There are people who read this blog religiously, eager to find out when the next giant crash is going to occur. Blogman sez the giant crash is occurring right now under everyone’s nose. It just doesn’t look like a crash, rather more like a bit of vaudeville grafted onto a horror movie.

Bloggers, economists and finance analysts gain credit from their peers by predicting crashes and for no other reason. A good crash prediction allows financiers to shift away from potentially illiquid asset markets before they freeze up … so they might re-enter the same markets later when it is safe to do so. Prior to the Lehman collapse, about fifty high-level analysts fingered the last giant crash out of 6.2 billion humanoids on this planet (none of those other billions really cared). Estimable Gary Karz, CFA has taken the time to curate a comprehensive list of them. Included are familiar names like Dean Baker, Richard Baker, Roy Barnes, Susan Bies, Rick Bookstaber, Claudio Borio, Brooksley Born, Jesse Colombo, Vox Day, Richard Duncan, Marc Faber, Fred Foldvary, Robert Gnaizda, Wynne Godley, James Grant, Jeremy Grantham, Jeffrey Gundlach, Fred Harrison, Kenneth Heebner, Michael Hudson, Eric Janszen, Med Jones, Steve Keen … etc.

Where are these guys now? Some analysts like James Grant and Robert Prechter have been calling for a crash every week for the past twenty five years, but others are vague or they demur. In the foreground, the media circus trumpets ‘recovery’ and growth. In the background, nothing in the West’s finance- or energy throughput systems has been fixed or even amended since the beginning of the millennium and the ‘Dot-Com Crash’. Credit overstretch is greater now than in 2007, there are hundreds of trillions of dollars of derivatives cluttering the finance industry’s books, the too-big-too-fail banks are more bulbous and corrupt than ever … The same banks’ low-cost credit has inflated asset prices far beyond their underlying, fundamental worthlessness. The fuel for a giant crash is in place, all that is needed is a match. Everywhere in the world the economies are staggering; Japan, Russia, India, Brazil … even manufacturing powerhouse China is on the ropes.

When the slide passes the point where it cannot be ignored any more, people will cry, “nobody could have seen it coming!”

To a large degree, nobody will. Because the establishment adapts to crashes over time, each new one takes a slightly different form. The toolkit to combat money panics has been expanded and refined: bank depositors are possessed of almost universal government treasury-backed guarantees. Central banks offer cheap credit by the trainload which validates the worth of collateral taken in exchange for it. Risk-averse, under-capitalized retail speculators that were quick to leap head first out of windows have been driven out of markets; their places occupied by professionally-managed funds which have in turn been consolidated into behemoths. The monolithic firms tend to be panic- resistant because they are able to hedge themselves across multiple markets and have access to liquid credit at near-zero cost. At the first sign of trouble political establishments around the world rush in to ‘prop up’ key institutions with bailouts. Markets and banks certainly aren’t risk-proof but the finance system is more able to respond to a margin call more effectively than could markets twenty or thirty years ago.

The current crash has unrelated, non-financial components falling apart at distant margins: the un-crash crash. Emergencies pop up then disappear as soon as the mediasphere changes focus or is distracted by something else: Argentina defaults (again), Russia, Israel, Iraq and Libya engulf themselves or their neighbors with mad war, methane bubbles out of the ground in Siberia … returns on CAPEX in the oil patch decline … the air leaks out of bonds …

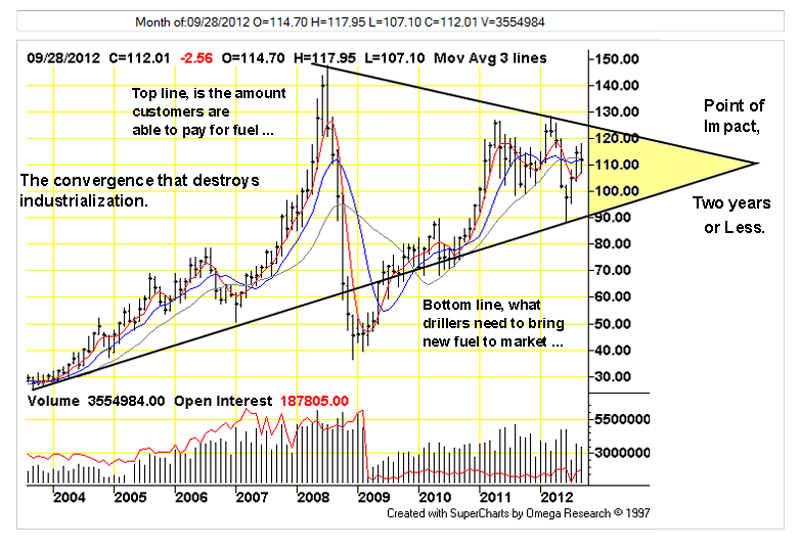

Figure 1: Back in 2012 the gnomes at Economic Undertow predicted that there would be ‘trouble’ sometime right about now … How it works is simple: at some ‘high crude price’, the economy seizes up; an ‘oil shock’ as in 1973. Conventional analysis assumes that the economy-killing price will trend higher with inflation and the passage of time: $147 crude in 2008 is followed by $200 crude then the $300 crude. This is a false assumption: observations since 2008 indicate that the economy-killing high price has declined and is now a little more than a $110/barrel for Brent crude. As extraction costs increase, the price that shocks the economy is lower than the price needed by the energy industry to bring new crude oil to the marketplace. The result is a shortage of fuel …

