Around the world, markets have taken a hit and the establishment responds as best it can; liberal applications of happy talk and cheap credit along with promises of a lot more where that came from.

Much of our finance problem has been caused by the costs associated with a surplus of cheap credit. This conforms to the First Law of Economics which states the costs of managing any surplus increase along with the surplus until at some point they exceed it. Adding more credit cannot provide a solution as it adds to already- breaking costs at the same time. We cannot borrow our way out of debt even as it is the only means industrialization has left to us. Cracks are widening, the credit structure will fail, it isn’t a matter of ‘if’ but ‘when’.

As per usual, the bosses rush to prop up finance key men. This is the only thing they know. The bosses are creatures of the key men, when these stumble so do the bosses. Each groups aims to hold the other along with the rest of the economies hostage. Sending in the clowns on suicide missions is how economies work in the New Millennium. The Chinese government directs the retirement accounts of ordinary Chinese into the stock market furnace. They fear that the plunge in China issues is not an ordinary asset market correction but the end of the entire Chinese industrial enterprise as we know it. The government does not dare utter these terms but they don’t have to, their actions speak for themselves.

China follows the rest of the world in tapping its retirement accounts. We are in the middle of a crisis that has been steadily intensifying since 2007. Managers demand the economic system be bailed out; instead of tapping entrepreneurs and technology, the finest minds of a generation rob from pensioners.

The economies must become more productive which means increasing the efficiency of output. Consequently, pensioners are called upon to sacrifice their retirements in the UK, Greece, Russia, France, in the US … in cities and states pensions everywhere are under attack. Now, add China.

Public sector pensions in the US are looted to support stock buybacks which keep US stock markets afloat, (Financial Sense):

Massively underfunded public pensions are driving an epic credit boom in the corporate bond market that will likely accelerate in the coming years.Lawrence McQuillan of the Independent Institute explained on Financial Sense Newshour this week how public pensions are being operated under rules and assumptions that would be considered criminal under Federal law if operated similarly in the private sector.

We spoke with him about his very important book, California Dreaming: Lessons on How to Resolve America’s Public Pension Crisis, where he said that in order to meet their funding requirements the Big Three pension funds in California (CalPERS, CalSTRS, and UCRP) assume that “they will outperform the average portfolio return…by 21 percent every year for decades.”

That never happens, the idea is ridiculous. Instead the retirees’ funds support the stock market price-inflation regime; when that market falters and prices decline the funds vanish into the pockets of well-positioned elites … just as they are set to vanish in China.

Bosses insist deploying more- and fancier machines will solve our economic problems; this presumes machines are productive. Technology is endlessly advertised as saving us but the raiding of pensions indicates otherwise: the scraping of the bottom of the barrel in real time. It’s an admission that technology doesn’t and can’t work, from the people who are in a position to know.

What happens after the retirements are pilfered? Who knows? Nobody has a plan. The elites have no choice but to reside on the same broken planet as the rest of us, using the same (diminished) services. There is nowhere to hide, no place to escape from what are fast becoming universal consequences.

Here you go way too fast,

Don’t slow down, you’re gonna crash.

You should watch, watch your step …

Don’t lookout, gonna break your neck.So shut, shut your mouth,

‘Cause I’m not listening anyhow.

