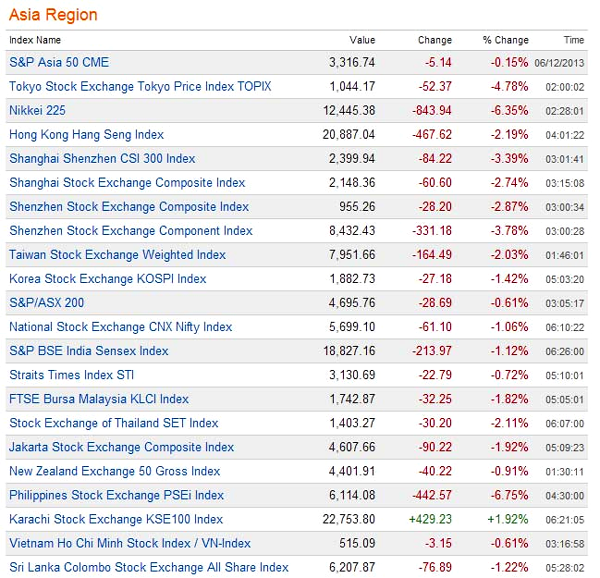

Figure 1: if a picture is worth a thousand words, a chart should be worth more … in this case a lot more than securities listed on various Asian stock exchanges right now.

Conventional analysis suggests not-quite soothing words from the Federal Reserve Chairman and The World Bank as the cause for Wednesday’s market rout in Asia. The focus should be on Japan’s trade deficit; that country has become a failed exporter/mercantile state.

This failure gives pause to the other nations who are also exporters or whose ambition is to become one. Due to persistent high energy prices and the associated burden upon credit, the exporters’ customers are broke and unable to finance their own consumption, they are in turn unable to subsidize the consumption of others.

It is indicative when the only exporters who can afford ‘junk’ right now are the energy producers … because of high prices these producers can afford too much junk! The result is more wasted energy resources and less fuel to export.

What is emerging are the effects of Peak Oil. Supply constraints relative to increased demand lead to generally higher prices with all the associated credit consequences; these in turn effect Japan and other top-tier exporters ‘on the bounce’ as customers’ ability to meet high prices is diminished/destroyed. Afterward, the prices for goods including fuel decline as any price no matter how low is out of reach. There is the race for the bottom, the process feeds on itself, it is ‘energy deflation’: countries like Japan are perched at the edge of it.

The ‘cost’ of loans taken on to buy Japanese goods in years’ past reaches forward to ration purchases, today. Very little of Japan’s export trade — mostly cars and electronic gadgets — provides any return for the purchasers, this means little in the way of income to retire debt. Instead, there is perpetually rolling loans over plus the tricks by central bankers to shift the lenders’ risks onto others, none of these tactics are enough to support gigantic industrial economies for more than shortest periods. As risks emerge like vampires from out of coffins, there is less desire for customers to either take on new loans or for lenders to offer them, or for capitalists to hold securities for a future that is ever-less likely to arrive.

Global Stocks Slide as World Bank Pares Outlook; Yen UpGlenys Sim & Stephen Kirkland (Bloomberg)

Global stocks fell, sending the benchmark index to a seven-week low, after the World Bank cut its growth forecast amid concern central banks will pare stimulus. The yen and Treasuries advanced while Portuguese bonds declined.

More than $2.5 trillion has been erased from the value of global equities since Fed Chairman Ben S. Bernanke said May 22 the central bank could scale back stimulus efforts should the job market show “sustainable improvement.”

The global economy will expand 2.2 percent in 2013, the World Bank said yesterday, paring a January forecast of 2.4 percent. The Federal Open Market Committee meets next week after the Bank of Japan this week left its lending program unchanged. Stocks have plunged 5.4 percent worldwide from their May 21 peak this year on speculation the Fed may ease stimulus.

Stocks fluctuate, daily movements don’t matter, what does is the market dependency on monetary cheerleading and moral hazard … followed by hiccups when the cheerleading is revealed to be something less than adequate to the task at hand.

Markets want unlimited state support at the exact same time the market cannot tolerate their being perceived as being dependencies. Monetary authorities are anxious to provide whatever they can in the way of support for markets at the same time they dare not be caught out by a panic or over-extended. Here is a paradox: to gain the ability to provide support the central bank must withdraw it … even when there are severe consequences to doing so. This is the gist of Chairman Bernanke’s “tapering” remarks. Should markets stagger when monetary authorities are offering what is in effect unlimited credit at very low cost, there is are no additional remedies the authorities can effectively offer. The central bank must curtail its support now … so that it might be able to offer unlimited credit again in the (near) future.

The central banks cannot lower interest rates further because rates are already near-zero; they are negative relative to inflation, the demand for credit too modest to press rates. Central banks can lend against collateral but are already doing so to the degree there is a severe shortage of acceptable collateral. The central banks have exhausted ready resources … just like the rest of us.

