Part of the current frenzy about energy prices is the insistence on a petroleum ‘glut’. According to conventional wisdom, there is simply so much excess crude on the markets there is nowhere for oil prices to go but down.

The reasons given for the excess crude are many: Saudi intransigence, a Saudi-US geopolitical contest (price war) with Russia/Iran, pesky futures’ market speculators … because/in spite of the president, because/in spite of the governments energy (non)policy … because of clear and concise leadership from Congress. Excess crude is the incredible free enterprise system working its magic! There is a glut of crude because Americans are incredibly clever and hard-working, because they are too fat/not fat enough … because they take too many drugs/not enough drugs, are red (blue); because our brilliant technology has permanently solved the problem of shortages so that our greatest challenge is to manage the onrushing, cornucopian abundance …

Keep in mind, a glut or the appearance of one makes sense at the oil extraction peak, after all, what is a ‘peak’ but the period of the greatest rate of extraction? There cannot be more petroleum available any time than at a peak. All that remains is for consumption to sort itself out; our brilliant-as-technology marketplaces will take care of that by themselves. Glut = cheaper crude! It’s morning in America, again!

That’s can’t be what’s happening … there has to be some mistake. What goes down must go up, right? If prices drop too far the entire extraction industry will go out of business, that the prices have crashed indicates half the industry is already out of business, it just doesn’t know which half it is yet.

Figure 1: various rates of extraction from multiple data sources compiled by Stuart Staniford, this chart is from December, 2013. The top line indicates 92 million barrels of various flammable ‘liquids’ per day including bitumen, natural gas plant liquids and biofuels.

The increase in petroleum volume isn’t necessarily a blessing as the energy content of the newer fuels is no greater than that of smaller volumes seven- or eight years ago. The increased volumes cost more to extract, transport and process so the net-energy yield is less. Regarding conventional crude, the likelihood is that the output peak occurred in 2005.

Every single one of the billions of barrels indicated on this chart have been burned up for nothing. This is the topic that is never discussed, never even acknowledged; our incredible permanently extinguished oil. There are literally zero returns for the precious capital we have burned, nothing to show but junk. This is the collateral for all of our (borrowed) ‘money’ … and the reason why we have financial ‘difficulties’. The dollar and other currencies are backed by fraud, used cars and smog.

Given that the world is at some sort of peak right now, what happens afterward? Because the world has not experienced a peak of existential magnitude before, we tend to make assumptions about what to expect. One assumption is that technology will provide substitutes, higher prices will allow extraction of deeper, harder to extract reserves. In this line of thinking, nothing really changes because extracting crude oil and using it has always been a costly endeavor, it will be a little more costly but manageable.

The plunging price of crude oil does not reflect the cost of extracting it or finding substitutes but rather the paucity of return on its use. This is sensible because returns are what are supposed to pay for extraction- plus a profit. What pays instead are sub-prime loans made against promises of bottomless production rather than actual remunerative use. The highest and best use for crude oil and related goods has been as subjects in a Wall Street finance shell game which is undone by the crash in crude prices … and crash it is, (Bloomberg):

Energy Commodity Futures

| Commodity | Units | Price | Change | % Change | Contract |

|---|---|---|---|---|---|

| Crude Oil (WTI) | USD/bbl. | 55.26 | 0.00 | 0.00% | Feb 15 |

| Crude Oil (Brent) Hammered again | USD/bbl. | 60.13 | -1.25 | -2.04% | Feb 15 |

| RBOB Gasoline | USd/gal. | 153.50 | 0.00 | 0.00% | Jan 15 |

| NYMEX Natural Gas | USD/MMBtu | 3.14 | 0.00 | 0.00% | Jan 15 |

| NYMEX Heating Oil | USd/gal. | 195.14 | 0.00 | 0.00% | Jan 15 |

Precious and Industrial Metals

| Commodity | Units | Price | Change | % Change | Contract |

|---|---|---|---|---|---|

| COMEX Gold | USD/t oz. | 1,179.80 | -16.20 | -1.35% | Feb 15 |

| Gold Spot | USD/t oz. | 1,177.06 | +0.62 | +0.05% | N/A |

| COMEX Silver | USD/t oz. | 15.69 | 0.00 | 0.00% | Mar 15 |

| COMEX Copper | USd/lb. | 287.25 | 0.00 | 0.00% | Mar 15 |

| Platinum Spot | USD/t oz. | 1,182.88 | +0.88 | +0.07% | N/A |

Individual countries are going through the Peak Oil process making it fairly simple to see what sort of outcomes can be expected … these are generally ugly.

