Events emerging from the murk of crisis bring to mind Billy Batts.

Billy who?

Murder of William “Billy Batts” Bentvena, Wikipedia (Edited)

In Nicolas Pileggi’s book ‘Wiseguy’, Henry Hill describes a 1970 “welcome home” party held at a lounge called ‘The Suite’, in Queens, NY, for William “Billy Batts” Bentvena, 49, a mid-level soldier in New York’s Gambino crime family. The Suite was a mob hangout owned by Hill, an associate of Lucchese family gangster James ‘Jimmie the Gent’ Burke, who later became notorious for the December, 1978 Lufthansa Heist of $5.8 million dollars in cash-plus valuables from JFK International Airport. Bentvena had just been released from prison after serving a six-year term for drug possession. Hill states that Bentvena saw Burke enforcer Tommy DeSimone and asked him if he still shined shoes … DeSimone took this as an insult. Hill also stated that Bentvena provoked DeSimone to impress mobsters from another crime family.Shortly afterward, intoxicated Bentvena was ambushed in the bar, pistol-whipped repeatedly and stomped by DeSimone and Burke. Believing he was dead, the three placed Bentvena’s body into the trunk of Hill’s car and removed him to rural Connecticut. During the trip — with a stop at DeSimone’s mother’s house to obtain a shovel — the three men discovered Bentvena was still alive in the trunk. Hill claims, after stabbing the wounded Bentvena ‘thirty or forty times’, Burke and DeSimone finished him off by beating him with a tire iron and the shovel. The men later buried him under a dog kennel.

There are several versions of the Batts killing, which put the beating in different bars with different resting places for Batts. While he was incarcerated, Batts’ drug- and loan-sharking operations had been taken over by Burke and his crew, Burke was loathe to give them up which was his motivation for killing Batts. In 1979, DeSimone was lured to a Gambino hideout on the pretext of ‘being made’ and summarily executed — presumably by John Gotti or Thomas Agro — for the brutal killing of Bentvena and other transgressions against the Gambino hierarchy. Bentvena was a ‘made man’ — that is, an Italian by blood who had performed at least one contract killing at the orders of the organization — as such, Batts was an untouchable to common criminals such as the psychopath DeSimone.

Like Bentvena’s, DeSimone’s body was never recovered.

Another made man? … or a man unmade? Come to your own conclusions …

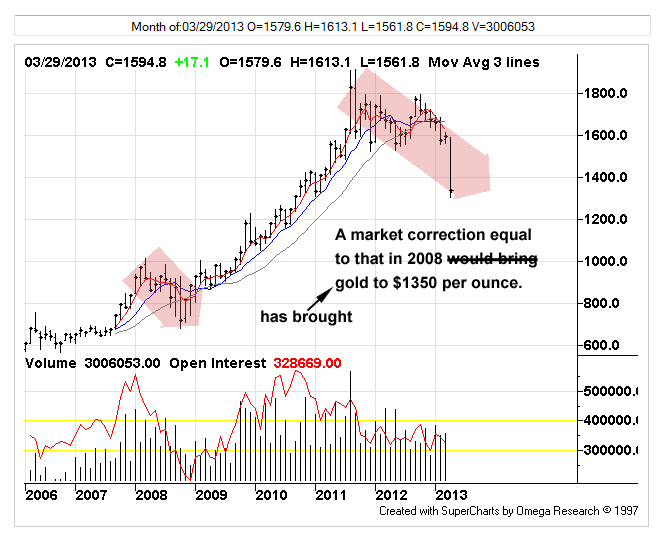

Figure 1: (TFC Charts), In two trading days gold is whacked: “Where’s the shine box … Bernanke?” (New York Times)

“We’ve traded gold for nearly four decades and we’ve never … ever… EVER… seen anything like what we’ve witnessed in the past two trading sessions,” Dennis Gartman, a closely followed gold investor, wrote to clients on Monday.The shift in gold’s fortunes presents a moment of reckoning for many so-called gold bugs, who had expected their financial lodestar to continue moving up in response to the Federal Reserve’s effort to stimulate the economy through bond-buying programs.

