditor repression. If there was the merest prospect of growth, economies would not bother with debt repayment but would take on even more … Not only does industry require debt but the waste-based industrial economy will always and under every circumstance increase its debts until it is physically incapable of doing so.

More Kyle Bass:

“So … this is a debt super-cycle that is coming to an end. It’s coming to an end at different end-points for different countries … A lot has happened in Japan in the last 12 months, in fact, in the last two months we believe they crossed that proverbial Rubicon … we think that you’ve seen 20 years … of conjecture regarding Japan’s eventual demise and now we see a point where in the last couple of months what you see a continued deterioration in their balance of trade. It’s actually running at about negative- $100 billion on-the-dollar … a hundred-billion dollars, or close to ten-trillion yen … and we think given this resurgence of Chinese nationalism over the Senkaku crisis … you are going to see that (trade imbalance) move another … one-and-a-half or two percentage of GDP … or another $100 billion dollars. To put that into perspective, what that means is we could see full current-account negativity in Japan in October (actually, November) … that’s something nobody is ready for …We think about it: we have a secular decline in the population happening, you have a balance of trade literally being re-written and falling off a cliff … and their GDP is tracking negative 3.5, negative 4 percent.

In other words, Detroit.

Japan has reached the point where it cannot borrow any more because it has already borrowed as much as it possibly can. As long as Japan borrows the costs are manageable. Debt is a treadmill, once on you can never step off or slow down. Japan will learn that as the borrowing slows the real cost ramps. Repayment does not work because doing so increases the worth of the money used to repay. Returns on Japan’s industries are not an issue: they never did matter because they never existed. What matters is the narrative of ‘progress’ and ‘innovation’ which for Japan has soured. The narrative itself is collateral, the country has become hopelessly old-fashioned … passé and unworthy of credit. Japan tries on new narratives but the only ‘innovation’ remaining in the cupboard is more quantitative easing (QE).

Like the Motor City, Japan hitched its fortunes to the automobile industry. The car business has succeeded by more efficiently devouring its own capital. Since the ‘peak oil’ low in 1998, capital has been repriced, there is a scarcity premium added. It does not matter whether capital is officially recognized as scarce or not! What matters is the market price of capital relative to other goods. Resource capital is now too pricey to waste. The waste-based enterprise is stranded by its capital costs and there is nothing the establishment can do about it!

In Japan and elsewhere, the strategy to ‘manage’ debt has been to always add more of it until the cost becomes prohibitive ridiculous. Instead of debt, labor costs are cut by eliminating jobs … even though labor costs have little to do with the debt and are not the cause of it. Businesses borrow to pay executives and business owners, labor is expendable.

Michael Hudson suggests that the burden of taxation has been swapped for interest payments/economic rents to financiers. Instead of flowing toward governments- then cycling back toward the public, funds flow toward banks and to tycoons. The consequence is not taxation without representation, it is taxation without the means to pay the taxes. This is a strategy of pauperization that leaves the labor force dependent on meager handouts and indebted to both business and government.

Some Detroit-Japan notes:

– Detroit is a ‘company town’ dependent upon a single industry. It gained net cash flow from outside the city/the rest of the world. Japan is a ‘company country’ that is also dependent upon a single industry. It also gains net cash flow from the rest of the world … or it did.

– Japan needs that cash flow to service debts and subsidize their industries. The government can borrow from the central bank but for only a short time. Then it must either stop borrowing or pay higher prices on international credit markets and subject itself to credit embargo. Detroit obviously cannot borrow from its central bank because it does not have one. It is already subject to credit embargo.

– Detroit and Japan ‘play the resource spread’: buying resources then repackaging a portion of these into costlier forms so as to subsidize their own consumption. The increase in input costs has made spread(s) impossible to finance as the needed debt is too costly.

– Detroit is almost 90% African-American, Japan is 90% Japanese. Both American and Japanese cultures are rigidly resistant to changes in the status-quo. In Detroit, difficulties are blamed on Negroes rather than automobiles. Time will tell whom the Japanese will blame their difficulties on … certainly not the beloved automobiles, which are the real culprit.

– Aging Detroit’s population is entering retirement, workers have few assets outside of their personal homes. Japan’s population is nearing retirement, workers are converting non-monetary assets into currency. They are selling Japanese government bonds, that is, they are not lending to the government.

– Both Detroit and Japan have little in the way of native resources, both seek to exhaust the resources of others. Detroit has exhausted available resources and Japan is on the way to doing so.

– Both economies feature smokestack-manufacturing industries that have migrated to China and other low-wage countries … associated wage arbitrage has reduced discretionary incomes of both Detroit- and Japanese workers.

– Managements of both places are inept and cruel, beset with cronyism and corruption … leading to catastrophic consequences. It is hard to say which place is more ruined. Neither ‘systems’ allow imagination or risk, any persons exhibiting imaginative tendencies are excluded. Conventional managers repeatedly fail conventionally until they are undone by the magnitude of their failures.

