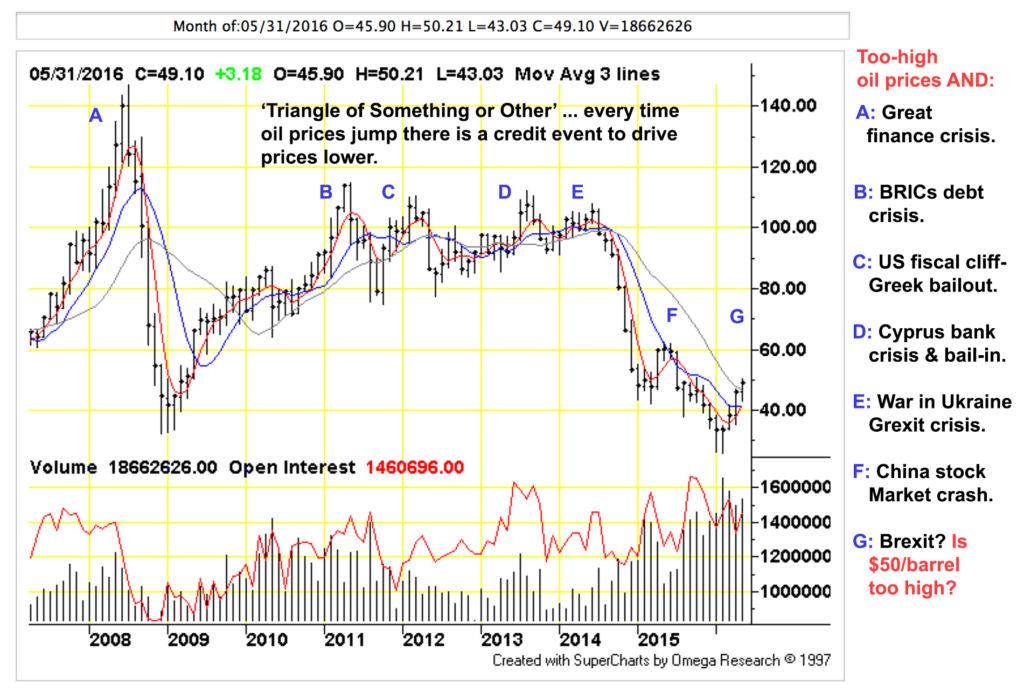

Figure 1: Chart by TFC Chartz (click for big): It’s called the Triangle of Doom for a reason, carried through to the end, no outcome is possible other than demise of the automobile industry and its petroleum dependencies. Since 2000, there have been a series of petroleum price surges intended to meet the industry’s exorbitant extraction costs. Each attempt has failed as credit conditions outside the fuel markets deteriorated. As can be seen, many of the credit failures originated within the European Union. These fails, credit shocks and price retrenchments are to some degree, a product of EU structural shortcomings. Now, the British have voted to leave the EU, panic ensues: (NY Times).

‘Brexit’ Sets Off a Cascade of Aftershocks …

Maybe the future does not include flying electric cars after all.

By Steven ErlangerBritain’s startling decision to pull out of the European Union set off a cascade of aftershocks on Friday, costing Prime Minister David Cameron his job, plunging the financial markets into turmoil and leaving the country’s future in doubt. The decisive win by the “Leave” campaign exposed deep divides: young versus old, urban versus rural, Scotland versus England. The recriminations flew fast, not least at Mr. Cameron, who had made the decision to call the referendum on membership in the bloc to manage a rebellion in his own Conservative Party, only to have it destroy his government and tarnish his legacy.

So it goes. There is a huge reaction and certainly more to come as markets digest what has happened … and what is certain to come. In the end it is very simple …

The Brexit vote was inevitable. Britain had no choice but to jump in the lifeboat and abandon the sinking EU Ponzi scheme.

Will it succeed? Probably not but it has to try. If not England it would have been another big European country, perhaps Italy as the first to abandon the scheme. The rest have to wait … but not for long. England’s alternative would be to devolve in a few short years to a petty euro protectorate like Greece or Ukraine begging Russia for fuel and Frankfurt for loans and forbearance. At issue is UK’s massive (£6+ trillion) external balance sheet, its banking liabilities vs. the dubious quality of its assets.

Brexit states unequivocally the City of London is insolvent; at the the point where it cannot finance itself any longer. This is the reason why the establishment rolled out the Brexit referendum in the first place, to save the banks. Think of Brexit as a bailout: the small will pay for the excesses of the great. The City certainly cannot finance the rest of the country and its massive and non-remunerative fleet of gas-guzzling automobiles; something has to give. There are 31.5 million cars in a country of 64 million humans, each car requires the resources of 20 persons. UK staggers under the equivalent human population of 630 millions on a small island … the bulk of those being dented, metal deadbeats. Talk about immigration, no wonder the economy struggles.

The automobiles and their need for fuel imports and infrastructure paid for w/ endless credit issue have bankrupted the entire West, not just England. In Europe: the euro = gasoline. For once — maybe not realizing exactly why and not being entirely happy about it — the British have voted against their cars.

It’s about time!