Finance crises have tended in the past to be dramatic affairs. A critical (‘systemically important’) firm or bank fails and the investors/gamblers across markets race at once to close accounts, retrieve what cash they can and exit before others ‘beat them to it’ … The idea is to re-enter later … when it is safe to do so … to gain the free lunches in the future … like those enjoyed in the past.

If you see a Swiss banker jump out a window, jump after him. There’s surely money in it.— Voltaire

Speculators race to sell, there isn’t enough circulating money to satisfy all of them … and there is madness! The desire to gain cash confronts the certainty there is no cash to be had. Soon enough, the entire country is emptied out of currency by the speculators … and it is still not enough. There is hand-wringing, wailing and window jumping.

The New York Stock Exchange on Black Tuesday, October 29, 1929 (Unknown photographer). The Mother of All Money Panics: Wall Street financiers lost billions of dollars in the course of a single day when all of them attempted to exit the market at once.

Manias, panics and crashes are expressions of the ‘Paradox of Thrift’, which states that one-way markets — all buyers or all sellers (or all savers) — cannot exist without severe consequences. A market where all participants are buyers means a market that is ultimately deprived of them. Everyone who is willing to buy has done so: no one remains able to ‘buy from the buyers’. A market where all are thrifty is one where money is ‘saved’ out of circulation so that day-to-day business becomes impossible. A market crash occurs when free-spenders are forced by conditions … to be thrifty all at once!

It can be said that what has overtaken the United States is a condition where all Americans have been consumers and there are too few savers: the paradox of non-thrift. Americans are forced into penury on account of it, there has been too much business, goods have been over-consumed, goods-markets are saturated. Businesses cannot endure periods when there is no consumption and they fail, the outcome is the same as too much thrift. Instead of a shortage of currency, there is the shortage of timely demand.

When panics occur, the Establishment strategy has been for banks to deploy reserves, for governments to print money and depreciate it, for central banks to offer credit and force interest rates lower along with other strategies that make more money- and credit available. One of the new strategies is to offer lies by establishment figures in the media. The aim is to add new buyers to suddenly-thrifty markets, to span the interval until demand returns … to preserve gamblers’ illusory gains and prolong the mania that precedes the crash as long as possible … or to replace one mania with another. These strategies offer diminishing returns, problems multiply after they are deployed over and over. When effects of easing ‘wear off’ and lose effectiveness there is nothing to prevent the certainty of loss from engulfing all markets and running wild until speculative gains everywhere are entirely erased.

The only tactic that has not been attempted so far is for governments to issue currency and thereby extinguish/repudiate debts. Doing so does not support speculators so this instrument is not considered … so far. When the economy of the world is made up entirely of the schemes of gamblers there is little to be gained by quashing them.

Thrift is a form of class warfare against the wealthy … who borrow their fortunes and thereby require circulating money to flow to them so that their stupendous debts might be serviced: the non-wealthy are the support for the tycoons. By saving, the non-wealthy deny the tycoons funds, the tycoons are ruined by their own creditors, the creditors are likewise ruined.

Strategies are severely constrained by currency pegs and/or currency redeemability. For one country or group of countries takes steps to ease policy requires all the other countries to do the same. This interconnectedness allows crises to take new, unfamiliar forms, for panics emerge in markets that are not necessarily speculative.

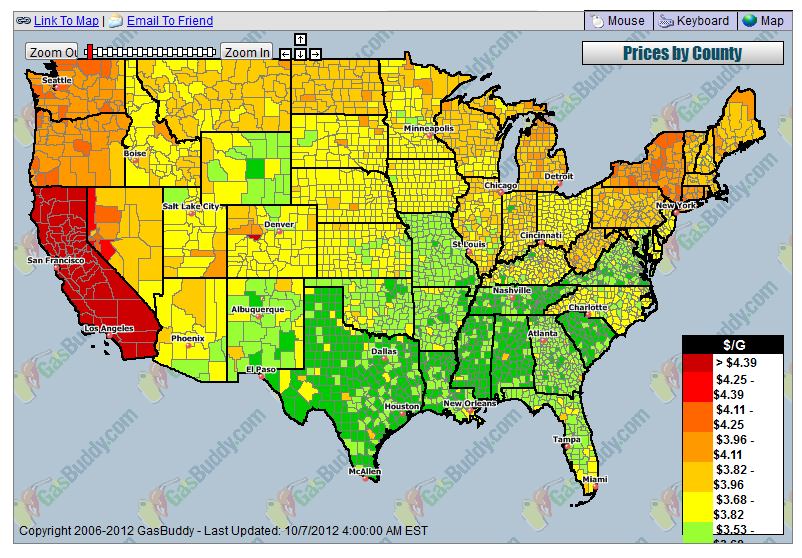

Figure 1: Gasoline price heat map from GasBuddy.com. Gas prices in California are shooting through the roof. Instead of speculators trying to buy all the currency at once drivers in California are panicking, trying to buy all the gasoline at once.

