Dear Sir and Madam,My name is Jurre Hermans. I am 10 years old and live in the Netherlands. I am quite worried about the eurocrisis and look at the TV news daily. The eurocrisis is a big problem. I think about solutions. Since I read in the newspaper about your price, I thought that I would like to submit my idea. The idea might fit. So here it is:

I made a picture of my solution and I will explain it to you.

The situation in Europe has reached the point of embarrassment, when a 10-year old boy has as good a strategy for dealing with Eurofailure as the professionals. Says Jurre:

The Bank gives all these euro’s to the Greek Government (see topleft on my picture). All these euros together form a pancake or a pizza(see on top in the picture). Now the Greek government can start to pay back all their debts, everyone who has a debt gets a slice of the pizza …

We can call this the ‘Pizza Policy’. The Greek’s creditors get the (theoretical) pizza, the Greeks get ‘unhappiness’, worthless drachmas and a kick in the pants.

Youngest entrant

An eleven year old boy from the Netherlands has received a special mention from the judging panel of the Wolfson Economics Prize for his application to the prize.

Jurre Hermans, a school boy from Breedenbroek in Gelderland Achterhoek, was the youngest entrant to the Wolfson Economics Prize. He decided to enter the prize after watching Jeugdjournaal, and because of his concern about the Eurozone crisis. Jurre’s paper, complete with diagram, proposes that Greece should leave the euro. Greek citizens would exchange their euros for drachmas and anyone caught moving euros abroad would be penalised financially.

He will receive an €100 gift voucher for his efforts.

€100 gift voucher, good at any McDonald’s. Jurre’s platform is shockingly similar to German Finance Minister Wolfgang Schäuble’s: knock those Greeks down then beat them with clubs with nails sticking out. Jurre certainly has a job waiting for him at Goldman-Sachs or at the US Treasury as the euro will certainly be long gone by the time he comes of-age.

The only hole in the Jurre-Schäuble argument is the Greeks lack the euros to repay anything in meaningful amounts. This shortage of euros IS the credit crisis not the outcome of it. The absence of euros feeds on itself: the shortage multiplies demand for available euros and their cost in credit markets. Euros are hoarded or removed from the marketplace which pushes credit costs higher still. This isn’t debt-deflation so much as it is a deliberate policy of credit strangulation.

Keep in mind, the ECB with its LTRO- and the discount window operations cannot create new credit only recycle or re-allocate what already exists. Its balance sheet expands because private-sector balance sheets shrink by equal amounts elsewhere. What economists ignore is central banks are collateral constrained: they can accept zero-quality collateral but cannot lend against zero collateral, otherwise there is no central bank.

What would end the rationing scheme and the credit crisis would be the addition of more euros or any other form of liquidity. Since credit isn’t a natural resource and can be created in virtually unlimited quantities, shortages of credit are matters of policy or corruption. In the Eurozone, the absence of liquidity is the small matter of an absent fiscal structure. There is no European ‘federal government’ to provide euros. Only the national governments and the private sector can create credit: the private sector refuses and precious rules inhibit the nations themselves from doing so themselves.

In credit economies, access to credit rations access to resources as well as other goods. Shortages that take place are blamed upon ‘deadbeats’ who ‘purposefully choose’ not to meet their obligations. As credit vanishes, demand for it increases to infinity. Credit demand becomes impossible to satisfy, this leaves demand for the goods to be exported to the creditors who gain the ‘moral claim’ to consume in the borrowers’ place.

The borrowers fail to make good because of the denial of credit on the part of private creditors with interests to promote. Out of this failure the creditors’ claim against the borrower becomes perpetual. The only means by which the borrower can make good is now possessed by the creditor who refuses to release it. Because funds are borrowed in order to waste resources, debts cannot be satisfied unless the borrower is able to waste more which requires more borrowing.

Here is where the edifice of so-called capitalist economics collapses under its own weight: waste as the center of industrial activity is presumed to be ‘productive’ even as the wasting- borrowing process bankrupts the entire enterprise. The leverage regime acts against itself as agents borrow themselves into ever-deeper holes that they can only pray to be allowed to borrow their way out of … which of course, they cannot do.

