Figure 1: Does the crude market unravel due to hoarding of funds or is there a ferocious price spike followed by a crash? The EU plays with fire. Chart comparing costs for replacement crude oil to what the customer can afford to pay: by TFC Charts (click on for big). The time remaining to adjust or make positive changes in policy direction has become shorter and more uncertain. The window of roughly two years until fuel supply shocks presumed no policy errors on the part of the establishment.

Welcome to the new, improved bank run!

The European Union bosses have levied a tax against bank depositors in Cyprus, the purpose being to maintain the drive-first status quo. By doing so they appear to have stepped off the end of the gangplank (NY Times):

Facing Bailout Tax, Cypriots Try to Get Cash Out of BanksLiz Alderman, NY Times

ATHENS — In a move that could set off new fears of contagion across the euro zone, anxious depositors drained cash from automated teller machines in Cyprus on Saturday, hours after European officials in Brussels required that part of a new 10 billion euro bailout be paid for directly from the bank accounts of ordinary savers.

After Negotiations, Cyprus Agrees to a Euro Zone Bailout Package (March 17, 2013)

The move — a first in the three-year-old European financial crisis — raised questions about whether bank runs could be set off elsewhere in the euro zone. Jeroen Dijsselbloem, the president of the group of euro area ministers, declined early Saturday to rule out taxes on depositors in countries beyond Cyprus, although he said such a measure was not currently being considered.

This is naked confiscation of funds from ordinary citizens, there is no correlating increase in worth of the remaining funds or expansion of the Cypriot economy. It is simply shoveling more good money down the euro rat hole to save senior secured creditors to the banks from loss … as well as support the automotive waste status quo.

Athens, Greece is flooded with rainwater as well as with endless streams of traffic. Europeans do not realize that as long as one car is running in Europe and elsewhere, there will be economic decline. Globalization at work: the Europeans are subsidizing fuel demand in China which increases competitive cost pressure in Europe. This decline is spread to Cyprus by way of its banks, an afterthought to the crisis that has engulfed Greece and the other euro-states.

Under an emergency deal reached early Saturday in Brussels, a one-time tax of 9.9 percent is to be levied on Cypriot bank deposits of more than 100,000 euros effective Tuesday, hitting wealthy depositors — mostly Russians who have put vast sums into Cyprus’s banks in recent years. But even deposits under that amount are to be taxed at 6.75 percent, meaning that Cyprus’s creditors will be confiscating money directly from pensioners, workers and regular depositors to pay off the bailout tab.

Problems in Cyprus are not new, the country’s banks have loaned large amounts to Greek businesses and banks, the loans are multiples of Cypriot GDP. As Greece falls further into bankruptcy, so do the Cypriot banks.

Cyprus is also in the cross-hairs of European bank regulators as Russian ‘investment’ funds flow into Cypriot banks from Russia … then back out again. Regulators accuse Cypriot bankers of laundering funds of Russian gangsters and oligarchs. The source of particular funds is unclear but in aggregate, all euros in the hands of Russian depositors are from European energy consumers buying Russian non-renewables including natural gas and crude oil.

The Washington Post says:

Why today’s Cyprus bailout could be the start of the next financial crisisNeil Irwin

It is a bad day to have your money deposited in a bank in the Mediterranean island nation of Cyprus. And it may just mean some bad days ahead for the rest of us.

Early Saturday, the nation reached an agreement with international lenders (IMF, European Central Bank and European Union) for bailout help. Part of the agreement: Bank depositors with more than 100,000 euros ($131,000) in their accounts will take a 9.9 percent haircut. Even those with less in savings will see their accounts reduced by 6.75 percent. That’s right: Anyone with money in a Cypriot bank will have significantly less money when the banks open for business Tuesday than they did on Friday. Cypriots have reacted with this perfectly rational reaction: lining up at ATM machines to try to get as much money out in the form of cash before the money they have in their accounts is reduced.

The idea that emerges is that banks — like real estate — are currency traps, that there is no ‘safety’ for funds … anywhere. – A bank run has been underway in Europe for several years. Part of this is the foreign exchange aspect of the eurozone and is structural.

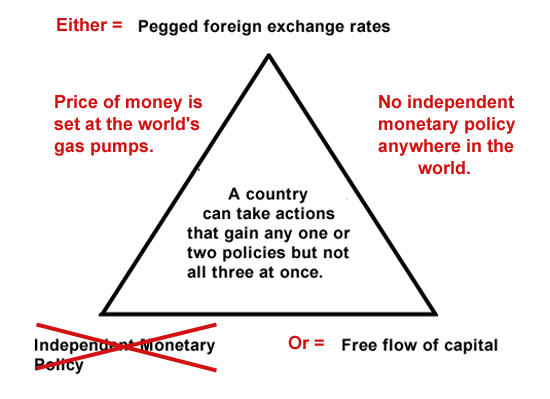

Figure 2: The God-like Unholy Trinity which determines the course of foreign exchange for all countries including those in Europe. A country can have an independent monetary policy, it can maintain a currency peg with another country or countries and it can enjoy the free flow of capital across its borders. It can effect two of these, or two can be denied, but never all three at once.