Gasoline prices in California are high as a result of fuel shortages elsewhere in the world. Because of the ‘relationship’ between dollars and other currencies, consequences emerge in California where residents are able to stump up for the pricier gas. In other parts of the world, folks are addressing the structural shortage of fuel by not buying. Horrors!

Californians create the shortage the same time they battle its effects by destroying every bit of gasoline they buy! Californians are trapped: if they continue to drive they push the cost of gasoline to the level where demand is ‘effected’ and the price cannot be met. At the same time, Californians cannot afford to stop driving, they have too much invested in the process. Aside from the speculating, the entire economy of the state — as well as the rest of the developed world — revolves around buying and using cars for everything.

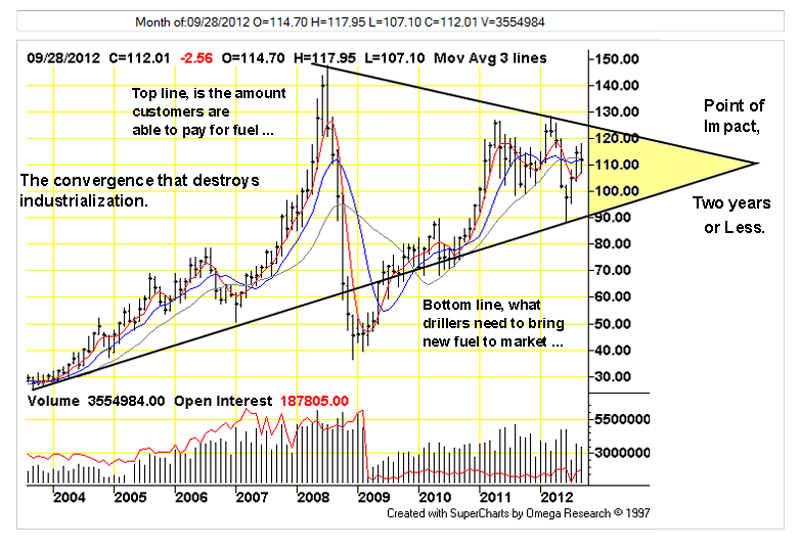

The human race is in the process of polishing off the Mother Of All Free Lunches, a multi-million year-to-produce petroleum resource consumed for the most part in less than 100 years … with nothing to show for it, (TFC Charts: click on for big):

Figure 2: Brent crude continuous front-month weekly futures’ prices. The maximum price customers can afford to pay for fuel decreases while the price required to bring crude to market continuously increases. The current price at any given time is too high, firms fail and customers are left with diminished discretionary income. At the same time, the current price is too low to allow drillers to complete the increasing numbers of wells in difficult areas that are needed to keep pace with demand- plus depletion in older wells.

High prices strand consumption infrastructure. Low prices strand the drillers … When prices are ‘low’, the high priced reserves become unavailable. At some near point in the future both the too high- and the too low prices will be the same … then it’s game over. From the chart it looks to be about two years in the future … all else being the same. If conditions change, the price will plunge and oil shortages intensify. Under no possible circumstance will our pauperizing meat-grinder-economy be able to afford higher real costs: resource waste is unproductive everywhere but at the margins, so is the debt taken on to subsidize it, (Gregor Macdonald):

The Federal Reserve is probably not ready to take the aggressive plunge into Nominal GDP Targeting, but it likely will.Such a policy, which received wider attention during Ben Bernanke’s Congressional questioning last year and was also highlighted this year in a paper delivered at the Jackson Hole conference (Woodford, opens to PDF), has not caught any visible traction with Washington policy makers possibly because it’s seen as either too radical, or simply too new.

However, after four years of broad reflationary policy (and another year to come) failing to meaningfully spur U.S. employment growth, the Fed may be willing to try such measures by late next year, 2013.

What’s ‘exciting’ about the emergence of NGDP Targeting into mainstream economic thinking is that, once implemented, it will provide a real-world test of reflationary policy’s final effort to combat the forces that have led to the end of strong, economic growth. The appearance of the Woodford paper (link above) further highlights the reality that endless amounts of cheap capital will be provided to restart economies, now that we are in energy transition, with the world having lost its cheap oil. The battle between credit and natural resources will be renewed.

