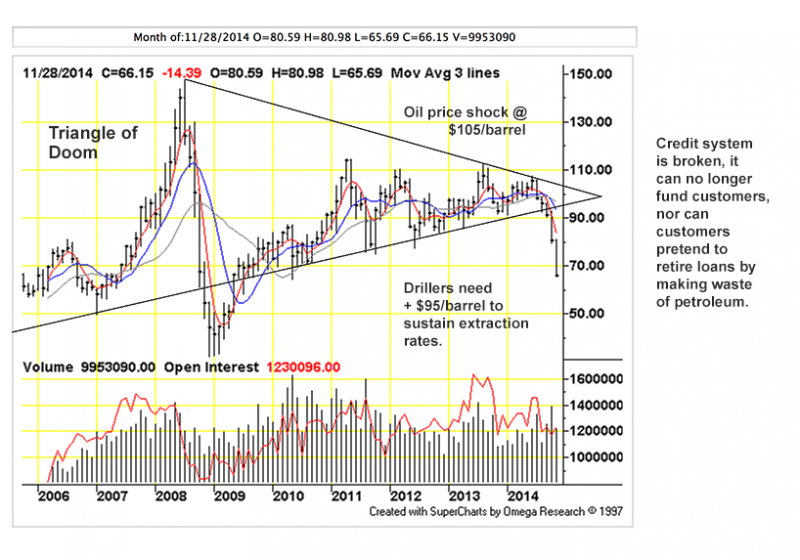

Figure 1: Triangle of Pants by TFC Charts, (click for big). What is taking place right now is an oil shock very similar to that which occurred in 2008-09. What triggered the current reaction was $105/barrel a few months ago as opposed to the much higher 2008 price. The lower price confounds expectations, convention leads us to believe that any fuel price shock would result from prices higher than $147 per barrel.

Since 2008, the world has become poorer; what remains of purchasing power has been diverted away from ordinary customers toward elites. Monetary- and fiscal policies around the world have amplified this flow making it difficult for customers to buy industrial goods including oil. By catering to crony ‘friends’ the central banks and governments have been working against their own stated interests, precipitating the very crisis they have been working so hard (?) to avoid.

The hope: more easing => lower money cost for drillers => price bubble ‘hedge’ against high- and increasing crude price => more financial market support for drillers. Finance makes money lending to all concerned.

The reality: more easing => more tycoon ‘success’ => more customer insolvency => lower crude prices => deflation => finance-lender bankruptcy => driller distress leading to more easing. Finance fails as customers are unable to retire firms’ debts and they (firms) default.

Because there are no organic returns from fuel use, customers must borrow.

There is a constant need for individuals to take on more debt; even as globalization has expanded the number of debtors it has not expanded their means. The world’s credit market is inundated with obligations that outweigh the ability of humans to retire them by way of labor. Reduced means = price declines. The elites cannot- or will not support a mass-market enterprise like oil consumption: they will lend some of their own (borrowed) funds to participating firms but refuse to squander a meaningful proportion of their wealth to simply buy and waste fuel. As the non-elites imitate their betters => price declines.

The economic arguments against inequality have narrow merit: the success of elites of grabbing more for themselves offers diminished returns. Non-elites’ obligation include servicing and retiring the elites’ debts, they do so by borrowing- and buying overpriced goods. From a wider viewpoint, elite success at pauperizing the bulk of the human race is a crude form of resource conservation. Greed undermines our consumption economy; this is a blessing in disguise! Pillage-to-breakdown gives our planetary life support system what small chance remains for it to do its job through the balance of the millennium … until we can learn to husband our capital wisely.

Retirement of loans requires productive activities that gain returns that can be applied against principal; productive activity is where ‘means’ are supposed to come from. The gargantuan amounts of debts today indicates there are really no productive activities at all, only borrowing platforms and (false) narratives. Debts are not retired with the output of industry but rather with new rounds of lending. Debts multiply exponentially as old debts drag from coffins like vampires-plus-interest. At the same time, new credit is always needed to fund the latest fashionable failing enterprises. Our dead-money debts are worthless claims against a rapidly diminishing capital account. Not just citizens but the world entire economy is insolvent: the oil price tells us that we can no longer borrow against the promise of future productivity … because there is no such thing.