From this particular vantage point, the euro becomes the instrument of bait-and-switch credit fraud like a sub-prime mortgage. Policy failure on the part of the European Union is to not have a lender of last resort: the fact of such an absence after ten years of euro speaks for itself.

The cost of credit scales inversely to the amount of debt an enterprise can take on. Inversely scaled credit cost is the competitive advantage the ‘too bigs’ possess over the ‘not quite so bigs’ who must pay more to borrow. Sovereign debtors are expected to outlive (or to execute) their creditors even as economic ‘growth’ (inflation) reduces the real amounts debtors must retire or service. Because sovereigns are the largest debtors they claim extraordinary privilege … of not having to repay debts but to infinitely roll over and monetize them. Because sovereigns are the ultimate consumers of credit, national debts are too great for any economy to repay even when it has gone far down the road to Ponzi financing. At some distant point in time both the borrower and the lender have been migrated to the (sovereign) balance sheet which allows the loan to be extinguished. Alternatively, debts are repudiated.

The sovereign is vulnerable: the borrower must take on debt denominated in the country’s native currency. Otherwise, all of his debts are external, at the pleasure of repayment on the lenders’ terms in the lenders’ currency! Here is the set trap at the center of the eurozone: no country within the Eurozone who carefully follows its rules has the use of its own currency. The euro is no-nation’s currency and all debts denominated in euros are external debts. Each Eurozone country is held hostage to private lenders: in a practical sense every European country is a colony of the finance industry.

It is that industry that sets money rates at any given time because there is no public competition, no alternative bid. Governments lack the structural means to control their own destinies. If ‘investors’ collude so as to refuse to lend for any reason at all … there is no agency to lend in their place and compel a bid.

Because there is a bid, the Japanese can borrow at low rates with debt/GDP ratio of 204%. Because there is no European bid, the political economists Reinhart and Rogoff can effectively pronounce a death sentence on Greece’s debt to GDP ratio of 130% even though such a thing is irrelevant to a sovereign. Nevertheless, the Greeks are are cut off from private credit. Had Europe a real lender of last resort rather than the current fake, there would always be a bid for the national debts and there would be no debt crisis to speak of.

What the foregoing insists is that European nations cannot survive their human or corporate creditors … which is astonishing and suggestive. The demand is exercised that Greece in a multi-year recession must repay finance-level debts that are beyond the ability of any economy to retire and to do so at once without any support. This indicates that Greece is expected to expire: there is no other possible explanation.

At the same time, private lenders are in extremis because of habitual poor credit underwriting both within Eurozone and elsewhere. Add the strains of unrequited repayment demands made upon Greece and the others credit spreads have deteriorated and risk has increased making all lending unprofitable.

The financiers and core states of the Eurozone have changed the rules in the middle of the game, from allowing Greece and the other peripherals to roll over maturing debts at reasonable rates of interest to cutting off credit and calling outstanding loans. Here is Greek default, imposed upon it by the rest of the Eurozone.

Greece has been a nation for thousands of years, certainly a ‘modern’ Greece would be expected to survive long enough to manage its debts. It could do so if it could access credit at Germany’s rates of interest.

If Greece had a government worthy of the name, the Greek treasury would issue fiat euros and use them to put citizens back to work. A government worthy of the name would dare the financiers in Frankfurt, London and Wall Street to do anything about it as there is nothing that they could do.

About the Wolfson Economics Prize

The Wolfson Economics Prize will be awarded to the person who is able to articulate how best to manage the orderly exit of one of more member states from the European Monetary Union.

There is now a real possibility that political or economic pressure may force one or more states to leave the Euro. If the process is managed badly it would threaten European savings, employment and the stability of the international banking system. The Wolfson Economics Prize aims to ensure that high quality economic thought is given to how the Euro might be restructured into more stable currencies.

The Wolfson Economics Prize, worth £250,000 (€286,000), is the second biggest cash prize to be awarded to an academic after the Nobel Prize. Deadline for submissions will be January 31st 2012.

Who is Wolfson?

