Figure 1: Petroleum markets go non-linear as peak oil theory predicted; the steadily increasing price leads to collapse, something peak oil theory missed; chart by TFC, (Click for Big). The cause is the breakdown in credit; customers are broke which in turn strands the drillers; then ultimately the lenders … leading to real, absolute fuel shortages when drillers can no longer borrow. We find ourselves, between the rock and the hard place; without fuel there is no industry, without credit, industry is insolvent.

Relative fuel shortages occur when increased output does not keep pace with increasing demand. Absolute shortages occur when output decreases regardless of demand. Output is a function of geology and the availability of payments. Demand by itself cannot produce payments, consumption does by way of the collateral function.

“Since 2000, each incremental dollar (euro, yen or other currency) produces less crude than the dollar before. That is, today’s dollar produces less crude than yesterday’s dollar, tomorrow’s dollar will produce less crude than today’s. What is important is the relationship between the real cost of gaining fuel relative to the ability of the customers to meet this cost. This relationship is driven by the need of the driller to spend more in order to return less: this is net energy, it is currently declining, at some point net energy will become negative, that is, the use of energy will not provide returns, in the form of credit, sufficient to bring new energy supplies to the market.”— Economic Undertow: Net Energy End-Game Theory

Is this the endgame or something else? A lot depends upon who pays your salary. Traders armed with buckets of zero-interest cost loans push wholesale prices one way then the other, profiting on movement. Analysts insist the change in fuel prices since last summer are a market phenomenon no different from normal/expected price movements in all markets. The same analysts put blame on manipulators Saudi Arabia, Russia, Iran … or USA frackers. They also finger speculators who are spotlighted when prices go up. All of these cannot be true at once: if price moves are normal and expected then there is nobody to blame. If traders/speculators are able to force prices upward they are certainly able to push them the other way; if speculators do not damage the industry with higher prices they have no power to affect the industry when prices decline. After all, losses to one group of market participants are gained by others; the sum for all participants is zero.

What’s missing from the analysis is the existential threat to the industry posed by current low prices. The industry mouthpieces can put out whatever spin they want but facts don’t change; the world’s inexpensive, easily accessed petroleum has been used up, what remains is costly and difficult to extract. Without sufficient funds flowing toward the industry, oil remains in the ground. Without some sort of fundable margin between returns and expenses there is no fuel industry. Right now the spread between industry income and expenses is widening … the wrong way!

The petroleum industry is a classic ‘bottom-up’ business. Every drop of oil or cubic foot of natural gas must be sold in some shape or form to a retail customer. Pump- and product prices cannot increase without ordinary consumers having access to more credit. So far there is little sign of that happening. Monetary- and tax policies such as QE and bank bailouts shift credit away from customers towards big business and their lenders. As tycoons gain the lion’s share of monetary stimulus, less remains for the customers … who are then unable to retire oil drillers’ loans.

Retirement of loans requires productive activities that gain returns that can be applied against principal; productive activity is where ‘means’ are supposed to come from. The gargantuan amounts of debts today indicates there are really no productive activities at all, only borrowing platforms and (false) narratives. Debts are not retired with the output of industry but rather with new rounds of lending. Debts multiply exponentially as old debts drag from coffins like vampires-plus-interest. At the same time, new credit is always needed to fund the latest fashionable failing enterprises. Our dead-money debts are worthless claims against a rapidly diminishing capital account. Not just citizens but the world entire economy is insolvent: the oil price tells us that we can no longer borrow against the promise of future productivity … because there is no such thing.— Economic Undertow: Oil Shock

Market players pushing the wholesale price leaves middlemen and refiners with excess inventory they cannot sell, hence the apparent supply ‘glut’. The question is whether today’s low prices are a point in the trading cycle or a sea change?