I’ve had enough, enough of you,

You know to last a lifetime through …

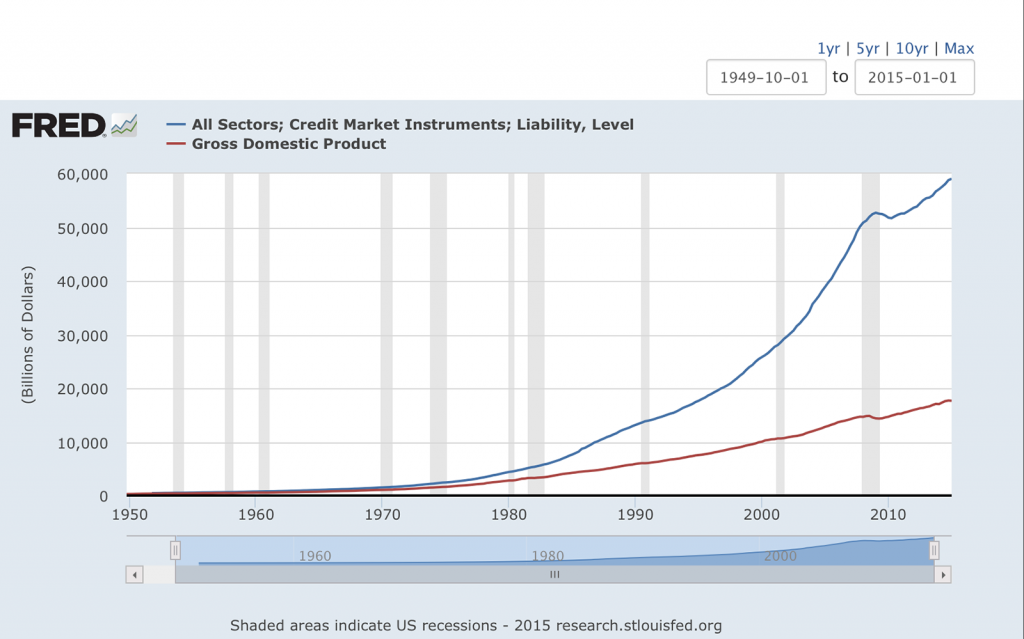

The Federal Reserve offers to reconsider raising interest rates next month as if this was a thing seriously considered in the first place. The fact of ongoing zero-percent interest rates speaks louder than any words. The fact of it reveals that the doctrine upon which American-style ‘prosperity’ is erected is false. Each succeeding unit of business activity requires ever-greater amounts of credit to produce; finance productivity, like the machine variety, turns out to be a fairy tale:

Figure 1: Total US credit market debt including US government versus US nominal GDP by way of FRED. Credit expands exponentially but business activity never catches up. Credit is a necessary subsidy for all industrial activity, we are now past the point of diminished marginal returns, where each additional borrowed dollar offers only a few well-pinched pennies in return.

Na nana na na na nana na na-aaaa

Na nana na na na nana na na-aaaaHere you go, way too fast.

Don’t slow down, you’re gonna crash.

You don’t know what’s been going down,

You’ve been running all over town.So shut, shut your mouth …

‘Cause I’m not listening anyhow

I’ve had enough, enough of you,

You know to last a lifetime through …

The ‘Great Trade’ since the emergence of Southeast Asian manufacturing ‘tiger economies’ has been the short-dollar carry; this is this trade that is unwinding right now around the world. Dollars are borrowed from New York finance and swapped overseas for higher-yielding investments denominated in non-dollar currencies. The tigers grow and the currencies strengthen vs. the dollar. Direct yield is added to currency appreciation. This carry trade is one reason why so many US corporations have set up shop overseas, to capture currency appreciation. The dollars lent overseas become collateral for new forex issue in the target countries, this is then spent on infrastructure which amplifies the entire process in a virtuous cycle.

Dollars are also sold short into various asset markets with the same intent, to capture ‘currency’ (share price) appreciation. Asset- and currency investment ‘bubbles’ since 1973 have been a kind of petroleum price hedge, where the fuel and other investments are treated as if they are the same. Appreciation of assets such as stocks or real estate is intended to exceed appreciation of the fuel ‘asset’. With time fuel users become rich enough to afford fuel at any price. This works in theory but fails in practice because of the need to unwind the carry trade — to sell the asset and buy back the dollar — to capture the appreciation and apply it to the fuel. As with other Ponzi schemes, only a relative handful of shills are able to exit the trade with gains in hand. The schemes only work as long as (borrowed) funds are flowing in, as long as each succeeding round of funding is cheaper than those ‘invested’ before … and as long as all participants in the trade don’t try to exit at once. When any of these trends shift into reverse the scheme collapses.

