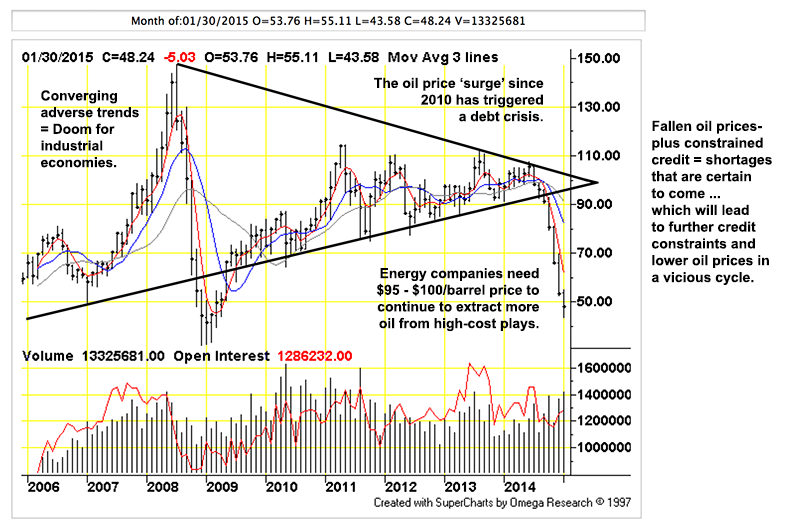

Figure 1: The Triangle of Flop: (chart by TFC Charts, click on for big). Industrial economies are set to go the way of the Dodo as cost of credit proves to be too great for customers to bear. As oil prices fall the drilling industry calls for more support. The rationale is that drillers borrow already, there can be no harm in adding to the pile of existing debt: if customers cannot pay immediately they certainly will when prices ‘recover’.

(The prices cannot rise unless the customers begin to pay … )

Additional repayment obligations are set to be heaped upon the same customers who can’t bear the drillers’ present costs … this is what the crashing oil prices actually mean. Credit breakdown is taking place in plain sight, under the noses of- and unremarked by ‘real’ economists. That people cannot afford their petroleum doesn’t appear to matter; not nearly as much as how the same people ‘feel’ about the economists themselves.

If the customers could pony up for high-cost fuel they would be doing so; oil prices would be unchanged from last year. In a high-cost environment, lower prices = less petroleum: as with ‘invisible’ credit collapse, the oil extraction peak is occurring right now, but in the shadows! There will never be more oil on petroleum markets than there is right now. It is hard to see how having less petroleum available will make us wealthier or more able to borrow- or service our debts. Instead, lower prices => more oil industry failures + more credit exposure => lower prices in a compounding cycle.

The signs of credit breakdown can be seen everywhere one chooses to look. The US appears to be the cleanest dirty shirt in the laundry basket but the illusions cannot be maintained too much longer, (Gallup):

The Big Lie: 5.6% UnemploymentJim Clifton

Here’s something that many Americans — including some of the smartest and most educated among us — don’t know: The official unemployment rate, as reported by the U.S. Department of Labor, is extremely misleading.

Right now, we’re hearing much celebrating from the media, the White House and Wall Street about how unemployment is “down” to 5.6%. The cheerleading for this number is deafening. The media loves a comeback story, the White House wants to score political points and Wall Street would like you to stay in the market.

None of them will tell you this: If you, a family member or anyone is unemployed and has subsequently given up on finding a job — if you are so hopelessly out of work that you’ve stopped looking over the past four weeks — the Department of Labor doesn’t count you as unemployed. That’s right. While you are as unemployed as one can possibly be, and tragically may never find work again, you are not counted in the figure we see relentlessly in the news — currently 5.6%. Right now, as many as 30 million Americans are either out of work or severely underemployed. Trust me, the vast majority of them aren’t throwing parties to toast “falling” unemployment.

There’s another reason why the official rate is misleading. Say you’re an out-of-work engineer or healthcare worker or construction worker or retail manager: If you perform a minimum of one hour of work in a week and are paid at least $20 — maybe someone pays you to mow their lawn — you’re not officially counted as unemployed in the much-reported 5.6%.

Clifton speaking truth to American (business) power leaves him looking nervously over his shoulder, presumably for CIA hitmen:

The industrial regime has oversold ‘productivity’. What meets industry costs are loans, not returns: economists don’t understand this … economists don’t understand this … economists don’t understand this. Maturing loans are refinanced or repaid with new loans; ‘wages’, ‘earnings’, ‘profits’ are all borrowed. In the eurozone, anything that qualifies as ‘money’ is borrowed from commercial financiers in Frankfurt. Total credit expands exponentially. No matter how to to what extent loans are restructured, all repayments are borrowed, the new amounts added to the debt total. Debts can be repudiated, but industry cannot exist or function without a steady diet of loans. If such a thing were possible, industry would be loan-free already! There would not be a crisis, the ordinary operation of a single, remunerative industry would retire all debts, would make every human being rich.

