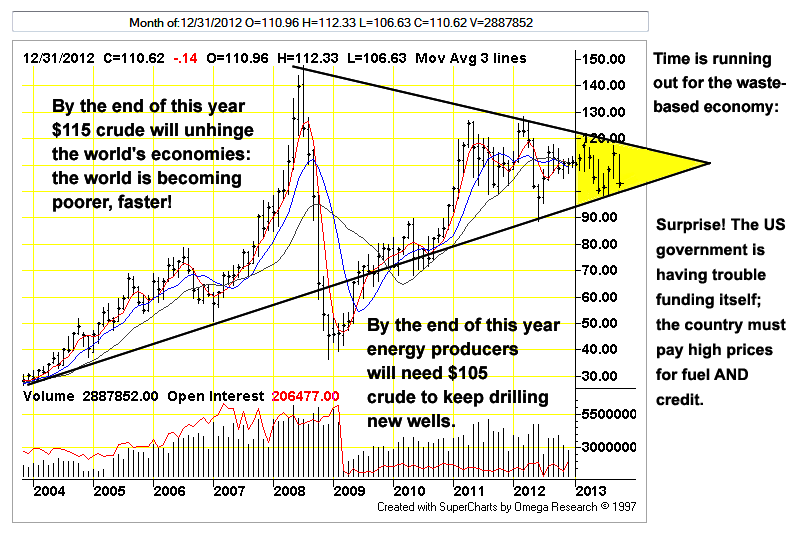

The ‘Almost-but-not-quite Goldilocks Oil Price’: not so costly as to torpedo the world’s economies at once but costly enough to strangle them slowly (click on for big). Costly enough to assure drillers of a profit for their hard-to-gain crude, never costly enough to bring extra-cheap crude onto the marketplace as during the ‘Good Old Days’ …

Costly crude = non-costly crude: if you cannot wrap your minds around the foregoing paradox, don’t worry. None of the ‘Brand X’ analysts are able to do so, either: “”We had to destroy the village in order to save it!”

This small notice appeared in a major media outlet;

Cyprus’ energy minister says that a gas field off the country’s southern coast contains between 3.6 and 5 trillion cubic feet (0.1-0.14 trillion cubic meters) of natural gas, noticeably less than an earlier estimate.

A 2011 estimate put the size of the field -— being developed by U.S. firm Noble Energy Inc. and its Israeli partners Delek and Avner -— at 5-8 trillion cubic feet.

The initial rosy estimates of available ‘reserves’ invariably shrink; this reduction takes place before the first drops of petroleum- or the first cubic millimeters of natural gas are out of the ground. There are technical reasons behind this but real issue has to do with finance. Initial estimates are always made large enough to guarantee funding for the necessary infrastructure; everything else by necessity follows along behind.

21st century petroleum extraction has become one of the world’s most expensive industrial enterprises along with nuclear power and military. As with these others infrastructure must always be built first. This would appear to be self-evident but appearances are deceiving: the crude and other resources are presumed to spurt themselves out of the ground at our pleasure after some hand-waving and utterance of the magic words ‘fracking’, ‘deepwater’ and ‘technology’.

Petroleum cannot bootstrap itself and hasn’t been able to since the Rockefeller era. There was never enough petroleum available early on to create and support petroleum extraction, what enabled the pioneer wildcatters was the nation’s gigantic coal industry. We could extract crude oil because we had an industrial base. Inventors were ready to design- and steel mills and factories were in place to produce the inexpensive rotary rigs used to gain the crude bounty lying out of reach in the super-giant fields of Texas, Oklahoma and California. Those were indeed the good old days: the highest quality sweet crudes were to be found in porous, easy to drill free-flowing formations relatively close to the surface, on dry land with good year-round climate, near transportation, refining and ultimately customers. At the same time, the infant automobile industry was producing what looked to be unlimited fuel demand — cash flow — as fast as highways could be built and banks could provide credit.