Technology makes every sort of outlandish promise but is never able to simply pay its own way. Technology-related costs expand faster than returns, at the same time tech pushes aside forms that might serve to retire some of these costs: the voracious power demands of Internet data centers must be met with coal, Internet companies such as Amazon that perpetually lose money replace profitable ‘brick and mortar’ stores that provided the revenues which enabled the online firms’ rise in the first place.

The price for crude oil does not measure the worth of extraction but rather the worth of consumption … over the past six months there has been the downward repricing (depricing) of consumption by 35%. At the same time, reducing the price of inputs does not increase the solvency of the world’s bankrupts. A society cannot borrow- or consume its way to wealth. Only the careful husbandry of capital produces wealth. Industrialization is the strip mining of our capital and hunt for more. What propels the wasting process is the false promise that the mining process ‘creates’ capital rather than annihilating it.

Crude futures take another hit, (Bloomberg):

Energy Commodity Futures

| Commodity | Units | Price | Change | % Change | Contract |

|---|---|---|---|---|---|

| Crude Oil (WTI) | USD/bbl. | 62.93 | -2.91 | -4.42% | Jan 15 |

| Crude Oil (Brent) | USD/bbl. | 66.10 | -2.97 | -4.30% | Jan 15 |

| RBOB Gasoline | USd/gal. | 170.40 | -6.94 | -3.91% | Jan 15 |

| NYMEX Natural Gas | USD/MMBtu | 3.62 | -0.18 | -4.81% | Jan 15 |

| NYMEX Heating Oil | USd/gal. | 205.09 | -5.69 | -2.70% | Jan 15 |

Precious and Industrial Metals

| Commodity | Units | Price | Change | % Change | Contract |

|---|---|---|---|---|---|

| COMEX Gold | USD/t oz. | 1,204.30 | +13.90 | +1.17% | Feb 15 |

| Gold Spot | USD/t oz. | 1,202.67 | +10.32 | +0.87% | N/A |

| COMEX Silver | USD/t oz. | 16.39 | +0.13 | +0.78% | Mar 15 |

| COMEX Copper | USd/lb. | 288.50 | -1.75 | -0.60% | Mar 15 |

| Platinum Spot | USD/t oz. | 1,233.25 | +10.25 | +0.84% | N/A |

Oil took a 4 percent hit, and concern is growing that this is a sign of slackness in aggregate demand, and not a over production move by the US and some of its allies to punish Russia, or the Saudis to give the shale oil crowd a stiff gut check on their long term viability.

The same folks who are needed to push up the price of crude are on food stamps, have lost 35% of their wealth in Japan, have ‘slowed’ in China; are mired in depression in southern Europe … and in northern, eastern and western Europe as well. Because a car cannot be paid for by driving the car, the world is ruined by way of its 1 billion cars.

Driving the car does not pay for the fuel, or the roads or any of the rest of the associated junk including the massive, intrusive governments that everyone loves to hate. What pays is hundreds of trillion$ of debt … that can never be retired.

The costs of housing, education, Obamacare, wars, infrastructure maintenance and entertainment (drugs) are borne by citizens who must borrow additional amounts to bid the price of petroleum products. The customers have reached their credit limits, as a consequence they are insolvent: customers must borrow to retire their own debts. Credit breakdowns caused by driller defaults will smash the customers even harder … the bid will shrink leading to more defaults in a vicious cycle: this is ‘Energy Deflation’, similar to Irving Fisher’s debt deflation model.

Energy Deflation is Underway Right Now.

The price will decline to the level where use (waste) of petroleum is deemed to offer a return. Because there are no returns, there is nowhere for oil prices to go but to decline. At the same time, no matter how low the nominal prices fall, they will always be a bit out of reach for the marginal customer. Ultimately, only the elites will be able to afford fuel, time will tell how much of a fuel supply- and use system elites can support.

By refusing to institute voluntary stringent conservation we are set to experience ‘Conservation by Other Means™’ less fuel use by way of war, national ruin, credit and currency crises.

Saudi Arabia has nothing to do with this as they are fully committed to high-priced crude to pay welfare to their millions of unemployable citizens. This is also true for the rest of OPEC. There is also no real excess supply of crude as the flow of fuel supplies is 6- or 7 million barrels per day below pre-2005 trends. This ongoing shortage does not cause price to increase, it reduces customer purchasing power, instead. This is what the economists miss: oil prices will test the 2009 low, there will be the tendency toward even lower prices.

Tighten your chin straps: the next phase of the Great Financial Crisis has begun.