Figure 2: Egyptian crude imports, exports and domestic consumption. Map- graphics by Mazama Science; data by BP. Egypt’s oil output peaked in 1995 at roughly 1 million barrels per day and has followed the classic M. King Hubbert decline curve since then. At its peak, Egypt was a substantial exporter, since then it has become a socioeconomic basket case, increasingly dependent upon both dollar- and fuel subsidies from the US and Persian Gulf states plus the meager returns from the European tourist trade. The country’s fabulously corrupt, autocratic government pretends to manage its zooming human- and auto population, Islamic militancy in the hinterlands, diminished foreign currency reserves and ballooning external debts. Like many other producing countries, Egypt offers, albeit in diminished amounts, subsidized fuel for its millions of worthless cars.

Explosive unrest occurred in the country in 2011 as part of the Arab Spring. Egypt’s management was able to keep the lid on the mid- 90’s as long as there was an increase in marketable fuels, once supplies tightened so did the grip of poverty and a sense of middle-class hopelessness.

Figure 3: Crude oil extraction never allowed for a Nigerian ‘golden age’ as much of the returns from sales were stolen by elites. Output increased sharply beginning in the 1970s. It is possible that the peak occurred during that period or later, in 2010. It is hard to say because much of the country’s crude is siphoned off by criminal gangs or spilled from the country’s leaky pipeline infrastructure. Like Egypt, post-peak Nigeria is slowly becoming a hospice patient with grinding poverty, instability and a thievishly inept, autocratic government. Like Egypt, Nigeria is plagued with militants who make life miserable for farmers and villagers in the northern hinterlands.

High crude prices over the past few years allowed the Nigerian establishment to take on the appearance of stability and to paper over some of its economic problems, one such effort has been subsidies for millions of drivers. Lower overall crude prices can do little but cut ordinary citizens’ purchasing power while intensifying the Nigerian elites’ urge to steal as much of the country’s remaining portable wealth as they can and remove it from the country while they still have the chance.

Figure 4: Arguments regarding ‘above-ground issues’ notwithstanding, the peak of Iranian crude production occurred in 1974. The output bumpy plateau from 1990 to 2012 has kept the country ‘open for business’, but the story so far appears to be that of a mature fuel producing region that now extracts less — for whatever reason. At the same time domestic consumption is relentlessly increasing largely due to fuel subsidies for motorists. Like other petro-states, Iran is controlled by an autocratic regime that rules by fear, informants and secret police. Recent high crude prices have allowed Tehran to fund a proxy war against Saudi Arabia for hegemony over the Middle East. Iran also funds ‘resistance’ to Israel at the same time pursuing a costly, pointless nuclear weapons program. The high prices + hard currency inflows by way of Dubai have tended to counteract the effects of international trade- and economic sanctions against the country. Those days are over: lower prices and dollar shortage will amplify the effects of sanctions and certainly act to constrain Iran’s influence, its solvency along with its ability to wage proxy war against ideological- but otherwise almost identical adversaries.

Figure 5: Under the lash of Soviet commissars and the prodding of Five Year Plans, Continental Russia experienced its output peak before the regime collapsed in the late 1980s. Since then, Russian output recovered to some degree but the oil experts within Russia admit now that future output will irretrievably decline.