The crude oil added to the coal energy represented a colossal surplus that had the effect of driving the price of all energy products to the cost of production. Energy became a ‘loss-leader’ for the consumption side of the economy, perpetually cheap fuels became an American entitlement that is in force today. Nevertheless, without an industrial base the crude surplus would not have been available. Oil reservoirs were well beyond the reach of hand-dug wells.

The coal industry was only partly able to bootstrap its self. Large coal deposits could be found early on near the surface. Coal mining required agriculture, firewood and human labor. Farmers created enough food to allow the surplus labor to delve deeply within the earth chasing coal seams rather than farm. With time, coal provided the necessary energy for miners to dig more ‘efficiently’: fewer farmers and more coal. Instead of claustrophobic and dangerous underground mines there were gigantic open pits made possible by explosives, steam engines and railroads.

Eventually there were diminished returns to mechanized mining; the coal seams were exhausted, greater efforts were needed to retrieve less coal: the bootstrap started running in reverse.

Fast-forward and we have painted ourselves into a technology corner. Relentlessly increasing real costs are ‘baked into’ the petroleum cake. We retrieve hard-to-get oil by wasting ever increasing amounts of oil that is slightly easier to get. Petroleum isn’t a stock, it’s a chain of increasingly expensive flows, every link dependent upon all the others.

Analysts insist peak oil isn’t about ‘running out’ and that there will always be oil available. Without relatively cheap petroleum and a high-tech industrial base there is no way to access the expensive crudes needed to replace those already depleted … any more than Welsh miners and pit ponies could possibly gain natural gas from Cyprus’ Mediterranean waters.

Deepwater gas fields require a massive up-front expenditure in dynamic positioning drillships, undersea robots and well-control hardware, gas separators, processing plants and a network of pipelines along with the factories needed to create all of these things. Drillships are nor made in garages by entrepreneurs but in a handful of gigantic specialized shipyards by companies with multi-decade experience building such things. They are not pulled out of the air ‘from nothing’; every drillship in the world today is conceptually dependent upon every one built before. Ship building is an institution rather than simply a mechanical process; the products are not just ships but the continually improved means to design and build them. This must be so otherwise there would be no deep water oil drilling at all. There are too many chances within the drilling process for company-killing failures, the greatest of these; not being able to retrieve enough oil with the newly-purchased ship to pay for it.

Every bit of infrastructure must be in place and paid for before the Cyprus gas enterprise turns its first dollar. Customer dollars in turn are dependent upon the amount of credit these customers have available to them. This in turn is dependent on how much credit is left over after the drillers have taken their share! Our new credit economy can be difficult to understand because it is in many ways paradoxical; drillers depend on their customers as a source of credit at the same time they compete with them. We don’t recognize a contest for credit because consumption is never considered to be a component of energy production. We intently focus extracting more supply in order to overcome shortages without considering why there are shortages in the first place.

Because Cyprus’ gas industry cannot bootstrap itself it must oversell and borrow. With time, the Cypriot’s necessary fuel supply will be unaffordable if it isn’t so already. Cyprus will fall further into debt even as it is already bankrupt. Its natural gas will either be exhausted for a pittance or unaffordable to end users … whereby it will remain in the ground; the drilling endeavor will be a bust.

Humans consume petroleum to gain two things: waste and empty feel-good abstractions such as ‘prosperity’, ‘freedom’, ‘growth’, ‘progress’, presumably Godliness and proper manners. Waste is self-explanatory, the rest can be hard to grasp. Growth, etc. are not things. They can only be experienced vicariously by way of television and the gloating overlordship of billionaire tycoons whose luxurious idleness is gained at the expense of everyone else. None of these abstractions can be held in the hand, they can only be inferred- or referred to relative to other empty abstractions, or to other real resources that shrink like petroleum. Prosperity has become an inventory of disposable novelties. Freedom is the sensation that occurs when sitting in a traffic jam. Growth is like a football score with an exception: there is no clear public understanding what happens when the growth wins.