The worth of money is determined — not by central banks — but by its voluntary exchange for a valuable physical good on demand … at gasoline stations around the world millions of times a day. Even with policy rates set to zero and the all-out lending to governments by central banks there is no independent monetary policy … anywhere. The worth of money is determined by its exchange for crude and crude products and nothing else. The only policies that central banks can effect are those that make matters worse.

The euro is not a currency in the sense that it is the product of a nation named ‘Europe’, rather it is the collection of currencies of individual European nations that all happen to be called the euro. These currencies are all pegged to each other, a source of Europe’s misery as there is no way for the individual euros to be repriced independently of the others. Europe has the pegged currencies and no independent monetary policy: all that remains is the free flow of capital or not across European borders … that is, bank runs.

Bank runs are baked into the cake to some degree because of the use of the European Stability Mechanism (ESM) which is a credit-laundering machine to allow the ECB to make unsecured loans. This is fatal to the central bank because it has insufficient capital and its assets are the same assets that have bankrupted the various commercial banks. Once implemented — due in April — here is no effective lender of last resort in Europe. The ECB is simply another insolvent European commercial lender.

Keep in mind, if states impose capital controls — to restrain the free flow of capital — there is no more peg which means no more euro!

The system is clearly worth more to the Europeans than the funds it contains. The system is embodied in the euro which = gasoline. Stripped to essentials, the Europeans are choosing to drive over maintaining a functioning economy. Granted, the economy has depended upon driving to maintain cash flows, but this waste-based approach is unraveling. Cash flows will be interrupted regardless of what the Europeans choose to do. It would be best for the Europeans to jettison the driving and use the money to re-capitalize a less wasteful economy.

When the euro system fails it will be as a result of eurozone countries being bankrupt, not defects of the euro itself. When a country is bankrupt to the degree it torpedoes the euro that country cannot do better with any other currency! In other words, these countries in Europe could dollarize and they would still be bankrupt.

At this point in the five-year decline in Europe, policy errors are unavoidable. Bank assets in Europe are worthless. They are essentially car loans … along with loans to enable the Europeans to buy fuel which has been burned up for absolutely no return. This is why the countries are bankrupt, not because of the euro which is simply a currency.

Europe has made itself vulnerable to push-back from Russians who are large depositors to Cypriot banks. Russia will pay itself at the front end of the natural gas pipeline: 10% less deposits, 10% less gas. All Putin has to do is order pet Gazprom to turn a valve and the Europeans freeze inside their houses.

Not the first time depositors have been ravaged in Europe: Spanish depositors have been made into stockholders of combined banks after smaller home-loan banks failed. When the combined banks failed in turn the new shareholders were completely wiped out.

From the ‘shooting oneself in the foot and liking it’ department: the entire euro banking system collateral is the same system’s deposits. European banks need more deposits not less! Instead of stifling contagion in Europe as is claimed by the managers, this action looks to be the trigger for Continent-wide bank runs.

It will be very hard for the establishment to put this particular genie back into the bottle. Even discussions about withdrawing the action will be destabilizing as every word will be freighted with consequences to depositors, not just in Cyprus but elsewhere.

The strategy to solving money laundering is to deal with it directly, by prosecuting criminals rather than penalizing ordinary bank customers. It isn’t the customers’ fault that Russian- and other overseas criminals use Cypriot banks, there is nothing ordinary bank customers can do about it, either.

Whatever the Troika hopes to gain by annexing deposits will be lost by the European Central Bank and the banking system as a whole.

Notice that the action took place on a weekend, as was the case during the ‘Lehman breakdown’. Also notice that Cypriot banks are now to be closed on Tuesday as well (Monday is a Cypriot national holiday).

“(Cyprus President Nicos) Anastasiades explained that Cyprus gave way after the ECB threatened to push the island into a disorderly default by withdrawing liquidity support for Laiki, its second-biggest bank, on Tuesday.

He said Cyprus had a choice between “a catastrophic scenario of disorderly bankruptcy, or a scenario of a painful but controlled management of the crisis”.

According to Cyprus sources, the IMF and German managers wanted a 40% haircut. 7-10% is only the first installment. The Cyprus bank insolvency cannot be cured, only the money interests made whole by the rest.

All EU depositors — in countries with similar finance problems as Cyprus or not — are facing theft of funds. In Cyprus, funds are stolen from depositors and handed to senior secured creditors of the Cypriot banks, preferred shareholders, lenders to the Cyprus state and depositors to Cypriot banks outside of Cyprus. The establishment is afraid the bondholders won’t lend any more. The EU system is broken, nobody knows what to do, there is no reason to lend, anyway.

With the cost of new fuel rising due to geological constraints, with access to credit diminishing due to high energy prices, there has been a rapidly shrinking window of opportunity for the managers to take appropriate actions to strengthen the money- system and to conserve resources/capital. That window is now being slammed shut by foolish managers.

Notice how the ‘system’ works, nothing really changes except the scale: from, “Hiding in plain sight”:

It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.

Henry Ford

Q: How would you describe the economy?