The assumption among gold bugs was that the flood of new money would cause inflation, making hard assets like gold more attractive. So far, though, there have been few signs of inflation taking root even as central banks in Japan and Europe have begun their own aggressive bond-buying programs.

“Gold has had all the reason in the world to be moving higher — but it hasn’t been able to do it,” said Matt Zeman, a metals trader at Kingsview Financial. “The situation has not deteriorated the way that a lot of people thought it could.”

The recent drop in gold prices has been partly attributed to signals from powerful members of the Fed that the central bank may begin to wind down its bond-buying programs. But the list of reasons to sell gold grows longer by the day. European politicians have indicated that Cyprus may need to sell off some of its gold holdings to pay for its bank bailout, which could lead other countries to do the same.

Selling the modest gold-holdings in marginal Euro-states — or threatening to do so — would not move the futures’ market 20% over the course of four days. If forced to sell, the Cypriots would do so carefully rather than dumping gold in such a way as to crush the price … anyone making repayment demands on Cyprus would want them to obtain a high price as well. The suggestion that other countries or large holders would senselessly dump their gold … or gold derivatives in advance of such sales … just to do so … does not make sense.

The suggestion that the price-dive is a response to economic improvement in the US and elsewhere is also complete nonsense. Economic improvement removes the immediate urgency to exit perceived-as-risky long positions. During upswings prices tend to inflate, supported by organic credit expansion and willing buyers. It is hard times and panic — deflation and credit contraction — that initiates runs out of assets, not bull markets.

A real recovery might indeed result in a decline in the gold price over time … then again it might not. Gold is a hedge against systemic risk: not always and at all times. If risk diminishes gold does not become instantly worthless. In any event, hedgers and speculators would act out of self-interest and close their positions incrementally so as to minimize loss. At no point would they simply jettison positions out of any kind of market context, losing collectively millions- or billions by doing so.

Is there a deflationary panic in gold? Possibly, as gold is an asset artificially supported by credit that is now eroding. At the same time, gold is an asset that hedges against the sort of systemic monetary risk that is the form that deflation is now taking. A ‘run’ out of gold is a run out of the lifeboat back onto the Titanic.

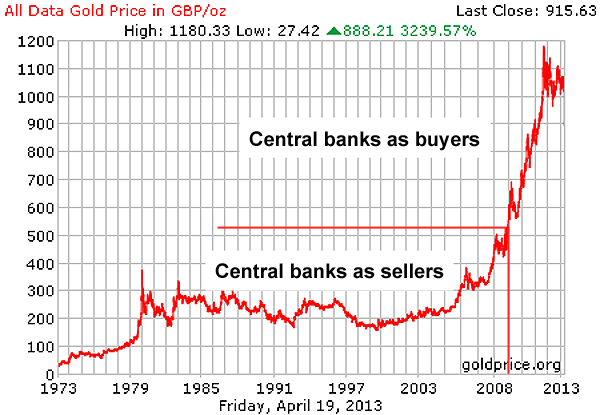

Figure 2: Is gold a deflating ‘bubble’ … or something else? (Gold Price UK, click on for big.) Gold prices are influenced by central banks which are largest holders of the metal. Prices have increased since the early 2000’s largely because of central bank purchasing just as they were flat from 1980 to 2000 due to central bank selling. There are also other large private purchasers besides the banks.

Extraction of gold has become less profitable due to rising costs. Given further declines in profitability there will be less gold on the physical marketplace. As with petroleum, supply and demand indicates support for higher price for gold relative to other goods and services: even if the nominal price of gold declines. Unlike petroleum, gold tends to be the property of the wealthy who can afford gold at any price, persons who — unlike gasoline consumers — are unaffected adversely by price increases.

There is no indication that central bankers decided over the past weekend to dump large holdings at once, although it is possible that the banks have made large forward sales in the futures markets so as to reduce the cost of their own physical purchases. They may also have leased their gold holdings and cannot now recover them and must now bail out the bullion banks or COMEX. The strategy would be to drive ‘gold bulls’ from the marketplace allowing the banks to obtain the needed gold at an affordable price. If this is so the central bankers have outwitted themselves as physical sellers are not selling at the low futures’ price or are inundated with bargain hunters who are crowding aside the banks.