Walter Bagehot famously remarked, “John Bull can bear many things, but he cannot bear two percent.” A rate too low for Victorian English would be dangerously, perhaps fatally high, today. Such a rate might also be unobtainable, at least for self-issuers of credit. For those borrowers where credit is not natively available such as within the euro-zone, there are credit embargoes and crushingly high rates. What matters isn’t price as much as the certainty of being unable to earn enough from the use of the loan so as to retire it.

This in turn illuminates our fundamentally unproductive nature of our physical economies: output emerges from lenders rather than from factories which must be financed by debt before they can be built … and before the first products can be spat out of them and sold. Our factories make us modern, that being so they are fashionable; we like our factories and their cheap output of mostly useless junk. It does not matter to us that the factories are unable to pay their own way. We can borrow using the factories and the junk that is produced in them as collateral. In return, the financiers use our own lust for modernity, our insecurity, to obtain dominion over us. We obey the financiers’ commands otherwise they withhold credit. Without credit there are no goods, no progress, there is nothing; we are creatures of bankers and tycoons: “I borrow, therefore I am.”

We are also creatures of petroleum, without it everything comes undone including finance …

Figure 2: More marginal crude price increases, from Bob Brackett/Bernstein Research/Business Insider, (HT Glen):

Bernstein suggests higher crude prices are in the offing as the Shale Oil Revolution is revealed as a dud. As noted previously, new plays offer less crude per driller dollar than previous conventional plays. As these last are depleted the amount of available oil declines — Peak Oil.

Bernstein does not indicate how customers who cannot afford today’s high prices will somehow magically afford higher prices in the future. More likely is a steady decline in prices as bank accounts and credit are emptied out, as per Japan. When folks become broke they cannot afford fuel even at the lowest price.

Meanwhile, bankruptcy lurks in the shadows of even putatively prosperous countries as they confront Peak Oil:

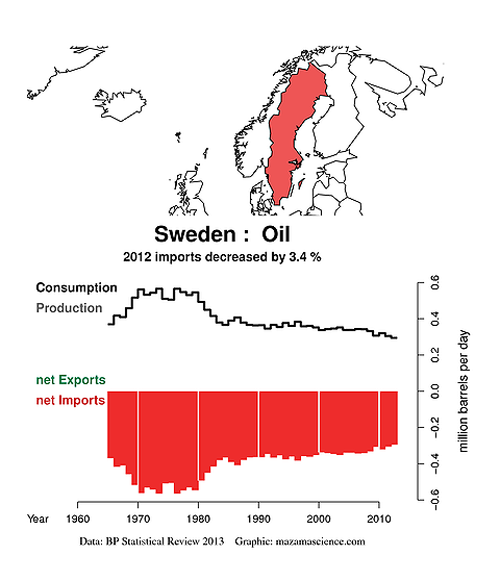

Unrest in Sweden among frustrated emigrants, many from the Middle East, who have been left out of the general prosperity. Riots are the outcome of a police killing and include the burning of dozens of cars.

Figure 3, map by Mazama Science (click on any chart for big): Cosmopolitan Swedes would suggest that the country’s 2.4% decrease in fuel consumption over the past year was due to greater efficiency. It is more likely that the savings have been extracted from those at the bottom of the economic food chain: Islamic immigrants from the Middle East.

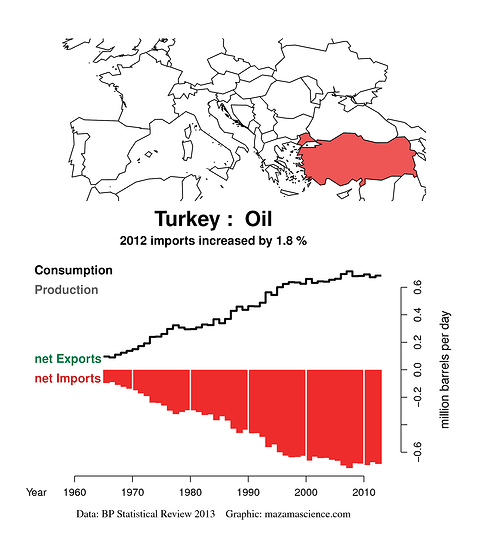

Few vehicles were hurt in the making of this Turkish video but hundreds of Turkish youths wound up in hospitals nursing wounds at the hands of police.

Figure 4: Red everywhere: Turkish petroleum consumption relentlessly increased until about 2008 as Turkey morphed from a military dictatorship to a neo-liberal market state. The country is now facing hard limits, its fuel consumption is set to decline. Turkey has very small reserves of natural gas and crude petroleum. The country’s energy policy includes an all-out assault by the establishment on the country’s most vulnerable citizens; those to be excluded from current and future fuel consumption. With less to go around, bosses and their cronies reserve access to fuel to themselves, this can then be sold on the black markets, while the citizens are left to fend as best they can.