As in Iran and Egypt, the long, post-peak interval in Russia has been marked by a slide into despotism, sputtering external conflicts, internal repression, harassment and spying, loss of liberties and varying degrees of economic hardship. The role of the ordinary citizens within the current regime is to bear the regime’s ballooning costs: the outcome is a race to remove portable wealth from the country as fast as possible. Russia subsidizes its energy consumers which accelerates depletion, mostly natural gas. Instead of leveling the economic playing field, subsidies divert funds to drillers, toward Russia’s elites, with the customers as conduits.

High crude prices have allowed Russia to keep up pretenses. Hard currency inflows counteracted the effects of the Russian government’s incompetence and corruption. Lower prices and a dollar embargo will have the opposite effect, magnifying Russian leadership failures and burying Russia’s economy: go to sleep in Moscow, wake up in Cairo.

Figure 6: the word ‘England’ looks to mean ‘unending crisis’ as the country’s petroleum fuel resource was dumped on the world markets for narrow political advantage in the mid-1980s and ’90s with the peak output occurring in 1999. Since then, England has been experiencing what can only be called a ‘Long Descent’ into the energy abyss. Along with the other post-peak examples, England suffers from incompetent and increasingly autocratic government and an economy undermined with fuel subsidies on one hand, unpayable debts on the other. The UK’s economic assets are opaque derivatives and pricey houses for tax exiles in central London. Its liabilities are millions of guzzling automobiles and a hodgepodge of poorly considered, blindingly expensive energy megaprojects that have zero chance to solve the country’s problem … if they are ever finished! England and fuel-starved Japan look to be the world’s first credit providers to default or experience runs out of their respective currencies.

Low prices will hammer what remains of the UK’s petroleum industry which is almost entirely offshore. This version of the Seneca Curve will leave Britons more dependent upon imports … and an increasingly shaky pound. Worst-case scenario would have UK looking to buy hard to find dollars at any price in order to gain fuel; conservation taking the form of a bitter and cruel comeuppance.

Figure 7: This is what denial looks like: Australia’s peak occurred in 2000, since then fuel output has relentlessly declined alongside Australians’ galloping internal consumption. Australia government has coped by becoming increasingly inept. As the coal- and iron miner to China, Australia has been able to avoid some of the worst outcomes that afflict other post-peak economies. If nothing else, lower China consumption and the more costly US dollar will end the lucrative carry trade that has subsidized Australian credit expansion and wasteful consumption.

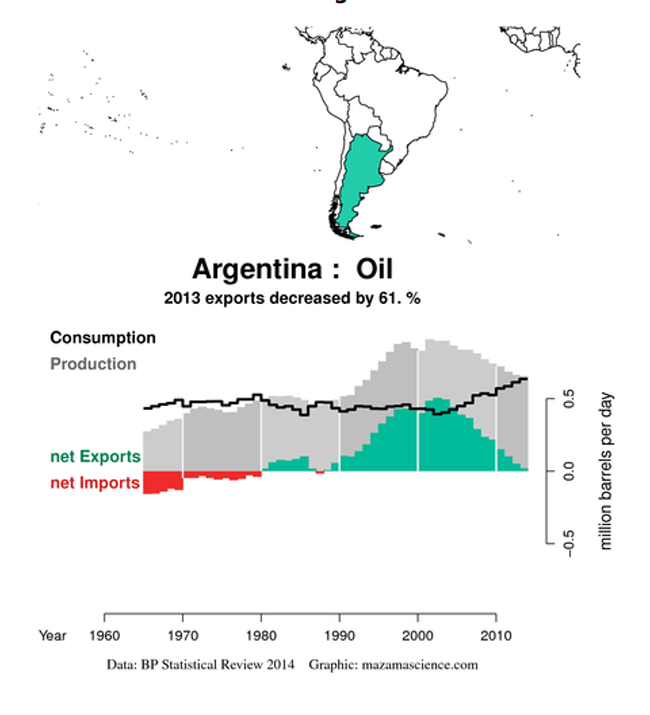

Figure 8: Argentina’s oil output peak took place in 2002, the same time auto-driven consumption began to increase; like other oil nations, Argentina subsidizes consumption. The outcome as been creeping bankruptcy … default, hyperinflation/currency collapse, goods-shortages and riots, instability, increasing poverty; all helped along by the usual inept, thievish government(s). Lower prices and the broken Argentine economy look to strand drillers leaving the country to import fuel … if citizens can find the dollars to do so.