Progress is war by other means …

— The flaming Tesla, an apt symbol of our vulnerable failed technological paradigm. The fiasco underway in Washington right now is a failure of government, not necessarily a failure of particular components of a particular government but rather the generalized failure of the the modern technocratic state itself. What technocrats are able to do now is manage their own bankruptcy. They are limited to do anything else because they were designed around the modern premise of continual ‘more’: more resources to gobble, more growth, more business, money and credit … more waste, more political power and influence. Theirs is the ‘Politics of More’, which has been stealthily rendered obsolete by events, by their own prior management success.

Governments are now faced with problems they are ill-equipped to solve. Questioning problems is by itself destabilizing because of the ominous implications. Discussing energy implies there is a shortage. Discussing default implies that one is underway. Policy ceases to exist because words needed to frame the policy dare not be spoken. The analog is Walter Bagehot’s observation about finance, “Every banker knows that if he has to prove that he is worthy of credit, however good may be his arguments, in fact his credit is gone …” Every effort our politicians make to prove their credibility undermines it.

That governments are unwilling to solve their self-created crises does not mean they cannot be solved, it is just that our ‘more’ economic and political solutions are inappropriate to changing times. We need solutions devised around the necessity for less in all things. We throw around the term ‘efficiency’ but the more useful approach is restraint. Americans consider themselves conservatives, our governments are filled with them. Some of these governments should start conserving. The alternative is self-solutions; indirect conservation by other means driven by events.

It’s not too hard to notice how close to the edge we really are. The triangle of doom is nothing other than the corner we have painted ourselves into. Every component of the world economy must function flawlessly, policy makers must avoid errors. Even so there is little time left before the cost of extracting fuel — driven by the necessary extent of our industrial base — runs higher than what customers can afford. This can be safely estimated to occur at the end of next year.

If the managers err, credit will likely be affected first although direct energy shortages are a possibility. Fatal management error could occur next week, uncertain customers would be unable or unwilling to borrow … fuel prices would decline. Unable to borrow, the entire industrial base — not just the petroleum segment — would be stranded like over-mortgaged house purchasers were in 2007. Oil production starting with the least productive would be shut in: the deep-water, the arctic, the tight- heavy oils and bitumen production, biofuels. When consumers have no credit they cannot bid prices higher or afford to take deliveries, whether there is a fuel shortage does not matter if fuel users have no money, falling fuel supply cannot grant more credit or make it available to consumers, neither can ‘artificial shortages’ caused by OPEC or others.

Reduced fuel supply would then strand consumption dependent firms such as real estate, auto making, trucking, airlines and tourism; business failures would reduce credit which in turn would reduce available fuel supplies in a self-reinforcing cycle. The danger that lurks behind the ongoing charade in Washington, DC, is that an inadvertent ‘technical default’ would look like the real thing and credit system would delever in a panic. Borrowing costs particularly for short-term credit would quickly escalate out of reach; there would be a rapid return of the Great Finance Crisis … with the central banks’ policy rates already at the lower bound, with them already buying securities, with governments either embracing fiscal austerity or having it forced upon them by force of events.

Painted into a corner: even full-on fiscal and monetary easing directed toward individuals would have little effect other than to kick the proverbial can, but only so far! Even now, there are visibly diminished returns to increased credit flows; the real costs of energy extraction relentlessly increase, the real returns on energy consumption remain at zero … the costs of energy added to the cost of additional credit become too burdensome to bear.

Moderns have gotten used to more, we have known nothing else. We’ve been stupendously lucky; our entire lives, our parents’ lives and generations into the past, from the beginning of the Enlightenment and the founding of the republic onward … every American has had available some measure of more. Even during the depths of the Great Depression, Americans in general lived better than their counterparts did a hundred years’ previously … even though there were far more Americans in the 1930s than in the 1830s. Now we are confronted with less, something alien to moderns as the tropics would be to a walrus. Our economy emerged to manage the costs associated with increased surpluses. Now all the surpluses are questionable, are false assumptions or claims made against phantoms. We need to embrace a new conceptual approach … and do so in a big hurry.

How do we reinvent our society? Creativity is going to save us, not repeating the same errors, making greater efforts until we exhaust ourselves …