More signs of status-quo unraveling in real time are seen in China, the Chinese lending edifice looks to be cracking, (Bloomberg):

China Everbright Bank Co. failed to repay 6 billion yuan borrowed from Industrial Bank Co. on time yesterday because of tight liquidity conditions, Market News International reported today, citing three unidentified people in the interbank market.Industrial Bank said market speculation that Everbright Bank failed to repay it more than 100 billion yuan was “untrue and exaggerated,” according to an e-mailed statement from the lender. Everbright Bank said in an e-mailed statement that its relationship with Industrial Bank is good and that “all liquidity indicators for Everbright Bank are good.”

“Some smaller banks may be unable to cover cash openings as big banks are unwilling to lend cash,” said Chen Jianheng, a bond analyst in Beijing at CICC, the nation’s biggest investment bank. “If the central bank doesn’t inject more capital into the financial system, the cash shortage will probably last for the rest of June.”

The Chinese say everything is fine but money markets suggest otherwise as there is a scramble for liquidity with many left out (like the Chinese government). As in Japan there is a shortage of funds and a central bank trying to keep up, (Bloomberg):

China PBOC Halts Open-Market Operations First Time Since MarchChina’s central bank refrained from draining funds from the financial system for the first time in three months after a cash squeeze pushed up the overnight money-market rate to an all-time high.

The People’s Bank of China hasn’t offered repurchase contracts or bills today, according to two traders required to bid at the auctions. Two calls by Bloomberg News to the PBOC’s media office went unanswered. The central bank has held repo operations every week since February to drain cash and resumed sales of bills in May for the first time since December 2011.

The overnight repo rate, which measures interbank funding availability, touched 9.78 percent on June 8, the highest since May 2006, when the National Interbank Funding Center started compiling the weighted average. China’s financial markets were shut in the first three days of the week for the Dragon Boat Festival holiday. The rate was at 6.32 percent as of 10:39 a.m. in Shanghai today, little changed from June 9. The seven-day repo rate dropped 34 basis points to 5.63 percent.

“If the PBOC sold repos or bills today, the market would have collapsed,” said Liu Junyu, a bond analyst at China Merchants Bank Co., the nation’s sixth-biggest lender. “The cash shortage hasn’t eased and banks are still busy borrowing money.”

China exporters with dollars in hand offer them to private lenders for yuan instead of swapping at the official rate with the Chinese central bank, (Caixin):

Money Supply Grows on Banks’ Continuing Forex Purchases

Financial institutions’ net acquisitions continued for fifth straight month, putting pressure on central bank to actLi Yuqian

The country’s banks bought 294 billion yuan more in foreign exchange than they sold in April, posting the fifth straight month of net acquisition and increasing pressure on the central bank to control money supply.

This comes on top of nearly 800 billion yuan in new bank loans. By the end of April, the broad measure of money supply, M2, had increased by 16.1 percent from the first four months of last year, outpacing the government’s target of 13 percent.

In response, the central bank used open market operations to absorb liquidity, resuming bills sales for the first time in 17 months on May 9. This is in addition to regular repurchase agreements.

The surge in money supply coincided with a jump in the yuan’s value against the U.S. dollar. The central parity rate of the yuan against the U.S. dollar climbed to a record high at 6.1980 on May 8 and has been fluctuating around it since then.

The official exchange rate of yuan per dollars is approximately six-and-a-fraction to one. Inflation in China suggests that private lenders have been buying more dollars than has the central bank, they have been offering a better price, bailing out stressed export manufacturers and adding more credit to the Chinese economy at the same time. The China central bank tolerates the private market because it allows the Chinese currency to be depreciated ‘on the street’ (and in the alleys) while the central bank pretends to do what it can to ‘force’ the yuan to appreciate. Currently, credit is over-extended both in the official and ‘underground’ markets, there is too much leverage, little in the way of good collateral. The ‘shadow bank’ loans must be refinanced when they mature due to their very high cost. When refinancing is difficult there are panic shortages of overnight credit. Lenders in China are playing the most dangerous game, ‘Borrowing Short and Lending Long’: this never ends well, there is either too much credit or not enough. Constraining credit to contain speculation and asset-bubble inflation threatens to deflate the bubble all at once causing a crash. So does a bank failure and the associated demand for liquidity.

Like Japan, China relies on a constant flow of subsidy funds from overseas customers: these customers are going broke like everyone else as a result of paying exorbitant fuel prices. Because they are broke, they are less able to subsidize the Chinese. Add this to the top-heavy credit regime in China groaning under its own weight and there is unsupportable risk.

Everything is of a piece: There are fuel shortages due to decades of wasteful consumption = fuel price increases due to supply and demand = customers going broke trying to meet the higher prices = customers who cannot afford to buy non-fuel goods from China or Japan who also go broke = borrowers defaulting and banks failing = less credit/money for fuel extraction = more shortages. This cycle is not something that central bankers can effect. They can mark assets to disbelief and shuffle some risk around but the greatest risk of all is running out of affordable petroleum fuel.

That risk is growing every single day.