Central bank fundamentals have not changed since 2009: banks are expanding their balance sheets and taking on more dubious assets as collateral … edging toward insolvency as a result. They have become the world’s credit providers of last resort. Direct purchase of gold by the banks is not to be confused with liquidity provision or bond ‘purchases’. In a world filled with dubious- and redundant abstract claims gold is not an asset, rather it is a natural resource and as such, capital.

The finance shills paint a picture of marketplaces (re)acting rationally and impartially: the ‘Invisible Hand’ at work. Look instead to the tire-iron-to-the-head beat-downs of the mafia crews … to the economic high-jackings in Spain, to the bludgeoning of Cyprus, of Greece, Ireland, … to the theft-without-end in China, the ‘Flash Crashes’ on Wall Street, the Libor manipulation, the in-your-face MF Global heist, Morgan’s ‘London Whale’, Bruno Iksil … The flash crash in gold is more of the same, another finance crime.

Where’s the shine box, Columbia University professor Jeffery Sachs, Director of the Earth Institute? (HT: Jesse’s Café Américain).

I believe we have a crisis of values that is extremely deep, because the regulations and the legal structured need reform. But I meet a lot of these people on Wall Street on a regular basis right now. I’m going to put it very bluntly. I regard the moral environment as pathological. And I’m talking about the human interactions that I have. I’ve not seen anything like this, not felt it so palpably.These people are out to make billions of dollars and nothing should stop them from that. They have no responsibility to pay taxes, they have no responsibility to their clients, they have no responsibility to people… counterparties in transactions. They are tough, greedy, aggressive, and feel absolutely out of control, in a quite literal sense. And they have gamed the system to a remarkable extent and they have a docile president, a docile White House and a docile regulatory system that absolutely can’t find its voice. It’s terrified of these companies.

If you look at the campaign contributions, which I happened to do yesterday for another purpose, the financial markets are the number one campaign contributors in the U.S. system now. We have a corrupt politics to the core, I’m afraid to say… both parties are up to their necks in this.

… But what it’s led to is this sense of impunity that is really stunning and you feel it on the individual level right now. And it’s very very unhealthy, I have waited for four years… five years now to see one figure on Wall Street speak in a moral language. And I’ve have not seen it once. And that is shocking to me. And if they won’t, I’ve waited for a judge, for our president, for somebody, and it hasn’t happened. And by the way it’s not gonna happen any time soon, it seems.

Where’s the shine-box Nigel Farage? As the rotting enterprise of industrial modernism sinks beneath the waves nothing remains but pillage … The fact that the thefts are blatant and that the establishment makes no excuses … speaks voluminously for itself:

There is no difference between how the Establishment manage their affairs and the wiseguys …

Paulie is Paul Vario, a capo in the Lucchese crime family associated with James Burke and Henry Hill. Vario controlled activities in and around JFK International Airport in the 1960s and 70s, activities included truck hijackings, cargo thefts and extortion. Vario’s crew also controlled gambling, drug trafficking, business shakedowns, loan-sharking, embezzlement and other crimes in the Brownsville-East New York area of Brooklyn and the Ozone Park/Howard Beach area of Queens.

In the clip, Vario becomes a silent partner of a restaurateur (Greece) in exchange for a favor (bailout): his crew (Troika) strips it of every worthwhile asset then burns what’s left for the insurance.

Assets are sold out the back door … “Paulie can do anything … especially run-up bills on the joint’s credit. And why not? Nobody’s going to pay for it anyway! and soon as deliveries are made in the front door, you move the stuff out the back and sell it at a discount. You take a $200 case of booze (a hotel in Athens) and sell it for a hundred. It doesn’t matter … it’s all profit!And then, finally … when there’s nothing left … he can’t borrow another buck from the bank or buy another case of booze … you bust the joint out … you light a match.”