Four-hundred-plus years of industrialization and factory efficiency has done exactly the opposite, the world is sunk up to its nostrils in a incalculable morass of non-payable debt and strangling pollution. The ‘efficiency’ of debt has declined sharply; that is, each marginal dollar (or euro, yen or whatever) lent into existence returns less in the way of real output. Part of this is the simple exponential function applied to money supply over time: new loans taken on to refinance existing loans increase at a (modest) fixed rate of interest adding to the immensely growing pile. Another component is increased financing for hedging purposes in derivatives’ markets (the costs of which must be borrowed), part of it is confluence of demographics and politics (fewer, older people in industrial nations buy- and borrow less which means governments must borrow more in their place). The basic premise of industrial West is to leverage itself beyond its means … the credulous fools at the base of the economic pyramid cannot afford to pick up the tab any longer.

Diminished funding in the oil patch will result in actual shortages, not immediately but as reservoirs are depleted … a matter of months in ‘unconventional’ plays. All the talk about ‘production’ (or its absence) misses the point: our problems are entirely on the consumption side. We have burned up a trillion barrels of oil and have nothing to show for them … nothing that can replace the oil or match its usefulness. The more the drillers borrow the further underwater they find themselves because their customers have no value that can be ‘spent’ back to the drillers.

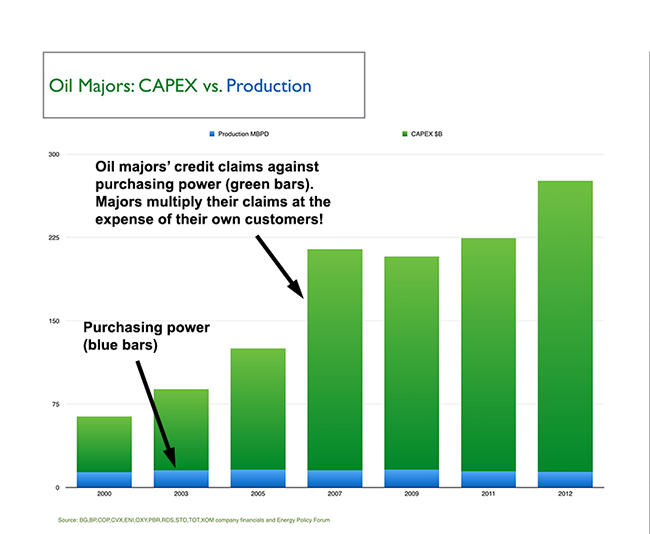

Against the background of the ‘non-peak oil discussion’ what turns out to be in short supply is credit, something that is technically infinitely reproducible. Credit (or money) is a claim against purchasing power, not purchasing power itself. The number- or amount of claims can be infinite, underlying purchasing power is tightly bound to the ‘good’ (in aggregate) that is being purchased. When this good runs short, so does purchasing power. Increasing credit claims overall cannot increase purchasing power but shifts it instead from one group (customers) toward others (drillers and their lenders). Drillers and lenders are firms, they can borrow more than customers. The drillers become rich = so what? They beggar their own customers by front-running them: when the customers can no longer borrow or are unwilling, the drillers are stranded. In an trice, drillers’ assets become liabilities: this transformation is occurring right now. It turns out the limit to ‘infinite’ claims is the credit-worthiness of customers.

The stranding process is underway, both in the US and everywhere in the world. Prices cannot rise to reflect perceived shortages (supply vs. demand) because the customers do not bid. Instead prices decline even as the (credit) means to meet the prices declines faster. Eventually, they fall to the level where they can be supported by actual returns, not credit.

Figure 2: Purchasing power in the form of petroleum-capital vs. money-claims against it; chart by Deborah Lawrence- Energy Policy Forum. Purchasing power claims by drillers have consequences, not the least of them is the difficulty on the part of drillers to find and extract oil to replace the oil that has already been consumed.

Desperate drillers who cannot borrow must cut their credit exposure any way they can:

Cash-Starved Oil Producers Trade Treasured Pipelines for MoneyOil and natural gas producers confronting a cash drain are auctioning off the family silver: pipelines and processing plants.

Bakken shale billionaire Harold Hamm and Canadian gas giant Encana Corp. are among the latest to peddle some of their most valuable assets and steadiest earners. They don’t have much choice — as the oil price collapse deflates the value of drilling operations, pipes and plants are about the only things attracting big payments for producers vying to stay afloat.

The deals for quick cash are another facet of the energy industry meltdown leading to more than $40 billion in spending cuts and thousands of job losses. The capital infusion comes with a trade-off because producers pay more to process and transport fuel over the lines and in the facilities they used to own.

“At some point they all get desperate enough,” said Michael Formuziewich, a fund manager at Leon Frazier & Associates Inc. in Toronto. Low prices will spur a rise in deals, he said. “The longer it goes on, the more we’ll see.”

Vulnerable drillers can put whatever spin they want onto this process but the end result is little different from liquidation.

Energy return on investment (EROI) does not matter so much as energy return on consumption (EROC). This turns out to be a negative number. Because the energy return on extraction was so great during the beginning of the twentieth century, the absence of returns on the consumption side didn’t matter. Oil became a ‘loss-leader’ for the automobile, real estate and construction industries. Wasting oil was a conversation piece, then a way of life.

This wasting process is coming to a long overdue end. We have no choice but to find some better use for our resources other than to burn them up for nothing. The first step is to stop lying to ourselves, time is running short.