Simon Wolfson, Baron Wolfson of Aspley Guise (born 27 October 1967) is a British businessman and currently chief executive of the clothing retailer Next and a Conservative life peer …

As if there is any other kind of life peer … Here is a sampling of entries:

Roger Boodle, A Practical Guide To Leaving The Euro:

Secrecy versus openness

In theory, keeping a country‘s planned exit secret for as long as possible would help that country to minimise – or at least delay – the disruptive effects likely to be caused by the disclosure of its plans to leave.

Such effects might include: large capital outflows from the country as international investors and domestic residents withdrew their funds; associated falls in asset prices and increases in bond yields; runs (i.e. large and rapid deposit withdrawals) on banks in the country, perhaps causing a banking crisis; and negative effects on consumer and business confidence.

Thousands of words from Mr. Boodle but not one mention of energy in his entire proposal.

If we assume the costs caused by the additional legal uncertainties are equivalent to just 10% of annual external trade in goods and services, a typical euro-zone country might face an additional hit of 4% of GDP. But the disruption in the immediate aftermath of an unanticipated exit from the euro could be much greater.

There is as much or more secrecy to propositions as there is to nuclear power … and for the same reason. The truth would have persons running for their lives. It is far better, as our 11-year old economist suggests, to force or mislead people into serving the interests of moneylenders. This will not work if people discover their ‘destiny’ as economic fodder ahead of time. Here is another secrecy pimp, Not Really Niel Record:

If member states leave the Economic and Monetary Union, what is the

best way for the economic process to be managed to provide the soundest foundation for the future growth and prosperity of the current membership?[Author’s Name withheld]

I make six practical recommendations in the essay:

Recommendation 1: Germany (possibly together with France) establishes a secret Task Force, with a Charter to design proposals for planning and managing possible Eurozone Exit. Ideally France would join to give legitimacy – but secrecy and speed is essential, so only a token joint operation may be possible.

Recommendation 2: Whatever the results of the Task Force’s deliberations, firm plans and proposals should be in place by 30 April 2012, or as soon thereafter as is practicable using all means at the Task Force’s disposal.

Recommendation 3: The Task Force would propose to the Council of Ministers that the Euro should cease to exist on the day of the Exit announcement, to be replaced by new National Currencies.

Recommendation 4: The ECB would be closed and its functions terminated with immediate effect. All its functions to be transferred to the relevant National Central Banks (NCBs). Its balance sheet to be shared out pro-rata to NCBs by reference to the ECB shareholding proportions and (for banknotes), NCB banknote issue …

Notice how utopia arrives tomorrow … as soon as the monarchy has, “managed to provide the soundest foundation for the future growth and prosperity of the current membership.” What must come first is the tonic: robbery. As long as the boarded up nuclear reactors don’t melt down, all is good … until tomorrow!

Adjusting finance so that failure is not self-induced is necessary. Doing so now will buy valuable time: Europe and the rest of the world are gripped in an energy crisis. By not coming to terms, the economics profession marginalizes itself. This is understandable to some degree: the greatest of all human enterprises, the culmination of millions of years of evolution is to take good capital and throw it into the fire. The few managing the fire reward themselves for their cunning. The economists’ job is to rationalize this monstrosity: to convince the public that two-plus-two equals twenty-two. That they succeed is unsurprising, the world seeks to be deceived. After all, success and prosperity are sure to come … tomorrow.

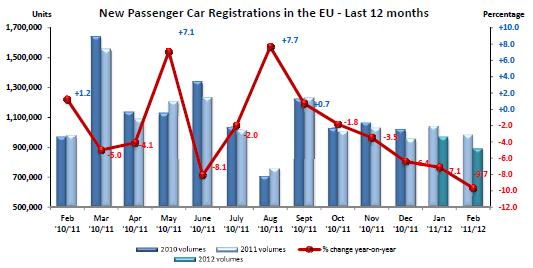

Figure 1: EU auto registrations for the past year (from ACEA). It is possible that registrations might recover, but hardly likely when consuming countries such as Spain and Italy are now on the euro credit stringency chopping block. The demand for fuel in peripheral countries is removed. This is done by creditors cutting off peripheral access to euro-denominated credit. Those remaining with credit have the means to then ‘import’ Spanish- and Italian domestic fuel demand for themselves without any monetary or credit penalties.