The incipient fuel shortage is manifest as credit ‘problems’, runs out of bonds, wars, social disturbances; things other than gas lines and ration coupons.

Before 1998, each succeeding dollar spent on fuel extraction accessed an increased amount of petroleum, much of this petroleum was simply left alone as spare capacity. From 1999 onward, every dollar spent has accessed diminished amounts of petroleum … with no end to this trend in sight. At the same time, demand for fuels has exploded with the addition of millions of Chinese, Indian and the Middle Eastern consumers … something has to give.

Three things are occurring simultaneously:

– oil prices are too high — regardless of what that price is. Even if prices aren’t high enough to cause an outright crackup as such, their effect is to slow the economy to a crawl. Our economic infrastructure has been built assuming sub-$20/barrel crude oil into the foreseeable future. Current $100+/barrel prices are unaffordable, our consumption infrastructure is stranded.

– Customers are less solvent and are less able to borrow due to the high cost of both fuel and debt. This means there are less funds available, fuel prices cannot be bid higher.

– The result is insufficient funds for oil drillers whose need for funds increases with time and whose costs can only be met with borrowing, (from, ‘The Mother of All Free Lunches’)

The maximum price customers can afford to pay for fuel decreases while the price required to bring crude to market continuously increases. The current price at any given time is too high, firms fail and customers are left with diminished discretionary income. At the same time, the current price is too low to allow drillers to complete the increasing numbers of wells in difficult areas that are needed to keep pace with demand- plus depletion in older wells.High prices strand consumption infrastructure. Low prices strand the drillers … When prices are ‘low’, the high priced reserves become unavailable. At some near point in the future both the too high- and the too low prices will be the same … then it’s game over. From the chart it looks to be about two years in the future … all else being the same. If conditions change, the price will plunge and oil shortages intensify. Under no possible circumstance will our pauperizing meat-grinder-economy be able to afford higher real costs: resource waste is unproductive everywhere but at the margins, so is the debt taken on to subsidize it

The proposition is that more loans can command capital to appear: analysts assume that changes in the rules governing finance can change conditions on- and under the ground. Central banks offer loans used to gain capital but they cannot offer capital itself, which requires work to extract and make usable. Additional work is required due to the ‘destroyed capital’ effect and continually diminished capital concentrations.