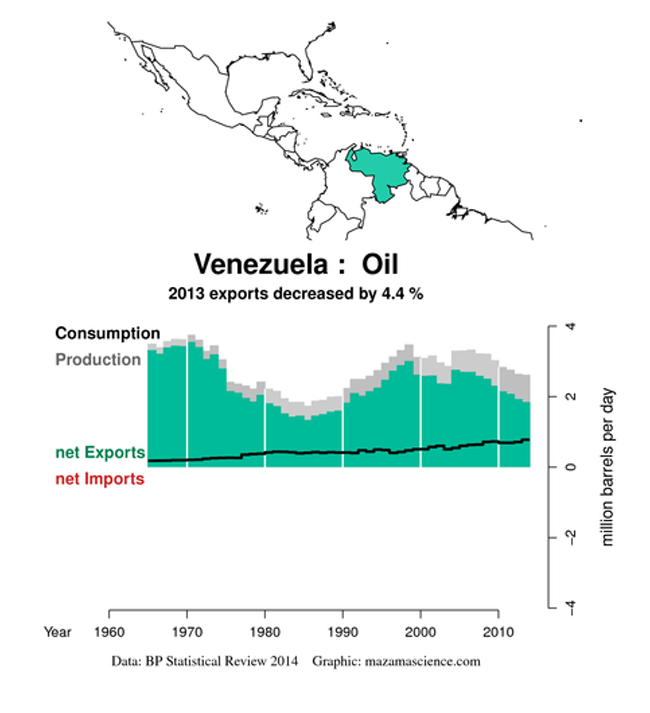

Figure 9: Venezuela’s peak was in 1970 … it has been a roller-coaster ride since. Output- and price fluctuations have since played havoc on Venezuela’s clownishly inept governments and flailing economy. If oil bounty is a curse, the depletion of bounty is descent into Inferno: as in Argentina, there is government corruption, inflation/hyperinflation, instability, social unrest. Even though the country is bankrupt, the government subsidizes fuel for its non-remunerative fleet of worthless automobiles. Venezuelans can use their last tankfuls of gas to drive to the poorhouse …

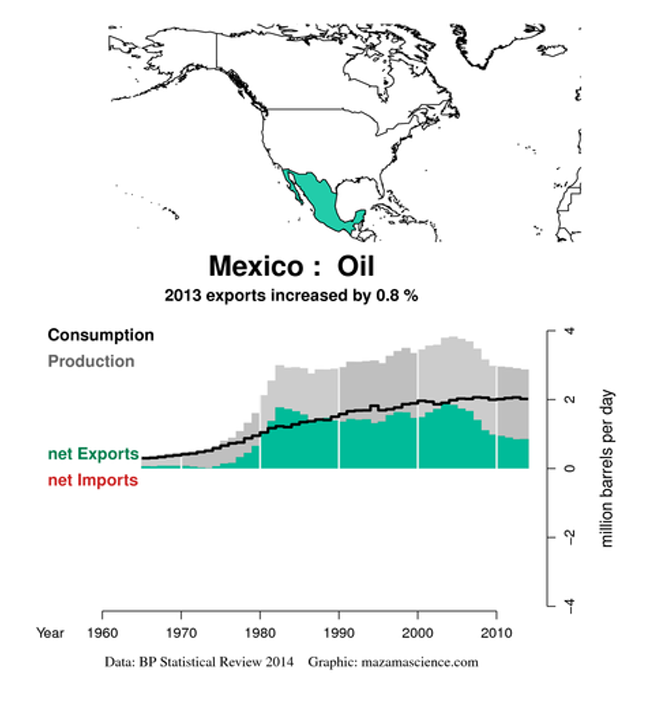

Figure 10: Poor Mexico; so far from God, so close to the United States. Mexico’s petroleum story has largely been that of the super-giant Cantarell oilfield; its peak was in 2005. Since then, Mexican output has declined despite much hand-waving on the part of the Mexican establishment. Up until recently, petroleum extraction was nationalized, Mexico also subsidized motor fuel consumption. Along with the baleful effects of NAFTA and the burgeoning drug trade to the US, Mexico suffers the usual economic- and political rot found elsewhere in other oil states: sclerotic government, wrenching poverty, corruption, pollution with drug mafias standing in for the ‘Brand X’ militants found elsewhere.