It’s cars versus jobs and people. Car is winning today but will ultimately lose.

Purposeful deflation is energy conservation by other means.

This is not completely arbitrary as the conservation impulse is not optional. It will be enforced by events or otherwise. There is nothing that can be done to stop or slow conservation. It is driven by entropy which is a physical law.

Instead of jettisoning car industry and keeping the EU, the union jettisons Greece to keep the car industry. The EU stupidly thinks the crisis is ‘fixed’. At some point Germany exits the EU which is then destroyed: at the end of the day there is no EU and no car industry, either.

Greece failed rapidly, the other EU states will collapse even faster, so will the UK which must import fuel. This is the crisis, Europe must import almost all of its fuel and has borrowed heavily to do so. There is no return on the burning of the fuel, the outcome of this dynamic is bankruptcy and national economic collapse.

Once countries start failing there will be full-on finance crisis. There will be fuel shortages as are appearing now.

Fuel shortages will be permanent. The cost of fuel will be greater than the return on wasting it or the cost of borrowing to waste it.

European economic reforms:

– Energy conservation shall be the centerpiece of policy aims everywhere on the European continent,

– Shared sacrifice: industries will bear accrued costs of waste instead of countries and citizens. The ongoing strategy sacrifices countries for the temporary benefit of banking and motor vehicle-related industries. This shall be reversed: to save the people, jettison the machines.

– Any and all monetary tactics that come to hand shall maintain necessary services: food, clothing, shelter, useful — not wasteful — activities. This includes but is not limited to forensic analysis of the outstanding debts followed by restructuring, finance transaction taxes, punitive tariffs and exclusion of Chinese and petroleum imports, consumption taxes, common bonds, demurrage money, fiat national currencies with the euro as a continent-wide reserve currency and more.

– Break the waste-debt cycle: debts are to be taken on only to promote conservation. To discourage waste, all legacy dead-money debts shall be written off and creditors bankrupted without exception. Those who lend to promote and enable waste must be made example of. Otherwise, new forms of credit subsidies for similar enterprises will emerge as tomorrow’s waste will be justified by the debt-residue from yesterday’s waste.

For those who might think the third and fourth propositions are at odds, the vital services would reflect payments to those who do not waste: payments made to those who don’t have automobiles, who do not make use of health ‘services’, who do not have children, who do not consume. These payments are investments that provide real returns: petroleum that is not burned today is made available for higher-value use in the future.

The weakness in the markets started late last night when Australia posted a surprising second consecutive deficit of $480 million on expectations of a $1.1 billion surplus (with the previous deficit revised even higher). This is obviously quite troubling because as we pointed out 3 weeks ago when recounting the biggest Chinese trade deficit since 1989 we asked readers to “observe the following sequence of very recent headlines: “Japan trade deficit hits record”, “Australia Records First Trade Deficit in 11 Months on 8% Plunge in Exports”, “Brazil Posts First Monthly Trade Deficit in 12 Months,” then of course this: “[US] Trade deficit hits 3-year record imbalance”, and finally, as of late last night, we get the following stunning headline: “China Has Biggest Trade Shortfall Since 1989 on Europe Turmoil.” So who is exporting? Nobody knows …

How about Saudi Arabia, analytical dudes?

Europe’s problem is a waste-based economy not currency imbalance. No amount of tinkering adjustments will fix Europe without stringent energy conservation. The cost of borrowing to buy fuel thence burned up for nothing has destroyed Europe. What is left is the post-mortem.

Excellent piece Steve.

Been looking at the Irish M1 figures recently and they ain’t good.

M3 has been down since mid /late 2007 but M1 declines are a more recent occurence.

M1 (cash & checking accounts) is down big which is serious in my view.

Y2011 Month4 : 99,086 (peak)

Y2012 Month2 : 91,147

In the name of God what are they playing at ?

We are running half empty trains & busses in this country.

March Irish car regs. (CSO)

There were 10,581 new private cars licensed in March 2012, compared with 12,390 in March 2011, a decrease of 14.6%.

The number of new goods vehicles licensed in March 2012 was 1,155 compared with 1,179 in the corresponding month last year – a decrease of 2.0%.