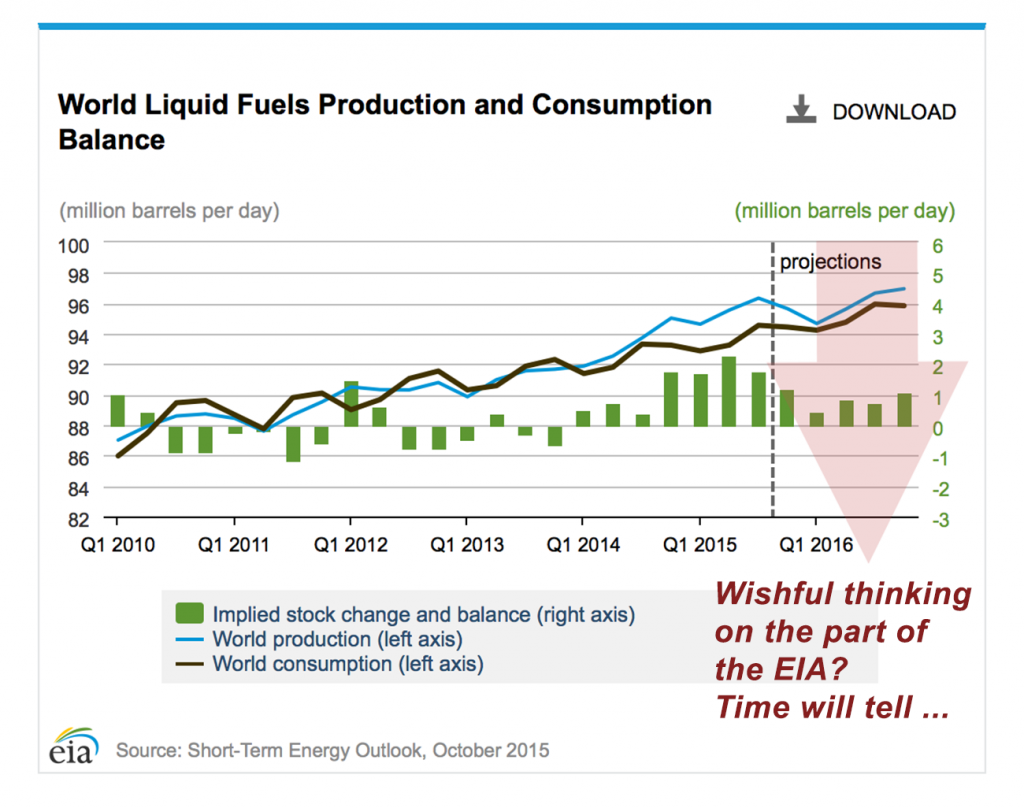

Figure 2: Output declines by way of the US Energy Information Agency Short-Term Energy Outlook, (Click for Big). The agency believes hopes prices and output will increase by the end of next year. The idea is falling fuel supply will trigger a bidding contest … this assumes there is something to bid with.

Americans are cornered trying to meet skyrocketing housing expenses, higher education costs, medical costs, and more medical costs. Customers are also nickel-and-dimed by rapacious cartels whose cumulative effects must be subtracted from the nation’s gasoline budget:

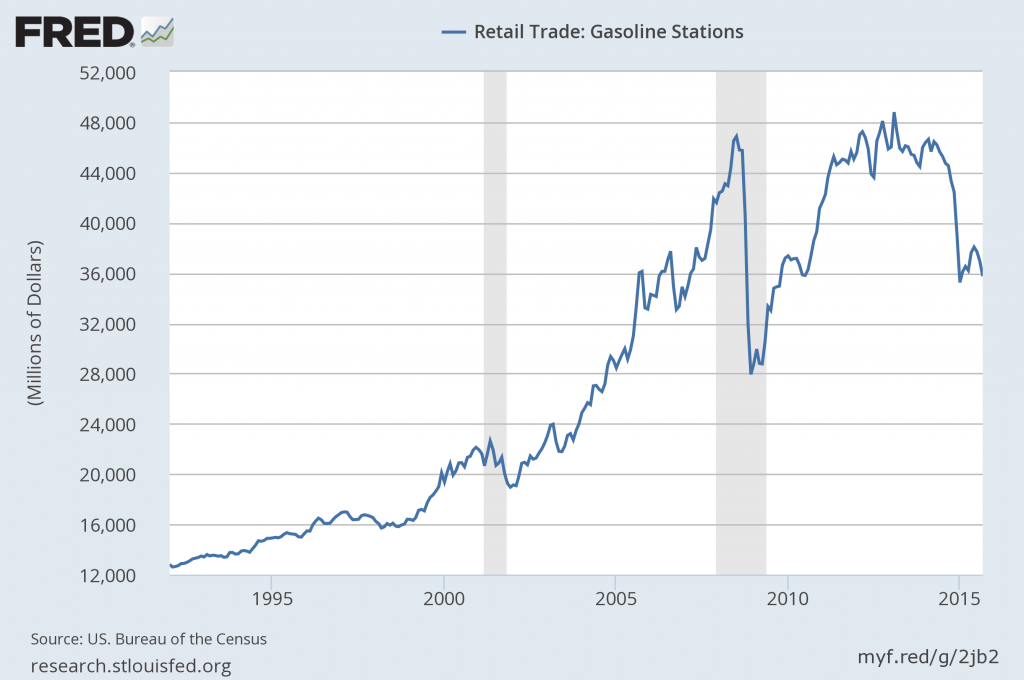

Figure 3: Gasoline sales in the US stutter even at very low prices FRED, (click for big). Absent the necessary cash flow, drillers look to credit markets, yet the increased repayment burden leaves drillers further underwater. Companies jettison investments and assets, perhaps even precious dividends; (Oil Price):

The U.S. Department of Interior announced the cancellation of the two Arctic offshore lease sales on October 16, which were to be held in 2016 and 2017. This sealed the fate of future Arctic exploration for the next few years (at least) as the Obama administration officially slammed the door on any future U.S. Arctic drilling, limiting the North American prospects for offshore drilling by some of the world’s biggest oil majors.With sustained low oil prices, political pressure from environmental groups and fading industry interest, it is highly unlikely that any entity (with the exception of Russia, which is still trying hard to break the Arctic jinx) would be interested in resuming Artic drilling even if the leasing process were relaunched in coming years. As a result, the Arctic is officially out of sight.

Analysts fixate on US fracking plays but the bulk of the world’s unconventional reserves are found elsewhere: in Venezuela Orinoco bitumen, in ultra-deepwater Brazilian pre-salt … in Alberta; also from Oil Price:

Shell’s Scrapped Oil Sands Project Highlights Major Issue For CanadaCharles Kennedy

It has been a brutal few weeks for Royal Dutch Shell.

On October 27, the Anglo-Dutch oil major announced that it was pulling the plug on its Carmon Creek oil sands project in Alberta, Canada. The project was expected to yield 80,000 barrels per day in oil sands production, which was originally greenlighted in 2013.

However, the markets have turned against Shell. In March, the company said that it would alter the design of the project to “take advantage of the market downturn to optimize design and retender certain contracts.” The logic was that low oil prices are forcing cost reductions up and down the supply chain, potentially allowing the company to lower construction costs.

The canceled projects represent reserves that must be taken off the books, oil that will not find its way to markets ten years from now. Shortages do not appear in the immediate term but are certain.

More rock vs. hard place; (Wall Street Journal by way of Wolf Richter):

The country’s two biggest oil companies offered a bleak picture of demand from the world’s marginal consumer of the commodity in its latest quarterly results, out Thursday. At Sinopec, the country’s biggest refiner, officially known as China Petroleum & Chemical, total sales of refined products in the third quarter dropped 3.4% in volume from a year before. That’s a marked change from their 5.3% rise during the first half of the year.Yet this dismal figure is bloated by Sinopec’s increasing exports of refined products, a symptom of China’s excess refining capacity. Strip those out and Sinopec’s domestic sales of gasoline, diesel and more were down 4.2% in the September quarter. At PetroChina, the nation’s second-largest refiner, product sales fell about 2% last quarter.

Time will tell how this plays out. Should prices continue to decline there will be cutbacks in petroleum output and more desperate efforts by governments to subsidize the industry. There will be a shakeout with the weaker hands being folded into larger, slightly more solvent enterprises. The media will insist that petroleum output decreases are temporary. Afterward = a run out of a (trans)national banking system (EU) or out of a major currency (yen or RMB). Possibly, not likely, prices will rise back to 2014 levels leaving the real crunch to come in a year or two.