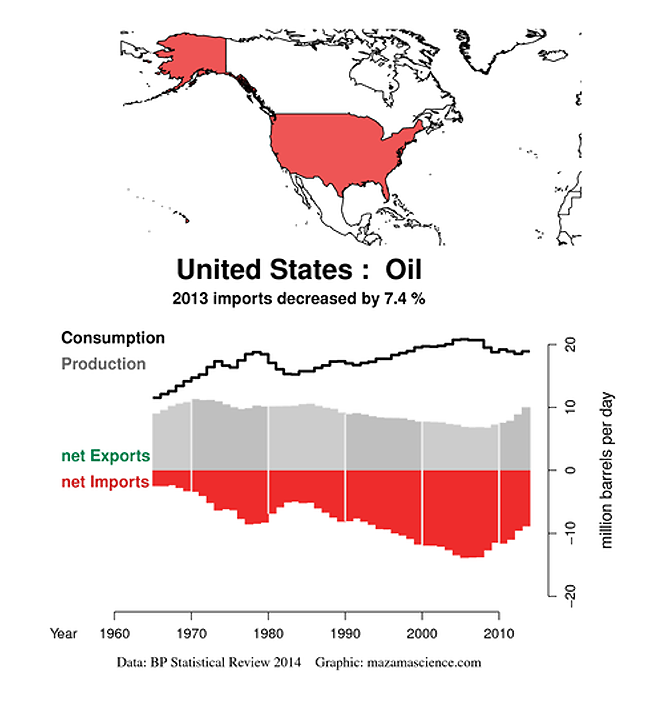

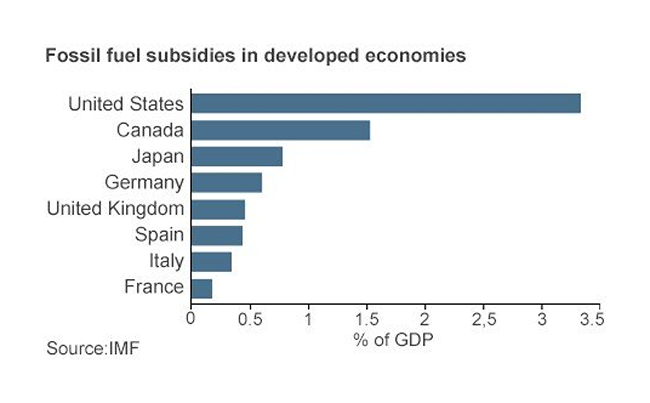

Figure 11: The USA peak in 1970 looked to be overtaken by new output from Bakken and other shale plays leading to throaty proclamations of ‘energy independence’. Even with shale additions, US finds itself importing six million barrels per day; ongoing reductions are due to creeping impoverishment and less consumption. As with other countries the US massively subsidizes petroleum consumption:

Figure 12: Industrial nations’ fuel subsidies by way of BBC/IMF: The cost of subsidies ultimately proves to be unbearable even for petro-states with large reserves such as the US. Subsidies are a primary driver of declining net exports. Subsidies directed toward consumers flow immediately from them to the drillers: they are loans, laundered by way of governments from the same customers who receive them. As with monetary easing: more subsidies => more bankrupt customers and ultimately, bankrupt drillers.