The licensing figures also show that:

In March 2012, the total number of all vehicles licensed was 17,171 compared with 19,307 in the corresponding month last year – a decrease of 11.1%. See Table 1 below.

The total number of all new vehicles licensed during March 2012 was 12,568 compared with 14,483 during the same month in 2011 – a decrease of 13.2%.

In March, of the 10,581 new private cars licensed, 2,568 (24.3%) were petrol and 7,705 (72.8%) were diesel

That ACEA website is a great find Steve – I have been looking for info like that for a while now.

The commercial vehicle data is very interesting.

The UK is showing strong growth in med / heavy Bus Sales for Jan & Feb , why is that I wonder ?

It could be a interesting statistical quirk but the UK ,Spain & Italy are not small markets and are roughly give or take a fair margin the same size.

Jan Y2011 : 363 Jan Y2012 : 450 a 24% rise (Spain -63.5%) ( Italy-35.2%)

Jan Y2011 : 256 jan Y2012 :491 a 91.8% rise (Spain -35%) (Italy -24.6%)

Looks like effective good substitution is happening in the UK while the 2 biggest pIigS are in the killing pit.

“Europe’s problem is a waste-based economy not currency imbalance. No amount of tinkering adjustments will fix Europe without stringent energy conservation. The cost of borrowing to buy fuel thence burned up for nothing has destroyed Europe. What is left is the post-mortem.”

This is NEXT.

There won’t be any conservation according to the thesis put forth by Lt. Col. Eggen…

http://www.dtic.mil/cgi-bin/GetTRDoc?AD=ADA556169&Location=U2&doc=GetTRDoc.pdf

…until after we hit the ceiling.

He also puts the peak comfortably in the future rather than in the recent past.

Interesting paper, nonetheless. The military is conflicted; it understands the dynamic and the consequences of resource constraints but its management refuses to make other than marginal adjustments even as the military is the country’s single largest fuel consumer.

At the same time, a policy maker has a lot of options and all of these can be relabeled. For instance, gas rationing can be relabeled ‘removing Iran’s weapons of mass destruction’. That might indeed be the purpose of an Iran war, to justify fuel rationing and ‘whatnot’.

As long as there is football on TV, people won’t bother …

BTW, whatever happened to Occupy Wall Street?

BTW, great paper, JB.

For more reading pleasure: Axel Leijonhufvud (Something like ‘LeJohnaford’)

http://gesd.free.fr/leijon79.pdf

Leijonhufvud is a tremendous writer and not at all well-known as he should be. Like all great economics writers he renders the subject understandable. (HT @ Mike Konczal)

Lotsa people paying attention to the Paul Krugman/Steve Keen brouhaha w/ Keen pointing out shortcomings in current models (also pointedly illustrated by Leijonhufvud for what it’s worth). Keen notes the fabulous models did not predict the (obvious) oncoming crash while his model did predict it. That’s all over at Steve Keen’s web pages.

Here’s another good rant:

http://hat4uk.wordpress.com/2012/04/06/happy-easter-bilderbergers-heres-a-little-problem-for-you-to-think-about/

John Ward.

Regarding his timeline, yes – he relies on data from the NIC and EIA without a challenge. Perhaps it’s irrelevent given the narrowly defined abstract.

I was pleasantly surprised by his references to Kunstler. It suggests to me that the military is reading doomer porn in official as well as unofficial capacities.

Are there even marginal adjustments the management could make ahead of time? I think his Conclusion #3 explains it all: timing is everything. The US military cannot show the slighest signs of weakness to her enemies / competitors.

On the other hand, the US Navy (NAVFAC) was instrumental in getting the green building movement started. As the largest property owner in the US, they realized the need for energy efficient improvements very early on. They helped change the industry by requiring subcontractors to get on-board. Looks like they are still committed to it albeit at the margins (LEED certified hangers and admin. buildings are low hanging fruit IMO):

http://www.washingtonptac.org/documents/MooreNAVFACSustainability.pdf

War gives the perfect cover for rationing, however, Americans need motivation. Maybe cancel NASCAR for a year or two?

