As JP Morgan famously remarked, markets fluctuate; its impossible at any particular moment to pick trends out of the background noise. Nobody can say for sure whether tops or bottoms are in. Trends only reveal themselves in the rear-view mirror, even as they are obscured by non-stop advertising campaigns and PR. By the time a trend is clear it is usually too late for investors — otherwise known as ‘fools in the market’ — to do anything about it, the free lunch is already eaten and the punch bowl taken away …

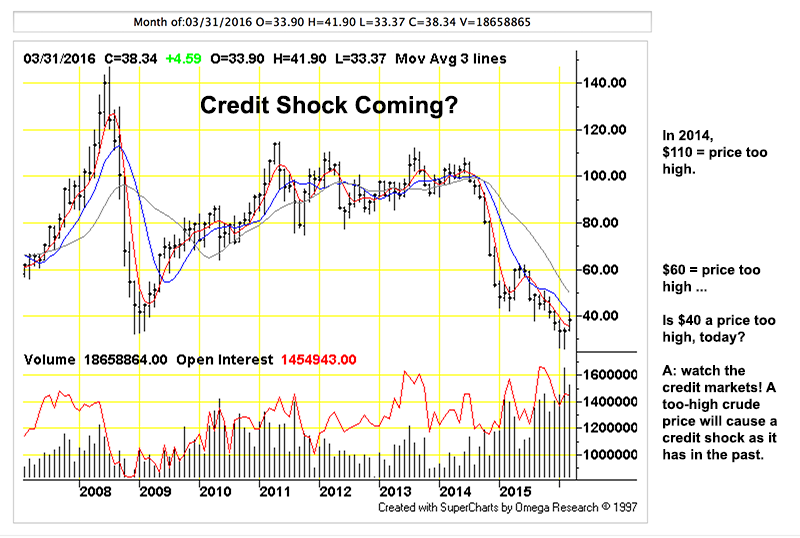

Figure 1: Is the bottom in? Chart by TFC Charts (click for big). Oil prices have been fluctuating higher in futures’ markets but nobody can be sure whether prices will rise from here or head back for the cellar.

With current prices at- or below the cost of extraction, drillers look to survive by reaching for the plastic, offering themselves and their properties as collateral. This is a medium-sized problem for drillers: along with all the other industries they have been borrowing from the beginning of time. In the good ol’ days they borrowed less, now they borrow more while praying for the trend change that brings that punch bowl back.

Ordinarily, the oil drillers’ customers step forward with their own borrowed funds to retire the drillers’ loans. Customers don’t simply sign over the money to the drillers, they over-pay for drillers’ products. This is what the term, ‘sustainable business model’ actually means; customers pay higher prices for successive rounds of cheaper-to-produce goods; the margin is used by firms for debt service and the retirement of maturing loans. Naturally, as each round of financing is rolled over the firms borrow more. Some of this money flows to executives, by way of this process CEOs become tycoons. Economists gain as well because every increase in borrowing represents GDP growth they can take credit for.

Fast-forward to the present: goods are unaffordably expensive to produce, emptied-out customers are no longer able to over-pay. They have nothing to offer as collateral for loans but their (near worthless) labor and frantic urge to Waste as seen on TV. Because the customers are unable to borrow, they cannot benefit the drillers, the drillers must borrow for themselves and pray …

Because the ‘waste as collateral’ concept is absurd/ridiculous, both the customers’ AND the drillers’ loans are effectively unsecured. This leaves a maturity mismatch between drillers and their customers. Firms are borrowing tens- of billions of dollars even as their customers are standing in line at the food bank. Customers cannot borrow => they cannot overpay => prices crash as drillers have no place to put unsold crude => whatever collateral the driller offers becomes worthless. The customers stiff their lenders => there is nothing for lenders to seize. At the end of the day, drillers, customers and lenders are all ruined … this dynamic is playing out in real time, right this minute, under everyone’s nose, all over our Great Round World.

This is perfect if unremarkable sense; conditions within oil industry finance must reflect resource depletion and it is clear that they do. The non-stop PR campaigns touting driller technology, efficiency and innovation are irrelevant, none of these things touch the customer. Losses cannot be made up with volume. Real returns, solvency and cash flows matter; when customers cannot gain the means to buy fuel industry products there is ultimately no more fuel industry. Redistribution, or giving customers the means to buy fuel is an immediate-term (non)solution. Some expensive time is borrowed until the customers’ financing is exhausted. Because resource waste offers no tangible returns to the waster; his credit will eventually run out, he will waste no more.

Meanwhile, the drillers must borrow or go out of business while lenders hold their noses and lend! The alternative is an output crash; we are caught between a looming crash and conditions that are pregnant with crash possibilities. Credit access becomes a matter of desperate necessity with every borrowed dollar lodged against the lenders’ deteriorating balance sheets. At the twilight of the petroleum age, drillers survive by cannibalizing their bankers who in turn are becoming the global economic link under the greatest strain.