‘On 10 December 2009, Mr Kypri [the Chairman of the Bank of Cyprus] informed the market that BoC had sold €1.7 billion of GGBS [Greek government bonds], stating that from the beginning of the year, the Bank had decreased its exposure of GGBs to €o.1 billion. On 10 December 2009 (ie, the same day), BoC began repurchasing GGBs, with a rapid increase in the Bank’s GGB portfolio to almost €2.4 billion by June 2010.’

Clearly Yiannis Kypri, he being not entirely dumb, lied to the markets in order to avoid a run-panic about buying Greek bonds. The big unknown here is WTF he bought them in the first place.

Ask Paulie!

Two separate sources have told me over the last three months that Kypri was ordered to support Greece by person or persons as yet unsubstantiated. That belief is widespread among the business community here in Athens. As he had nothing personal to gain from this insanity, I can only conclude the sources are probably right. It might have been Venizelos, might have been Lagarde, might have been Schäuble, and probably was Trichet. But whatever: as a result of this patriotic hari-kiri, BoC lost just shy of a billion euros in the lender subordination later ordered by your friend and mine, Mario Draghi.Within a short period of time after the Berlin-am-Brussels smash-and-grab raid on Nicosia, the Troika “terminated the services” of Kypri as well as the board of directors at the Bank of Cyprus, the country’s largest lender. The report cited sources who said the action is “necessary” due to the legislation approved by Cypriot lawmakers to restructure the country’s financial sector by having the Bank of Cyprus absorb the “good” assets of Laiki Popular Bank. These assets would not, however, have needed good ones without the forced purchase of Greek bonds in the first place.

The outcome of the process is the same, everywhere: survivors searching through the debris, looking for something to eat (Ward in Greece):

Today, in April 2013, everything in Greece is for sale. Two days ago a small girl – aged no more than ten I would estimate – came up to me, playing her violin in a main market thoroughfare close to the Acropolis. She wasn’t much of a violinist, but after finishing the piece, she said something to me … and of course, I didn’t understand. A man watching nearby, resigned of expression, said “She is saying she costs very little for your pleasure”.I gave the kid a small coin and asked the bloke if this was commonplace. “Not common,” he replied, “but not rare either. These bastards will reduce us to an animal state”. I wanted to ask him more, but he waved me away. I don’t blame him; imagine how I’d feel in my own country, being asked by a passing Swede if all English prepubescent kids now whored on the streets.

In a Telegraph piece posted last night from Rhodes by Harriet Alexander, she notes that a Mr. George Georgas told her, “We are like a bankrupt housewife forced to sell the silver, to save the family,” he said. “Greece has no choice.” On the island of Rhodes, the 1,850-hectare Afandou estate, on the peninsula of Prasonisi – a paradise for windsurfers – is up for grabs … and grab (as in land) is the operative word.

Antonis Samaras the Greek Prime Minister knows only too well that flogging off bits of Greece is vital in order for his country to get the lifeline monies from the Troika. These monies, of course, zoom from an escrow account straight into the copious pockets of various lending institutions anything up to 9000 miles from Athens. The Greek people – his electorate – are left manage on their own. The ‘Government’ headed by Samaras offers them less and less help while demanding more and more of their money.

It is becoming clear that the sure way to succeed in post-petroleum world is not to become an organic farmer or an artisan but to become a criminal. The opportunities are without end. By doing so one takes the side of one’s betters who are also criminals: the bankers, the ‘leadership cadres’ and ‘business managers’, the public economists and the other rationalizers. What is there to lose?

Instead of putting in cabbage, backyard chickens and goat cheese, far better to put in some machine guns, dope, ‘rigged’ gaming tables and truckloads of cigarettes; use some of the proceeds to pay off the police. Burglarize houses, steal cars and money, sell the loot in your own black market offering a share to the more powerful crooks. In a society that offers diminished opportunities … to be a slave and to give thanks for the chance to be one … criminality offers a harsh and uncertain path to self-determination and dignity … but a path, nevertheless.

Being a criminal also offers to become notorious and immortal thereby: here is fashionable determinism run to its logical conclusion, the unnatural war of all against all, with the Pyrrhic winner taking everything that remains … of the pile of corpses … of a world that has been destroyed.