Thank you,

Jb

“the military is the country’s single largest fuel consumer”

This point cannot be stressed enough. They have a fuel budget just like the rest of us, and all of us are going to paying less at the pump soon with what dollars we have left.

US Dollar – Crude inverse correlation

http://i43.tinypic.com/34zjbxg.png

The Kia car make seems to have had the biggest % increase of non luxury car Jan – FEB figures total EU

Y2011 : 33,478 units

Y2012 : 43,743 units

increase of 30.7%

Could it be because of this car which at least officially beats the Skoda Fabia Greenline for fuel econ & in the UK qualifies for zero road tax……

http://www.youtube.com/watch?v=xqNOQAgQIf0

(he was a bit hard on it going up & down those Welsh hills but me thinks its better to go for the Greenline if you need a car)

Skoda has recorded the highest % increase of the VW brands perhaps because the regular Fabia is so cheap yet is considered very reliable.

Jan – Feb figures total EU

Y2011 : 70,596

Y2012 : 74,253

Increase of 5.2%

The european car market will become a savage race towards minimalism again (volkswagen have introduced a basic very small car called the UP & Kia have a smaller car called the Picanto)

It harks back to the 1950s/ 60s 2CV Vs VW Beatle fight.

http://www.youtube.com/watch?v=xnkrE0mKJX8

Honestly, at this point there’s a glut of cars worldwide as fuel availability decreases and more people are forced to chose between eating and driving. The savage race that will happen in Europe won’t be about cars.

@Po1

Sure eventually it will come to that but there is much fuel to burn between then and now.

The total Irish car fleet is physically decreasing for the first time since the early 1980s (our first attempt at euro monetory integration although we were in a fuel glut period at that time our banking system was not set up for a higher waste ratio operation until after 1987)

Irish private road vehicles

Y2008 : 1,924 T (peak)

Y2009 : 1,902 t

Y2010 : 1,873.

It has moved from a rapid expansion of 150 -200 T vehicles a year registered to a dip in Y2009 to 50,000+ to the 80,000+ range in Y2010 & 2011…… what will 2012 bring ?

But 90+% of the cars registered are now in the A range which is a dramatic shift from the pre 2008 era.

http://www.cso.ie

go to Environmental Indicators Ireland 2012 (PDF 1,142KB) as seen on the right (transport)

Also the energy chapter has good comparisons with the other Pigs & illustrates their oil dependence relative to the core.

PS – expect a few quirky cars on the Streets of Paris & Milan this summer.

http://www.youtube.com/watch?v=kPhjSoR0bdM

“If Greece had a government worthy of the name, the Greek treasury would issue fiat euros and use them to put citizens back to work. A government worthy of the name would dare the financiers in Frankfurt, London and Wall Street to do anything about it as there is nothing that they could do. “-Steve

This would be a fairly hilarious outcome, but I am not sure how plausible it is. First off, far as Paper Euros go, do the Greeks have access to plates to print them? If they went wholesale into the Counterfeiting Biz this way, it would not bode well for the Euro overall.

The Geek CB could issue digital Euros to drop into the accounts of all the pensioners, but there is retaliatory ability here for the Euro Commanders. They would just negate any bank account the Greek CB had access to for dropping “fake” Euro digibits into.

One does suspect though at some point one of the Euro countries will just go ahead and print their own Euros regardless of what the ECB will issue out. particularly if they can print a good Paper facsimile, it would be just as good on Germany as Greece. This would however drop confidence in the Euro as a currency quite rapidly.

RE

http://www.doomsteaddiner.org

John Ward is horrified the Greeks are producing euros but all euro currency is produced by the Eurozone member nations not by the ECB. The central bank can lend but it cannot and does not issue currency. The ECB has no fiscal entity to act as currency counterparty: there is no ‘European Treasury Department’.

If the euros are produced in the ordinary manner — borrowed from (Greek or other) central bank — the consequence is to migrate liability from a bankrupt bank to another bankrupt bank in a bankrupt country. That is stupid-funny (and certainly underway).

This cannot work for obvious reasons, further ‘inside-out’ re-liquification cannot take place because the transmission mechanisms have broken down, all the Greek banks are sans-capital and the government accounts are … empty!