A: It is a system that allows a select few to borrow immense fortunes. The rest of us … you, me, everyone else … repay the debts.

…

Q: That’s it?

A: That’s it.

The face of Peak Oil. [1]

We are in the middle of a crisis that has been ongoing for almost five years now: the managers demand the economic system be bailed out. Of whom do they make demands? Entrepreneurs? Innovators? The finest minds of a generation?

A: Pensioners. (Bank depositors.)

The economies must become more productive which means increasing the efficiency of output. Consequently, pensioners are called upon to sacrifice their retirements in the UK, Greece, Ireland, Portugal, in the US … in cities and states pensions everywhere are under attack.

Why not more machines? If machines are productive, wouldn’t deploying more machines solve the economic problems around the world rather than deploying pensioners (and bank depositors)? Technology is supposed to save us but the raiding of pensions — and bank accounts — insists otherwise: the scraping of the bottom of the barrel in real time. It’s an admission that technology won’t work, from the people who are in a position to know.

What happens after the retirements (and bank accounts) are pilfered? Who knows? Nobody has a plan.

The world is shocked to discover a shortage of capital, not for investments but to prop sagging balance sheets. Who could have guessed as capital has been shoveled into the furnaces of ‘development’ for decades? Only economists and bureaucrats believe that we never run out of inputs.

China’s Biggest Banks Are Squeezed for Capital

Neil Gough (NY Times)

China’s banks are among the biggest and most profitable financial institutions in the world. But the state-backed banks are also starved for capital after an aggressive lending spree that was encouraged by the government.

Maybe they are profitable and maybe not. “Starved for capital,” suggests not. The operating idea is that capital is money rather than material inputs. These inputs are mispriced so that the money-equations used by industrialists add up to something ‘positive’. Cheating works until it doesn’t any more: substituting debt for unaffordable inputs doesn’t produce anything. Debt isn’t capital and self-delusion isn’t capitalism. Maybe we should call our economic system ‘Delusionism’ and be done with it.

Within the last year (2011), seven of the biggest Chinese banks tapped the markets for 323.8 billion renminbi ($51.4 billion ) in new funds, according to Citigroup estimates. Several financial firms are expected to raise another $17.7 billion in the next few months, with China’s fifth-biggest lender, the Bank of Communications, accounting for $9 billion.Banks around the world have been tapping investors for new funds as they struggle with slumping share prices and waning profits. But Chinese firms have maintained that their profit growth is strong and their balance sheets are solid, raising red flags among some analysts about the banks’ persistent capital needs.

Chinese bankers and business tycoons, each more corrupt than the last: raise that Red Flag high! The Chinese need capital because so many are stealing it and removing themselves overseas.

The problem is that paying out high dividends blows holes in their base capital. Thus, banks need to continue tapping the markets for fresh funds, often diluting minority shareholders by issuing new shares. The finance ministry, the banks’ ultimate controlling shareholder, always buys in, keeping its stakes topped up.

Somebody at the bottom always takes it in the neck. Today, it’s the minority shareholders, tomorrow it will be the junior bondholders or the pensioners or the schoolchildren forced to eat radioactive school lunches. This is part of an ongoing process, not a new feature within delusionism. It was invisible when everyone was busy getting rich: now that the abuses are visible it can only be on account that fewer are getting rich. The endgame heaves into view.

The journey from ATM to ATM to withdraw money is just beginning in Europe, as it was years ago in Argentina. After that comes the banging of pots and pans in the streets, then come bomb attacks on police stations. This is not a good journey for the Europeans to be embarked upon.

ADDENDUM: One of Mish’s correspondents breaks down the liabilities of the Cyprus banks involved in the ongoing fiasco and brings some info to light, (Jeff Baryshnik, Baryshnik Capital Management Inc.):

Hi MishI read with interest your article on the Cyprus bailout deal. After a quick review of the most recent financial statements of the four publicly listed Cypriot banks as shown on their websites, it is notable that a simple alternative proposal could protect the country from bankruptcy and make its depositors whole.

By wiping out 100% of the equity, 100% of the bondholders, and 17% of the banks’ liability to central banks, the Cypriots could stabilize their banking system (based on the 5.8Bn EUR figure being discussed) without penalizing local savers.

Instead of raising 5.8Bn EUR from depositors, it could raise 1.4Bn from combined market cap, 2.0Bn from bondholders and preferred shareholders, and 2.4Bn of the 14.3Bn in combined Central Bank loans (Cypriot and ECB) it has on its books. This assumes zero contribution from the Cypriot subsidiaries of foreign banks so it may be conservative.

If the banking system is bankrupt, anything other than an Alice-in-Wonderland recovery system suggests that the order of liquidation is shareholders, preferred shareholders, debt holders, Central Bank creditors, and THEN depositors. If 10Bn or even 17Bn EUR is truly required, then coincidentally up to 17.7Bn EUR is available from equity holders, debt holders, and Central Bank creditors without impairing a euro cent from depositors.

Ed Harrison suggested that there were insufficient senior creditors and attaching depositors was necessary. This does not appear to be the case.

[1] Unidentified cinematographer, ‘The Character Humongous from the film, Road Warrior’.