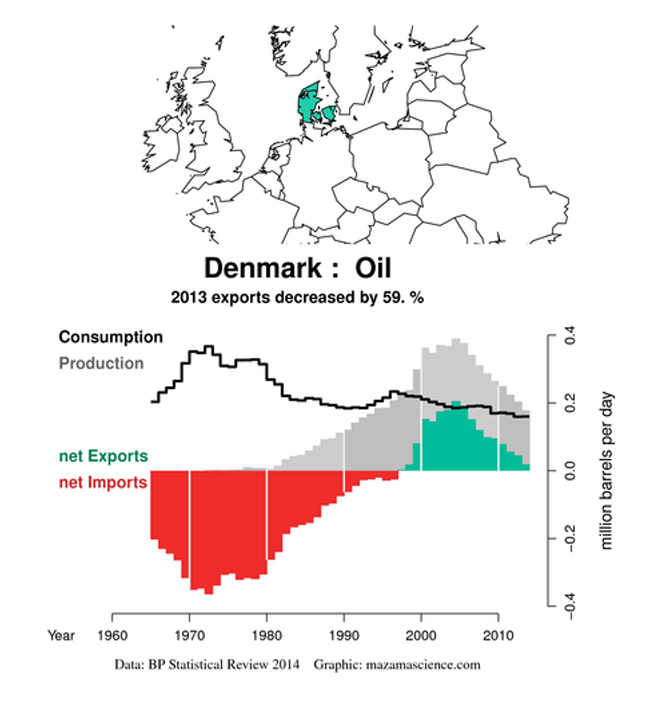

Most oil states post-peak share the same characteristics: inept, pilfering, absolutist regimes, faltering economies overburdened with debt, over-reliance upon subsidies; there is war, militancy and social unrest. Some of these countries face more of some problems and less of others. Of the oil ‘producers’ that are post-peak only a handful, such as Norway and Denmark, have been able to maintain a tentative of political-economic equilibrium.

Figure 13: Denmark’s extraction peak occurred in 2005, Norway’s in 2002. It would appear the best way to cope with oil peaking is to reduce consumption, for countries to become more like Denmark and less like Argentina or Egypt. Consumption in Denmark has declined by more than half since 1973; for it to decline by half again over the next ten years does not look to be a big problem.

With world-wide financial repression and the propping up of key-men everywhere, any energy crisis initially will not take familiar forms: gas lines, rationing and highway speed restrictions. Instead, the crisis will emerge as a credit crunch which is underway right now. Credit is being systematically revealed as worthless, leaving the fuel industry to provide for those elements of the fuel-use economy that can pay for themselves. This amounts to a very small fraction of current ‘use’ which is mostly for entertainment and pleasure.

It is hard to see how prices can rise in real terms from here.

Purchasing power rests more with the tycoons. Given enough deflationary medicine and tycoons will be just as broke as the rest of us. Purchasing power is the equivalent relationship between a good that is exchanged and what is gained for it: one is always worth the other; otherwise the exchange does not occur. Capital is non-renewable resources, it is the ultimate good, the basis of all ‘production’; as capital is depleted or diminished for whatever reason, so is purchasing power.

Customers must buy the fuel products that allow the drillers to retire their own loans. Customers can only buy when they borrow themselves … or after their employers borrow in turn from their own customers. The cost of ongoing oil peak = fewer customers borrowing overall, they have been fired, lost their businesses, have had their wages cut or they have other more important costs to meet, like food, housing or medical care.

Every post-peak country is in the same boat. China is slowing … because Americans and Europeans are buying less Chinese-made goods with borrowed money => less purchases from Australia and other resource providers. Large swaths of the world are embroiled in conflict which is a dead- loss to all sides. There are fewer places for any bid going to come from. How are prices going to rise?

“Central banks will print money,” is the usual nonsense refrain. Central banks cannot increase purchasing power, they can only dilute it. Finance can lend but the cost of moral hazard — a kind of indirect subsidy — has risen to where even largest governments cannot bear it. More loans won’t work anyway: money flows to drillers starving customers of funds leaving nobody to retire the drillers’ loans.

At the same time, oil states need to sell as much as they can to gain what cash-flow is possible. All petroleum is high cost now b/c of the need to work over old, depleting fields. Drillers are frantic to make up their losses on volume …

There is nobody with a handle on this situation, it is running away on its own.