Giant finance firms preserve the illusion of system sufficiency by lending to each other. Self-pleasure here is deadly; the lenders have become zombies rotten with non-performing loans. Growth is stagnating, economies are falling into deflation, turning Japanese. The zombification of the banks becomes both the reason for- and the consequence of extraordinary monetary quackery: the intent is to goad finance into squeezing out every possible loan, to kick that can one more day while hoping for a miracle. For business as usual, there is no alternative: interest rates fall to zero- then negative, currencies depreciate, pensions are looted and depositors bailed in … we must endure these abuses or else! Everywhere in the Westernized world useless industries and sectors are propped up regardless of consequences. Deflation results from the longer-term inability of billions of end-users to gain purchasing power or returns on capital from a mechanized regime that is designed from the ground up to annihilate capital.

No capital, no purchasing power, no problem; we’ve got iPhones, instead!

Blows are starting to rain down on the technology sector. Instead of saving our bacon as its promoters endlessly insist, the industry is having problems saving itself:

Figure 2: It isn’t just the energy sector: looking at this pretty chart (Yahoo Finance, click for big): Apple’s decline looks to be part of a longer-running trend rather than a fluctuation. The firm reported earnings, which were terrible; the company is being punished for its customers’ misbehavior.

Rotten Apple: Stock plunges 8% on earnings, revenue miss

Everett Rosenfeld

Apple reported quarterly earnings and revenue that missed analysts’ estimates on Tuesday, and its guidance for the current quarter also fell shy of expectations.

The tech giant said it saw fiscal second-quarter earnings of $1.90 per diluted share on $50.56 billion in revenue. Wall Street expected Apple to report earnings of about $2 a share on $51.97 billion in revenue, according to a consensus estimate from Thomson Reuters.

That revenue figure was a roughly 13 percent decline against $58.01 billion in the comparable year-ago period — representing the first year-over-year quarterly sales drop since 2003.

Shares in the company fell more than 8 percent in after-hours trading, erasing more than $46 billion in market cap. That after-hours loss is greater than the market cap of 391 of the S&P 500 companies.

AAPL is not some disposable startup at the end of a cul-de-sac somewhere in suburbia, it is (or was) the world’s largest company by capitalization. It is the technology sector’s tech company. When people hear the word ‘progress’, chances are they think robots and iPhones. Yet, markets are becoming unfriendly for the behemoth: its shares presently lurk at a support level, that if breached, would indicate a decline to $55 or so … from $125 per share a little over a year ago. In other words, a slump that mimics the fuel price crash.

This is very serious business. Stockholders are a who’s who of finance: pension funds, sovereign wealth funds, central banks, private equity and hedge funds. Shares are collateral for billions in debt that has been used for stock buy-backs and mergers. The entire tech investment ecology is at risk. Damage from a sixty-percent-ish price decline would be severe. Leverage against the shares applied backward compounds the damage just as it expands returns on rising prices; this puts more pressure on the hapless lenders reeling from their debacle in the oil patch. It isn’t just the money: against a backdrop of hand-wringing and denial, the science fiction narrative of a future running on innovation (and sharp business practices) is falling apart.

Ironically, Apple is constrained by a cleverness shortage: successive iterations of iWhatevers have become predictable variations on now-familiar themes. Offering customers novelty in modest increments at stratospheric prices has consequences; buyers are skipping over the brand and buying cheaper look-alikes. Commodity ‘clone’ products represent the race to the price basement, they can’t generate the marginal returns or snazzy narratives that support inflated share prices. In this sense, Apple is a victim of its own success, it must either compete going forward with its imitators on price or invent the next great must-have-at-all-cost consumer product that will re-establish its position of leadership in the technology firmament.

This is what AAPL has come up with …

So much for redemptive innovation and technology … Apple aims to reinvent the Dodge Caravan. It turns out all roads lead to more and more roads. Why not battleships, instead?

HMS Dreadnought, a brilliant technological achievement in 1906, it was rendered obsolete before its keel was laid by the airplane.

Apple cannot be serious! In choosing the car, AAPL lurches in the direction of the hapless Japanese, who make brilliant cars (made brilliant battleships) but cannot return value to the cars’ users (neither do battleships). The auto (battleship) industry is a subsidy hog, it twists in the wind even as it is on life support. By way of its actions, APPL admits its customers can no longer subsidize the company and its lenders, it looks instead toward the government (just like battleship manufacturers), to gorge at the public trough.

Figure 3: TSLA, another investors’ darling, (click for big). Strapped customers can afford the cars by bellying up to their friendly sub-prime auto lender for eight-year loans. Even this absurd financing is inadequate without billions in additional subsidies. These in turn can only come from finance, the same industry under so much solvency pressure from resource depletion … resulting from over-reliance on cars (battleships).

And all for what end? Nobody connects the big picture dots behind the empty gestures; battleships, Teslas and iPhones are status symbols, worth little- or nothing outside their self-generating, hubristic narratives. “In the long run,” said Keynes, “we are all dead”, it seems certain that we have to humiliate ourselves first.