– Legacy obligations are carried forward with increasing amounts of new debt required to service and retire (roll-over) the older maturing debts. Japan’s lending capacity is entirely consumed meeting the burdens of existing debt. Detroit has almost no capacity to borrow at all and is dependent upon begging.

– Japan’s so-called ‘Bubble Economy’ was a hedge against rising energy costs … a hedge that was unraveled by increased energy costs. Hedge versus expedient: Detroit’s success was the reason for Japan’s economic strategy in the first place. The auto industry destroys the capital the industry requires over the longer term. It also forecloses the future, destroying capital that was-and is needed for actual productive enterprises including those that have not been imagined yet! Motown’s business strategy has been to deploy successive expedients .. good for the moment and costly afterward.

– Monetary policy — in the form of multiple rounds of bond-buying/quantitative easing and super-low interest rates — has failed/is irrelevant. The desire has been to create monetary/currency inflation: Japan is mired in deflation! The end-game for Japan is identical to the end-game in deflationary Detroit: ruin.

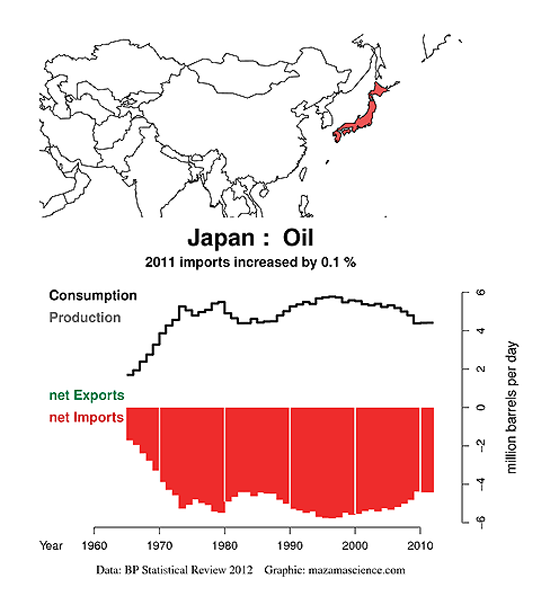

Figure 1: Japan’s crude oil consumption: the failure at Fukushima and the resulting shutdown of the country’s nuclear park left an expensive energy deficit that the country must close by importing petroleum and liquified natural gas. Every yen diverted to the petroleum suppliers is a yen extracted from other sectors of the Japanese economy … including debt service.

The world is not in danger of becoming Japanese with its 20-year deflation. Instead, the danger is Japan becoming Motown, (James Howard Kunstler):

Finally, I have one flat-out prediction, one I have made before but deserves repeating: Japan will be the first society to consciously opt out of being an advanced industrial economy. They have no other apparent choice really, having next-to-zero oil, gas, or coal reserves of their own, and having lost faith in nuclear power. They will be the first country to enter a world made by hand. They were very good at it before about 1850 and had a pre-industrial culture of high artistry and grace – though, granted, all the defects of human psychology.

Japan is trapped. It must maintain enough of a functioning industrial economy to support its fleet of crumbling nuclear reactors for an indeterminable period of time, perhaps centuries. Imagine Detroit with reactors.

Industrialization is supposed to bring more goods at lower costs to customers who have to work less in order to enjoy more. From cradle to grave, modernity promises more of everything for everyone.

Sadly, the goods are not enjoyable or useful. For example: the promised mobility has degenerated in a set of unremarkable yet rigid rules. It is the flowing mindlessly in drainage canals from no place to no place, from one slum to another in pursuit of low quality, unsatisfactory goods!

The systemic costs of these ‘goods’ are unaffordable to the system. The customers discover they are unable to work because they are unemployed or they find the work is too hateful to bear. The ever-multiplying poor struggle to survive while the rich increasingly and for good reason fear the poor.

Meanwhile, waste — which is the real product of modernity — overwhelms the natural life-support system for rich and poor alike. Modernity cannibalizes the capital the system needs to run. The waste products and the loss of capital — and their associated increase in costs — is why modernity is failing. The problems discussed by Kyle Bass and other analysts are all symptoms of extinguished capital.

The managers desperately seek solutions that don’t change anything because of the perceived costs of change. What they miss right under their noses is to resist change is to become Detroit … or worse. Changes are inevitable, they will occur as a result of intent or as a result of system breakdown … which in turn forecloses the possibilities of creative alternatives. It is best to seize the day … to assign costs where they belong and start making the hard choices about what we need to give up … so what remains can be made available to ourselves and our offspring. What is needed isn’t anything extraordinary, only restraint.

The establishment has nothing left, they are scraping the bottom of the barrel. Everything is offered but energy conservation and doing with less. This is total nonsense … There isn’t enough room on Planet Earth for unlimited humans + cars + associated ‘other goods’. Something has to go, otherwise, the world = Detroit.