The Greek treasury needs to simply issue this currency and not borrow from the central bank/finance system. Currency dynamics are all binary. Within debt money systems (including hard currency regimes) the binary is asset-liability. With fiat system the binary is issue-taxation. If the Greek treasury issues Greek euros and offers them to pay Greek debt denominated in euros, how can a bank refuse them? It can claim the notes are counterfeit but the government can counter by claiming the debts are also counterfeit for the same reason.

The banks can then claim the debts were taken on to obtain real, physical goods. The Greeks can demand the banks produce evidence of these goods. Since the ‘goods’ in question are now CO2 in the atmosphere and the debts themselves (!) there is nothing for the bank to point to as a liability: it is a phantom and for all practical purpose does not exist. Nobody put a gun to the bankers’ heads and demanded they make loans to subsidize non-remunerative activities.

One good fiction deserves another, right?

The Greek treasury can issue euros so as to retire Greek debt on the margin: no need to scare the horses. As the debts are paid the ‘new’ euros are extinguished along with the debts. As long as it can be seen that Greece can pay its debts there becomes no reason for anyone to not lend to Greece (and its borrowing rates can be reduced or more useful levels).

The banks don’t allow this: they want blood (demand) rather than euros the Greek government has pulled out of a hat. Why?

If credit cannot be used to ration real goods (and allocate them to bankers) some other non-economic way must be found to ration them.

If the Greek (or other nations’) treasuries issued fiat euros and offered to repay their debts it would turn the tables on the banks. The bankers insist that their loans — which were pulled out of a hat by the bankers themselves — have something called ‘value’. The treasuries insist their hat-euros have exactly the same ‘value’ for the exact same reasons as the bankers. The eurozone rules that were written to benefit the banks would now be used to benefit the governments (and presumably the public …)

Instead of penalizing the Greeks who wish to take euros out of the country the government should pay € 50 bonuses (per € X amount) to Greeks taking euros out of the country. By way of deposits in other banks outside of Greece the euro banking system would be re-liquefied (and recapitalized in the bargain). Sorry, Jurre, you’re fired as chief economist.

LTRO = ECB lending at usurious terms to client banks.

Greek ‘capital flight bonus’ = Greek government lending at much more advantageous terms to same banks.

All the euro countries should do this but are captives of the banks (see Michael Hudson). There is more (there is always more) but you get the idea.

Of course, treasuries cannot ‘print oil’ but the absence of a conservation-by-credit-stripping regime would put the oil constraints in plain view. It would be up to the various waste industries to justify themselves and their continuing claims on the EU’s resources.

I’m in agreement that far as the Greeks are concerned, they would be better off naked printing then being strangled here by the Euroclown Banksters. For obvious reasons though, the Technocrats just will not let that happen. Obvious reason is Contagion, because as soon as the Greeks start doing it, so will every other PIIGS country. In fact, I can’t see why the Krauts would not do it also.

If the Greeks start printing Naked Euros, Tanks would roll into Greece, paper printing presses would be destroyed or shipped over to China to print Renminby and computers inside the Greek CB would be smashed.

In order to keep any kind of “Faith” in the system, it cannot become obvious that Nations can simply Print more money. The Eurocrats CANNOT let the Greeks do that, and the only way for them to do that is to take control of the whole apparatus, which is of course run and administered by Banksters who buy into the whole system to begin with.

If the Greeks wholesale REVOLT, they could start printing their own Euros, but one suspects the rest of the Euro countries would quickly change the Plates and not send the new ones to the Greeks. Greek “Euros” would look different and would be no better than Drachma.

RE

http://www.doomsteaddiner.org

Big Site Improvements on DD!

We now have a “Newz” page which features among other good Blogs like Automatic Earth and Our Finite World, Economic Undertow as well 🙂

I set it up so the redirect for the .com URL brigs you to the Newz page while the .org URL brings you to the Blog. I either case of course you can navigate between them and the Forum as well.

Direct URL for the Newz page is

http://www.doomsteaddiner.com

Direct URL for the Blog is

http://www.doomsteaddiner.org

Lots of cool widgets installed already and more to come!

RE

The one advantage of the euro was/is the ability to import capital stock cheaply.

The one problem is that we (ireland) imported the wrong capital stock.