What will be the effect on global natural resource extraction in an era of NGDP Targeting?

Simple. All of the remaining fossil-fuel BTUs will be extracted on an accelerated basis, and governments will race to provide the capital to do so.

The proposition is that more loans can command capital to appear: analysts assume that changes in the rules governing finance can change conditions on- and under the ground. Central banks offer loans used to gain capital but not capital itself, which requires work to extract and make usable. Additional work is required due to the ‘destroyed capital’ effect and continually diminished capital concentrations.

Debtonomics indicates industrial enterprises cannot pay for themselves but require constant debt subsidy. Firms borrow to be born, they must borrow to enrich their owners as well as meet day-to-day expenses plus expanding costs of servicing legacy debt. In Gregor’s own terms, enterprises must compete with their own lenders for the funds needed to gain capital. As long as the corpse of industrialization appears to have some life, it will never escape its creditors’ claims. The purpose of targeting therefore is not to provide what it cannot but to prevent the creditor claims from cascading: to prevent borrowers from becoming ‘instantly thrifty’.

Gregor’s article acknowledges the existence of rationing by price, he doesn’t say whether it works or not. If it does then fuel prices must decline (rationing effecting consumption). If it doesn’t, the rationing mechanism becomes actual shortages, the necessary resources slip out of reach … businesses fail … the ability to bid prices and meet them by way of credit diminishes … which puts more resources out of reach.

By the way, shortages that are the consequence of un-affordability are permanent.

In Europe, China and elsewhere, property speculators are imploding: real estate is a fuel consumption enterprise. Enough of world’s demand is collapsing right this minute to knock $10 a barrel from the crude price even after all forms of easing by all central bankers. Subtract a few dollars more and oil production begins to be shut in as unaffordable. This leaves older sources that are depleting fast … to satisfy consumption.

The endgame is taking place in real time right now. The problem is not with mismanaged industrialization but with industrialization itself. The process cannibalizes irreplaceable capital leaving useless junk as the return.

Gregor sez:

… the energy-funding requirements to run a flat global economy will still necessitate that we extract enormous volumes of fossil fuels each year. And that is precisely what will happen as long as aggressive reflationary policy is pursued.

The assumption is that the ‘aggressive reflationary policies’ are going to make the physical fuel extraction process less costly relative to the rest of the economy. NGDP targeting is a mirage, its promoters either don’t understand how central banks work — or they don’t care. If NGDP targeting pushes on some prices, it will press on all of them together. The cost of fuel relative to other prices — its ‘real’ price — will continue to increase.

To reach some indicated nominal Gross Domestic Product (NGDP), central banks must attempt to create inflation. They must offer unsecured loans: that is, they must create additional ‘money’. To create inflation they must create circulating money which they cannot do by themselves. In the first place, central banks are collateral constrained: if a central bank offers unsecured loans under current conditions (insolvent banking systems) they don’t create inflation, they become insolvent themselves … just like their banking clients and for the exact same reason! In the place of ‘reflation’ there are depositor runs (underway). This is because there are no real lenders of last resort, only a constellation of banks destroyed by leverage. Carried forward, there are runs out of the currency and system collapse (see ‘euro’).

Meanwhile, circulating money is just that: money that changes hands. This is outside the reach of central banks which cannot control the intentions of customers or of creditors who hold the greatest claims against money. Adding central bank ‘money’ adds to creditor claims without necessarily increasing the amounts of funds changing hands … the process defeats itself! There is nothing new under the sun: tomorrow’s central bank credit is yesterday’s private sector credit. NGDP targeting is a conjurers trick to pull a rabbit out of a hat.

Reflation is a sure-to-fail attempt to retrieve extinguished capital. At the same time, nothing of value has been gained in exchange for the capital. What remains of our free lunch is largely inaccessible: what Gregor and NGDP economists suggest is that expanding central bank balance sheets will make vanished capital magically reappear, this is a not going to happen.

Vanishing resources do not allow for resources to be depleted faster. The ‘rising prices create reserves’ argument is defective: the expensive reserves are difficult to get at, easy to extract reserves are gone. If fuel prices decline to $20 per barrel it isn’t because there are four or five new Saudi Arabias producing an oil surplus, it is because there are few customers with funds and little demand remaining in a largely de-industrialized world.

Speculation in any market is by nature a zero-sum operation: there are free lunches for a few, reduced rations for the rest. A panic is the inevitable longer-term consequence of all the lunches having been devoured. We’ve enjoyed the Mother of All Free Lunches, now it’s gone …