Just as real estate- or oil prices have been expected to continually rise in price, the dollar is expected to continually cheapen relative to other currencies; to ‘go down’. As such the dollar trade is subject to the ‘Paradox of Thrift’, when too many interests are on the same side of a trade. Having all investors on the short side means a market ultimately deprived of sellers, where everyone has sold out: eventually nobody is left to ‘sell to the sellers’. At this point there is nothing for the dollar but to defy conventional wisdom and ‘go up’.

If economists paid attention to ‘inputs’ rather than dissing them, they would acknowledge that billions of dollars and other currencies are swapped on demand for a valuable physical good at gas stations around the world every single day. It is this exchange- on the global scale, rather than the forward pricing of credit by central banks and finance lenders that determines the price of money. As such there is no independent monetary policy, anywhere; central banks are irrelevant. Priced in oil, ‘commodity’ dollars have worth. Instead of being a proxy for the waste-extravaganza we call ‘commerce’, the dollar becomes a proxy for scarce and valuable petroleum, just like the dollar was a proxy for scarce and valuable gold during the early 1930s. As fuel vanishes forever out of a billion tailpipes, dollars become precious, then hoarded; leaving fewer dollars for drillers which in turn amplifies fuel scarcity in a vicious, self-reinforcing cycle.

So what do you want of me,

Got no cure for misery.

And if I go about with you,

You know that I’ll get messed up too with you …Na nana na na na nana na na-aaaa

Na nana na na na nana na na-aaaa

Increased dollar demand is best evidence for fuel scarcity rather than the non-stop media bawling about a glut. Users are voting with their wallets, spurning ‘Brand X’ currencies and other assets, scrambling to gain cash dollars. The increased worth of once-blighted buck becomes a dagger to the heart of the short-dollar carry and its variations in other asset classes.

Those who have borrowed dollars are now just now finding out how expensive it is to repay: costly to the point of national ruin. China is dumping billions in Treasury securities every month in order to gain dollars. Once spent these dollars never return: this turns out to be the First Law cost of China’s vast dollar reserve surplus. China’s resource providers are likewise seeing runs out of their own currencies. Businesses and governments borrowed billions from Wall Street lenders, they all need cheap bucks to service their debts and can’t get them. The flood of easy money to the rest of the world to support miniature versions of the US ‘growth story’ has been replaced by a dollar ebb and so-called ‘capital flight’, (Don Quijones/Wolfstreet):

With Friends Like These…It doesn’t help when your own national investors and corporations are offloading the domestic currency (Mexican peso) as fast as they can. As Jorge Gordillo, chief analyst at Grupo Finaniero CI Banco, told the Mexican daily El Excelsior, as confidence in Mexico’s economic fortunes wanes, more and more Mexican banks and businesses are exchanging their pesos for dollars, fueling further demand for the world’s reserve currency.

It is the worst of vicious circles: the stronger the dollar gets, the more the locals want it. The more the locals want it, the weaker the peso becomes. Rinse and repeat …

It isn’t just carry traders desperately seeking dollars. The gigantic fuel industry itself is left to grope beneath the cushions for spare change, (Bloomberg):

Oil Industry Needs Half a Trillion Dollars to Endure Price Slump

Luca Casiraghi and Rakteem Katakey (Bloomberg)

At a time when the oil price is languishing at its lowest level in six years, producers need to find half a trillion dollars to repay debt. Some might not make it.

The number of oil and gas company bonds with yields of 10 percent or more, a sign of distress, tripled in the past year, leaving 168 firms in North America, Europe and Asia holding this debt, data compiled by Bloomberg show. The ratio of net debt to earnings is the highest in two decades.

If oil stays at about $40 a barrel, the shakeout could be profound, according to Kimberley Wood, a partner for oil mergers and acquisitions at Norton Rose Fulbright LLP in London.

Five hundred billion is a lot of money. That is the amount needed to roll over maturing debts and pay interest on ‘junk’ loans; it does not include fresh funds needed to keep drilling. This amount does not include national oil drillers indirect costs, the amount needed is likely to be much larger, (Reuters):

The speed of decline in Saudi Arabia’s foreign reserves slowed in July after the government began issuing domestic debt to cover part of a budget deficit created by low oil prices, central bank data showed on Thursday.The world’s largest oil exporter has been drawing down its reserves to cover the deficit. Net foreign assets at the central bank, which acts as the kingdom’s sovereign wealth fund, have been sliding since they reached a $737 billion peak last August.