Y2008 dec 31 : Age of cars 4 years or over : 66%

Age of cars 6 years or over : 51%

commercial vehicles 4Y or over : 58%

commercial vehicles 6Y or over : 42%

Y2010 dec 31 : Age of cars 4 years or over : 75%

Age of cars 6 years or over : 56%

Commercial veh. 4Y or over : 73.4%

Commercial veh 6Y or over : 50.5%

God knows what it was on dec31 2011.

The costs of our extreme car based transport policey have manifested themselves now.

A typical heavily used Taxi is buggered after 5 or 6 years

You may get a bus to 10 years ?

A Train or tram (although not a Spanish Alstrom unit-

en.wikipedia.org/wiki/IE_2700_and_2750_Classes

en.wikipedia.org/wiki/IE_8200_Class )

can have a full and eventful life into its 30s if well cared for.

Our stock of Transport capital is depreciating rapidly because of its extreme road based nature.

The true costs of our car /road culture is manifestly unsustainable at least under this present oil price envoirment.

Our goods imports are getting swapped with oil money exports (Oil imports were 3 times higher then vehicle imports during 2011) – we have little choice but to eject & devalue given our poor investments when we were fiscally the best boys in the class which = the importation of high quality BMW credit grot.

Its a choice of getting on those rails or experiencing a nasty monetary entropy debt where all those high value Euros go to pay for oil & external interest.

The Euro and its poisoned monetory institute ideology is at the heart of this gross & spectacular misallocation of resourses.

Too true, we have erred grievously.

Right now we are still in the ‘denial’ stage of the Kubler-Ross model. If we can only get some more economic growth, everything will be fine. Growth is taking place because car sales are up!

We are all energy self-sufficient/independent/sustainable. Technology will save us, higher prices bring more reserves to the marketplace. The Titanic is unsinkable.

I’m not particularly looking forward to the ‘anger’ stage of the Kubler-Ross model. Unfortunately, there is no ‘humor’ stage.

Vehicle sales dropping:

http://3.bp.blogspot.com/-mVnAeB-bsc8/T4CPLFBK0kI/AAAAAAAABSg/VzoUy1vDdAI/s1600/120407-S.png

And the biggest stock market top in modern history:

http://2.bp.blogspot.com/-f_JT0vlxHfw/T4RFMUbYHbI/AAAAAAAABbA/R7yVyQwSpY0/s1600/120410-C.png

Interesting times indeed.

Yes , it can be quite funny in a sick sort of way.

The Irish state electricity supply company sold a old oil fired station to Endesa a few years back………(Great island power station)

By ELAINE FURLONG New Ross Standard , (JFKs families old town)

Tuesday March 06 2012

“NEGOTIATIONS ARE understood to be underway to buy Great Island along with Endesa’s other Irish power stations.

Two groups from the United States and Singapore have visited the Spanish utility giant’s Irish power stations in recent weeks and are believed to be in negotiations to buy them.

It is also understood that a Korean group have viewed Endesa’s power stations at Great Island and months.

In 2009, Endesa paid €450 million for four former ESB power stations and it is now reported that US venture capitalist firm Contourglobal is in talks with Endesa to acquire the Irish assets for €300 million.

Executives from the company are understood to have visited Great Island and Tarbert before Christmas, while a delegation from a Singapore company also visited the two power stations.

Endesa was purchased by the Italian power giant Enel in an €11 billion deal in 2009 and since then Enel has been eager to sell the Irish assets, it is understood.

Preparatory work is currently underway at Great Island for a multi million Euro redevelopment of the ESB plant into a natural gas electricity generating power station. A multi-million Euro pipeline is to carry a gas supply to the proposed €250 million Combined Cycle Gas Turbine electricity generating plant”

Dork – in the meantime Spanish construction workers were bused in for this operation with only one token Irishman involved….

This is the view (first video) from the now closed (Summer 2010) Rosslare to Waterford rail route – closed because nobody was using it as all were riding continental cars and burning Arabian oil………….. as I said , its a sick but funny world out there.

http://www.youtube.com/watch?v=b9jMhH7A-EM

http://www.youtube.com/watch?v=KglxVleosh0