Turning points come and go without notice, they are hard to pick out of the background noise, and are usually only recognized long after the fact and after much dispute. A good example is peak oil; did it really occur, if so when … ? Did it slip out of town under the cover of darkness in 2005 or in 2009; is such a thing even possible with the substitution effect; when higher retail prices invariably make new forms of energy available?

Right?

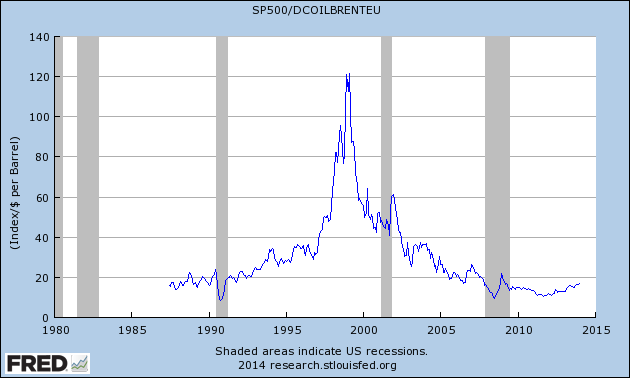

Figure 1: It certainly looks like a peak of the oil thingy from here: S&P 500 divided by Brent crude price from the FRED; the S&P is a proxy for the private sector, equity is its ‘money’. Crude oil has never been so affordable in post-WWII America as it was in 1998-99. This major turning point came and went and nobody bothered: no recession, no clowns or cocaine parties, no fireworks displays, wars or parades down Main Street; no billabongs, panda-bears or double-headers, just a change in the modern world’s way of living; a couple of years of ecstasy and super-low prices and then … gone.

The super-low prices represented the greatest number of humans across Planet Earth able to afford fuel: peak customer. Since that time, the pool of potential customers has been continually shrinking even as fuel production/consumption has remained steady. Carried to its logical conclusion, it would make sense that only tycoons would be able to afford fuel. Sadly this minuscule group’s grip on reality is made up of nothing but claims — empty promises. The so-called ‘great wealth’ of the tycoons is not able to support the colossal infrastructure needed to get tomorrow’s petroleum out of the ground. The industry cannot scale backwards, to run it needs energy that is cheaper than what it delivers … not promises; there are no inexpensive-to-deplete energy supplies remaining to scale back to.

The tycoons are just as stranded by the depletion of low-cost fuel as everyone else; they foolishly took on the world’s teeming billions in a pizza-eating contest and they won. Oorah! All too quickly the pizzas are gone, a Pyrrhic Pizza Victory for the tycoons.

Meanwhile, the bulk of the world’s citizens were unable to afford to buy into the fuel consumption regime even at the super-low price. Free barrels would have been too costly for those unable to afford the car needed to burn them. At this margin of desperation equilibrium economics simply falls apart: supply + demand = irrelevant.

Physical output does matter but scarcity affects price first. Less crude = higher price, the current price is suggestive of a shortage even when physical production appears to be increasing. Petroleum extraction does not exist out of context which is demand and consumption. Consumption always equals extraction so it is impossible to make a qualitative judgement of one relative to the other. Demand is an entirely different story: the change in the price per barrel represents the contest between potential users. It illuminates the relative merit of the winning bidder; price is a ‘stupidity indicator’ in that the highest- and best use of fuel is to keep it in the ground and not waste it. This is never the outcome: money is borrowed then spent in a frenzy, the fuel is gone so is the cash; the game is lost before it’s begun! Price never lies: the greater the amount of money spent on waste, the more foolish we are. Analysts dodge around price because it tells a story that people would rather not hear, that energy problems needed addressing fifteen- or more years ago and that industrial modernity has been living on death row ever since.

Rising prices ration customer access to fuel. No credit = no fuel. Using dollar price or a stock index to determine peak oil is sensible when these things are the means of fuel allocation. Measuring by price is no different from barrels-per-day. A dollar is a unit of measure just like a share of stock or an inch. Only when the credit rationing regime falls apart does output matter because rationing from that point forward is physical and immediate rather than intermediated by friendly bankers; there are gas lines, ration cards, travel restrictions, odd-even days, checkpoints, the hated ‘Double Nickel’. Also massive unemployment, the shortage of ‘real money’, black markets, collapse of automobile-related industries including real estate, finance, insurance and manufacturing.

First it was Bitcoin, now this …

A turning point appears to be underway on Wall Street; speculations are now so idiotic that even fools are dismayed, (Bloomberg):

Greed Turning Losers to Leaders in Russell 1000 IndexLu Wang

Unprofitable companies such as Zynga Inc. and FireEye Inc. are leading gains in the Russell 1000 Index.

Two things explain why the biggest gains in the U.S. stock market this year are coming from companies without profits, according to Jeff Mortimer of BNY Mellon Wealth Management: Greed, and fear of missing out.

Neither dooms the bull market, even as they signal to some investors a potential top after five years, said Mortimer, the Boston-based director of investment strategy for BNY Mellon Wealth Management, which oversees about $185 billion. More than $14 trillion has been added to American equity values since March 2009 and the Standard & Poor’s 500 Index is within 1 percent of a record.