But the latest data showed net foreign assets shrank only 0.5 percent from the previous month to 2.480 trillion riyals ($661 billion) in July, their lowest level since early 2013. They had dropped 1.2 percent month-on-month in June and at faster rates early this year.

Indirect costs include defending the domestic currencies of oil exporting countries. Where this money is going to come from is problematic because of the low fuel prices. The borrowed funds that have been supporting drillers are now stranded because the customers are unable to borrow … in a market made up entirely of (insolvent) borrowers there is nobody left who is able to repay!

Nouriel Roubini suggests a finance-system early warning system, (Project Syndicate):

A Financial Early-Warning SystemRecent market volatility – in emerging and developed economies alike – is showing once again how badly ratings agencies and investors can err in assessing countries’ economic and financial vulnerabilities. Ratings agencies wait too long to spot risks and downgrade countries, while investors behave like herds, often ignoring the build-up of risk for too long, before shifting gears abruptly and causing exaggerated market swings.

Given the nature of market turmoil, an early-warning system for financial tsunamis may be difficult to create; but the world needs one today more than ever. Few people foresaw the subprime crisis of 2008, the risk of default in the eurozone, or the current turbulence in financial markets worldwide. Fingers have been pointed at politicians, banks, and supranational institutions. But ratings agencies and analysts who misjudged the repayment ability of debtors – including governments – have gotten off too lightly.

Currency depreciation, national bankruptcies, non-stop wars, sacrifice of pensioners and fuel price crash, what sort of warning does Roubini & Company need? Every sort of alarm is going off and has been for years! Nobody pays attention. There have been climate warnings, bank insolvency warnings (little different from what Roubini proposes), resource depletion warnings, corruption- and cartelization warnings; warnings about pollution, overpopulation, consumption, exhaustion of topsoil, proliferation of nuclear weapons, rising militarism … over-dependence upon finance and central banks, etc. Economies are fragile, they are built on a foundation of lies, they cannot bear the weight of the truth so it is swept under the rug. Markets which are seen to measure the worth of information are institutionally incapable of measuring the same markets’ willingness to guzzle the Kool-Aid: the Paradox of Grift.

To Roubini, the only alerts that seem to matter can only come from economists themselves … the enterprise is painted into a corner.

Na nana na na na nana na-aaaa

Slow down, you’re gonna crash.

Even though unraveling is well underway, the various media components of big business are busy informing the proletariat (and each other) that everything is just fine and that ‘sustainable growth’ is right around the corner. Meanwhile, the markets around the corner grind relentlessly lower.

Warnings — early and otherwise — are seen to trigger the events that managers are desperate to avoid. This leaves no place for prudence. The central banker can never say there is an asset bubble or that the bankers are helpless to affect outcomes or admit a mistake. Central Banker-speak is carefully calibrated and purposefully innocuous. Should it be otherwise, a money-panic is certain to occur. This reveals the extent to which market capitalism is dependent upon fraud and participants eagerness to embrace it. As with much else in our benighted nonsense world we’ve built for ourselves, we and our leading characters are happy to follow the script … right off the edge of the cliff.

Na nana na na na nana na na-aaaa,

Slow down, you’re gonna crash.

Na nana na na na nana na na-aaaa,

Slow down, you’re gonna crash!Na nana na na na nana na na-aaaa,

Slow down, you’re gonna crash.

Na nana na na na nana na na-aaaa,

Slow down, you’re gonna crash!Na nana na na na nana na na-aaaa,

Slow down, you’re gonna crash.

Na nana na na na nana na na-aaaa,

Slow down, you’re gonna crash!Na nana na na na nana na na-aaaa,

Slow down, you’re gonna crash.

Na nana na na na nana na na-aaaa,

Slow down, you’re gonna crash!— The Primitives “Crash” (Paul Court, Steve Dullaghan, Tracy Spencer)