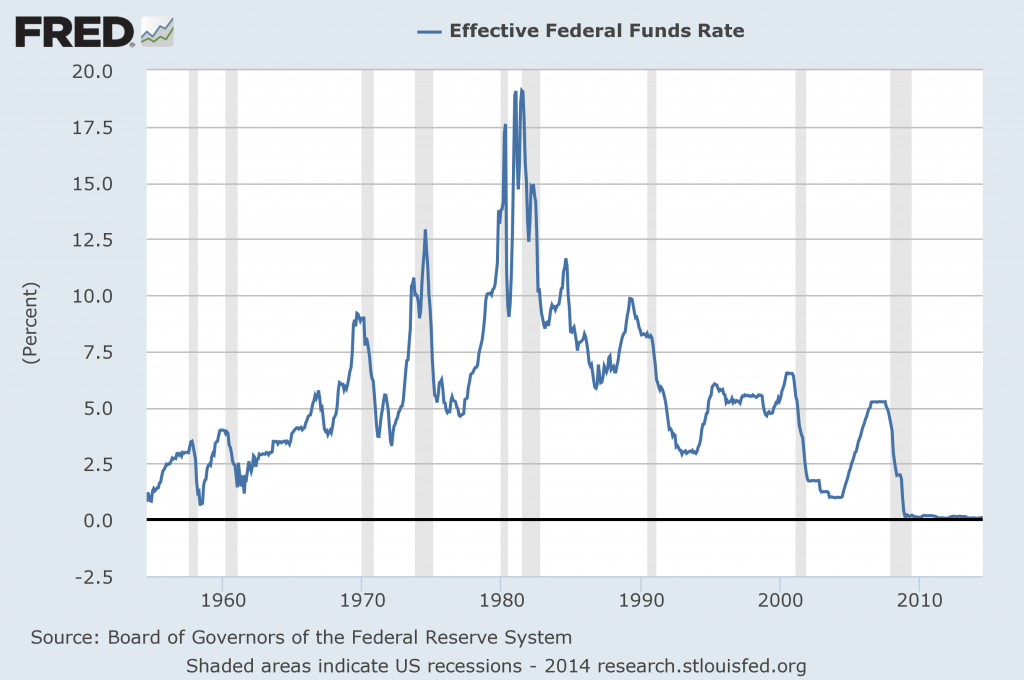

The fifty- or so prognosticators peering forward in 2007 thereabouts were looking through the prism of mortgage debt. Post crisis, the mortgage origination and funding regimes have been cleared; the housing speculator ‘weak hands’ sent into bankruptcy. Today’s debt related risks are spread out across a constellation of regimes that also happen to be subprime: auto loans, college education loans, stock buy-back funding, M&A, IPO/angel funding, also energy lending. Analysts today looking to predict must look through the telescope of energy cost. Energy firms are able to fund themselves because of the central banks’ concerted efforts to keep interest rates below the rate of inflation. Firms must fund themselves because their customers cannot afford to do so; that being the definition of ‘sustainability’ … when customers borrow in the place of the businesses they are buying from, putting themselves on the hook for repayment rather than the firms.

Figure 2: US Effective Federal Funds Rate by FRED, (Click on for big). The modest rise of interest rates beginning in 2004 was the proximate cause of the mortgage crisis; the reason behind the increase was the marketplace response to ‘inflation’, that is, rising fuel prices due to vanished spare capacity. After the crisis began, rates plunged to current levels: some of this credit flowed toward the finance industry itself and its pyramid schemes, much of the rest is flowing now to the energy extraction industry.

The International Energy Agency estimates that $48 trillion will be needed over the next twenty years to procure the modern world’s needed energy, a doomsday machine in all but name. Approximately half of the $48 billion will be required by the petroleum industry. Keep in mind, these fuel industry’s costs are ultimately the responsibility of customers to retire … assuming that individuals will be able to borrow these amounts … which are themselves likely to be an underestimation.

If the world’s GDP remains the same at roughly $60+ trillions per year, the IEA percentage appears modest; however, GDP cannot be assured any more than the cost estimates. Procurement amounts to a modest fraction of total energy- or even petroleum budgets. When fuel shortages actually materialize the GDP numbers will decline while the amounts directed by necessity toward the fuel industry will increase. As the industry attempts to compensate for legacy depletion it drills more wells, the new wells deplete along with the others. The result is an industry race against itself as accelerated extraction pressure draws down reservoirs that much faster …

Fast forward to the onrushing crisis under our feet: credit is stressed, customers are broke and cannot pay. Fuel prices are declining because there is less credit. Drillers are dependent upon Wall Street finance and central bank interest rate policy even though the finance is drying up and rates are set to rise regardless of what the central banks do. Everyone is running as fast as possible trying to catch up to themselves … and finding themselves always a little out of reach.

A personal note:

My friend Jim Hansen announced the other day that he is ceasing publication of his excellent newsletter ‘Master Resource Report’. Says Jim:

Since 2006 nearly 400 issues of The Master Resource Report have been distributed as a free educational service of our firm. The motivation was to share some of our insight with a broader group of interested people so they could make better informed decisions in their lives concerning energy. But now it is time to end this venture due to a combination of time constraints and other demands for my attention. In closing out the report I would like to leave a few observations concerning what history might tell us about what may be ahead.The first observation is that we have been here before with forecasts of oil abundance and lower prices on the horizon. While it is frequently pointed out that we have not run out of oil as if that is what Peak oil is about. The abundance side of the debate is seldom given the same critique.

Over the last 15 years there have been as many calls for cheap and abundant oil as there have been for scarce and expensive. But one reality holds, the inflation adjust price of oil today remains near an all-time high while the global economy remains sluggish and crude oil production flat lines. On this point always remember to check and see what is being represented as oil. When the term liquids is used it is a tip off that everything from NGLs, biofuels and the absolutely useless refinery gains are probably in the volume mix being quoted.

Energy is The Master Resource required to extract all others. Without the cheap transportation fuels provided by oil the global economy as we know it today would not exist. The food supply depends not only on the diesel fuel for farms and transport but the fertilizers and chemical inputs that oil and natural gas have provided the “Green Revolution”.

I hope that by making these points through this report I have given readers some perspective to plan both their lifestyle and investments. The risks we face are great but so are the opportunities. How it works out for all of us depends on how we choose to use or not use the information we have.

Best Wishes to All and thanks for all your feedback over the years.

It’s understandable that Jim would bring an end to his long-running project. After awhile behind the computer you forget your family members’ names or what they look like. I sent him an email suggesting that if he ever feels the need to write a commentary to feel to send it over this way. Thanks, Jim, for the timely intelligence!