Unprofitable companies such as Zynga Inc. and FireEye Inc are leading gains in the Russell 1000 Index. The Nasdaq Biotechnology Index is up 25 percent in the past 10 weeks, the most since February 2012, data compiled by Bloomberg show. Less than a third of its 122 companies earned any money in the last 12 months. Marijuana shares, which trade on venues with less stringent reporting requirements, are among the most active.

“In this backdrop of human emotions, which begins to take over, it’s one of greed, it’s one of willing to pay for something that will happen in the future and being afraid that one might be left behind,” Mortimer said by phone on Feb. 19. “It benefits the whole market. Whether or not they’re overpaying, only time will tell.”

Candy Crush

Investors are embracing riskier stocks after declines this month proved fleeting amid rising corporate earnings and improving economic data. Takeovers from Actavis Plc’s $25 billion bid last week to buy Forest Laboratories Inc. to Facebook Inc.’s $19 billion purchase of WhatsApp Inc. are fueling speculative bets as companies such as King Digital Entertainment Plc, the maker of the “Candy Crush Saga” game, sell shares for the first time.

The inflated prices for ‘nothing in particular’ have lost the power to outrage: the Return of the Dot-Com Fiasco is taking place right under everyone’s noses. The pot boils even as nicely-dressed very serious people in the media business watch carefully. Bloomberg provides a convenient list of companies to short: Zynga, Actavis PLC, Facebook, Fireye … the entire Nasdaq Biotechnology Index! Don’t forget Amazon, Twitter, Tesla and Hemp Inc. None of these companies earn money, nor do they produce anything of value … only distractions and the promise of endless free lunches some time in the indeterminate future. Ditto, General Motors, which has become a hedge fund favorite for the same reason as these other companies; because some wealthy escapee from a mental hospital is expected to pay more for it later! As with petroleum, the rising stock indexes taken together are a stupidity indicator.

America used to be a serious country but that was so long ago that it passes out of mind …

Anyone looking to measure how far we have fallen down the rat hole need look no farther. This high-quality ‘adult’ product is worth billions to enterprising investment market villains who will ‘pump’ it and then ‘dump’ it on unsuspecting retail bag-holders and pension funds. Nobody in their right mind would have anything to do with it …

America descends into mental illness, meanwhile, endless propaganda from the energy industry insists on a natural gas glut in the US resulting from improvements in technology. Enter a winter in the US that is more or less ‘normal’ and natural gas in storage has fallen sharply. Our glut does not seem to be quite so glut-ty after all;

| Working gas in underground storage, lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) |

Year ago (02/14/13) |

5-Year average (2009-2013) |

|||||||||||||||||||||||

| Region | 02/14/14 | 02/07/14 | net change | implied flow | (Bcf) | % change | (Bcf) | % change | |||||||||||||||||

| East | 685 | 814 | -129 | -129 | 1,119 | -38.8 | 1,049 | -34.7 | |||||||||||||||||

| West | 229 | 259 | -30 | -30 | 369 | -37.9 | 329 | -30.4 | |||||||||||||||||

| Producing | 529 | 620 | R | -91 | -91 | 930 | -43.1 | 806 | -34.4 | ||||||||||||||||

| Salt | 77 | 109 | -32 | -32 | 226 | -65.9 | 139 | -44.6 | |||||||||||||||||

| Nonsalt | 452 | 510 | R | -58 | -58 | 703 | -35.7 | 667 | -32.2 | ||||||||||||||||

| Total | 1,443 | 1,693 | R | -250 | -250 | 2,418 | -40.3 | 2,184 | -33.9 | ||||||||||||||||

| R=Revised. Resubmissions of data resulted in increasing estimates of working gas stocks in the Producing Nonsalt region by approximately 7 Bcf for the week ending February 07, 2014. The reported revision caused the stocks for February 07, 2014 to change from 1,686 Bcf to 1,693 Bcf. |

|||||||||||||||||||||||||

Table from EIA; The red figures at the bottom of the chart tell the story as gas is withdrawn from storage at a high rate. A year ago there was 2,418 billion cubic feet of natural gas in storage. Fast forward and approximately half has been drawn down. It seems America’s gas glut is less about ‘production’ and more a matter of successive mild winters with surpluses carried over year to year. In place of 100 years’ supply, there is an infrastructure bottleneck. Industry could expand storage- and distribution capacity, instead it races to build LNG export terminals whose massive costs are certain to be added to the gas price. It will be interesting when US customers wake up to find themselves competing dollar-for-dollar with Japan and China for American natural gas …

Turning points occur when folks realize they’ve been had …

Since oil peak in 1998, there has been widening turmoil across the world as governments fail to respond effectively to straitened credit flows and higher real fuel- and food prices. Citizens take to the streets and establishments fall apart. Latest country to emerge with a shiny, new power vacuum is Ukraine, which effectively jettisoned its pro-Moscow plutocrat Victor Yanukovych and his cadre of bullies and grifters. It is unclear what form the new Ukraine government will take, but one thing is certain: the country will be flat broke.

Looking at the failed governments and the countries that are on the edge of a regime change, ‘broke’ is the common factor along with the countries being energy deadbeats. Fuel is costly and using it does not offer a useful return, countries with little to trade must borrow, when they cannot they are insolvent:

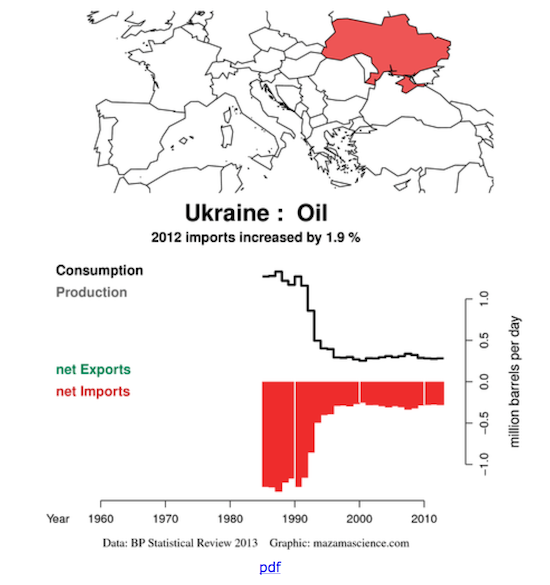

Figure 3: Tell-all chart from Mazama Science (click on for big); Ukraine has been on a stringent petroleum diet since the early 1990s even as loans outstanding have ballooned. In a way the country is a model for our post-petroleum world-to-come, having endured an almost 75% reduction in fuel consumption. Ironically, Ukraine is criss-crossed with petroleum- and natural gas pipelines that are the legacy of the old Soviet Union, carrying fuels from the Caspian- and Caucasus oil- and gas fields to Warsaw Pact states. Now these pipelines transport fuel from Siberia and Central Asian Republics to Western Europe. Geography has made Ukraine the gas transport route, there is little economic point to making changes. Routing pipelines through Belarus or elsewhere would consume both time and resources, the costs would exceed any possible gains.

Ukraine has had a contentious relationship with Russia regarding gas and credit since the collapse of the USSR. Over the interval Russia has taken to periodically cutting off Ukraine gas supplies causing shortages downstream in Europe. At the same time, Ukraine siphons gas from the pipeline network for its own purposes or for resale.

Ukraine has little in the way of domestic energy supplies and is dependent upon imports, mostly from Russia. The relationship between the two countries is like a marriage where the two parties hate each other but neither can afford to move. Ukraine is an exporter of agricultural commodities but these exports are insufficient to support fleets of automobiles and Western-style fuel waste. This leaves the country desperate for loans … with the various Ukrainian governments playing Europe against Russia in a contest alongside the one for natural gas.

Governments in Ukraine have been notably corrupt as is the case in other post-Soviet republics. Ukrainian politics is a rough trade where bosses are like Mafia dons, poisoning- and imprisoning each other on trumped up charges. Living alongside Russia, the country is subject to intrigues. A possible outcome is for the country to split into pro-Western and pro-Russian territories however, the need of one for the other and pipeline geography argues against this. The one Ukraine would not like to be held hostage to gas flows to-or-from the other Ukraine.

The Putin government in Russia does not appear capable of dealing with others except by way of bullying and threats of force. Measured against the vulnerable the Russians appear very powerful; girl bands, democratically inclined political opponents, Greenpeace activists, reporters and homosexuals. Against very small countries such as Georgia and Chechnya, Russia’s comic opera security forces have been relatively effective. Against Ukraine, the outlook is sketchier as the mostly unarmed but highly motivated citizens had little trouble keeping Ukraine’s military in their barracks while crushing the government’s elite internal security forces. This should give the Russian establishment pause as that country is as vulnerable to political upheaval as Ukraine whose citizens have now produced a practical guide in real time on how to conduct a successful street revolution.

It is too soon to tell how this will turn out but a turning point appears to be taking form; certainly toward long-overdue seriousness of purpose and away from elites’ impunity. The Ukrainian challenge is to find a way to isolate Russian provocateurs and troublemakers. The advantage lies with the Ukrainians: Russia cannot afford any act that cuts Gazprom from its European customers and their precious euros. This mitigates away from fracture, for Gazprom to deal with one Ukraine is bad enough, to have to deal with both an East- and West Ukraine would be unbearable. Russia is not a stable country, the strains there are already showing, already the rouble is unraveling, there is capital flight. To defend the currency after the inevitable Ukrainian default plus any level of conflict would pretty much destroy the country.

Instrumental to the Ukrainian citizens’ success so far is their vehement rejection of the tycoons and politicians’ self-interested culture of excess. The moral high ground has been gained by the ordinary Ukrainians, maybe for an instant only, certainly not everywhere at once. This is ground to which no tycoon anywhere can have any possible claim. The cynical Russians offer loans but with special favors for oligarchs. The equally cynical West offers hypocrisy and its own brand of TROIKA criminality. Ukrainians counter with a relentless insistence upon fairness and the end of corruption. Something is certain to come from this, honesty is dangerous to the tycoons on Wall Street and their bought-and-paid-for pets in Washington DC and the other world capitals as they look toward Kiev and tremble.